Electric Vehicles or EVs, as they are commonly called, are vehicles that run on electric power, either partly or fully. EVs are environment-friendly and have low running costs due to lesser moving parts.

As the chants for electrification get louder and louder across the world, it makes sense to examine the topic a bit more closely. We shall see what is the EV situation in India and globally.

Vehicle electrification: A brief history

The concept of EVs is older than International Combustion Engines (ICEs). Scottish inventor Robert Anderson created the first electric carriage in the 1830s. Its battery was not rechargeable and required replacement every time it ran out. However, electric-powered vehicles continued to be in use in the USA and some parts of Europe. New York had a fleet of electric taxis in the 19th century and battery swapping stations.

With the advent of ICEs, a major roadblock of frequent battery charging/swapping was removed and ICEs gained popularity the world over. Thereafter, there was sporadic research on EVs whenever crude oil flared or geo-political tensions mounted. However, for a large part, ICEs rule the roost.

It was not until the turn of the century that EV development found serious interest from companies and Governments. Companies such as Toyota (Prius), Nissan (LEAF), and Tesla (Model S) took the EV chapter ahead and “glamorized” EVs. Here’s a look at the EV evolution:

Advantage EVs

So why has the world started looking at EVs as the technology of the future? Aren’t we happy driving petrol/diesel-driven vehicles? Following are some reasons:

Reduces climate change

Effects of fossil fuels such as global warming, mass extinction of species, and growing weather calamities have forced lawmakers across the globe to look at cleaner alternatives

Lowers import bill

Countries such as India don’t have any significant crude reserves and have to import fossil fuel for their energy requirements. India incurred a crude import bill of $101bn in FY20 requiring to import 82% of its total crude needs. Hence, there is growing interest in technologies that look away from crude oil dependency – electric vehicles being one of them.

Reduces pollution levels

According to WHO, India is home to 14 of the world’s 20 most polluted cities. A major reason for high pollution levels is fuel emissions.

Advancing renewable energy technology

Over the past few years, strong advancements in wind and solar energy have brought down the cost of these forms of energy. This has stirred interest in EVs.

Low maintenance

While an IC vehicle has hundreds of moving parts, an EV has less than 30. This means less wear and tear and a low cost of ownership.

Quieter operation

EVs make much lower noise compared to conventional vehicles since there’s lower friction between moving parts. In fact, EVs are so silent that some OEMs add false sounds to make them safe for pedestrians!

Incentives for buyers

Governments in India (State and Central) are looking at ways to incentivize buyers to go in for EVs. They are offering lower vehicle tax, tax incentives, buyback

India’s EV Policy

The NITI Aayog, India’s policy think-tank, has given several suggestions to the Government of India for EVs. Accordingly, the following policy has been enacted:

-

- Reduce primary oil consumption in transportation.

-

- Facilitate customer adoption of electric and clean energy vehicles.

-

- Encourage cutting-edge technology in India through adoption, adaptation, and research and development.

-

- Improve transportation used by the common man for personal and goods transportation.

-

- Reduce pollution in cities.

-

- Create EV manufacturing capacity that is of global scale and competitiveness.

