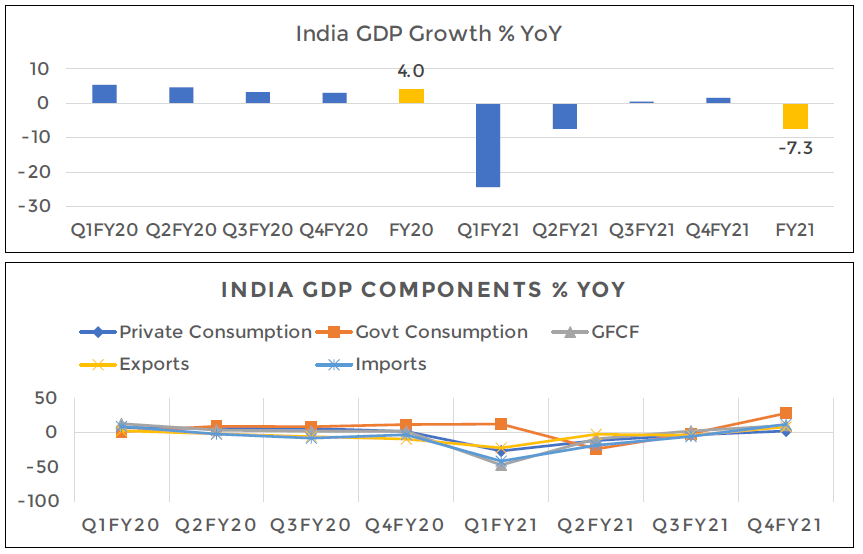

-7% GDP IN FY21 – WHY IS IT A ONE-OFF?

India’s Q4FY21 GDP growth at 1.6% YoY was positive for the 2nd consecutive quarter. However, FY21 GDP de-grew by 7.3%. Government consumption led from the front in order to pull up the overall GDP. Robust improvement in government expenditure can be attributed to increase in capex spending by both central & state governments. Private consumption showed a small positive growth in Q4FY21 for the first time during the year (55% of GDP). With most of services being subdued throughout the year, private consumption was expectedly poor and the biggest contributor to the FY21 GDP de-growth. While the year gone by has been tough and the start of this year is unassuming, all is not lost.

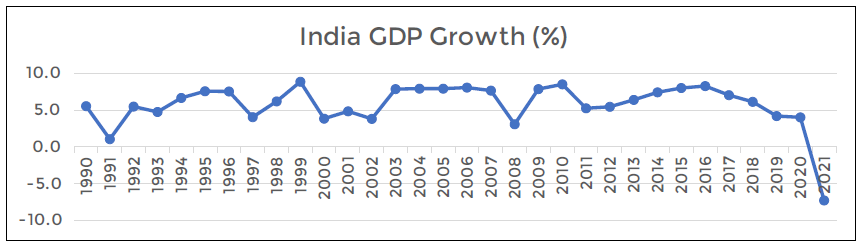

A careful analysis of the historical GDP growth trends reveal that this is the first time in the past 30 years that India has de-grown which suggests that this is a one-off year and we are sure to bounce back strongly as the situation starts to normalize.

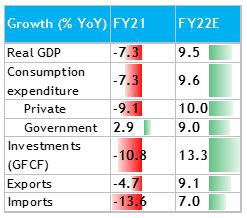

GDP Influencers: Journey from -7% in FY21 to +9.5% in FY22

- Private + Government consumption:

FY21 was a complete washout for the services sector which occupies more than 50% share in India’s GDP. With the steady increase in vaccinations and gradual unlock, we believe the travel & tourism, hospitality and related industries will make a strong comeback. The pent-up demand seen in goods in FY21 will now be witnessed in services in FY22 leading to pickup in private consumption expenditure.

- Investments (GFCF):

Investments witnessed strong momentum in H2FY21 after the Finance Minister urged all CPSEs to expedite capex spends. Nodal agencies like NHAI also increased awarding and reduced milestone payment duration to contractors, thereby witnessing record highway construction activity in FY21, despite the pandemic. With the government having loosened its purse strings despite rise in fiscal deficit, investment momentum should be strong.

- Exports:

Last year when India was in lockdown, there was global lockdown as well which led to a collapse in India’s exports demand. However, in this lockdown, the world is in an unlock mode. This has helped export and export industries pick up the momentum and offset the slack in the domestic economy. Exports’ growth in March ’21, April ’21 and May ’21 have clocked robust growth rates of 60%, 199% and 68% YoY resp.

