If you have been closely monitoring the global markets, you must have realized it is not in good shape. This week, tensions between Iran and Israel have sent ripples through stock markets worldwide, including India’s. But what exactly is happening, and how worried should Indian investors be? Let’s break it down.

What’s the Iran-Israel Conflict About?

The recent escalation stems from a long-standing conflict between the two nations. On April 14th, Iran launched a drone and missile attack on Israel in retaliation for an Israeli strike on an Iranian consulate in Damascus, Syria. This marks a significant development, as it’s the first time Iran has directly attacked Israel. The Israeli military confirmed the attack, highlighting the sheer scale with over 300 drones involved.

Global Financial Fallout

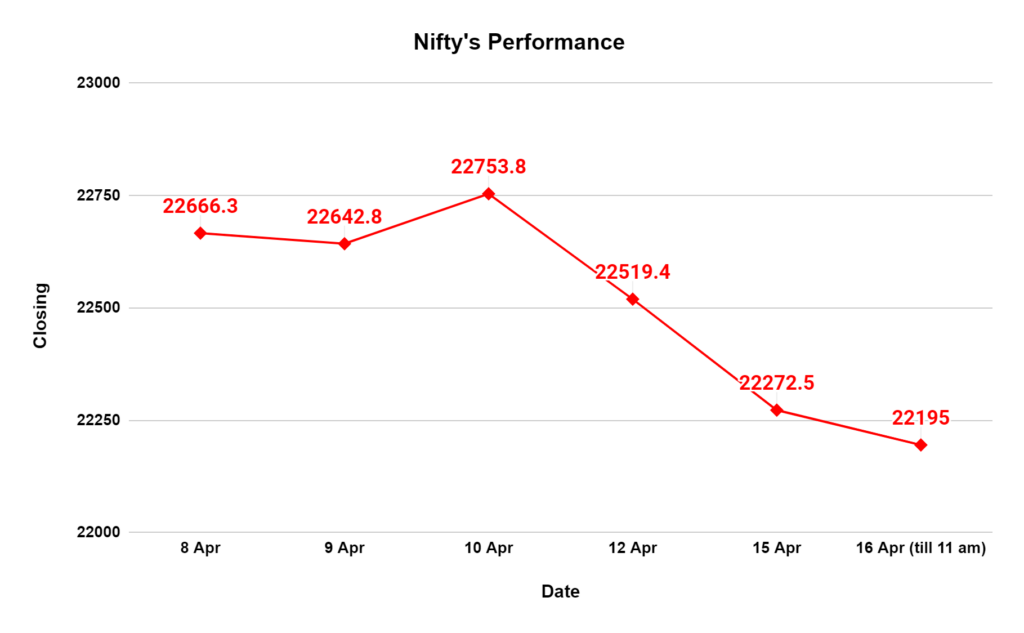

This conflict is making investors nervous across the globe. The Indian stock market, heavily influenced by global trends, is no exception. The Sensex and Nifty 50 indices witnessed a decline exceeding 1% on Monday morning. Experts predict the market to remain volatile as the situation unfolds.

Why Should Indian Investors Care?

The worry for Indian markets stems from the potential disruption to global oil supplies, with Iran being a significant oil producer. As the world’s third-largest oil importer, India is heavily reliant on these supplies. Let’s explore the five biggest concerns gripping investors:

- Crude Shock on the Horizon?

Iran sits as a major oil producer in OPEC. Any disruption to Iranian oil supplies due to escalating tensions will likely cause crude prices to skyrocket. This is bad news for India, the world’s third-largest oil importer. Higher crude prices pressure the Indian economy, weaken the rupee, and potentially lead to rating downgrades. While Israel hasn’t retaliated yet, any further escalation could trigger this price spike. - Bye-Bye Rate Cuts?

Globally, inflation remains a concern for central banks. Increased geopolitical tensions often push up commodity prices due to supply disruptions. This makes it harder to control inflation, potentially dashing hopes of future rate cuts. The US Fed, expecting a rate cut in June, might now have to hold off due to rising tensions. This disappoints investors in high-risk assets like equities and could lead to capital outflows. - Capital Flight

Rising tensions often make investors risk-averse. This could lead to more capital flowing out of the Indian market, especially considering its premium valuations. - Rupee’s Under Pressure

Geopolitical turmoil can disrupt global supply chains. This throws off India’s import-export balance, potentially weakening the rupee further. A weaker rupee translates to higher inflation, increased capital outflow, expensive imports, and lower profits for domestic companies. - Limited Upside Potential

While domestic investors might support the Indian market, the upside potential is likely limited due to the ongoing tensions. Analysts estimate a support level of around 22,000 for the Nifty 50, but the upside might be capped at around 22,800.

What’s Next?

The US response will be a major factor in how this situation unfolds. A protracted conflict could have significant repercussions across economies and sectors. Bond yields could rise, company credit costs could climb, oil prices could surge, and stock markets, including India’s, could face downward pressure. Investors need to be cautious as uncertainty remains high during such volatile periods.

Also read: Radhakishan Damani’s portfolio

What could it mean for your portfolio?

With the situation still developing, uncertainty remains high. The Iran-Israel conflict injects a dose of uncertainty into the Indian stock market. While domestic support may exist, the potential for disruptions in oil supply, inflation, and capital outflows are key concerns. It would be best if you were cautious and closely monitor the situation. Diversification and a long-term perspective are crucial during such volatile times. Remember, while short-term fluctuations might be unsettling, history shows that solid companies tend to weather such storms.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/