-

- Facilitate employment growth in a sun-rise sector

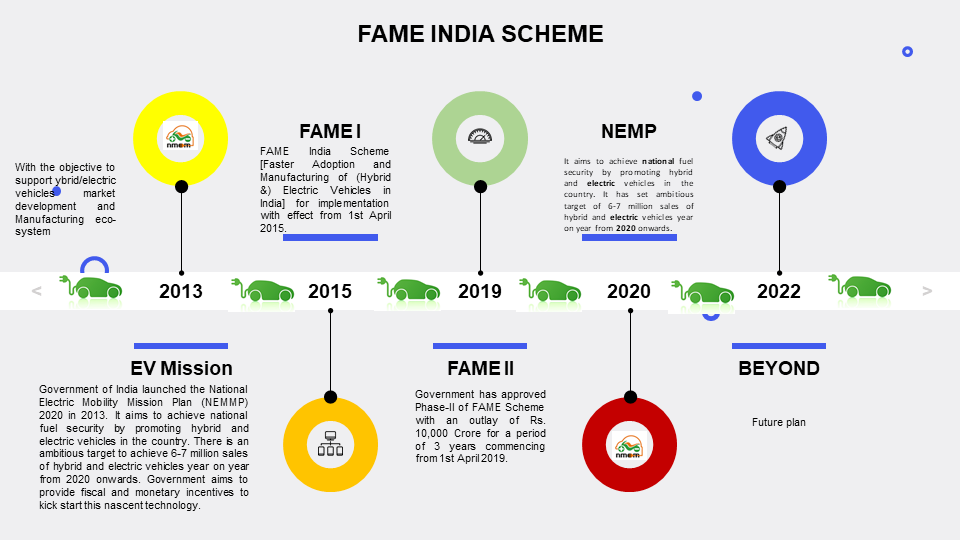

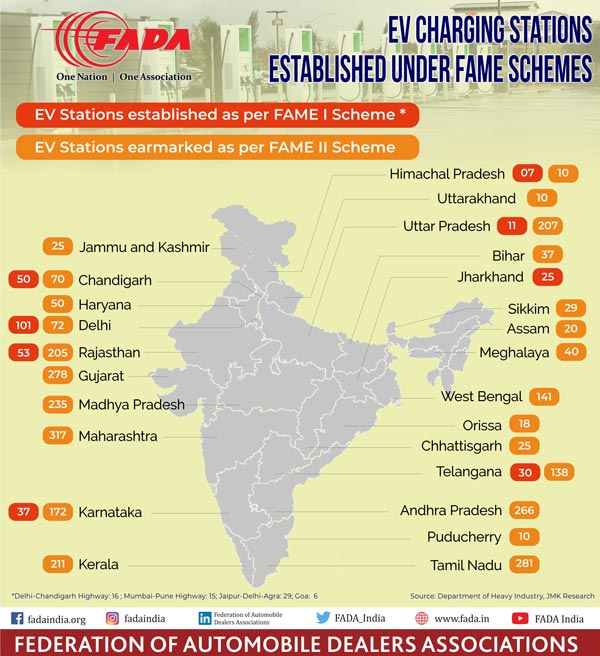

The government adopted the Faster Adoption and Manufacturing of Hybrid and EV (FAME) scheme in 2015, with an allocation of Rs. 895cr, which provided subsidies for e-2Ws, e-3Ws, hybrid and e-cars, and buses.

The FAME II scheme, which came into effect from April 2019, had proposed spending of Rs. 10,000cr. It was to be used for upfront incentives on the purchase of EVs (to the extent of Rs. 8,600cr and for supporting the deployment of charging infrastructure (Rs. 1,000cr).

Source: Department of Heavy Industries, Ministry of Heavy Industries and Public Enterprises, Government of India