Other drivers

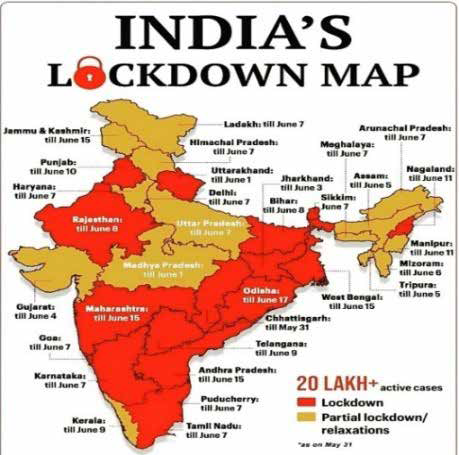

Lockdown

The 2 biggest factors that determine the impact of lockdown are intensity and duration. The intensity is far lower this year because different states are implementing various partial lockdown measures. Businesses are able to run in some form and are not crippled like last time. Many construction sites and infra activities are being allowed to carry on. On the duration front, last year we saw the country return to normalcy by October; this year most states have already begun unlocking and we expect to return to normalcy by July resulting in lower impact this time.

Household Financial Savings

During last year’s lockdown, fear of job losses and income reduction dominated headlines, instilling fear and responsible for people going completely into saving mode. Lack of spending avenues only aided this behavior. Thus, while income levels may have reduced, expenditure reduction was much more. This led to an improvement in household financial savings. Household financial savings as a % of GDP shot up to 21% in Q1FY21, when GDP was at its lowest level and the high household financial savings was responsible for the consumption boost in the economy subsequently. This time around as well, it gives us a strong reason to believe that consumption will come back in a big way when the full unlock happens.

Improved balance sheets and soft interest rate regime

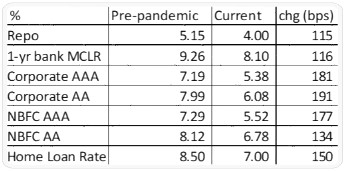

Just like individuals, corporates also slashed fixed costs as businesses slowed down in the first lockdown. Corporates were also successful in raising large sums of money and protecting their balance sheets thanks to the abundant liquidity available due to monetary policy easing adopted by many central banks globally. The quantum of money raised via the Indian equity markets in 2020 stood at a record Rs. 2.2 lakh crore, quarter of which went to large banks. This has put India Inc. in a strong position to navigate the pandemic and ensure stability in business. Interest rates in India moved downwards led by the sharp 115 bps cut of repo rate to 4% by the RBI. AA and AAA rated corporates saw rate cut of 180 -190 bps. Retail loans like Home Loans, Auto loans etc. have also seen a meaningful drop in interest rates in comparison to the pre-pandemic rate. For e.g., Home Loans (50% of Retail loans), saw 150 bps cut in rates since the pandemic making affordability the highest in a decade. Low rates will go a long way in helping borrowers in managing interest costs.

Digital / online medium

Companies and individuals alike have adopted a digital / online medium in a more meaningful manner post the pandemic. FMCG firms now generate 9% of their revenues via online sales as against 3% pre-pandemic, banks have seen higher share of digital usage, AMCs are seeing higher share of sourcing via the online mode. Companies like Big Basket, Amazon, Hotstar, Swiggy, PharmEasy, BYJU’s, Zerodha which have the digital theme running across, have seen revenues growing significantly over the past year. The fair amount of shift that happened towards digital adoption in just a year is benefiting the customers and also help businesses reduce cost of operations.

Conclusion

India is set for exciting times ahead. The economy has had its set of challenges but has been able to navigate and adjust itself quite well. Being one of the LARGEST FASTEST growing economy in the world, it surely has the attention of all major global investors and businesses.

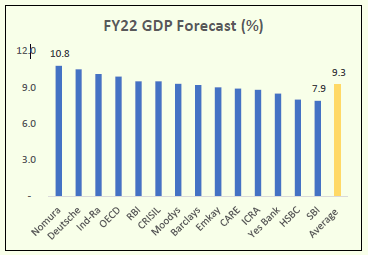

Higher exports growth, increased government spends, 6.0 rising private consumption expenditure led by rising vaccination coverage and unlocking, lower lockdown 3.0 intensity coupled with increased digital adoption, improved Balance Sheet strength of Corporates along with ultra-low interest rates across the entire spectrum of borrowers are multiple factors that will ensure a meaningful GDP growth in FY22E. We thus, expect the GDP to grow at 9.5% in FY22 and even on a worst basis, 8% GDP is doable. Any possible loss in GDP for FY22E, should flow through to FY23E.

