Introduction

In the fast-paced corporate maneuvering and investment strategies world, Anil Agarwal, the visionary mining billionaire behind the Group, orchestrates a bold move. A decade ago, he merged various entities under the Vedanta umbrella into one massive unit. But in 2023, something intriguing is afoot – the Group is on the brink of separating this colossal entity into six distinct parts.

But why?

The company believes this demerger plan would simplify its corporate structure and unlock significant shareholder value. But the big question on everyone’s mind was whether this move would resolve the most pressing issue that had the street buzzing with anticipation.

In the not-so-distant past, between 2012 and 2017, Vedanta had merged various entities. In November 2021, they had even toyed with having different listed entities, but that plan fell through.

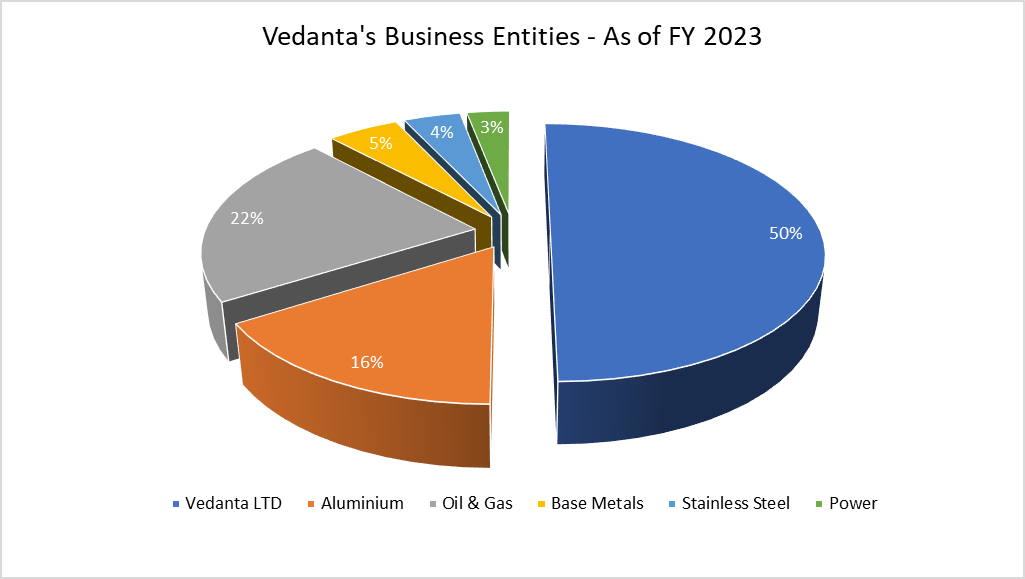

However, the company has made an exciting announcement – they will embark on a six-way vertical split for their listed entity to “discover significant shareholder value.”

While the news sent the company’s stock soaring, it was still down by over 25% for the year. The plan was to split the entities based on their core competencies. Shareholders would receive one share of each newly listed entity for every share of the currently listed Vedanta Ltd. they held.

Also Read: Top Semiconductor Stocks in India

What would the new demerged entities look like?

| Entity | Holdings/Stake/Business included |

| Vedanta Ltd | 64.92% stake in Hindustan Zinc, upcoming semiconductor and display business, stainless steel business |

| Vedanta Aluminium | Aluminum business, 51% stake in BALCO |

| Vedanta Oil & Gas | Cairn India |

| Vedanta Base Metals | Copper and zinc international business |

| Vedanta Steel & Ferrous Metals | Domestic iron ore business, Liberia assets, ESL Steel Ltd |

| Vedanta Power | All power assets |

The management argued that this demerger would simplify their corporate structure, allowing investors to invest in the commodity of their choice and provide a platform for individual units to pursue their strategic agendas. Interestingly, this was the same rationale highlighted when they had merged the entities a decade ago.

However, this grand plan had its challenges. Subject to approval from the board, stock exchanges, and the NCLT, the process would likely take another 12-15 months.

How does this help the Vedanta Group?

With this move, the group will gain the flexibility to unlock value for investors by liquidating a particular asset or bringing a strategic investor on board. In the current structure, there would be double taxation on profit from the sale of an asset and on dividend payouts. But post-demerger, the promoters would only be liable for long-term capital gains tax.

However, despite all the excitement, there was still a massive problem of owing $4 billion. The plan to split the company was meant to simplify things and create more value, but it may not solve the group’s most significant issue – paying off a considerable debt.

Vedanta Resources has pending payments of around $4 billion until 2025. The promoter entity had a few tricks up its sleeve – dividends from Hindustan Zinc and Vedanta Ltd., potential stake sales in the umbrella entity, and the brand fees from Vedanta Ltd. and its subsidiaries.

However, their options are thin as Hindustan Zinc’s cash balances have dried up, and credit rating agencies have downgraded them, leading to higher interest rates. Vedanta Resources had recently increased its stake by nearly 20% in the listed entity, only to sell over 4% via block deals a couple of months earlier.

What do analysts say about the demerger story?

[Source: Moneycontrol]

- Investec maintained a “sell” recommendation expressing concern about the company’s carbon-heavy assets and their skepticism about the cash flow burn in the new ventures.

- CLSA, on the other hand, had upgraded the stock to “outperform” but had reduced its price target, emphasizing the need for operational improvements to sustain the re-rating.

- Nuvama chose to upgrade the stock to “Hold,” seeing the demerger as a step in the right direction, even though they kept their price target unchanged.

And there you have it, the story of Vedanta’s ambitious demerger plans with the ever-present challenge of reducing that $4 billion debt. Only time will tell how this fascinating corporate journey will unfold, with shareholders waiting for the next chapter in the business journey.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is Vedanta's demerger plan and its purpose?

The demerger plan involves splitting the company into six entities based on their core businesses. The idea is to simplify the corporate structure and create value for shareholders.

How does Vedanta's demerger affect shareholders directly?

Shareholders of the company will receive shares in the newly listed entities resulting from the demerger. Each Vedanta Ltd. share held translates into shares in these new entities, potentially offering value diversification.

What challenges does Vedanta face with its demerger, especially regarding its substantial debt?

Despite the demerger plan, the business still grapples with a substantial $4 billion debt. The demerger itself may not directly resolve this issue, and the company is exploring various strategies, including dividends and stake sales, to manage the debt.

How useful was this post?

Click on a star to rate it!

Average rating 3.8 / 5. Vote count: 25

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/