As India celebrates another year of Independence, it’s not just our tricolour that’s flying high — the stock market has had its own share of fireworks.

From Independence 2024 to Independence 2025, Indian equities have weathered global volatility, showcased the resilience of our economy, and given investors plenty to cheer about.

In a year where India’s GDP growth remained one of the fastest in the world, and demat accounts crossed record highs, a select group of stocks surged ahead, creating serious wealth for their shareholders.

In this article, we spotlight the 10 best-performing stocks of the past year — from Independence Day 2024 to Independence Day 2025.

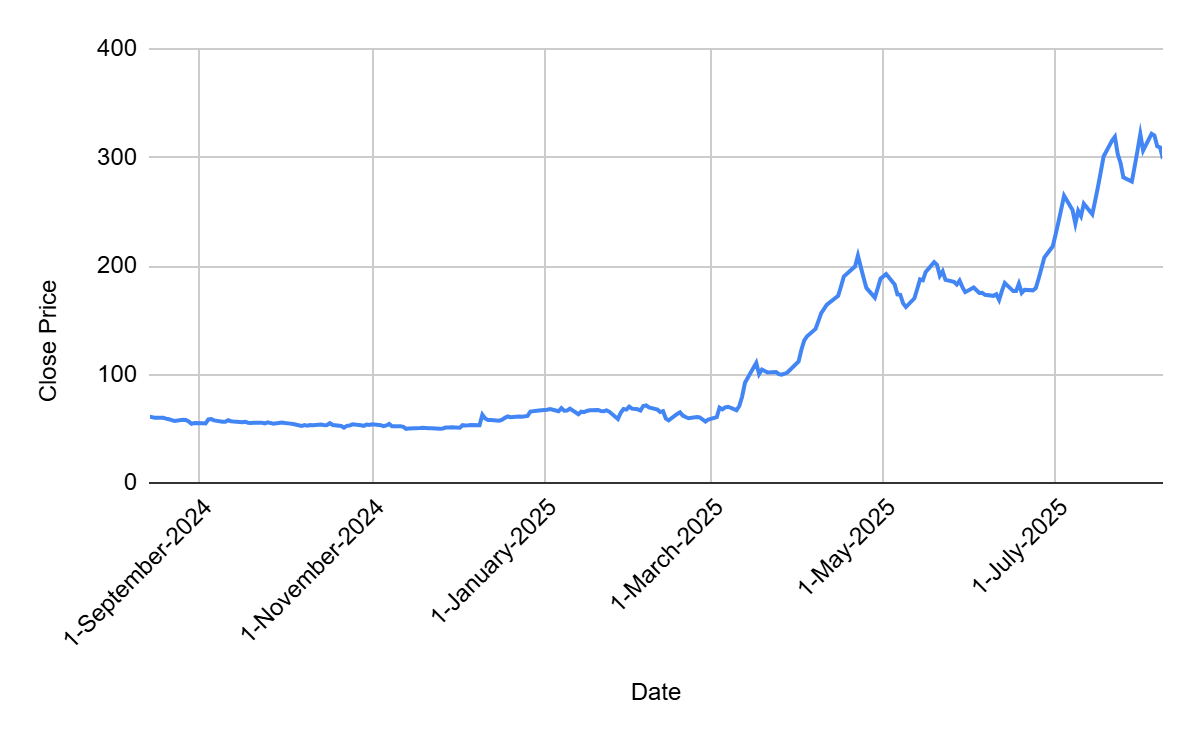

- NACL Industries

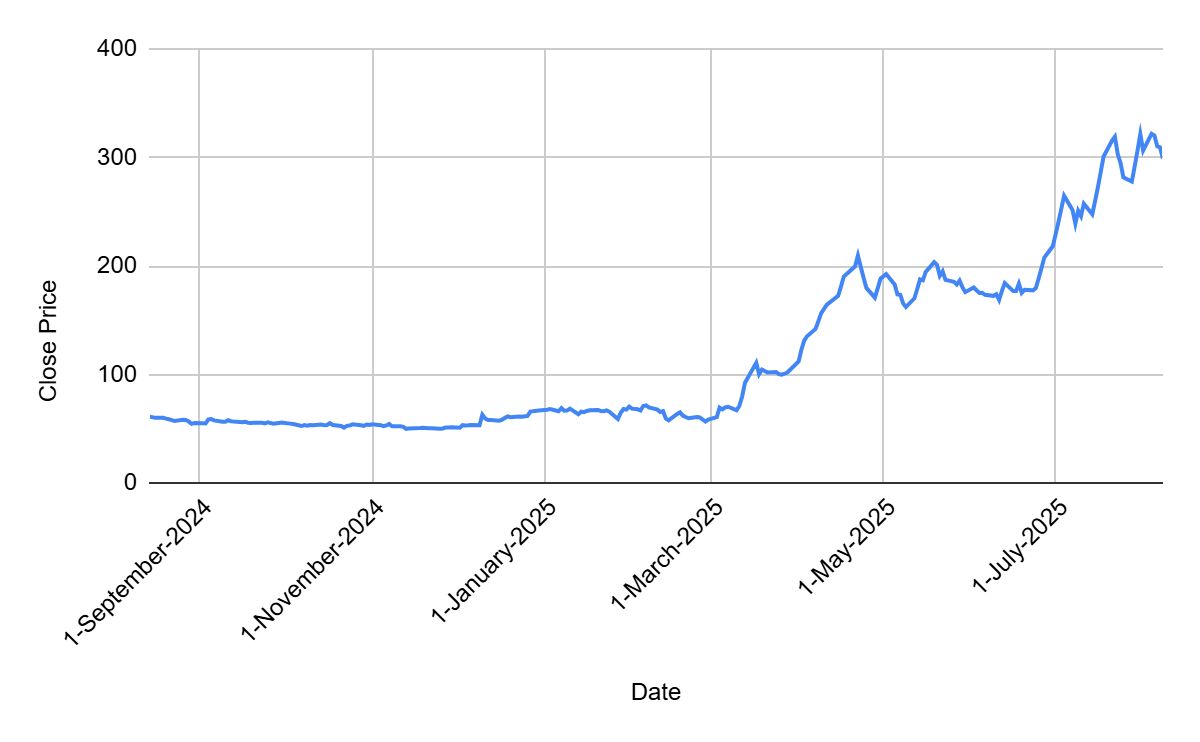

Between 15 August 2024 till 8 August 2025, share price of NACL Industries has rallied 390%.

NACL Industries Share Price Since Independence Day 2024

Source: BSE

NACL Industries manufactures a wide range of crop protection products, including insecticides, pesticides, acaricides, herbicides, fungicides, and other plant growth chemicals. The company serves more than 50 lakh farmers.

In FY25, the company posted weak performance. While FY25 may not have been its best year, NACL is planting the seeds for a strong comeback. Coromandel International — the Murugappa Group’s agrochemical giant — is set to acquire a 53% stake from NACL’s existing promoter.

For investors, this isn’t just another deal — it’s a chance to see a proven turnaround specialist step in. Coromandel’s track record, deep sector expertise, and scale create powerful synergies for NACL’s revival.

Armed with a dual growth strategy, NACL is ramping up its international operations and reducing reliance on a single segment.

Industry wide too, the company enjoys tailwinds. India, the world’s fourth-largest agrochemical producer, is poised for 5–6% annual growth through 2030. With per-hectare usage still far below developed nations, the growth runway is massive, driven by rising population, evolving farming practices, and climate-driven demand for higher yields.

