Introduction

On 30th June 2023, ICICI Bank announced that it would delist its broking arm, ICICI Securities, in a share-swap deal worth about ₹5,100 crores.

After NCLT approves the scheme of arrangement for delisting, ICICI Securities shareholders would be allotted 67 ICICI Bank equity shares of face value ₹2 each for every 100 equity shares. As of 31st March 2023, ICICI Bank held a 74.85% stake in ICICI Securities, and the public has the remaining 25.15% stake. This exercise will likely be completed in the next 12-15 months.

Four Reasons Why ICICI Securities is Delisting

Since its listing on the stock exchanges in April 2018, the shares of ICICI Securities have underperformed the market and not moved significantly higher. Its ₹4,017 crore IPO received a poor response, with only 78% of the issue being subscribed. So, the company reduced the IPO size to 3,500 crores, and the stock was listed at a 16.35% discount.

Declining Market Share

The dismal IPO performance of one of the largest full-service brokerage firms was unexpected, especially when new-age discount brokers were slowly gaining ground due to their simple client onboarding process.

The stock-broking ecosystem has changed in the past five years, and discount brokers today have a lion’s share of 60% of NSE active clients. At the end of FY23, Zerodha, Groww, Angel One, and Upstox were the country’s top four ranked stock brokers.

During this period, the market share of ICICI Securities declined from a 10% share of active NSE clients at the end of FY20 to 7% at the end of FY23.

Weak Financial Performance

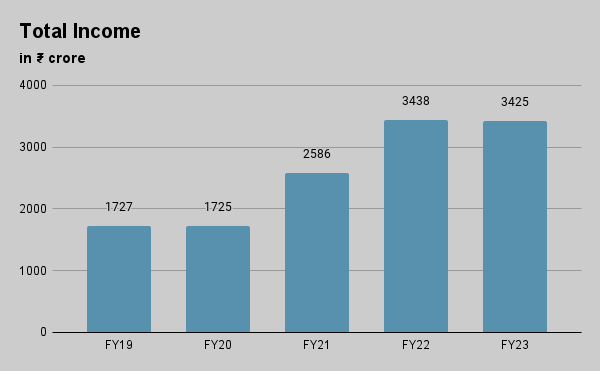

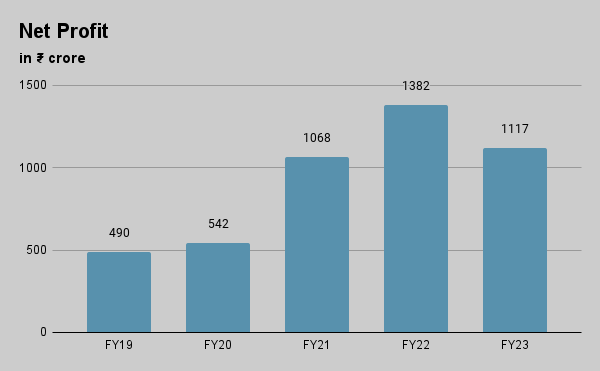

On a consolidated basis, ICICI Securities’ total income in FY23 was flat at ₹3,425 crores compared to ₹3,438 crores. And, net profit declined by 19% to ₹1,117 crores from ₹1,382 crores in FY22. Since its listing, ICICI Securities did not do well financially as well as the other listed subsidiaries of ICICI Bank.

The company’s revenue share of total income from cash broking has decreased from 31% in FY22 to 20% in FY23. Meanwhile, the revenue share of derivatives broking increased by four percentage points to 15%. The revenue share from broking & commission was over 90% at the end of FY20.

Overlap of Businesses

Over the last five years, ICICI Securities significantly diversified its operations, moving from a broking-led business to a complete wealth-tech platform and financial marketplace. Between FY22 and 25, the company planned to scale up its non-broking revenue streams like MTF, PMS, loans, insurance, distribution of mutual funds, etc.

This diversification led to a significant overlap in business activities with ICICI Bank, which also has a presence in wealth management, mutual fund distribution, insurance, etc.

Affecting Valuation

As the largest shareholder of ICICI Securities, the underperformance of the broking company’s shares was affecting ICICI Bank’s valuations.

If you look at ICICI Bank’s earnings, the five-year compounded profit growth is 35%. And, as of 5th September 2023, the stock gave a compounded Annual Growth Rate of 24% in the last five years.

While ICICI Bank is growing rapidly, ICICI Securities fell behind in financial performance while facing multiple challenges to shore up its core broking business.

By delisting ICICI Securities, the stock will no longer be subject to market volatility and value dilution. The delisting will help ICICI Bank have more control over its valuation as it will fully control the broking business, reducing the accountability of being listed in the market.

ICICI Securities Will Become A 100% Subsidiary of ICICI Bank

ICICI Bank, in an official statement, said that the decision to delist ICICI Securities and transform it into a wholly-owned subsidiary was driven by the pursuit of synergies between the two entities.

The bank intends to keep ICICI Securities as a wholly-owned subsidiary because of regulatory limitations that restrict it from undertaking securities broking business departmentally.

Dilution of ICICI Bank Equity Base

The issuance of ICICI Bank equity shares to ICICI Securities shareholders will reduce the equity capital of ICICI Bank. At the proposed share swap ratio, ICICI Bank will issue around 54.5 million of its equity shares to ICICI Securities’ public shareholders, who currently hold 81.45 million, which may affect ICICI Bank.

For ICICI Securities shareholders, the delisting arrangement holds potential benefits. Over the long term, they may gain from any positive returns of ICICI Bank. After delisting, ICICI Securities’ business model may be restructured to align with ICICI Bank’s wealth management product offering and the company’s long-term goals.

FAQs

What will happen to ICICI Securities after delisting?

After delisting ICICI Securities shares from the stock exchanges, it will become a wholly-owned subsidiary of ICICI Bank.

What is the share swap ratio for ISec delisting?

Shareholders of ICICI Securities will receive 67 shares of ICICI Bank for every 100 shares of ICICI Securities they hold.

When are ICICI Securities shares delisting from stock exchanges?

The ICICI Bank Board of Directors approved the delisting of ISec shares on June 30, 2023, with the shares expected to be delisted within the next 12 to 15 months.

How useful was this post?

Click on a star to rate it!

Average rating 3.6 / 5. Vote count: 8

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/