Investing in the stock market is often seen as a long-term game, and this sentiment is aptly captured by Warren Buffett’s famous quote: “If you aren’t thinking about owning a stock for at least 10 years, then don’t even think about owning it for 10 minutes.”

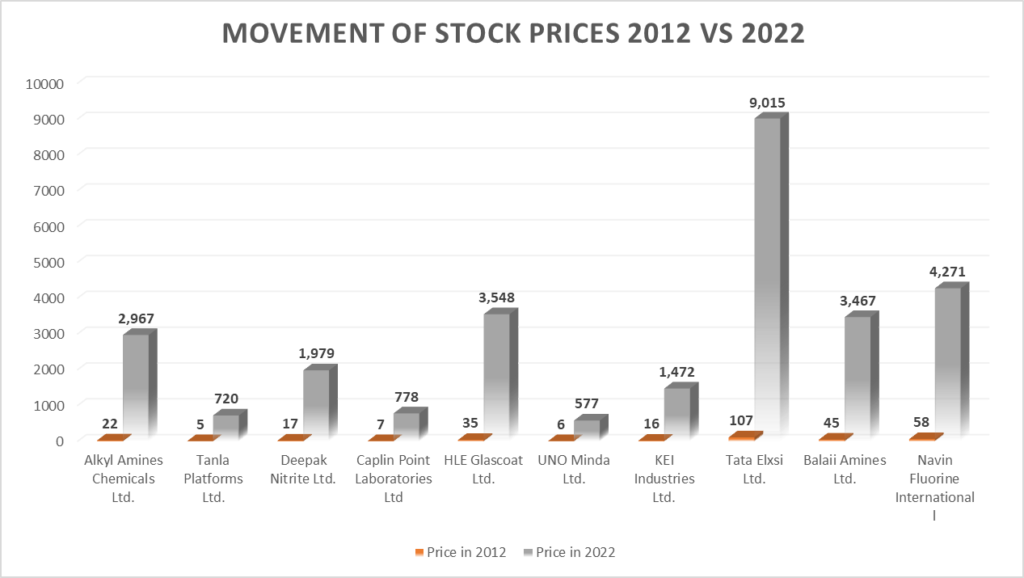

In line with this philosophy, let’s dive deep into the Nifty 100 list and examine some of the stocks that have defied the odds, generating massive returns of more than 1000% over 10 years from 2012 to 2022.

Let’s unravel the secrets of success behind these top-performing stocks.

| Rank | Company Name | Price (as of 30 Aug ’12) | Price (as of 30 Aug ’22) | Return (In %) |

| 1 | Alkyl Amines Chemicals Ltd. | 22 | 2967 | 13344 |

| 2 | Tanla Platforms Ltd. | 5 | 720 | 13030 |

| 3 | Deepak Nitrite Ltd. | 17 | 1979 | 11640 |

| 4 | Caplin Point Laboratories Ltd | 7 | 778 | 11492 |

| 5 | HLE Glascoat Ltd. | 35 | 3548 | 10125 |

| 6 | UNO Minda Ltd. | 6 | 577 | 9475 |

| 7 | KEI Industries Ltd. | 16 | 1472 | 9040 |

| 8 | Tata Elxsi Ltd. | 107 | 9015 | 8314 |

| 9 | Balaii Amines Ltd. | 45 | 3467 | 7586 |

| 10 | Navin Fluorine International Ltd. | 58 | 4271 | 7303 |

1. Alkyl Amines Chemicals Ltd. (Return: 13,344.49%)

Alkyl Amines Chemicals Ltd. is a popular success story in the stock market. Over the past decade, its stock price soared from a modest Rs 22.07 on August 31, 2012, to Rs 2,967.2 on August 30, 2022. So, what’s the success behind its incredible growth?

Strengths:

- Niche market focus: Alkyl Amines Chemicals specializes in producing a range of chemicals, including methylamines and ethylamines. Its focus on these niche products has allowed the company to maintain healthy profit margins and limited competition.