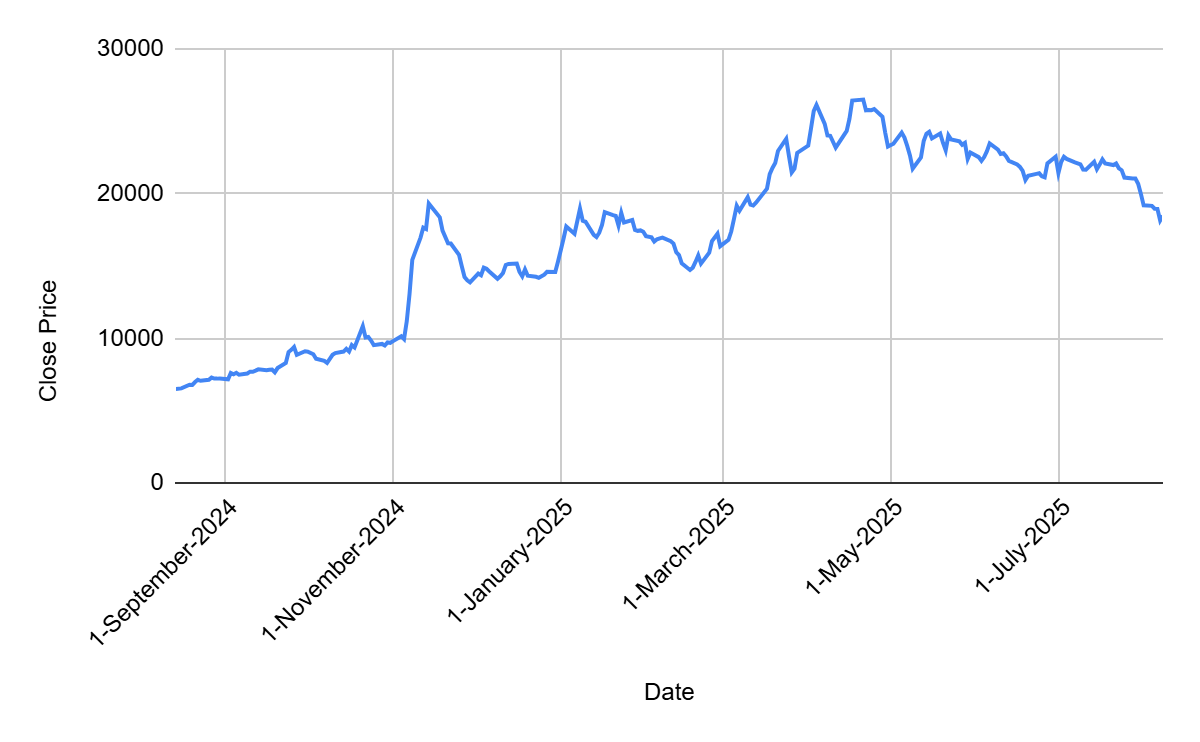

- JSW Holdings

On second comes JSW Holdings. Since last Independence day, JSW Holdings share price has increased by 185%.

JSW Holdings Share Price Since Independence Day 2024

Source: BSE

At the heart of the JSW Group’s growth story lies JSW Holdings — the quiet powerhouse fueling expansion, innovation, and value creation across the conglomerate’s diverse businesses.

As a core investment company, its role goes beyond just holding assets — it’s about making strategic, long-term bets that strengthen both the Group’s market leaders and its next big ventures.

Riding on the momentum of India’s industrial boom — from massive infrastructure projects to surging steel demand, clean energy transitions, and a consumption-driven economy — JSW Holdings sits in a prime spot to capture the upside.

Every time the JSW Group expands — whether in steel, energy, infrastructure, emerging green technologies, or the recent cement IPO — JSW Holdings shares in the value created. In this way, it’s not just a passive investor, but an active participant in India’s economic transformation.