DIGITALIZATION: PANDEMIC ADVANCED

THE ADOPTION

What is digitalization?

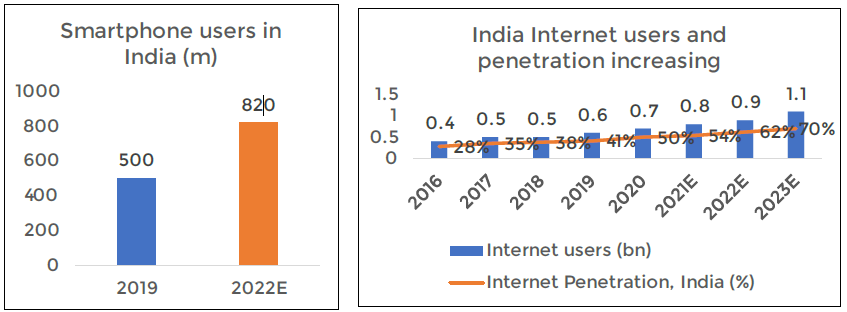

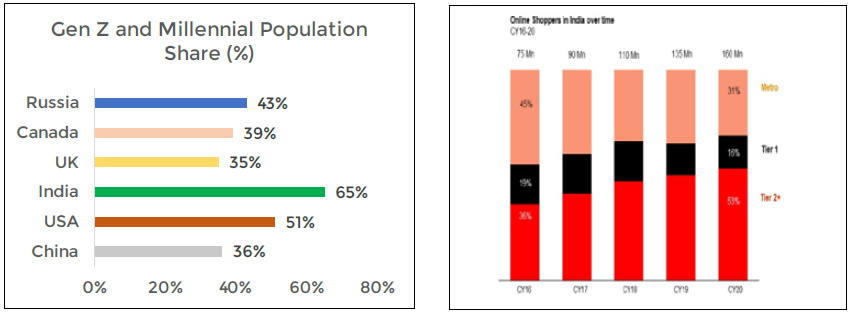

Digitalization can be described as ability of digital technology to connect businesses with customers, collect data, establish trends and make better & informed decisions. For consumers, it is the greater use of technology enabled platforms to meet their daily/necessary requirements. For businesses, it is the use of digital technologies to transform the way they do business and reach the consumer. It is not a nouveau concept but the pace of digital transformation across Industries and consumer acceptance of the same in the last year is what is noteworthy. The increasing smartphone & internet penetration and greater share of Gen X and millennials in India’s population have been key enablers of this acceleration.

Internet reach fueling adoption of e-commerce in smaller towns as well.

With increasing reach and digital penetration, the potential and opportunities are only increasing with greater acceptance from Tier 2 and beyond towns. Tier 2 and beyond customers contributed ~53% share in the online shoppers in India in 2020 vs 36% in 2016.

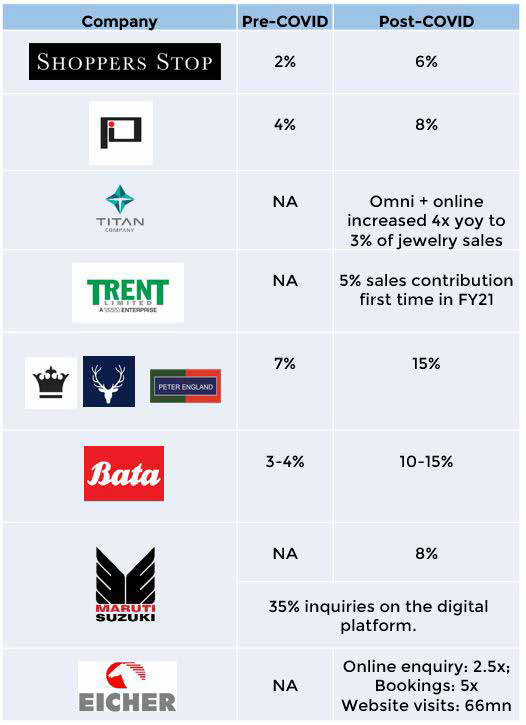

Increasing Omni Channel Focus?

Businesses have increased focus on the ‘omnichannel’ strategy. This strategy involves integrating various sales channels (online, mobile, store etc) and gain better insights about the consumer and their purchasing patterns irrespective of the channel they use to communicate with the business. Hence, a strong digital presence does not only mean greater online sales but also better customer data collation thus converging physical and digital sales.

