Introduction

Wipro is no ordinary company, taking its first step on its journey in 1945 when the world was recovering from the aftermath of World War II. It started as a humble family-run commodity-based vegetable oil maker to a professionally managed, diversified global corporation renowned for its expertise in IT, consultant, and business process services.

This article will dive deep into Wipro and explore the potential growth of Wipro share price.

Overview of Wipro

Wipro was started 1945 by Mohamedhusain Hasham Premji, who took over his late father’s grain trade business and established an oil mill known as Western India Vegetable Products.

For the next two decades, the company solely focused on growing its vegetable-based oil business. After the untimely death of Mohamedhusain Hasham Premji at age 51, his son, Azim Premji, took over the business and started working to transform it into a brand-oriented company, leaving behind its legacy as a vegetable oil maker.

Azim Premji re-registered the company as Wipro, which paved the way for diversification into various other industries. In August 1979, Wipro entered the Infotech division, and by 1989, it had successfully diversified into manufacturing computer systems, computer products, and industrial equipment.

After the Indian market opened in the 1990s, Wipro made a significant foray into IT services, propelling its growth and ultimately becoming a billion-dollar company by 2000.

The company is now one of the leading IT solution service providers for companies worldwide, with a workforce of over 250,000 employees in over 66 countries. As of 22nd July 2023, its market cap stands at ₹2.2 lakh crores.

Wipro Company Analysis

The businesses are organized into the following three operating segments:

IT Services

It is the biggest business unit for Wipro in terms of revenue and is divided into four Strategic Market Units (SMUs).

- Americas 1: It includes the entire business of LATAM (Latin America) and encompasses several industry sectors in the USA, including healthcare and medical devices, consumer goods and life sciences, retail, transportation and services, communications, media, and information services, as well as telecom products and platforms.

- Americas 2: It includes the entire business operations in Canada and covers various sectors in the United States of America, such as banking, financial services, insurance, manufacturing, hi-tech, energy, and utility.

- Europe: It includes business operations in the UK, Ireland, Switzerland, Germany, Benelux, the Nordics, and Southern Europe.

- APMEA: It includes revenues from Australia and New Zealand, India, the Middle East, South East Asia, Japan, and Africa.

IT Products

This segment includes revenue from the sale of hardware, software products, and other related deliverables. Wipro is a value-added reseller of security, packaged, and SaaS software for leading international brands.

ISRE

Indian Run State Enterprise (ISRE) generates revenue from the sale of IT Services offerings to entities and/or departments owned or controlled by the Government of India and/or any State Governments.

Wipro Key Management Personnel

- Azim H Premji is the Founder Chairman and is a Non-Executive and Non-Independent Director.

- Rishad Premzi is the Executive Chairman of Wipro Limited and joined the company in 2007. He works closely with Wipro’s leadership team providing direction and strategic insight to the business. Rishad has an MBA from Harvard Business School and pursued BA in Economics.

- Mr. Thierry Delaporte is the CEO and Managing Director of Wipro Limited and has over 27 years of experience in the IT services industry. Before joining Wipro, he held various leadership roles, including COO at Capgemini. Mr. Thierry holds a bachelor’s degree in economy and finance and a Master of Law from Sorbonne University.

- Mr. Amit Choudhary is the COO of Wipro Limited, and previously he was with Capgemini, where he was a COO for the company’s Financial Services Strategic Business Unit. He is an alumnus of IIT-Kanpur and IIM-Calcutta.

- Mr. Jatin Dalal is the President and CFO of Wipro Limited and joined the company in 2002 and has worked in diverse roles in finance. He is a qualified CA, CMA, CFA, and Chartered Global Management Accountant.