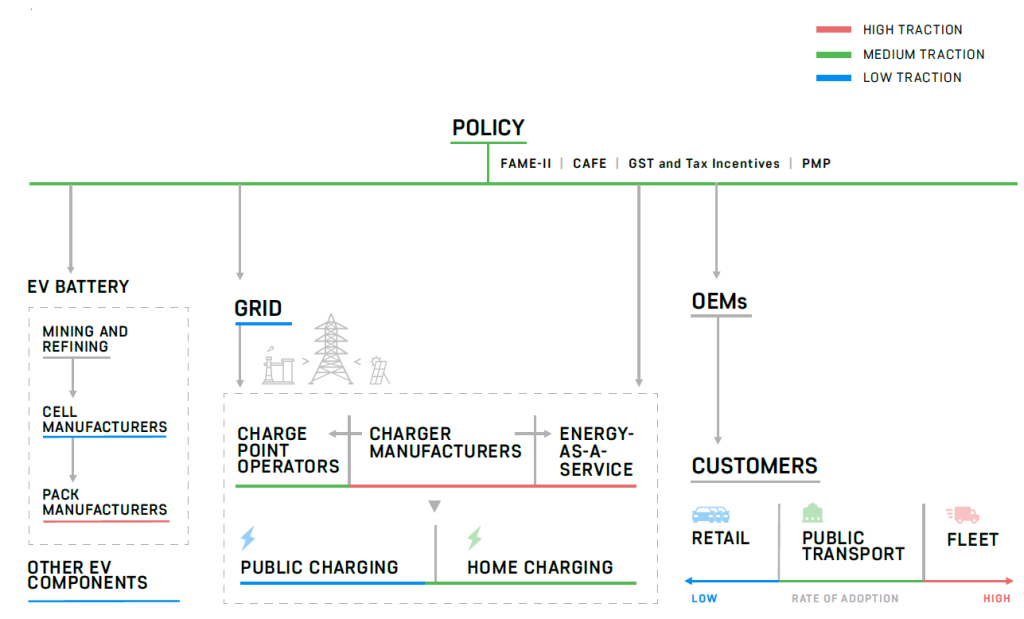

THE EV Ecosystem

Source: Avendus Capital Pvt Ltd

-

- Policy: The FAME II policy is India’s first step towards boosting EV penetration in India, though a lot needs to be done. The Government has taken baby steps by introducing e-buses for public transport in some cities. EVs for private use will go up once there are incentives, subsidies, and other such measures.

-

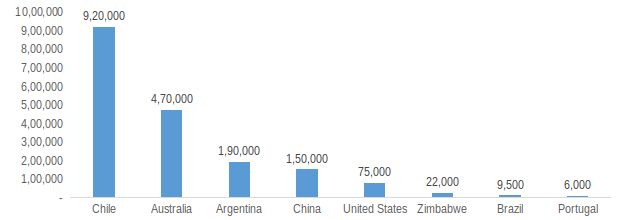

- Batteries: Battery cost is nearly 40% of the cost of the vehicle, hence reducing the same is key to increasing EV adoption. Raw materials for battery manufacturing – mainly Lithium and Cobalt – are not available in India, hence raw material dependency will continue (currently India imports crude). Currently, Indian companies only assemble imported battery packs, do not manufacture batteries.

The Lithium-Ion Situation in India

Source: Times of India

-

- OEM: Most OEMs are focused on specific sub-segment of the automobile space. 2Ws have seen the most momentum, given that nearly 79% of the Indian auto market (by volumes) comprises of 2Ws. E-3Ws have started by way of e-Rickshaws while e-4Ws are gaining prominence in shared mobility.

-

- Grid: There are two major issues that grids have to address

-

-

- Ability to handle peak load

- Grid composition must be ideally dependent on renewable generation rather than coal-dependent generation.

-

-

- Charging Infrastructure: India will need to simultaneously develop home charging and public charging infrastructure to boost EV adoption.

FAME I added 314 charging stations in India, FAME II 2,867

Source: FADA

-

- Customers: EV adoption in India is highest in public transport (buses) and shared mobility. E-2Ws have been the next ones to begin adopt since the cost differential between ICE 2Ws and EV 2Ws is lower than 4Ws.

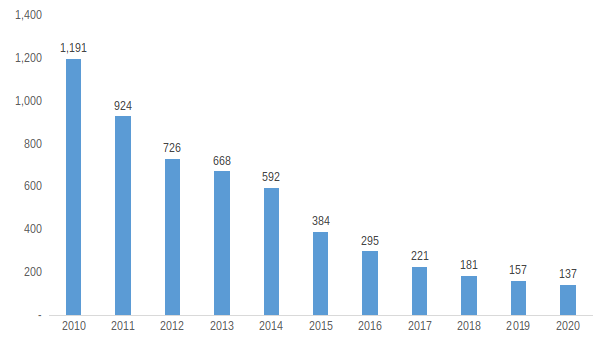

Lithium-ion price reduction – The biggest enabler

While demand for Lithium is expected to increase with growing EV adoption, prices, surprisingly, have continued to fall continuously. Over the past ten years (2010 – 2020), Lithium prices have dropped 88%. This is due to the following reasons:

-

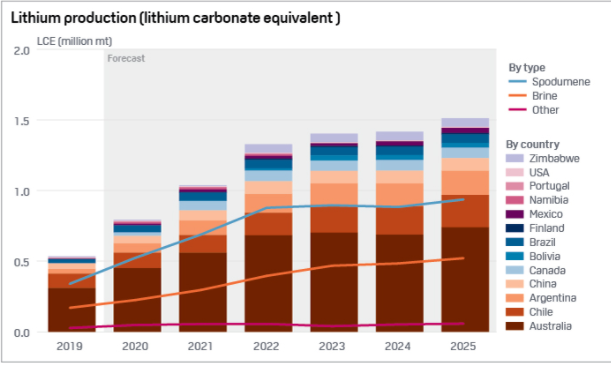

- The annual supply of Lithium is expected to grow from 2,15,000 tonnes in 2019 to 7,15,000 tonnes in 2025. This will be led by fresh supplies from Argentina, Australia, and Chile.

-

- Three new mines will come up in North America in the next couple of years, taking its share in global supply to 5% by 2025.

-

- New mines and increased production have brought an enormous quantity of material to market, hammering lithium prices.

Volume Weighted average of lithium-ion battery price (USD)

Source: Statista

Lithium production to triple between 2019 and 2025

Source: S&P Global

While lower Lithium prices are music to the ears of Auto OEMs, it is bad news for miners of the metal. Lower prices mean that investments in mining may become less profitable, reducing the pace of new investments. The pandemic reduced demand for EVs, thereby depressing prices further.

However, the freefall in Lithium prices is expected to get arrested by 2022. Several global companies have delayed or postponed expansion plans because of depressed demand currently. Some examples of postponed projects are:

-

- Chile’s SQM, the world’s second-largest Lithium producer, postponed key expansion at its Atacama salt flat operations from the end of 2020 to late 2021.

-

- Australian company Wesfarmers delayed its investment decision on the Mount Holland project in Western Australia by a year, to early 2021.

-

- World leader Albemarle postponed its project to buy 1,25,000 tonnes of processing capacity. It also revised a deal to buy into Australia’s Mineral Resources Wodgina lithium mine and said it would delay building 75,000 tonnes of processing capacity at Kemerton, also in Australia. (Source: Mining.com)

-

- China’s Tianqi Lithium Corp., the country’s top producer of the battery metal, also postponed commissioning the first phase of its flagship plant in Kwinana, as it struggles to pay back debt. (Source: Mining.com)

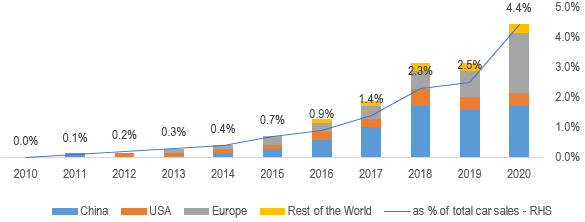

Snapshot of Global EV industry

Country-wise EV sales and penetration

Source: IEA

|

Country |

Comments |

|

China

|

EV sales have grown fastest in the world at 61% CAGR over the past 7 years |

|

The government offered subsidies worth $60bn into the EV eco-system over the past decade to push sales |

|

Was planning to phase out subsidies in 2020; however, declining sales due to lower subsidies in 2019 forced the Government to keep subsidies unchanged in 2020 | |

|

While China issues only a fixed number of ICE license plates every month, there is no restriction on EV license plates | |

|

The Government made it mandatory for Chinese OEMs to make or import at least 10% EVs out of their total vehicle production in 2019 and 12% in 2020 | |

|

The Chinese government exempts electric vehicles from consumption and sales taxes, it also waives 50% of vehicle registration fees for EVs | |

|

By 2030, 40% of all vehicles manufactured by Chinese Auto OEMs will have to be electric | |

|

USA |

EV adoption in the USA has been slower than in China and Europe since gasoline prices in the USA are lower than those in China and Europe |

|

Passenger car in the market in the USA has a large proportion of trucks, SUVs, etc. were achieving lower TCO vis-à-vis ICE is difficult |

|

California is the largest EV market in the USA since it offers the highest incentives ($2,500 – $7,000), discounts on recharging, and tax credits | |

|

The US EV market is dominated by Tesla which controls nearly half the market | |

|

EV growth slowed in 2019 because of the Trump administration’s phaseout of the federal tax credit and loosening of fuel economy standards | |

|

As the Biden administration is undertaking to electrify the entire fleet and more and more companies implement sustainability targets, the EV share will only continue to go up | |

|

Europe |

Europe has countries with some of the highest EV penetration — Norway (56%), Iceland (25%), and Netherlands (14%). |

|

Several European countries have created a difference between ICE and EVs to taxes, fees, tolls, and parking fees |

|

Most countries in Europe like Norway, the UK, France, the Netherlands, and a few others have set dates (in the next two decades) to ban conventional ICE vehicles | |

|

In 2019, France set a carbon-neutral target year of 2050, with the UK following suit | |

|

2020 was the target year for the European Union’s CO2 emissions standards that limit the average carbon dioxide (CO2) emissions per kilometer driven for new cars | |

|

Many European governments increased subsidy schemes for EVs as part of stimulus packages to counter the effects of the pandemic. | |

|

Japan |

Japan adopted EVs ahead of other countries, because of a dearth of oil |

|

The Japanese dominated the electric hybrid car market with Toyota Prius, the highest-selling low-emission car till today. |

|

Japan is promoting the Hydrogen economy in a big way. Availability of non-fossil electricity makes the proposition very attractive for Japan. | |

|

Japan’s network of EV-charging infrastructure is far superior to other EV markets — there are more battery recharge points than petrol stations across the country | |

|

Japan has pledged to switch to emission-free vehicles completely by 2050. | |

|

India |

Although the current market share of EVs in India is less than 1%10, India’s commitment to the EV30@30 global initiative targets a 30% new sales share for EVs by 2030 |

|

This translates to an addition of about 24 million two-wheelers, 2.9 million three-wheelers, and 5.4 million four-wheelers to its fleet in the next 10 years |

|

India’s EV market faces roadblocks because of a preference for mass and low-cost mobility since these are highly price-sensitive | |

|

India is experimenting with e-Mobility for public transport and has deployed electric inter-city buses across some of the major cities. | |

|

Going forward, the industry believes that the market will grow very rapidly in the upcoming years as many state governments are planning to convert the existing fleet of autos into electric under their EV policies |