What led to the rise of digitalization?

Since Mar’20 we have seen two rounds of strict lockdowns forcing businesses to tap into newer ways of selling their product. Instead of waiting for the customer to reach them, they kept the consumer engaged virtually through initiatives such as video calling, virtual store tours, buy online-pickup at store etc. Companies ramped up investments in their online platforms to increase customer traction. Digital marketing has also gained significant prominence given the wider audience it reaches.

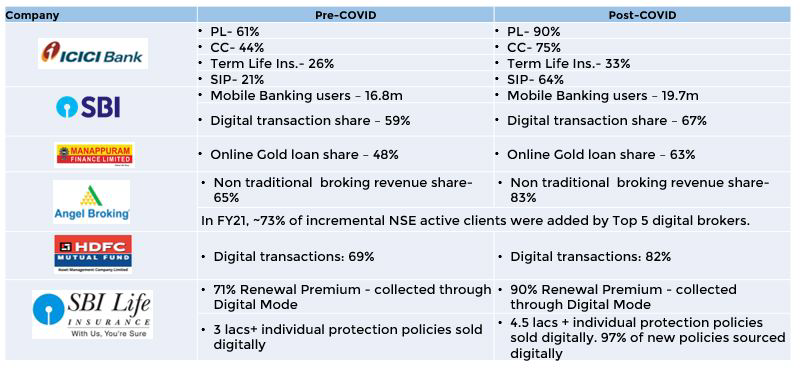

Customers were quickly able to adapt and accepted the new initiatives quite well, be it enquiries or online booking for high ticket items as well e.g automobiles, jewellery, real estate etc. Leading auto companies continue to use the digital route to drive sales following a ‘Phygital’ approach. Barring the test drive and delivery, most of the car purchase journey has been digitalized. BFSI has also seen a noteworthy surge in digital transactions across broking transactions, SIPs, loan dispersals, new policies sold, renewal premiums etc. Even for real estate, while site visit is essential for closing the deal, majority of the processes can be done digitally.

Traction of digital in Retail and Auto

Traction of digital in FMCG and Real Estate

Traction of digital in Banking & Financial Services

Case Study- Broad based acceleration across categories

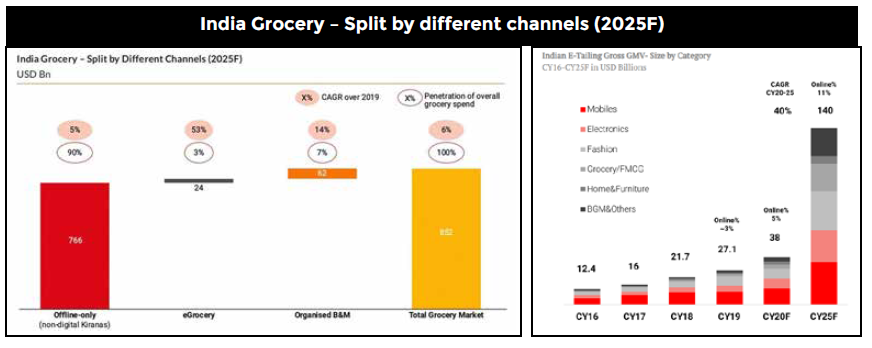

E-tailing (retail shopping using digital medium) or online shopping is expected to reach a share of overall shopping to 11% by 2025 from 3% in 2019. Subsegment like groceries for example, which is largely dominated by kiranas/unorganized players, the e-commerce platform is expected to grow at 53% CAGR over the next five years, thus raising its share from less than 1% in 2019 to ~3% in 2025 (vs ~10% in US). This provides further headroom for growth.

India Grocery – Split bydifferent channels (2025F)

Conclusion

Digitalization to help formal economy to get a boost; key enabler for $5tn & $10tn GDP

Customers are getting accustomed to the greater convenience offered by digital mediums and businesses have a strong channel to reach the end consumers.

Digital adoption across smaller towns has vaulted; Tier 1 & Tier 2 & Tier 3 consumers all have access to same product/services.

FOOD FOR THOUGHT

BOOK REVIEW

LESSONS FROM “THE RICHEST MAN IN BABYLON”

The man who desired Gold:

The “Richest Man in Babylon” is a classic written by George Clason in 1926. The book was written nearly hundred years ago & refers to 5,000 year old wisdom. Yet the principles remain relevant even today.

