Let’s say you’re scrolling through flight options and planning your next big adventure. Have you ever wondered which airline has the most significant global reach and market value?

Fasten your seatbelts because IndiGo Airlines has just stormed the aviation industry! As of April 2024, IndiGo has officially claimed the title of the world’s third-largest airline by market capitalization. It is a monumental achievement, not just for IndiGo but for the entire Indian aviation sector. But what’s propelling IndiGo to such impressive heights? Let’s explore the reasons behind IndiGo’s sky-high success.

Stock Price Takes Flight

This achievement wasn’t the only good news for IndiGo. The airline’s stock price of InterGlobe Aviation also took flight, surging by an impressive 4% and reaching its upper circuit limit. IndiGo started strong yesterday, with shares opening at ₹3,689.95. The stock price surged over 4% and hit a new 52-week high of ₹3,815.10 before settling at ₹3,806.85, a gain of 4.82%.

Numbers Behind the Rise

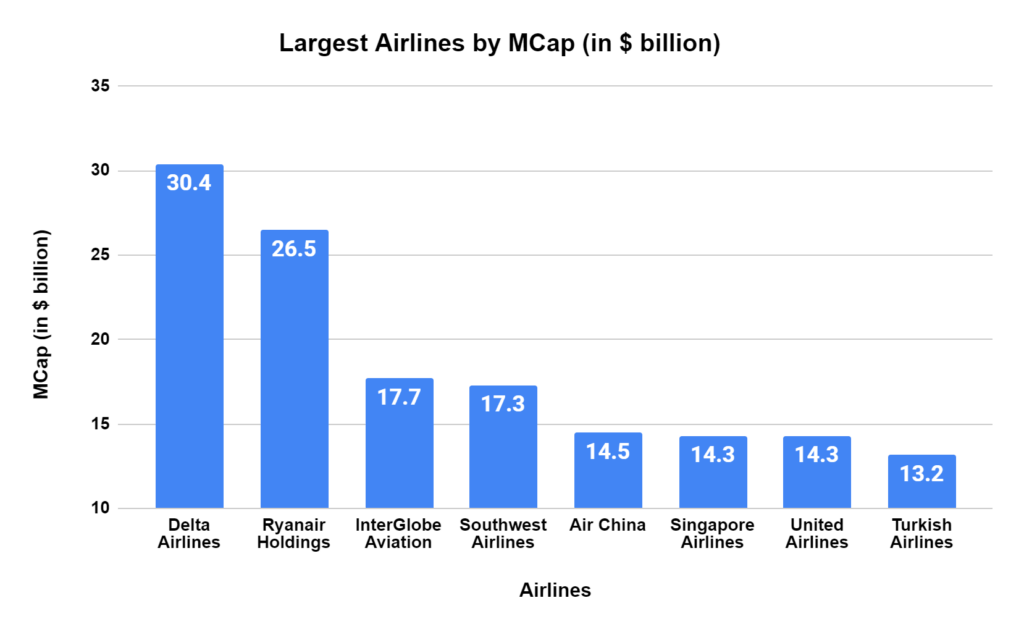

Some impressive data points can quantify IndiGo’s recent surge. In the last month alone, IndiGo shares have rallied nearly 22 percent. According to BSE data, this growth has propelled the airline’s market capitalization to a staggering ₹1,46,936.30 crore, approximately $17.7 billion as of April 10th.

To put this in perspective, the top two airlines in the world by market cap, Delta Air Lines and Ryanair Holdings, hold positions with $30.4 billion and $26.5 billion, respectively. IndiGo’s impressive growth spurt has placed them firmly in the number three position.

What’s Driving the Growth?

Several key factors are contributing to IndiGo’s remarkable success. Let’s delve deeper into the engines driving this Indian aviation giant:

- Network Expansion: IndiGo has been aggressively expanding its network, reaching new domestic and international destinations. The airline plans to add ten new destinations to its network in FY25E. This strategic move allows the airline to cater to a wider range of passengers and tap into new markets.

- Efficiency Edge: IndiGo is renowned for its operational efficiency. The airline maintains a young fleet of fuel-efficient aircraft, which translates to significant cost savings. These savings can then be reinvested in further growth initiatives.

- Strong Growth Trajectory: Analysts predict that IndiGo’s growth story is far from over. The Indian aviation market is experiencing a boom, and IndiGo is well-positioned to capitalize on this upsurge. The airline’s focus on operational excellence and customer satisfaction positions it for continued success in the future.

IndiGo’s Dominance in the Indian Aviation Market

IndiGo’s achievement is particularly noteworthy when considering its position within the Indian aviation landscape. The airline currently holds the dominant domestic passenger market share, consistently exceeding its competitors. This leadership stems from IndiGo’s commitment to providing affordable fares, a reliable network, and a comfortable flying experience.

A Young Fleet for a Bright Future

One of IndiGo’s significant strengths is its young aircraft fleet. The airline prioritizes modern fuel-efficient planes, reducing operational costs and minimizing its environmental footprint. This commitment to sustainability is a significant positive for IndiGo’s brand image and prospects.

Looking Ahead

IndiGo’s ascent to the top ranks of global airlines is a testament to its strategic vision and operational excellence. As the airline moves forward, seeing how it maintains its growth trajectory will be interesting. Continued network expansion, unwavering focus on efficiency, and a commitment to providing a superior customer experience will ensure IndiGo’s long-term success.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/