Get ready for an exciting opportunity as IBL Finance gears up for its upcoming IPO, extending an invitation to explore the flourishing microfinance sector in India.

As a frontrunner among microfinance companies, IBL Finance addresses the growing demand for small loans in rural and semi-urban regions—segments typically overlooked by traditional banks. Let’s look closer at what sets this IPO apart and makes it a valuable opportunity.

IBL Finance IPO details

| Offer Price | ₹51 per share |

| Face Value | ₹10 per share |

| Opening Date | January 9, 2024 |

| Closing Date | January 11, 2024 |

| Total Issue Size (in Shares) | 65, 50,000 |

| Total Issue Size (in ₹) | ₹33.41 Cr |

About IBL Finance

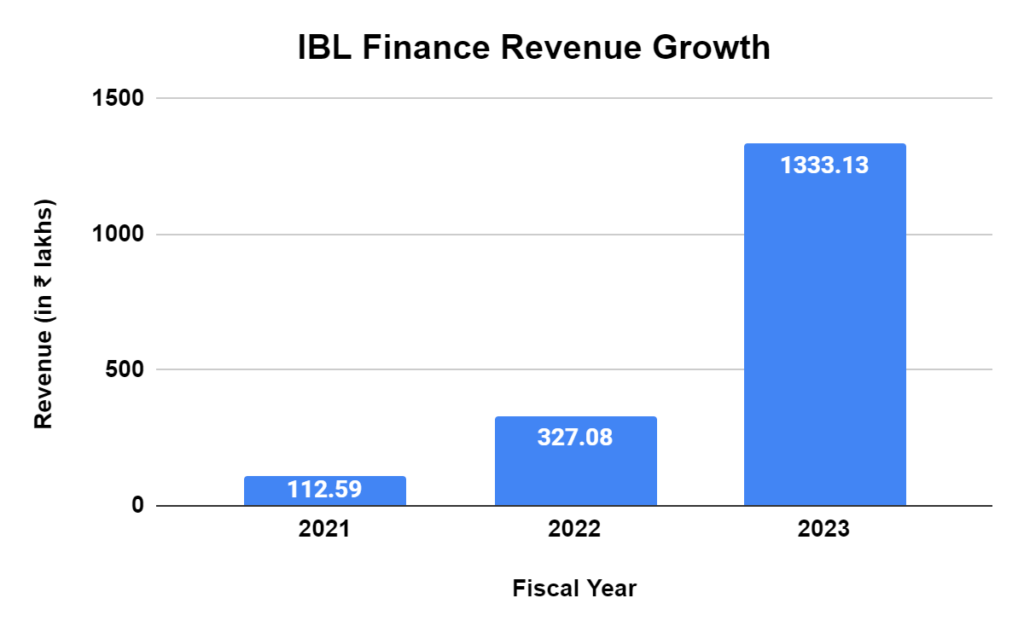

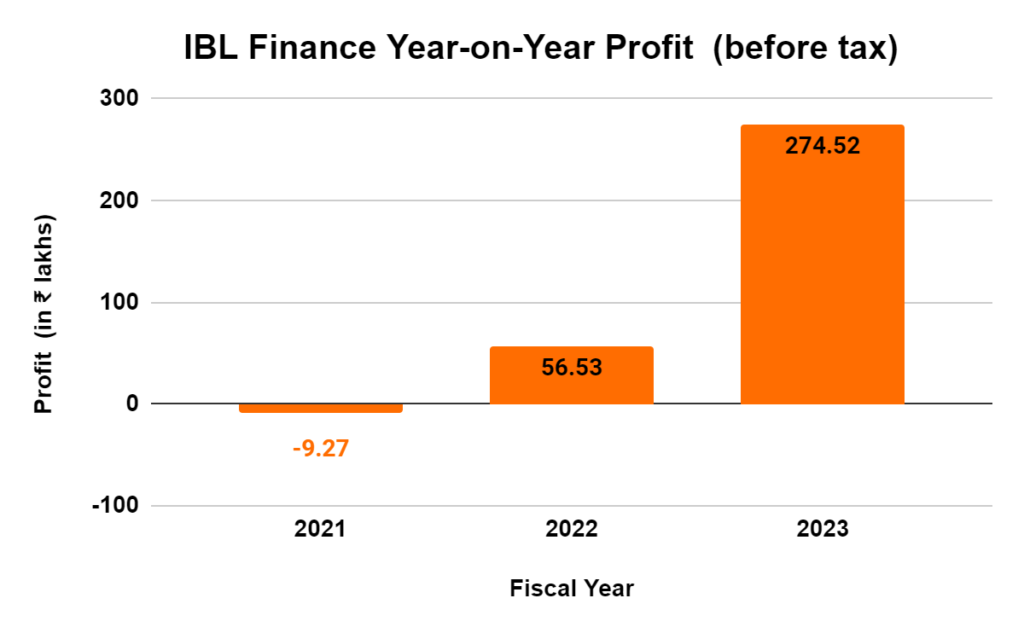

Track Record of Growth: The company has delivered impressive revenue and profit surges in recent years, showcasing its ability to scale and generate returns. This financial performance adds another layer of attractiveness to the investment case.

Focus on Microfinance: IBL Finance is primarily focused on the microfinance sector. This sector has the potential for significant growth in India, as there is a large demand for small loans from individuals and businesses who do not have access to traditional banking services. IBL Finance’s focus on this sector positions it well to capitalize on this growth opportunity.

Technology-Powered Efficiency: IBL Finance embraces technology by leveraging mobile banking and digital platforms, facilitating customer access and streamlining operations. This tech-savviness strengthens its competitiveness and future outlook.

Experienced Management Team: IBL Finance is led by an experienced management team with a proven track record in the microfinance industry. The team’s deep understanding of the sector and its ability to execute will be crucial for the company’s success in the IPO and beyond.

Tough Challenges: IBL Finance shows promise in a growing sector, but its limited outreach and intense competition may interrupt its growth. Plus, increasing interest rates and economic difficulties could also impact its performance.

For a better understanding, here’s a SWOT analysis of IBL Finance

| STRENGTHS | WEAKNESSES |

| Strong financial performance Focus on the high-growth microfinance sector experienced management team Focus on technology | Relatively small size compared to some of its competitors. Limited geographical reachDependence on external funding. |

| OPPORTUNITIES | THREATS |

| Growing demand for microfinance in India Government initiatives to promote financial inclusion Expansion into new markets and customer segments | Intense competition in the microfinance sector Rising interest rates Economic slowdown |

The company plans to leverage the IPO’s proceeds to enhance operational efficiency and expand its Tier-I capital reserves, paving the way for future asset investments and business growth initiatives.

The company’s focus on the microfinance sector and experienced management team position it well to capitalize on the growing demand for small loans in India. However, the company also faces challenges like competition and economic slowdown. Investors should carefully consider these factors before deciding about the IBL Finance IPO. For guidance, you can also take help of a share market advisory.

QUICK LINKS:

CURRENT IPOS | LISTED IPOS | UPCOMING IPOS

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 22

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/