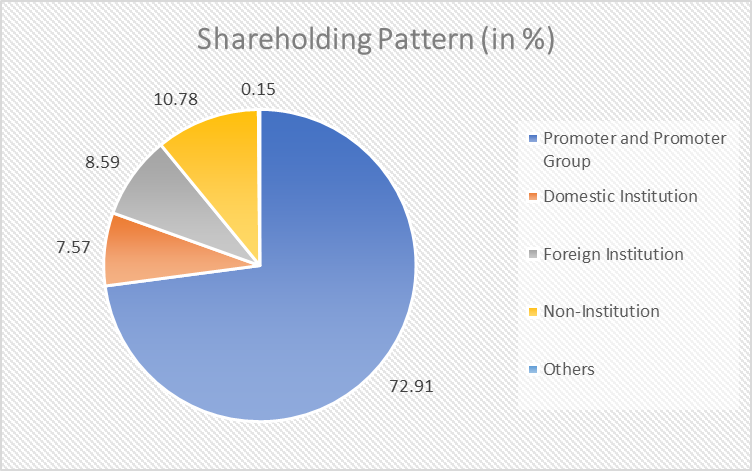

Wipro Shareholding Pattern

Wipro Financials

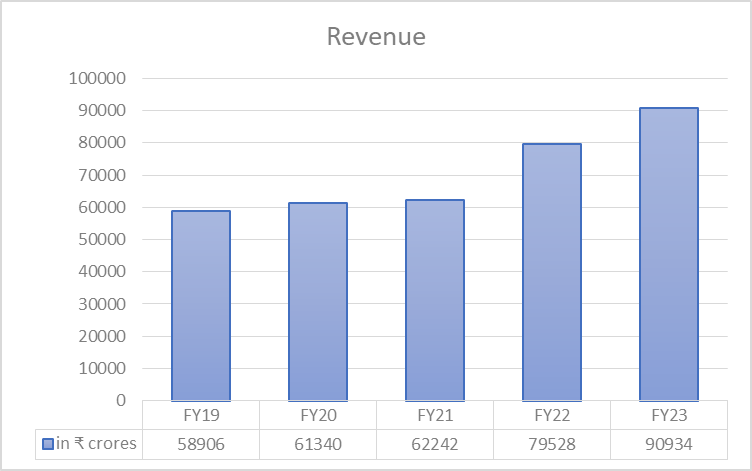

Revenue

In FY23, Wipro Limited reported a 14.3% growth in total revenue at ₹90,934 crores, from ₹79,528 crores in FY22. In Q1FY24, the company reported a marginal 6% growth in revenue at ₹22,831 crores, compared to ₹21,528 crores.

Revenue Breakup By Sector

| FY22 (in ₹ cr) | FY23 (in ₹ cr) | Q1FY23 (in ₹ cr) | Q1FY24 (in ₹ cr) | |

| Banking, Financial Services, and Insurance | 26,977 | 31,184 | 7,570 | 7,736 |

| Health | 9,105 | 10,519 | 2,429 | 2,788 |

| Consumer | 13,644 | 16,764 | 3,963 | 4,253 |

| Communications | 3,858 | 4,237 | 1,055 | 1,041 |

| Energy, Natural Resources, and Utilities | 9,458 | 10,273 | 2,378 | 2,735 |

| Manufacturing | 5,327 | 6,146 | 1,434 | 1,646 |

| Technology | 9,375 | 10,175 | 2,503 | 2,559 |

| IT Products | 617.3 | 604.7 | 194.6 | 69.4 |

| ISRE | 729.5 | 582.3 | – | – |

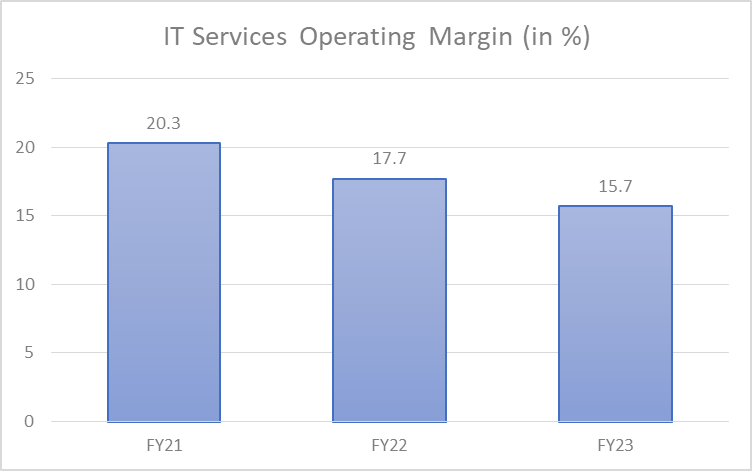

Operating Margin

Wipro Limited earns over 90% of its revenue from the IT Services segment. In FY23, the company’s operating margin from the segment was 15.7%, down from 17.7% in FY22. In Q1FY24, the company reported an operating margin of 16%, up from 14.9% in Q1FY23.

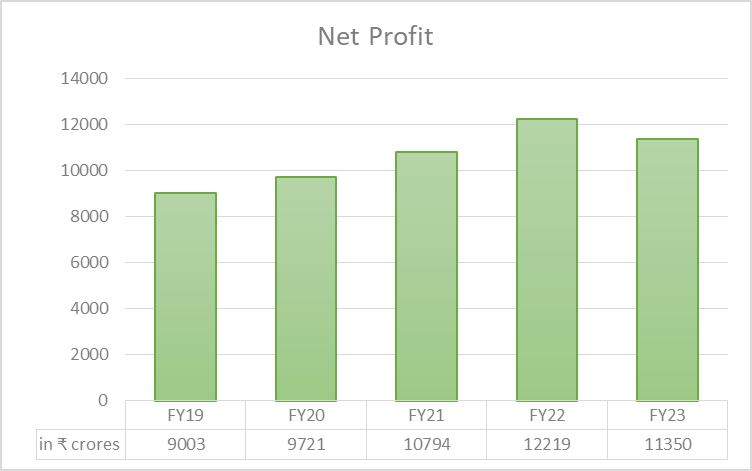

Net Profit

In FY23, Wipro Limited posted a 7.1% decline in net profit at ₹11,350 crores from ₹12,219 crores in FY22. And, in Q1FY24, the company posted a 12.8% growth in net profit at ₹2,886 crores, from ₹2,558 crores in Q1FY23.

