Indian Railways is not one organization but a combination of multiple organizations dedicated to the daily operations and functioning of the railway system. For example, IRCTC is responsible for the ticketing and catering services, IRFC is accountable for meeting the financing needs of rolling stocks (wagons and coaches), RailTel is the information and communication technology provider for the railway, IRCON is involved in the construction of railway projects in India and abroad.

In this blog article, we will discuss one more railway subsidiary, Rail Vikas Nigam Limited (RVNL), which plays a crucial role in developing railway infrastructure in India. And, let us understand Rail Vikas Nigam share price performance. Let’s dig in.

Rail Vikas Nigam Limited

Rail Vikas Nigam Limited (RVNL) was incorporated as PSU in 2003 under the Ministry of Railway to bridge the infrastructure deficit in Indian Railways. RVNL was set up after Late PM Atal Bihari Vajpayee announced the National Rail Vikas Yojna in his 2002 Independence Day speech.

It was created with twin objectives- raising extra-budgetary resources and implementation projects relating to the creation and augmentation of the capacity of rail infrastructure on a fast-track basis.

RVNL lays new lines, doubling, rail bridge electrification, and other critical infrastructure projects. It raises extra-budgetary resources through a mix of equity and debt from banks, financial institutions, multilateral agencies like the Asian Development Bank, etc.

Business Overview of RVNL

RVNL functions as an extended arm of the Ministry of Railways and is empowered to act as an umbrella Special Project Vehicle to undertake project development, resource mobilization, etc. It operates both through SPVs and subsidiaries.

The company generates revenue through management fees on the total expenses incurred for the projects at the following margin:

- 10% for national projects

- 9.25% for the metro projects

- 8.5% for other plan heads

It executes all types of railway infrastructure works such as new lines, gauge conversion, electrification, workshops, hill railway projects, institutional buildings, mega bridges, and metro railways. It consistently contributes 30% of the total Indian Railway infrastructure each year.

To date, RVNL has commissioned over 15,500 km of railway infrastructure with a project expenditure of ₹1.25 lakh crores. The company has an excellent MoU performance rating among Railway PSUs and was awarded “Navratna” in May 2023.

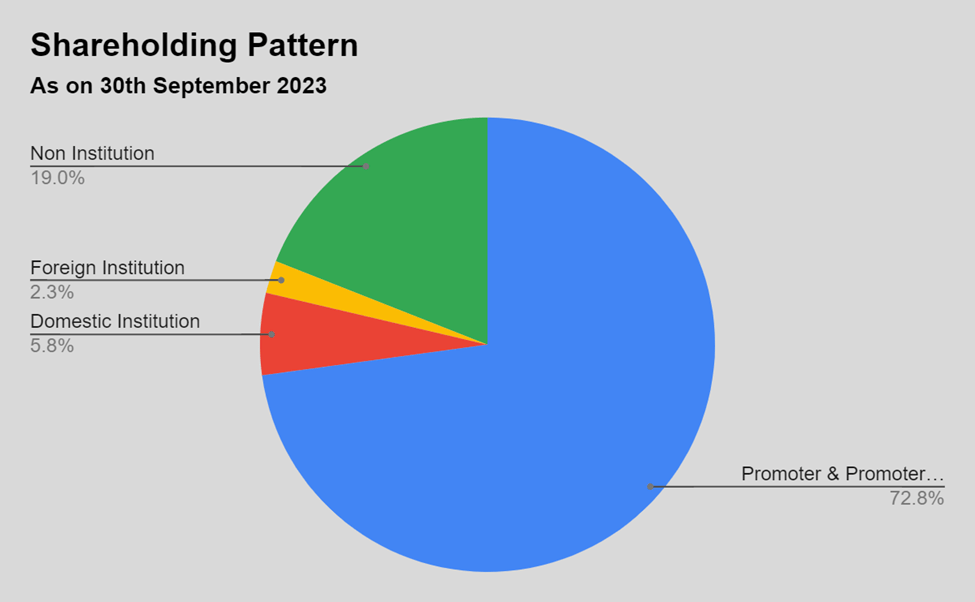

Shareholding Pattern

Key Management Personnels

Shri Pradeep Gaur is the Chairman and Managing Director of RVNL, appointed in September 2018, and has been with RVNL since its inception. He is a 1987 batch IRSE officer working with Indian Railways from 1989 to 2005. Mr. Gaur completed a B.Tech from REC, Kurukshetra, 1986 and an M.Tech in Structural Engineering from Punjab Engineering College.

