Amid Israel-Hamas War, How is the Share Market Performing Right Now?

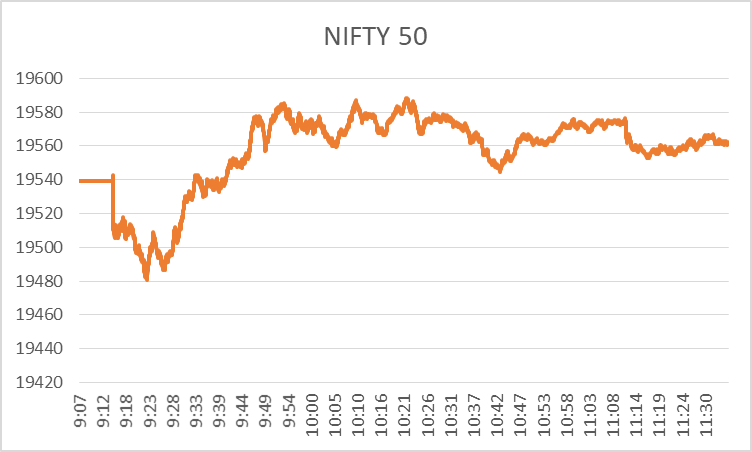

As the Indian domestic market was tuning in to the festive mood, stock prices were going up, freshly brewed Israel-Hamas war again jeopardized the entire market. As the global market plunged, Nifty 50 is also down by 0.46% in the share market today.

All the sectoral indices are in red except Nifty IT and Nifty Healthcare indices; however, these two have been gaining marginally until around 10:45 a.m.

Nifty today opened at 19539.45, again down from its 19600 level, which it surpassed in the last market session on Friday.

We have to wait and watch the situation. Today, the market may open lower, but we cannot judge how this will pan out going ahead,” Samir Arora, founder and fund manager at Helios Capital. He steered clear of taking any large calls. “Last time, after the Russia-Ukraine war, we did that, but the market did not really go down as much as we thought.” [Source: MoneyControl]

Stock Market Sectors in the Green Today

NSE IT Sector Today

The IT sector has been performing marginally positively in the share market today. Positive sentiments have pulled this sector upward as the second quarter results are about to be released. The Nifty IT is currently at 32491.35, while it closed on Friday at 32341.70, there has been an increase of 0.46% until now.

IT Stocks Today

- HCL Tech has gained the most until 11.08 a.m., 1.73% from its previous close. The company is about to announce its quarterly results next week.

- The next stock in this sector, which has gained 1.28%, is LTTS.

- MPhasis has lost the most in this sector. It has dropped by 1.29%, primarily due to global conflicts.

NSE Healthcare Sector Today

The healthcare sector has also been showing some gains, and the Nifty Healthcare index has increased by 0.15 % in today’s market.

- Max Healthcare has been the top gainer until now, which has increased by 2.27%. However, the increase in its price has been a result of market movement today.

- Metropolis Healthcare has also gained 2.24% until now as it announced 13% growth on a YoY basis in its revenue for the second quarter of FY24.

- Biocon, on the other hand, has lost 1.21% until 11.24 am today. However, the company signed a commercialization agreement with Juno Pharmaceuticals in Canada on 6th October 2023.

Stock Market Sectors in the Red Today

NSE PSU Bank Sector Today

As there are adverse global cues, the PSU banks in the stock market today started to lose the most. The Nifty PSU bank index has dropped by 2.05%, and the stocks pulling the market down the most include the following stocks.

PSU Bank Stocks Today

- The worst-performing PSU bank today until 11.30 a.m. is Central Bank, which has dipped by 4.20%.

- PSB is the next stock in this sector, which has plunged by 4.07%.

The stocks are going south due to market movement and rising tension between Israel and Hamas.

NSE Media Sector Today

The second sector, which has fallen the most in the first half of the market today, is the media sector. The Nifty Media index has fallen by 1.91% from its previous session’s close at 2286.75.

Media Stocks Today

- Hathway has been the primary force behind this significant fall in the sectoral index. The stock price dropped by 5.34%.

- Then TV 18 Broadcast Ltd.’s share price fell by 3.57% due to global cues.

Today’s share market is primarily driven by the war between Israel and Hamas. The tension between the countries is again taking a toll on the crude prices, as the market expects it to go up again. This, in turn, is affecting the domestic market and inflicting negative sentiments again.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/