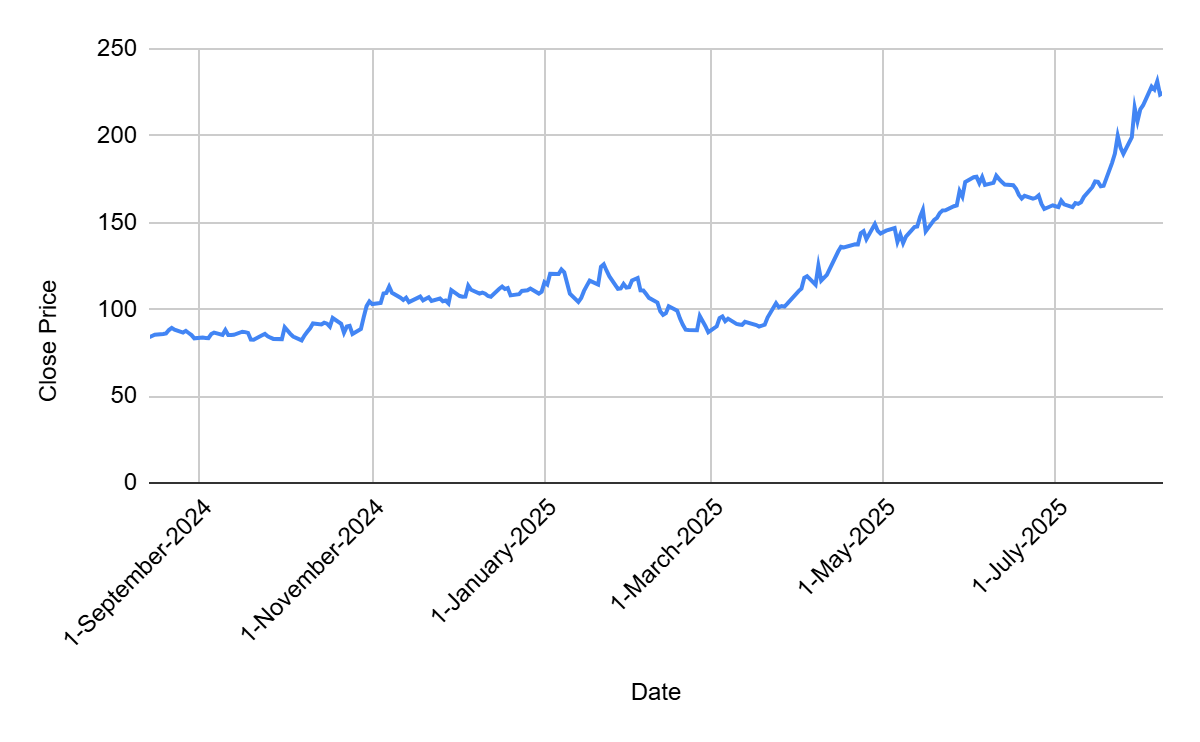

- Paradeep Phosphates

On third we have Paradeep Phosphates with 170% gains since last independence.

Paradeep Phosphates Share Price Since Independence Day 2024

Source: BSE

Paradeep Phosphates is one of the largest manufacturers of Di-Ammonium Phosphate and Nitrogen-Phosphorus-Potassium fertilisers in India.

It caters to over 90 lakh farmers and supplies industrial products such as gypsum, HFSA, sulphuric acid, and ammonia.

The company recently kicked off the year on a strong note, delivering robust Q1 results driven by higher revenues and improved operational efficiencies.

Now, the company is in expansion mode — with projects underway to boost both revenue and profitability, on track for commissioning by Q3 FY26.

The growth tailwinds are strong. With the government allocating ₹37,200 crore towards phosphatic fertilizer subsidies, Paradeep Phosphates is well-positioned to capture the benefits. Industry trends are equally encouraging, setting the stage for market share gains.

On the efficiency front, the company is investing in energy upgrades at its urea plant, aiming to cut energy consumption and improve margins. These cost-structure improvements, combined with capacity expansion, are expected to fuel sustained profitability in the years ahead.

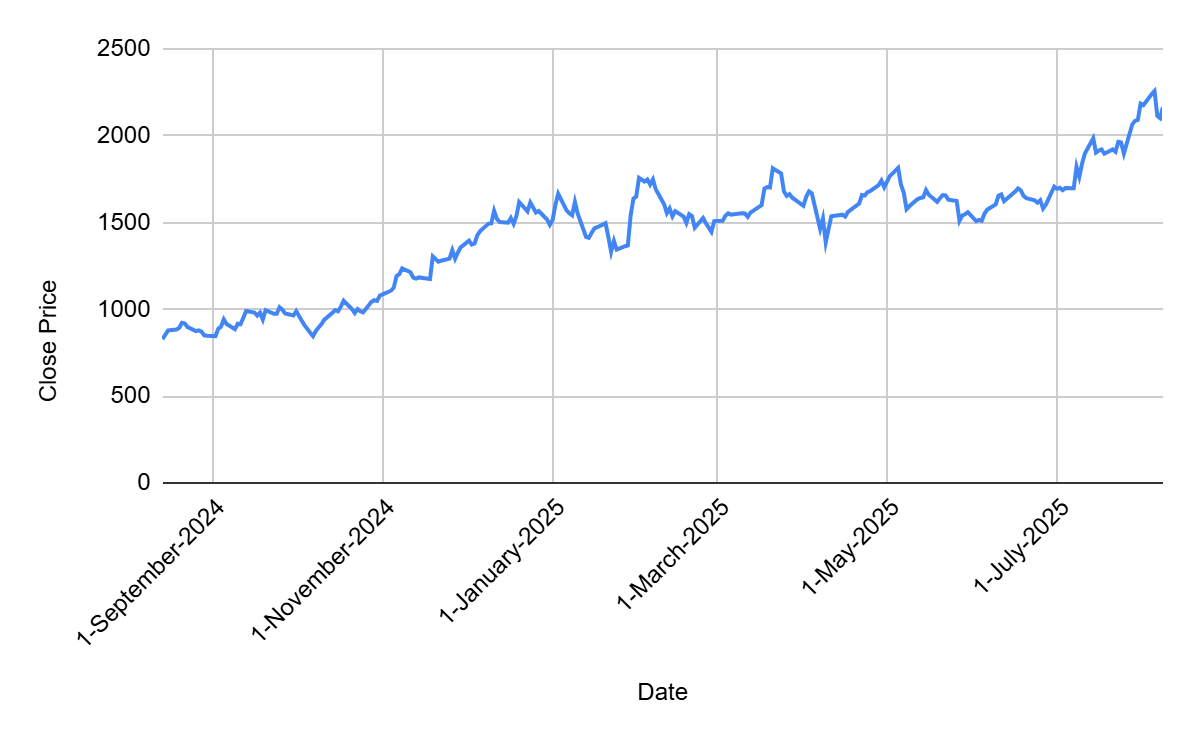

- CarTrade Tech

Next up we have CarTrade Tech.

