We shifted our newsletter thoughts collection base from Starbucks in suburban Mumbai in early October to Hotel Radisson Blu in Karjat, a 3-hour drive from Mumbai in early November. A few facilities such as gym, pool were still closed. Irrespective of this, the hotel was buzzing with guests who seemed to be enjoying their freedom after being locked for a good 6-8 months. Our channel checks to hotels, malls, food courts, local markets and glance into headlines or commentaries made by corporates suggests resumption of onground activities is unbelievable. With local trains expected to resume in some parts of India, all parts of the economy should be up.

OCTOBER: LIVING UPTO ITS NAME

October is typically associated with days which are flush with falling leaves, chilling weather, and growing anticipation for the holiday season. In India and globally, people lived up to the spirit of the month as we could see the fear of Covid reducing (read: treating it as a part of life for some time), people moving out of the comfort/warmth of their homes towards the cooler environment and spending time on shopping, entertainment, vacation etc. We guess besides the weather, temperatures at home had been rising month on month seeing the same faces every day, juggling between work and home, family time, kitchen and surrounded by electronic gadgets throughout the day.

Covid News Flow Incrementally Offering Bipolar Perspective

In the US and Europe, we saw more than a doubling of cases per day. However, India has seen a massive reduction from 98000 to <50000 cases per day.

The second wave globally, upcoming festival and winter make India vulnerable. However, India is better prepared considering business resumption, ramp up in testing rates and awareness campaigns. Testimony to this is recently concluded elections in Bihar.

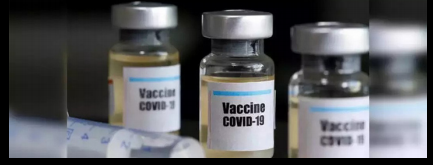

Vaccine with 90% efficacy is now available, but there are hurdles like transporting and storing a vaccine at -70°C. Does the world have enough freezers, distribution/ logistics infrastructure, etc. or we wait for another vaccine?

MACROECONOMIC VARIABLES- OCTOBER

- E-way bills rose 21% to 64.1 mn, highest ever since it was introduced.

- Railway freight volumes up 15% year-on-year (YoY).

- Manufacturing PMI at 58.9, which is a 13-year high and up 16% YoY.

- Services PMI at 54.1 (up 10% YoY) vs. 49.8 in September 2020. Reading above 50

indicates expansion, while a sub-50 print signals contraction. - GST collections up 10% YoY and month-on-month (MoM) to Rs. 105,155 crore.

Core data de-growth was much lower at 0.8% driven by the rise in

production of coal (21%), steel (0.9%), electricity (3.7%) and rest declining in

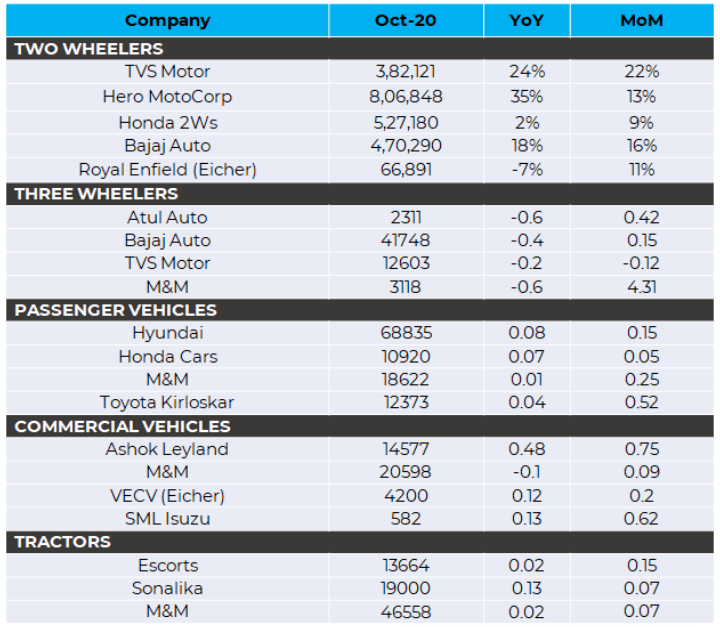

single digits. - Passenger cars volume up 14% YoY and 2-wheelers by 17%.

For a detailed assessment on on auto industry check out our video here.