The book uses ten chapters to give useful financial advice through story-telling. Stories are what we all love to read & hence the book dispenses gems on personal finance very effectively. The author uses a fictional character called “Arkad” who starts from a humble background & goes on to become the Richest Man in Babylon. As keen readers of finance, we thought of presenting to you a brief summary of the book. Here’s a look at the chapters:

The book begins with a dialogue between Bansir, the chariot maker of Babylon & his best friend Kobbi, the musician, both of who were very poor. They were fed up with their poverty & inability to get out of it despite working very hard. Both of them remembered their old friend “Arkad”, who had grown to become the Richest Man in Babylon. They decided to meet him & ask him the secret to his large fortune.

The Richest Man in Babylon:

This chapter introduces the central character of the book “Arkad” who has more wealth than needed to lead a good life. He reveals his secret, which was taught to him by Algamish, the rich money lender. Algamish told Arkad that every time you earn money, you need to keep one-tenth of what you earn with yourself. The key takeaway is that this helps to build discipline, learn to live with less & start saving systematically. Learn to make your treasure work for you. Make it your slave.

Seven cures for a lean purse:

Arkad is summoned by King Sargon of Babylon to reveal the secret of his wealth to others in the kingdom. He gives “seven cures” for not becoming rich:

- For every ten coins that you collect, spend only 9 of them, keep 1 to yourself

- Do not confuse compulsory expenditure with your desires, control your expenditure.

- Put every coin saved to work, invest it (or lend it) so that you earn interest

- Protect your capital against loss or theft by putting it at places where you are sure you can get it back when you desire, & by earning good interest

- Rather than paying rent & living in an undesired neighborhood, build your own home, so you don’t pay anything except taxes to the king (Government). Home can be monetized in times of distress

- Plan to have an income for later in your life, so that your old days are taken care of & your family is protected

- Your long term goals should be clearly defined along with a roadmap

Meet the goddess of good luck:

The desire to be “plain lucky” makes people run after unrealistic goals. Luck only happens by chance. No one can make a sustainable fortune by relying on good luck. Luck often takes the form of an opportunity that you need to seize at the right time. Men of action, who are quick to seize opportunities & make the best of them, are those whom the goddess of luck prefers

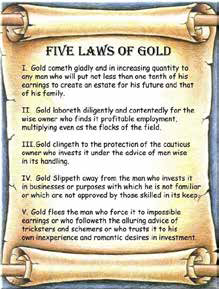

The Five Laws of Gold:

In this chapter, Arkad decided to test his son whether the latter was ready to inherit his hard-earned wealth. He gave him a clay tablet on which were written the following five laws of gold:

- Gold comes willingly to the one who puts aside at least one-tenth of the gold for future wealth creation

- Gold works diligently for an owner who finds a proper allocation for it, in suitable ventures

- Gold remains protected when you invest under the guidance of wise men Gold escapes the one who puts money in businesses he doesn’t understand

- Gold slips away from those who invest with an expectation of making impossible gains, by following advice of fraudsters.

The Gold Lender of Babylon:

This is the story of a common man who receives fifty gold coins as a gift from the king. He goes to a moneylender to ask advice on how the money (gold) can be used to make more money? The wise moneylender says that one who has a lot of gold (wealth & status in this case) has the fear of losing it or getting deceived. On the other hand, it also gives an opportunity to create power & do good to others. The lender must only lend to the one whom he’s sure can repay. Only lend to the one who has a clear plan for its allocation & timely repayment.

The Walls of Babylon:

In ancient times, the walls of a city protected it from enemies & attacks. Similarly, your wealth needs protection from attacks & untoward incidents. This can be done through insurance, proper savings & investments at right places.

The Camel Trader of Babylon:

This story is about how a Tarkad, a young man, was unable to repay the loan he had taken from Dabasir, a camel merchant. The latter explained to him that the one who accumulates debt without having a plan for its repayment is sure to get into trouble.

The Clay tablets from Babylon:

This chapter furthers details a slave’s plan to repay his debt. In short, a person who repays all his debt in time earns respect of his lenders & also becomes more disciplined with respect to managing his finances.

The Luckiest Man in Babylon:

Everyone desires to have all the riches in the world without having to work. However, no one can achieve financial freedom without working hard towards it. Make work your friend, not your enemy, & you will find yourself getting “lucky”.

To invest in portfolio of 20-25 multibagger stocks chosen after detailed research click here.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.