Since last Independence day, the stock price has rallied 160%.

CarTrade Tech Share Price Since Independence Day 2024

Source: BSE

CarTrade Tech is a multi-channel auto platform with a presence across vehicle types and value-added services.

The platform connects new and used automobile customers, vehicle dealers, vehicle OEMs, and other businesses to buy and sell different types of vehicles.

After a tough start since listing, the company is clawing its way back to sustained and improved performance. For the first quarter ended June 2025, the company posted record revenue which grew 27% YoY to Rs 199 crore while its net profit increased by 106% YoY to Rs 47 crore.

The company is leveraging its market leadership, asset-light model, and product/tech investments (notably in OLX) to drive growth across a large, underpenetrated TAM.

The company’s management is highly optimistic about the future across all business lines, with a clear focus on execution, margin expansion, and selective capital allocation.

- Axiscades Technologies

On fifth we have Axiscades Technologies.

Since last Independence day, the stock price of Axiscades has shot up to 160%.

Axiscades Share Price Since Independence Day 2024

Source: BSE

Although a relatively smaller player, Axiscades is present across engineering and design services and has been serving various verticals like aerospace, defence, heavy engineering, automobile and industrial products.

Axiscades is eyeing a Rs 3,000 crore+ addressable market in the fast-growing counter-drone and defence tech space — a perfect fit with India’s push for advanced security solutions.

At the same time, it’s carving a niche in the semiconductor ecosystem, building partnerships with global chip leaders like Texas Instruments, NVIDIA, and Qualcomm.

By focusing on post-silicon activities — from product development to advanced manufacturing — Axiscades is positioning itself at the forefront of two high-growth, strategically important industries. As these sectors scale, the company is well-placed to ride both the defence and semiconductor waves.

Best Performing Stocks Since Last Independence Day

Apart from the above, here are some more stocks that have delivered market beating returns since last Independence day.

| Company | Price as on 15 August 2024 | Current Price | Change (%) |

| Vimta Labs Ltd. | 248 | 635 | 156% |

| Camlin Fine Sciences Ltd. | 99 | 235 | 138% |

| Godfrey Phillips India Ltd. | 4,341 | 9,948 | 129% |

| Force Motors Ltd. | 8,124 | 17,795 | 119% |

| Acutaas Chemicals Ltd. | 610 | 1,280 | 110% |

| Ravindra Energy Ltd. | 69 | 143 | 107% |

| Timex Group India Ltd. | 140 | 289 | 106% |

| Authum Investment | 1,390 | 2,844 | 105% |

| Tilaknagar Industries Ltd. | 235 | 469 | 99% |

| Gabriel India Ltd. | 512 | 1,009 | 97% |

| One97 Communications Ltd. | 540 | 1,062 | 97% |

| Suven Life Sciences Ltd. | 130 | 250 | 93% |

| Avalon Technologies Ltd. | 466 | 898 | 92% |

| Tanfac Industries Ltd. | 2,122 | 4,078 | 92% |

| Lloyds Metals & Energy Ltd. | 734 | 1,403 | 91% |

| Laurus Labs Ltd. | 431 | 821 | 91% |

| SML Isuzu Ltd. | 2,021 | 3,850 | 90% |

| Lumax Auto Technologies Ltd. | 521 | 991 | 90% |

| Choice International Ltd. | 390 | 741 | 90% |

| Shankara Building Products Ltd. | 588 | 1,111 | 89% |

Conclusion

From crop protection to semiconductors, from fertilisers to financial holding companies — the past year has shown that India’s equity market rewards those who spot the right opportunities early.

These top performers didn’t just benefit from sector tailwinds — they had strong fundamentals, smart strategies, and the ability to ride India’s growth story at full throttle.

But here’s the catch — for every stock that rockets ahead, there are dozens that lag, stagnate, or fall behind. Picking winners isn’t about chasing last year’s returns — it’s about identifying tomorrow’s leaders before the market does.

This Independence Day, as we celebrate the nation’s progress, consider freeing your portfolio from guesswork, tips, and short-term noise. Instead, build it with the guidance of a SEBI-registered stock market advisory that can help you align with India’s long-term growth, manage risks, and uncover the next set of market outliers.

After all, the right advice at the right time can turn a good year into a great decade for your wealth.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 2.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora