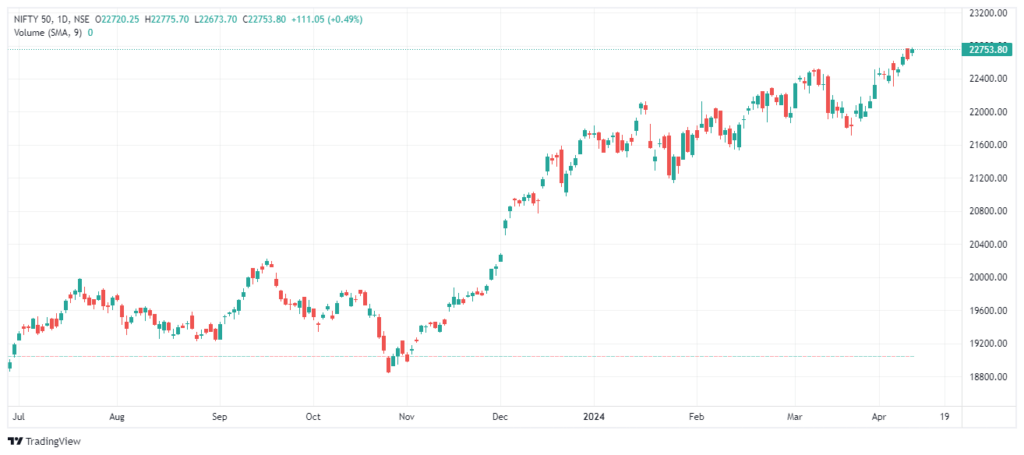

In a stunning display of financial prowess, the Indian stock market’s Nifty 50 and BSE Sensex indices shattered records and reached dizzying new heights. The Nifty 50 index peaked at a staggering 22,768 (11-04-2024), growing 29% in a year and beating the 5-year CAGR of 14.4%.

At the same time, the BSE Sensex has soared to an awe-inspiring 75,124 (11-04-2024), growing by 25% in a year. Not to be left behind, the Bank Nifty has grown by 20% in a year and successfully marched to 48,940.

Why is the Rally Extending?

This meteoric Nifty 50 rise is not just a number game; it’s a testament to the burgeoning investor confidence and a bullish outlook on India’s economic horizon.

Let’s dive into the five pivotal reasons that have fueled this extraordinary Nifty50 rally:

- A Robust Economy: India’s macroeconomic landscape is thriving with vigor. The country’s GDP growth has consistently outpaced global averages, representing a stable and growing economy. India’s GDP has grown by 53%, starting at 2.67 thousand points in 2020 and reaching 4.11 as of April 2024.

At the same time, inflation control measures have been effective, keeping the cost of living in check, while a disciplined fiscal deficit approach ensures sustainability. This robustness is a beacon of trust for investors worldwide, signaling a market ripe with opportunities.

- Corporate Giants on a Roll: As the earnings season unfolds, it’s clear that India’s corporate sector is excelling with flying colors. A cascade of strong financial reports has emerged, showcasing the resilience and innovation driving these companies. These impressive numbers are like a magnet, attracting investors and pushing the market to new summits. The success stories of these corporate giants, like House of Tata, Reliance Industries, ITC, and Infosys, underscore the market’s potential for high returns and long-term growth.

- Government Reforms Sparking Joy: The Indian government’s pro-business reforms and incentives have been more than just welcoming; they’ve been transformative. The government has set the stage for a thriving investment climate by rolling out the red carpet for investors. Initiatives such as the ‘Make in India’ campaign and tax reforms have bolstered investor sentiment, increasing domestic and international investments.

- Global Winds Blowing in Favor: The global economic scene is shifting, especially with cooling US inflation and softening bond yields. This change has had a domino effect, making emerging markets like India a hotspot for foreign investments. The weakening dollar has amplified India’s appeal as investors seek better returns in more dynamic economies.

- The FPI Wave: The wave of Foreign Portfolio Investors (FPIs) has been more than just a trend; it’s been a transformative force. Drawn by India’s compelling growth narrative, FPIs have been pouring in, bringing a wealth of capital and expertise. This influx of foreign capital has been a significant catalyst in the stock market’s ascent, driving valuations and providing the liquidity needed to thrive.

As the market continues to scale new peaks, it presents a golden opportunity for investors to ride the wave of growth. However, with great opportunity comes great responsibility, and investors must stay informed and cautious in this dynamic market landscape. You can also learn about gift nifty with our blog.

FAQs

What has led to the recent surge in the Indian stock market?

The surge is attributed to a combination of factors, including a robust economy with strong GDP growth, effective inflation control, and a disciplined fiscal deficit approach. Additionally, impressive corporate earnings, transformative government reforms, favorable global economic shifts, and significant foreign portfolio investment have all played a part.

How significant is the role of India’s economic growth in the stock market’s performance?

India’s economic growth has been a cornerstone of the stock market’s performance, consistently outpacing global averages and signaling a market ripe with opportunities for investors.

What impact have corporate earnings had on the market?

A series of strong financial reports from India’s corporate sector has attracted investors and pushed the market to new summits, highlighting the potential for high returns and long-term growth.

Can you elaborate on the government reforms that have influenced the market?

The Indian government’s pro-business reforms, including the ‘Make in India’ campaign and tax reforms, have been transformative, setting the stage for a thriving investment climate and increasing domestic and international investments.

What global economic trends are affecting the Indian stock market?

Cooling US inflation and softening bond yields have shifted the global economic scene, making emerging markets like India attractive for foreign investments. The weakening dollar has further amplified India’s appeal.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/