Shri Vinay Singh is the Director (Projects) and assumed responsibility in August 2019. He is a 1986 batch IRSE officer with extensive experience in planning, development, design, construction, and maintenance of Railway Transport Infrastructure. Mr. Singh has a B.Tech in Civil Engineering from IIT Roorkee in 1986 and M.Tech from IIT Delhi.

Shri Rajesh Prasad was appointed Director (Operations) in March 2020. He completed a B.Tech in civil engineering from IIT Kanpur in 1987 and an M.Tech from the same college in Environmental Engineering. Mr. Prasad joined the Indian Railway after clearing the IRSE 1988 exam batch.

Shri Sanjeeb Kumar is the Director (Finance) & CFO, and IRAS officer of the 1989 batch. He holds an M.A., MBA, and LLB from the University of Delhi. Mr. Kumar has served in various capacities in the Railway Board and Zonal Railways and has officiated as Director (Finance) in RailTel and IRCTC.

RVNL Financials

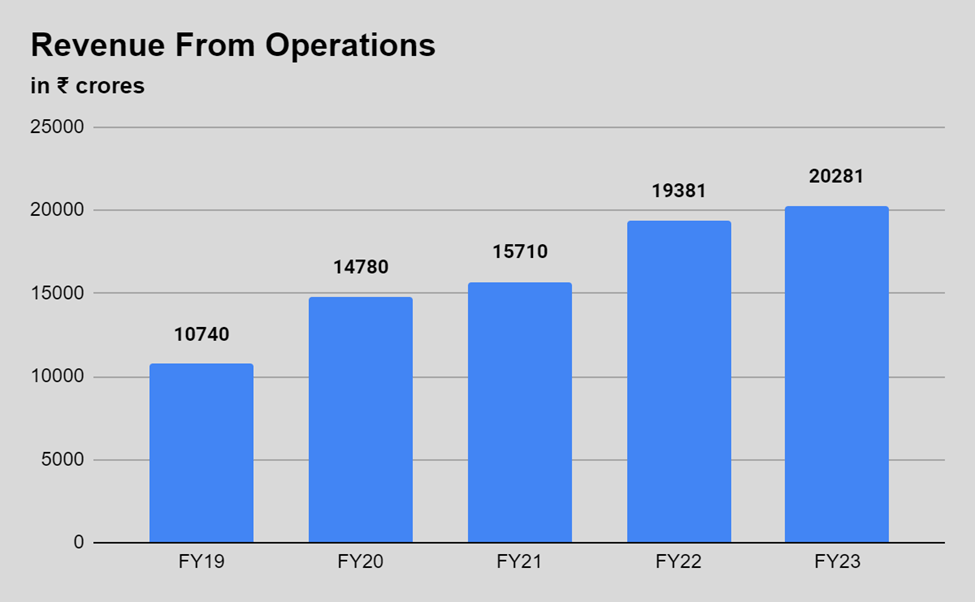

Revenue

In FY23, the company’s revenue increased by 5.42% to ₹21,285.51 crores from ₹20,190.97 crores in FY22. And, for the six months ending September 30th for FY24, the company recorded a total income of ₹11,063.52 crores, up by 10.53% from ₹10,009.16 crores in H1FY23.