- Global expansion: The company’s efforts to expand its presence in international markets and rising global demand for its products have been key drivers of its exponential growth.

- Strategic leadership: Alkyl Amines Chemicals is led by a visionary management team that has made prudent decisions regarding expansion, diversification, and product innovation.

2. Tanla Platforms Ltd. (Return: 13,030.47%)

Tanla Platforms Ltd. has achieved an impressive return of 13,030.47%, with its stock price surging from Rs 5.48 in 2012 to Rs 719.55 in 2022. This telecommunications technology company has found its unique path to success.

Strengths:

- Digital transformation: Tanla Platforms has capitalized on the global shift towards digital communication. Its cloud communication services have gained popularity as businesses seek efficient and scalable communication solutions.

- Strategic partnerships: The company’s partnerships with major players in the technology and telecom sectors have bolstered its market presence and helped it tap into new customer segments.

- Innovation in AI and automation: Tanla Platforms’ investments in artificial intelligence and automation have allowed it to offer cutting-edge services, enhancing its competitiveness in the industry.

3. Deepak Nitrite Ltd. (Return: 11,639.92%)

Deepak Nitrite Ltd. has delivered an impressive return of 11,639.92% over the past decade. Its stock price surged from Rs 16.86 in 2012 to Rs 1,979.35 in 2022. The company operates in the chemicals and dyes sector.

Strengths:

- Diversification: Deepak Nitrite’s diversification into various chemical segments, including specialty chemicals and performance products, has helped it mitigate risks and benefit from multiple revenue streams.

- Global reach: The company’s international expansion strategy has positioned it as a reliable supplier of chemicals to a wide range of industries worldwide.

- Innovation and research: Deepak Nitrite has invested significantly in research and development, allowing it to stay ahead in the highly competitive chemical industry.

4. Caplin Point Laboratories Ltd. (Return: 11,492.4%)

Caplin Point Laboratories Ltd. has rewarded its investors with a remarkable return of 11,492.4%. The stock price surged from Rs 6.71 in 2012 to Rs 777.85 in 2022. This pharmaceutical company’s success story is characterized by several factors below.

Strengths:

- Quality assurance: Caplin Point Laboratories has maintained a strong focus on product quality and regulatory compliance, instilling customer trust.

- Diverse product portfolio: The company’s extensive range of pharmaceutical products, including injectables and oral solids, has allowed it to cater to diverse healthcare needs.

- Global expansion: Caplin Point Laboratories’ global presence and strategic partnerships have opened up new markets, contributing significantly to its impressive growth.

5. HLE Glascoat Ltd. (Return: 10,124.5%)

HLE Glascoat Ltd. rounds out our list with a return of 10,124.5%, as its stock price climbed from Rs 34.7 in 2012 to Rs 3,547.9 in 2022. This company specializes in providing glass-lined equipment solutions.

Strengths:

- Specialization in niche market: HLE Glascoat’s niche focus on glass-lined equipment solutions for the chemical and pharmaceutical industries has set it apart, allowing it to establish itself as a market leader.

- Quality and innovation: The company’s commitment to product quality and continuous innovation has earned it the trust of its customers and enabled it to maintain a competitive edge.

- Global footprint: HLE Glascoat’s global presence and distribution network have enabled it to cater to a diverse customer base worldwide.

6. UNO Minda Ltd. (Returns: 9,475.46%)

UNO Minda Ltd. has shown a substantial return of 9,475.46% over the years, with its stock price growing from Rs 6.03 to Rs 577.4. The company specializes in manufacturing automotive components and solutions. So, what’s under the hood of UNO Minda’s success?

Strengths:

- Strong presence in the automotive industry: UNO Minda has established itself as a critical player in the automotive sector, providing various components to domestic and international markets. This diversified product portfolio has been instrumental in its growth.

