Introduction

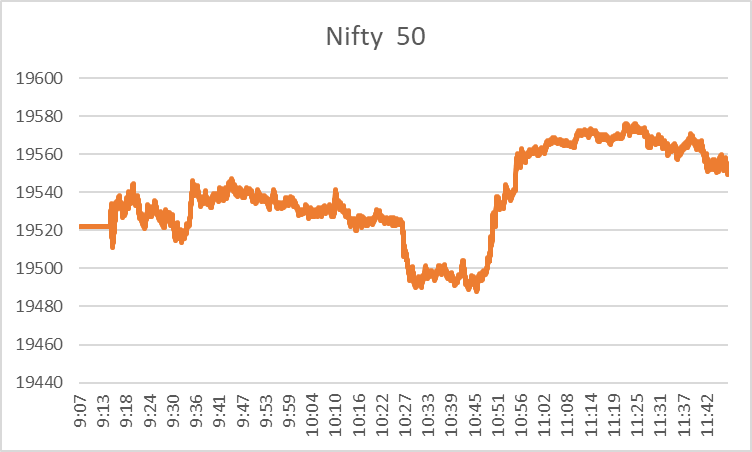

After closing at 19436.10 yesterday, which was a dip of 0.47%, the Nifty 50 finally started on a positive note today. Around 11 a.m., the index has been trading at 19492.40, up by 0.29% compared to yesterday’s close.

Media, realty, and IT sectors are the major forces behind the positive movement in the stock market today. However, the sectors performing better yesterday, such as the FMCG sector, are under selling pressure today. [NSE]

With the adverse global cues and rising crude prices still in play, the domestic markets are also under selling pressure. This is why, even though the market has gained today until now, the margin is tiny.

Sectors in the Green

NSE Media Sector Today

Media stocks are offering significant gains in the stock market today. The upcoming festive seasons, big-budget films, and OTT releases are in the pipeline, pulling the sector upward.

Top Media Stocks Today

- Network 18 has gained around 5.58% at 11.11 a.m. today, riding on the buoyant media sector.

- Nazara’s share price gained around 5.06% after it announced the acquisition of PublishME, a game marketing agency, by its material subsidiary, Nodwin Gaming Private Limited.

- Sun TV has also gained around 3.40% on the positive market cues.

NSE IT Sector Today

The IT sector seems to be reviving as the Nifty IT moved up by 1.55% until now in today’s session. Stocks like TCS, Infosys, and MPhasis are pivotal in pulling the sector up.

Top IT Stocks Today

- TCS has gained around 2.09% since the previous day’s closing following the announcement of its collaboration with the Georgia Department of Labor for upgrading the unemployment system.

- Infosys has also increased by 1.86% until now due to the overall positive sentiment around IT stocks today.

- MPhasis surged by 1.39% during today’s market session following the announcement of its strategic partnership with CoreStack.

NSE Realty Sector Today

The realty sector has also been pouring gains today as the festive season is knocking on the door. The Nifty Realty has surged by around 0.95% until now, mainly driven by shares like Prestige, Sobha, Lodha, and Godrej Group.

Top Realty Stocks Today

- Prestige Share price increased today by around 4.73% around 11.30 a.m., flying with the festive winds.

- Sobha Ltd. has gained around 2.83% following its release of sales figures for the second quarter of FY24. It recorded the highest-ever sales in a quarter of Rs. 17.24 billion. It is an increase of 48.10% on a YoY basis.

- Macrotech Developers, commonly known as Lodha, has gained 1.53% in today’s session following the release of its positive quarterly sales report.

Sectors in the Red

NSE PSU Bank Sector Today

As RBI is supposed to announce its decision about interest rates for the quarter, the PSU banks are sceptical, leading to a fall in this sector. The Nifty PSU Bank is down by 0.42% today.

Top PSU Bank Losers

- PNB has been pulling down the sector the most today as it dropped by 3.51% until now. However, the bank posted growth for the July- September 23 quarter. The bank’s total business has grown by 11.30% on a YoY basis, while the total deposits have grown by 9.7%.

- Union Bank is the second strongest force today behind the fall of the sector. Union Bank has fallen by 3.27% until now.

NSE Pharma Sector Today

If you look at the Nifty Pharma Index, today’s Pharma sector has dipped by 0.41%. The sector seems to be losing due to negative global cues and speculation around interest rate hikes.

Top Pharma Loser Stocks

- Glenmark lost 1.69%

- Granules, which lost 1.60% today.

Unlike the previous today trading session, the Indian stock market today is in the green as it waits eagerly for the RBI’s interest rate decision and the festive season to bring in new joys.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 1 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/