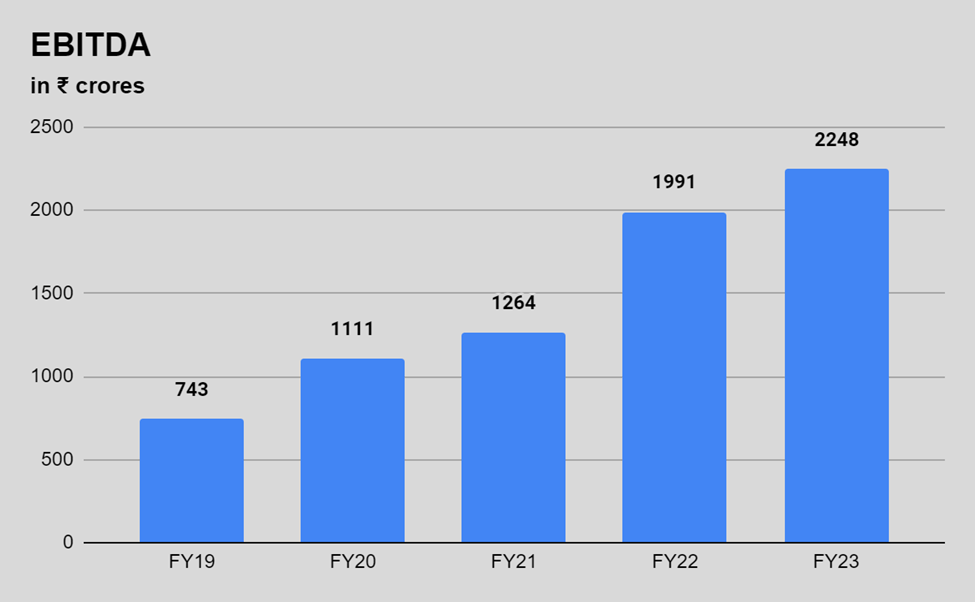

EBITDA

and_Annual_Report.pdf

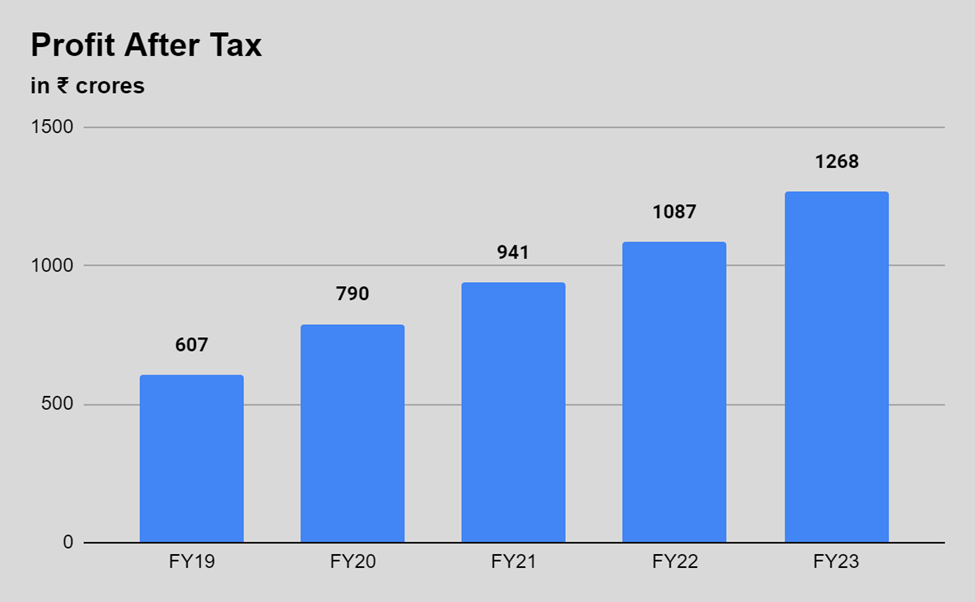

Profit After Tax

The company’s net profit increased by 16.57% over the previous year to ₹1,268 crores in FY23 from ₹1,087 crores in FY22. And, for the six months ending September 30th for FY24, the company recorded a net profit of ₹737.51 crores, up 8.6% from ₹678.89 crores in H1FY23.

Key Financial Ratios

Current Ratio: At the end of 31 March 2023, RVNL reported a 2.11% decline in the current ratio to 2.02 times from 2.07 times in FY22.

Debt-to-equity Ratio: The company’s debt-to-equity ratio deteriorated to 0.99 times in FY23 from 1.17 times in FY22.

Net Profit Margin: The company’s net profit margin in FY23 was 6.25%, compared to 5.61% in FY22.

Return on Capital Employed (ROCE): The ROCE of the company at the end of 31st March 2023 was 17.27%, compared to 16.11% in FY22.

Return on Equity (ROE): At the end of FY23, the ROE of the company was 20.94%, compared to 21.47% at the end of FY22.