- Innovation and technological advancements: The company’s commitment to innovation and adopting new technologies has allowed it to stay ahead of the game. UNO Minda’s focus on creating value-added solutions has resonated well with its customers.

- Global expansion: UNO Minda’s strategic expansion into global markets has opened new revenue streams. By tapping into international demand, the company has fueled its growth.

7. KEI Industries Ltd. (Returns: 9,040.06%)

KEI Industries Ltd. has showcased an impressive return of 9,040.06%, with its stock price surging from Rs 16.1 to Rs 1,471.55. This company specializes in manufacturing power cables and conductors. Let’s uncover the wires of KEI Industries’ success.

Strengths:

- Infrastructure growth: KEI Industries has benefited from the rapid infrastructure development in India. The demand for power cables in construction, real estate, and industrial projects has increased, and the company has capitalized on this trend.

- Quality and reliability: The company’s commitment to producing high-quality products with a strong emphasis on reliability has earned it a stellar reputation in the industry. Customers trust KEI Industries for their critical wiring needs.

- Innovation and R&D: KEI Industries has continuously invested in research and development, leading to the development of advanced cable solutions. Staying ahead of industry standards has been a critical driver of its growth.

8. Tata Elxsi Ltd. (Returns: 8,313.53%)

Tata Elxsi Ltd. has delivered an impressive return of 8,313.53%, with its stock price rising from Rs 107.15 to Rs 9,015.1. The company operates in the technology and design services sector. So, what’s the code behind Tata Elxsi’s success?

Strengths:

- Technological prowess: Tata Elxsi is known for its technical capabilities, particularly in automotive design and artificial intelligence. Its ability to offer cutting-edge solutions has attracted clients from diverse industries.

- Global partnerships: The company’s strategic alliances with global technology giants have helped it access a broader market and stay at the forefront of technological advancements.

- Diversified clientele: Tata Elxsi’s diverse client base across healthcare, media, and automotive industries has provided stability and growth opportunities even in challenging economic environments.

9. Balaji Amines Ltd. (Returns: 7,586.47%)

Balaji Amines Ltd. has seen a remarkable return of 7,586.47%, with its stock price soaring from Rs 45.1 to Rs 3,466.6. The company specializes in the manufacturing of amines and their derivatives. What has catalyzed Balaji Amines’ success?

Strengths:

- Specialized niche: Balaji Amines has carved a niche for itself by focusing on the production of amines. The specialized nature of its products has limited competition and allowed it to maintain healthy profit margins.

- Quality assurance: The company’s unwavering commitment to product quality and adherence to strict quality control measures has gained customers’ trust and ensured repeat business.

- Global reach: Balaji Amines’ international expansion has unlocked new markets, ensuring a steady revenue inflow from overseas customers.

10. Navin Fluorine International Ltd. (Returns: 7,302.51%)

Navin Fluorine International Ltd. has demonstrated an impressive return of 7,302.51%, with its stock price climbing from Rs 57.7 to Rs 4,271.25. The company is engaged in specialty fluorochemicals manufacturing. So, what’s the chemistry behind Navin Fluorine’s success?

Strengths:

- Unique product portfolio: Navin Fluorine’s specialization in fluorochemicals, which find applications in diverse industries, including pharmaceuticals, agrochemicals, and refrigeration, has positioned it as a market leader.

- Research and innovation: The company’s focus on research and development has allowed it to create new products and applications, staying ahead of competitors in a highly specialized field.

- Global presence: Navin Fluorine’s global presence and strong customer relationships have helped it tap into international markets and diversify its revenue sources.

Before You Leave

As we study these remarkable stocks, it becomes evident that there is no one-size-fits-all formula for success in the stock market.

Diverse industries, strategic agility, strong management, and adaptability to market dynamics all play crucial roles. It’s essential to remember that while these stocks have delivered exceptional returns, investing in the stock market always carries risks. Therefore, thorough research and a long-term perspective remain essential for investors looking to make the most of their investments.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 13

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/