The net profit margin declined to 13.45% in FY23 from 20.37% in FY22.

Wipro Key Financial Ratios

- Current Ratio: Wipro’s current ratio on 31st March 2023 was 2.86 times, up from 2.23 times at the end of FY22.

- Debt-to-equity Ratio: At the end of 31st March 2023, the company debt-to-equity ratio was 0.10 times, down from 0.16 times in the last 12 months.

- Return on Capital Employed (ROCE): ROCE for FY23 was 18.75%, down from 25.01% in FY22.

- Net Income Margin: In FY23, the company’s net income margin declined to 12.5% from 15.4% in FY22.

Wipro Share Price History

As per the company website, Wipro’s initial public offering was in 1946, and in October 2000, it listed its shares on New York Stock Exchange. It raised approximately $131 million in its US IPO, offering its American Depositary Shares (ADS).

As of 22nd July 2023, Wipro share price has given a CAGR return of 15% in the last three and five years. It reached an all-time high level of ₹739.85 on 11th October 2021. The company has a consistent track record of paying dividends to its shareholders. In the last three years, it has paid ₹1 in 2021, ₹5 in 2022, ₹1 in 2023 as dividends.

Its shares were split twice, once when it brought down the face value of shares from ₹100 to ₹10, and in September 1999, bringing down the face value to ₹2.

In addition, the company has undertaken numerous bonus issues over the past several years. To be precise, the company has implemented 13 bonus issues since 1971, as per data from moneycontrol.com.

Wipro Fundamentals

Over the past few years, Wipro Limited has faced a consistent challenge with declining operating margins. Additionally, the company has been unable to meet its revenue guidance for the last seven consecutive quarters. These factors have played a significant role in the underperformance of Wipro’s share price compared to the Nifty 50 index.

The primary cause for the decline in operating margin is reducing discretionary spending by customers due to uncertain macroeconomic conditions, which has also affected the closure of new deals as the company failed to increase the count of new clients in the $100+ million category in FY23. Its free cash flow to net income percentage in FY23 is 102.3%, indicating the company’s robust financial health. At the end of 31st March 2023, the company had net cash of ₹25,101.9 crores in its book.

Steady Deal Momentum

Despite the headwinds, the company can close large deals. In Q1FY24, Wipro won total deals worth $3.7 billion. There is a strong demand for Cloud Transformation among clients and newer technologies, especially AI.

Moderating Attrition Rate

Wipro’s employee attrition rate moderated to 17.1% in the latest quarter, compared to 23.3% in Q1FY23, which is positive for the company. It also trains its employees in emerging technologies like AI, which is in great demand. The company will invest $1 billion over the next three years in the organic development of generative AI technologies.

Share Buyback

Wipro has recently concluded its ₹12,000 crores share buyback program, the largest in its history. It bought back 20.95% of the fully paid-up equity share capital or 26.97 crores of equity shares at a price of ₹455.

Wipro Share Price Growth Potential

The Indian IT sector is expected to witness a decline in revenue growth by 700 to 900 bps in FY24, owing to global macroeconomic and financial sector slowdown, according to the CRISIL report. Customers across IT companies are now focusing more on curbing discretionary spending and vendor consolidation on deals.

Wipro, being significantly reliant on the BFSI sector in the US and Europe (accounting for over 30% of its revenue), will likely face challenges in earnings growth due to headwinds in this segment.

Also, the slowdown in IT spending is attributed to a strong demand uptick during the pandemic, which is now normalizing.

In the first quarter of FY24, Wipro missed its revenue growth guidance and has since revised it even lower, with expectations ranging from -2% to 1% for the second quarter. This lackluster performance could add pressure to Wipro share price in the short term.

Despite these near-term challenges, the long-term outlook for the Indian IT sector remains buoyant and robust. According to NASSCOM’s report “Strategic Review 2023 – Priming For A ‘No Normal’ Future,” India’s technology sector is projected to double its revenue to $500 billion by 2030, indicating significant growth potential.

Moreover, historical data shows that the Indian IT sector has delivered substantial returns over the long term. As of June 30, 2023, the Nifty IT Index has recorded an impressive CAGR price return of 16.14% over the last five years. This shows the sector’s resilience and potential.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was Wipro established?

Wipro was established in 1945 and was originally a vegetable oil manufacturer by Mohamedhusain Hasham Premji. It diversified into the Infotech division in 1979 and forayed into the IT Services market in the early 1990s under the leadership of Azim Premji.

How has Wipro share price performed in the last 5 years?

Over the past five years, Wipro share price has delivered a CAGR return of 15%. It reached an all-time high of ₹739.85 on 11th October 2021.

Who is the CEO of Wipro Limited?

Mr. Thierry Delaporte is the CEO and Managing Director of Wipro Limited and was previously with Capgemini as Chief Operating Officer.

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 14

No votes so far! Be the first to rate this post.