RVNL Share Price Performance Analysis

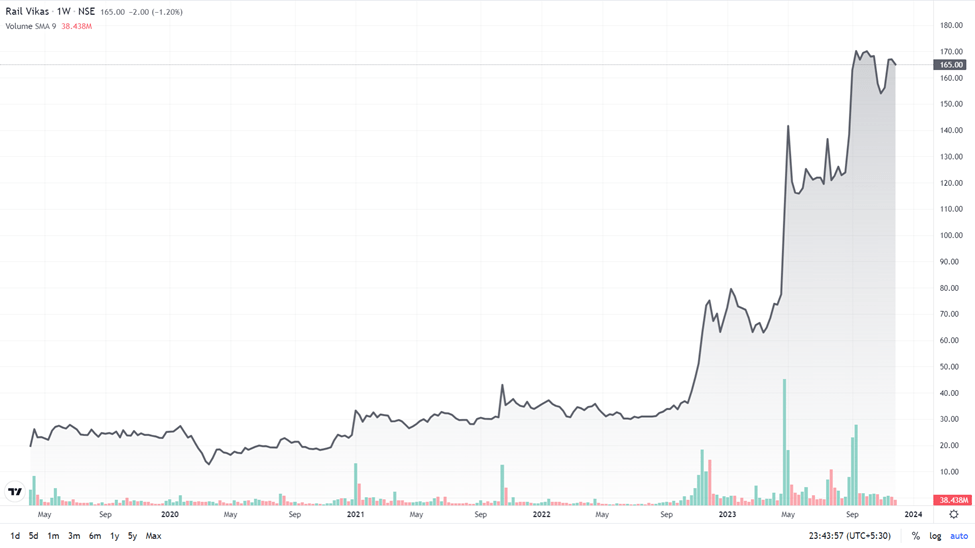

The IPO of RVNL was launched in March 2019 at a price band of ₹17-19 per equity share. The IPO was oversubscribed 1.78 times and made a flat market debut. However, the stock has provided good returns to investors since its listing, with a CAGR of 91% over the last three years (3rd December 2020 to 3rd December 2023).

RVNL has a track record of consistently paying dividends to its shareholders, paying ₹1.58 in 2021, ₹1.83 in 2022, and ₹2.13 in 2023 as dividends.

The RVNL share price hit an all-time high level of ₹199.25 on 19th September 2023, and the company has a market capitalization of ₹34,403 crores as of 3rd December 2023.

Key Highlights

- RVNL consistently contributes 30% of the infrastructure requirements of Indian Railways each year.

- For the past 12 years, RVNL has received the highest MOU Rating of “Excellent” among all central public sector companies. The rating is given by the Ministry of Finance.

- The company’s current order book stands at over ₹56,000 crores (₹36,000 crores assigned by the Ministry of Railways and ₹20,000 crores through bidding projects).

- RVNL has a very low interest rate and default risk as borrowings on the book are a pass-through entry where the Ministry of Railways bears interest and principal repayments.

- RVNL signed a shareholder agreement with Russia’s Transmasholding (TMH) to supply 120 Vande Bharat train sets and a maintenance contract for these train sets for 35 years.

- RVNL may sign projects worth over ₹300 crores with the Government of Kyrgyzstan, expanding its international operations.

- RVNL enjoys a near monopoly-like status in Indian Railways and by leveraging its position as an execution agency for the Ministry of Railways, it is now focusing on high-value projects in a sustained manner and also bidding on projects outside Indian Railways.

Increased Capex By Indian Railways

The government and the Ministry of Railways are spending heavily on improving the infrastructure of railways. In FY24, it may make a highest-ever capital outlay of ₹2.6 lakh crores, of which major spending will happen on the construction of new lines, doubling, rolling stock, track renewals, and improvement of customer amenities.

RVNL is expected to be chosen for the mega development contracts of important infrastructure projects since it is the Ministry of Railways’ preferred execution agency.

Capex by railways has increased from around ₹46,000 crores in FY14 to over ₹2.6 lakh crores in the last 10 years, and the government is likely to continue the spending momentum for the development railways as a part of efforts to reduce logistics costs and reliable transporter.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What does RVNL do?

Rail Vikas Nigam Limited (RVNL) is an extended arm of the Ministry of Railways. It is tasked with raising extra-budgetary resources through a mix of equity and debt from the market and executing key railway infrastructure projects.

How has Rail Vikas Nigam share price performed in the last 3 years?

RVNL share was listed on the market on 10th April 2019 and had a flat market debut at ₹19. RVNL share price is currently trading at ₹165 as of 3rd December 2023. In the last three years, from 3rd December 2020 to 3rd December 2023, the RVNL share price has given a CAGR return of 91%.

When RVNL was started?

RVNL was incorporated in 2003 under the National Rail Vikas Yojna, announced by Late PM Atal Bihari Vajpayee in his 2002 Independence Day speech to bridge the infrastructure deficit in Indian Railways.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 83

No votes so far! Be the first to rate this post.