The JNK India IPO opened for bidding on April 23rd, returning to the mainboard IPO space after a two-week hiatus. Alongside ongoing SME IPOs, JNK India has garnered decent interest from retail investors. Let’s look into the key details of the IPO, its GMP, current subscription status, and a company’s strengths, weaknesses, opportunities, and threats (SWOT) analysis to help you decide if this offering aligns with your investment goals.

JNK India IPO details

| Offer Price | ₹395 – ₹415 per share |

| Face Value | ₹2 per share |

| Opening Date | April 23, 2024 |

| Closing Date | April 25, 2024 |

| Total Issue Size (in Shares) | 1,60,15,988 |

| Total Issue Size (in ₹) | ₹649.47 Cr |

| Lot Size | 36 Shares |

| Issue type | Book built Issue IPO |

GMP (Grey Market Premium)

The grey market price of JNK India’s shares suggests a potential listing premium of over 6%. As of yesterday, the share price was trading at ₹25 above the upper price band of the IPO. This translates to an expected listing price of around ₹440 per share.

Subscription Status

JNK India’s IPO has received bids for nearly half (49%) of the shares offered. The breakdown is as follows:

- Qualified Institutional Buyers (QIBs): 67% subscribed (20.74 lakh shares out of 30.75 lakh)

- Retail Investors: 48% subscribed (27.12 lakh shares out of 56.06 lakh)

- Non-Institutional Investors (NIIs): 25% subscribed (6.05 lakh shares out of 24.02 lakh)

JNK India Company Overview

JNK India, established in 2010, designs, manufactures, supplies, installs, and commissions process-fired heaters, reformers, and cracking furnaces. It caters to both domestic and international clients, with a presence in over 17 Indian states and having completed projects in Nigeria and Mexico. Some of its notable domestic clients include Indian Oil Corporation Limited, Tata Projects Limited, and Rashtriya Chemicals & Fertilizers Limited.

JNK India boasts in-house manufacturing facilities and collaborates with third-party vendors to fulfill client requirements and adhere to relevant industry standards. They have a dedicated export-oriented facility in the Mundra SEZ, Gujarat, with a production capacity of 5,000 metric tonnes per annum.

Financials

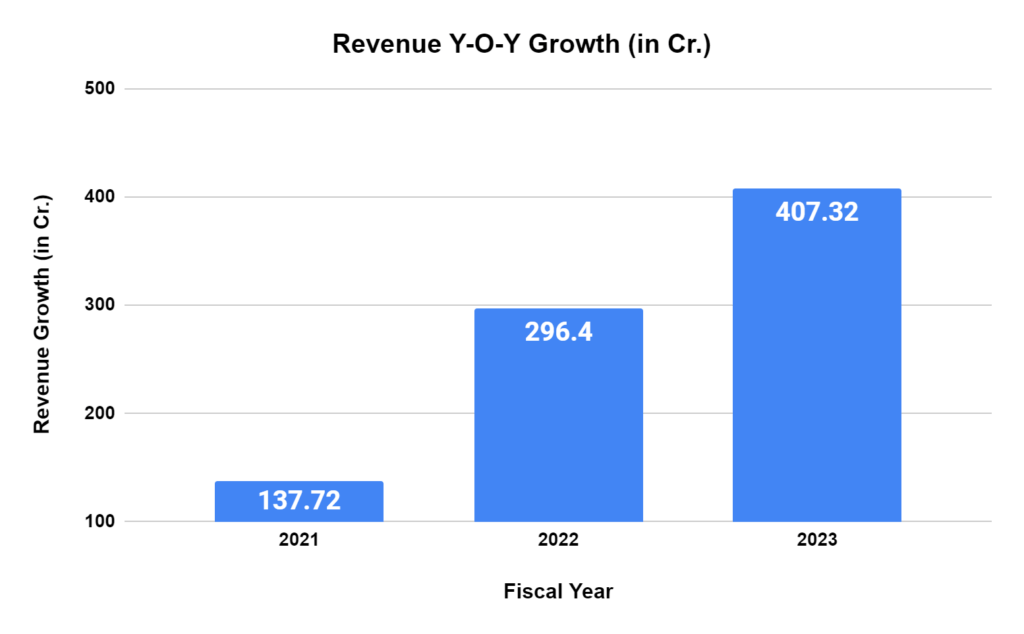

In FY23, they achieved a significant revenue increase, reaching ₹407.32 crore compared to ₹296.40 crore the previous year.

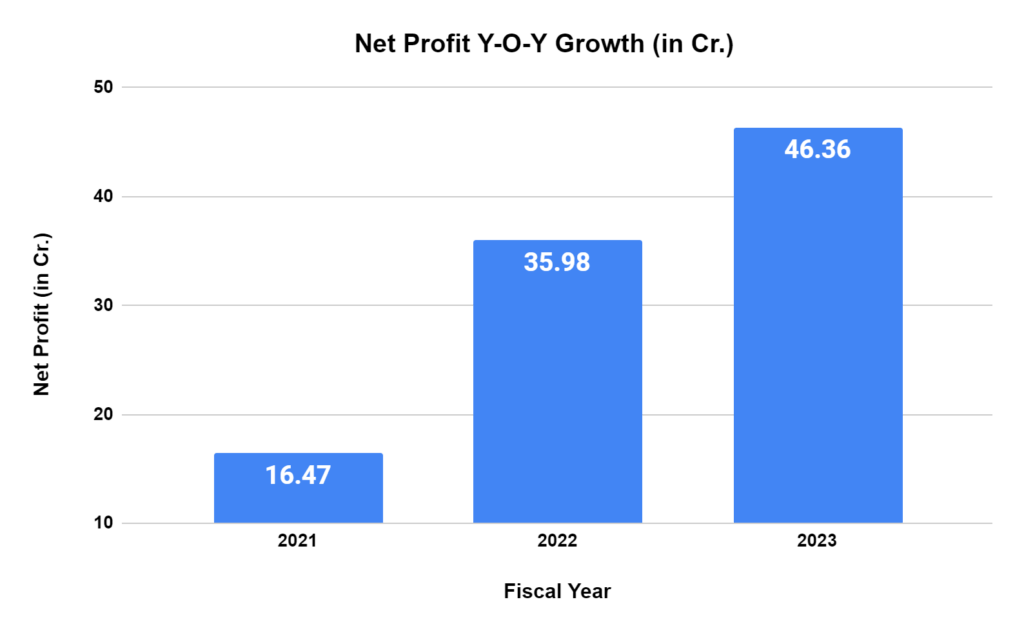

The oil and gas segment is their primary contributor, accounting for 77% of their revenue. Net profit also grew, reaching ₹46.36 crore in FY23 compared to ₹35.98 crore in FY22.

However, it’s important to note that the company’s total debt stood at ₹56.73 crore as of the nine months ending in 2023.

SWOT Analysis

Let’s look at JNK India’s SWOT Analysis to get a clearer picture

| STRENGTHS | WEAKNESSES |

Relatively high debt levels compared to net worth. Dependence on the oil and gas sector can be cyclical. Limited brand recognition compared to more prominent players in the industry. | Relatively high debt levels compared to net worth. Dependence on the oil and gas sector, can be cyclical. Limited brand recognition compared to more prominent players in the industry. |

| OPPORTUNITIES | THREATS |

Growing demand for process-fired heaters in the refining and petrochemical sectors. Potential for expansion into new markets and sectors. Increased focus on renewable energy projects could create opportunities for adapting their expertise. | Intense competition from domestic and international players. Fluctuations in raw material prices could impact profitability. Stringent environmental regulations could increase compliance costs. |

Final thoughts

The JNK India IPO offers investors a chance to participate in a growing company within the process-fired heaters segment. While the financials are encouraging, the high debt levels and dependence on the oil and gas sector warrant consideration. The subscription status so far indicates decent investor interest, particularly from QIBs. Carefully evaluate your risk tolerance and investment goals before making a decision.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.5 / 5. Vote count: 8

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/