A look at the future for electric vehicles

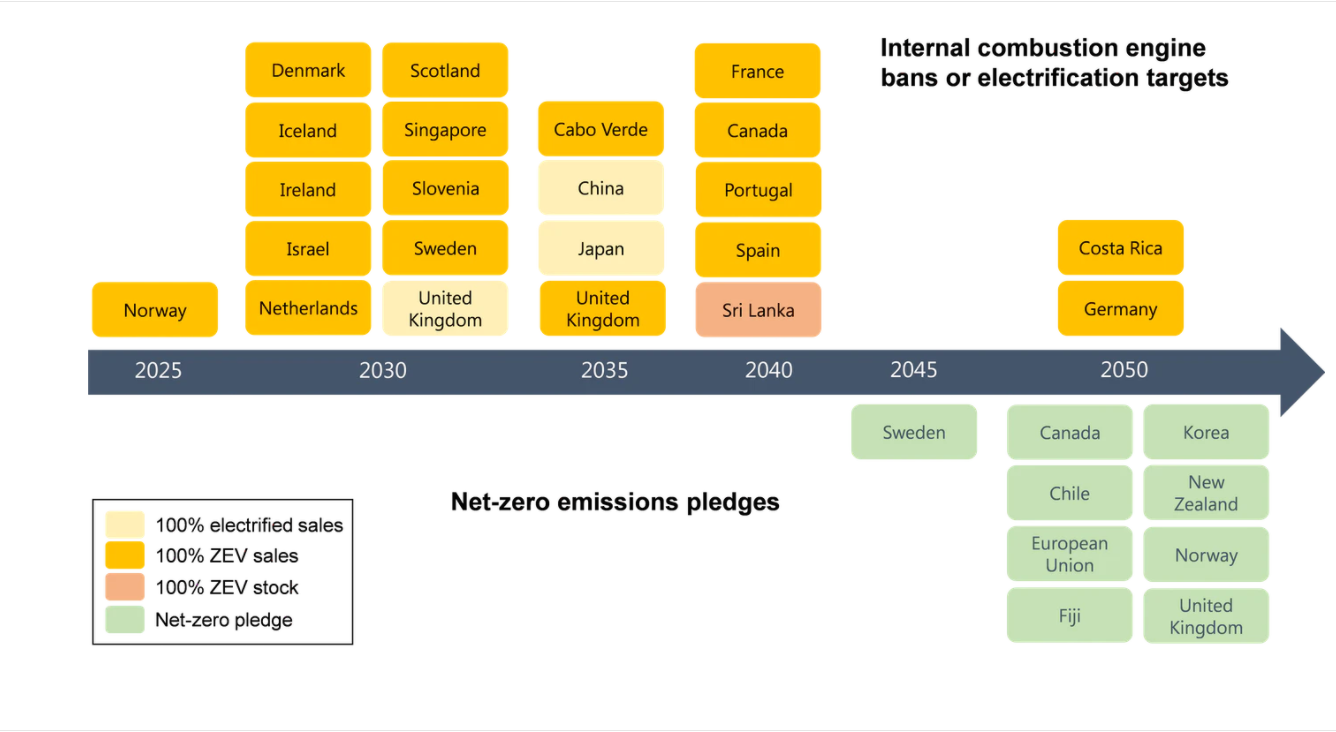

Several nations around the world have pledged to convert a majority of their fleet to electric over the next few decades. To date, over 20 countries have announced the full phase-out of internal combustion engine (ICE) car sales over the next 10‑30 years, including emerging economies such as Cabo Verde, Costa Rica, and Sri Lanka. More than 120 countries (accounting for around 85% of the global road vehicle fleet, excluding two/three-wheelers) have announced economy-wide net-zero emissions pledges that aim to reach net zero in the coming few decades.

|

Over 20 countries have electrification targets or ICE bans for cars, and 8 countries plus the European Union have announced net-zero pledges |

|

|

Source: International Energy Agency |

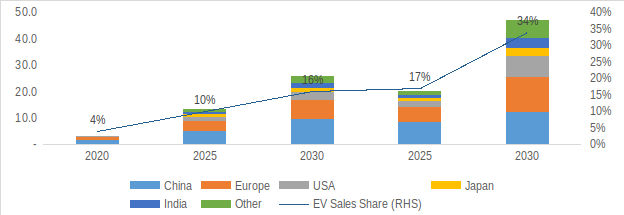

The way to look at the future of EVs is through two policy targets

-

- Stated Policies Scenario

In the Stated Policies Scenario, the global EV stock across all transport modes (excluding two/three-wheelers) expands from over 11 million in 2020 to almost 145 million vehicles by 2030, an annual average growth rate of nearly 30%.

-

- Sustainable Development Scenario

In the Sustainable Development Scenario, the global EV stock reaches almost 70 million vehicles in 2025 and 230 million vehicles in 2030 (excluding two/three-wheelers).

|

Global EV sales by scenario, 2020-2030 – Sales in Millions |

|

Stated Policies Scenario

|

|

Source: International Energy Agency |

The coming years are expected to usher in recent developments for EVs on a global scale. Some key areas of focus could be:

-

- Cheaper and more efficient batteries with a longer range.

-

- Greater Government support to reward EV buying vis-à-vis ICEs.

-

- Safety issues getting addressed (Lithium batteries)

-

- Penetration of electrification of vehicles to CVs like heavy-duty trucks (where EV penetration is currently the least)

-

- Favorable investments from companies as profitability goes higher

-

- Better charging infrastructure involving a combination of home charging and public charging

-

- Lower TCO for EVs compared to ICEs

-

- For India, supply chain localization is crucial to bring down the cost of batteries

-

- Battery disposal/recycling is an issue that will have to be taken care of, given that Lithium is a poisonous element that can affect soil, water, and the environment if disposed of incorrectly.

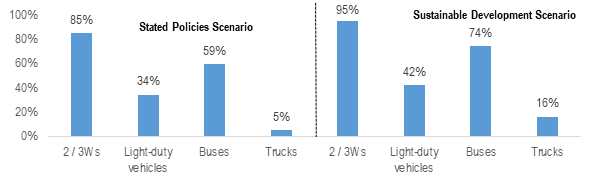

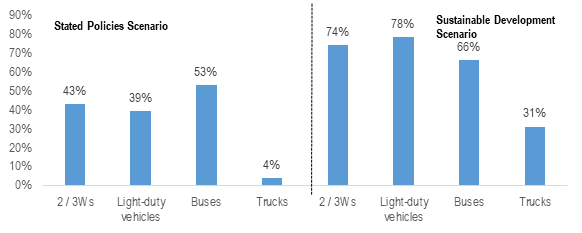

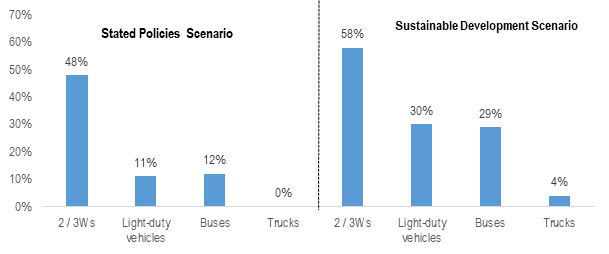

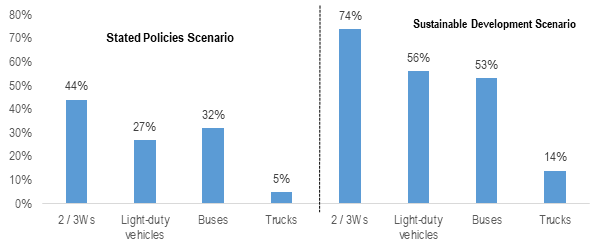

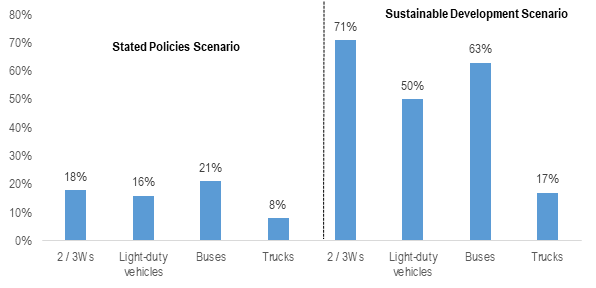

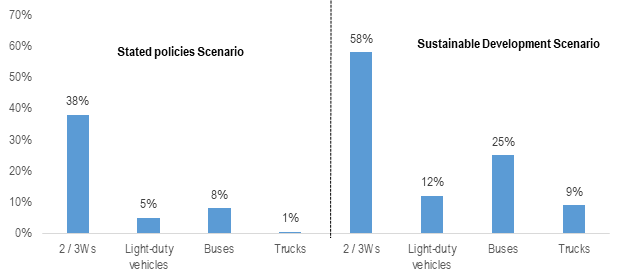

Given the current scenario of EV adoption, the following is the extent to which vehicles of different countries will get electrified:

Share of EVs to total vehicles by segment 2030 – China

Share of EVs to total vehicles by segment 2030 – Europe

Share of EVs to total vehicles by segment 2030 – India

Share of EVs to total vehicles by segment 2030 – Japan

Share of EVs to total vehicles by segment 2030 – the USA

Share of EVs to total vehicles by segment 2030 – Rest of the World

Source: International Energy Agency

Top EV stocks in India

Maruti Suzuki

Maruti Suzuki the undisputed market leader in the passenger vehicles segment in India is all set to launch its Maruti Suzuki WagonR electric vehicle in the latter half of 2021. The vehicle which is currently in advanced testing stages in actual road conditions may turn out to be a mass-seller with the right pricing strategy as has been the case with most passenger cars launched by the company in the past.

Minda Industries

Minda Industries is a leading manufacturer of automotive components and solutions with a formidable global presence. As many of its product offerings like electronic components, switches, lights, sensors can be used on both EVs and conventional vehicles the company enjoys a huge advantage.

Amar Raja Batteries

Battery is a major component of the electric vehicles. Amara Raja a leading player in the battery segment is currently building a Lithium-ion assembly plant. The company has tied up with several state governements for setting up battery charging stations for EV’s.

Motherson Sumi

Established in the year 1986, Motherson Sumi Systems Limited (MSSL) is a leading specialized OEM automotive component manufcaturer globally. As most of its product offerings like wiring harnesses, mirrors. moulded plastic interior and exterior parts, bumpers, dashboards and door trims and rubber parts are compatible with EVs the company enjoys a significant advantage.

Tata Motors

Tata Motors has taken a huge lead in the EV segment in India with its Nexon SUV being the largest selling car in the segment since launch. The company has made significant investments to increase its offerings in the EV segment.

Bottom line

With depleting fossil fuels and rising concerns of pollution caused by conventional vehicles, there is absolutely no doubt that EVs are the future of road transportation. However as in the case of any industry, not all companies in this segment will create wealth for investors. Hence it is important to invest carefully after detailed research. Click here for expert help.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.