EMERGING TRENDS

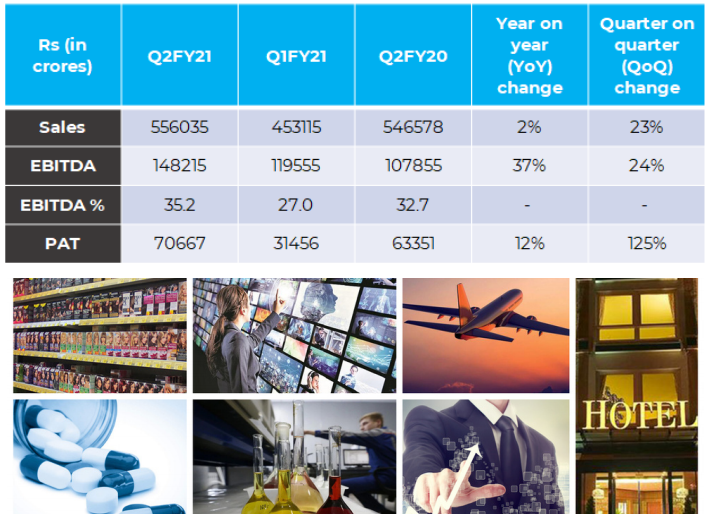

1: 2 Q F Y 2 1 SO F A R : Y O Y Growth Surpassing Even The Optimistic Estimates

- Unlock and resumption of normal activity at ground level in the 2nd quarter was much higher than estimated.

- Impact from sectors hit the most (retail, entertainment, hotel, airline) was covered by sectors that benefited (pharma, IT, chemicals) and others didn’t get impacted as much as estimated (auto, metals, realty).

- Fixed cost rationalization was very steep and some of it permanent, while many corporates have increased their IT/digital spend to prevent sales drop.

- Lower-than-expected provisioning costs in BFSI.

B S E 5 0 0 : S a m p l e o f 1 3 5 c o m p a n i e s

2: Corporate Commentary

IT companies have been posting results ahead of consensus estimates and new transformational deals are getting signed. Outlook by management has been bullish like never before. Leading IT companies have been hiring big as seen in spike in headcount q-o-q in 2QFY21 besides announcing salary hikes, bonuses, promotions for its employees. So is it a 2-3 quarter phenomenon or will stay for longer; we believe it’s the latter.

Banking sector is out of the woods with diminishing fear of spike in NPAs, the resilience of NIM. Private banks led by Kotak, ICICI, and Axis have beaten expectations, with higher collection efficiency, uptick in loan growth, and healthy Provision Coverage Ratio leading to doubledigit earnings upgrades. Management commentaries indicated stress on asset quality due to the pandemic may not be as bad as initially feared, although banks continue to increase provisions for COVIDrelated stress. Next trigger to watch for will be the upward trajectory in credit growth at the system level, which so far is languishing at 5% for Year to Date (YTD) FY21.

Most retailers including Samsung, LG, Aditya Birla Fashion & Retail Ltd (ABFRL) are witnessing higher sales in smaller cities compared to large cities even in higher priced discretionary categories, with footfalls back to normal at the stores. Metros are still under the attack of higher Covid cases and reduction in salary/discretionary budgets. LG now gets half of its sales from Tier 2 and 3 towns compared to a third pre-Covid. Samsung’s sales in October vs. same month last year, in smaller cities grew 36% overall and 68% premium products, much higher than large cities. ABFRL and McDonalds also allude to the fact that their sales in small cities are at par or even higher than pre-Covid levels, unlike trend seen in metros or larger cities.

52% of customer visits on Flipkart were from Tier 3 towns and beyond. Amazon got orders from 98% of Indian pin codes within the first two days of the festival denoting some relief for MSMEs and kirana stores (tie-ups done) in the hinterland.

3: Unlock Behaviour

Reliance Digital, India’s biggest electronics retail chain, saw 30-40% YoY growth in Aug and Sep largely from smartphones, TVs, refrigerators, ACs, laptops given requirement from homeschooling/WFH, etc. Reliance’s fashion store chain Trends sales grew 2x YoY in

2QFY21 and company expects aggregate sales to recover to pre-Covid levels by 3QFY21.

Amazon, Flipkart and Myntra, in their annual festive sales saw massive success. Flipkart generated 110 orders/second and delivered over 1 crore shipments (10x YoY). Amazon saw the biggest opening day for Prime members ever with leading categories sales from mobiles, fashion, electronics, grocery, toys, books and home furnishings. This trend suggests an impressive ecosystem developing around these massive events with millions of square feet of warehousing, lakhs of jobs getting created, quality products being available pan India and demand for ancillary products like packaging material, involvement of local kiranas, consumer financing etc.

Recently, SBI announced a 20bps discount for properties costing > 75L (users of YONO app, to get another 5 bps discount). This brings SBI home loan rates to the lowest they have been in years (~6.9%), Kotak is @ 6.9% too, others will likely follow suit. With RBI lowering rates, and easing of risk weights on home loans, the current home loan rates are the lowest ever in last 2 decades.

Thanks to these mouthwatering rates and stamp duty cuts, we see green shoots in real estate. Maharashtra saw 2.4 lac property registrations in Sept 2020 (+26% YoY), According to Knight Frank – FICCI Real Estate Sentiment Index, future sentiment score has climbed to 52 in the last quarter (vs. 41 in quarter before). In the US also, existing-home sales rose to an annual rate of 6.54m in Sep20

(+21% vs. Sep19, +9% vs. Aug20). According to Freddie Mac, the average rate for a 30-year fixed rate mortgage is at 2.8%, a historic low.

Businesses across the world are adapting to remaining operational during current times, and one exciting transformation seems to be happening at traditional British Pubs. Many British pubs are transforming into a digital office to beat the slump in trade and are offering hot-desking packages to people working from home. The deals include a table to work on, a steady internet connection, as well as

food and hot drinks. Under the package, people can pay £10-12 a day for unlimited Americano coffee or tea, internet connection, and a meal. It seems to be going strong so far, given monotony of being at home so far.

PARTY AT DALAL STREET CONTINUES IN NOVEMBER…

The unlock theme on Indian roads was reflected in October with Nifty rising 3.5% which continued in November till date with 9% rally fuelled mostly by the banking sector. Key events leading this were:

- Decisive win for Joe Biden, the new US president and continuation of ruling NDA government in Bihar.

- Announcement of 90% efficacy vaccine by Pfizer.

- Banking Index covering up for the underperformance in FY22 till date by rising 20% backed by solid results/commentary from large private sector banks.

- Government of India announcing PLI (Performance linked Incentive scheme)for 10 sectors totaling 2 lakh crore to be given over 5 years to incentivize manufacturing in India.

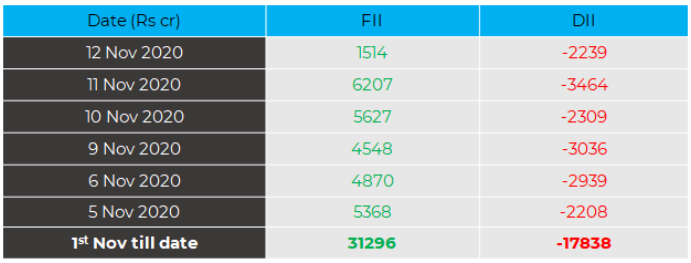

- FII buying in November till date stands at approx. Rs. 31,000 crore, which is the highest monthly in 2020 and double that of the previous best month (October). And all this while, the DIIs have been net sellers.

Making a New High Before Diwali

Nifty crossed its previous high made in January and is now around 12700. It has surpassed even the most optimistic targets set by any expert. This seems unreal given it was only in the end of February that Covid had struck globally. The scorching rally or pullback initially was supported by liquidity & fiscal stimulus, but soon got support from other areas like earnings recovery or degrowth much lower than estimated, gradual unlocking of the economy, rerating basis confidence that lower oil price and interest rate are there to sustain longer than expected. The momentum and strength in the US indices in the previous months also played its role.

As per IMF report, government across the world had committed $12tn in fiscal stimulus. And there could be another $2tn coming in the US. This totals to a $14tn stimulus. The world economy as per IMF is expected to contract by 4.4% in 2020. So on a base of ~$88tn GDP, a 4.4% decline is equivalent to a $3.9tn hole. As against this, the stimulus is 3.5x of this. And this is probably what markets are taking confidence from as they look ahead. Further, to sweeten the deal, Fed has already announced to keep rates lower for longer, and ECB also has some ‘arsenal’ of stimulus if required.

Can the momentum continue into Christmas/Newyear & beyond?

Read below and decide for yourself:

- Government stimulus direct or indirect doesn’t cease to be taking a halt.

- Fear of virus seems to be at an all-time low since March 2020 with 90-100% normalcy in the economic activity.

- Availability of vaccine and mass usage will happen sooner than later.

- Many businesses have adapted (rationalized fixed costs) or capitalized on the opportunity in the last 9 months.

- Earnings recovery in 1Q and 2Q has surprised the entire country.

- While some sectors will take longer to recover, majority of them are in better shape as compared to pre-Covid or should be at par in the coming months.

- Nifty at current levels is at 20x FY22 and 17x FY23 PE vs. the long term range of 18-22x. Current low interest rate environment makes a case for rerating to historical range.

- Market cap to GDP currently at 85% on FY21e and 75% on FY22e vs. peak of 95% in FY08 and average of 75% in the last 15 years.

- Moody’s has raised its India GDP forecast for calendar 2021 to 8.6% from 8.1% earlier.

We remain bullish on India’s growth story and advice our readers to capitalize on every market correction, adopt a staggered buying approach while investing in equities and most importantly follow the 3Ps of investing – Patience, Perseverance and Power of Compounding.

Wish you a very Happy Diwali & Prosperous New Year

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.