The Tata group stands as a steadfast lighthouse—its brilliance fueled by trust, tenacity, and a legacy of unwavering performance.

Time and again, enterprises under the Tata umbrella have weathered turbulent winds, emerging stronger, time and again.

In 2024, several Tata group companies dazzled the stock market, morphing into multibaggers and carving their names into investor folklore with extraordinary returns.

Yet, as the calendar turned to 2025, a storm of soaring tariffs swept across the landscape, rattling the foundations of even the mightiest players.

As a result, in 2025 so far, many Tata stocks are down up to 50%.

Let’s take a look at 5 best and worst performing Tata stocks of 2025 and examine whether a rebound or a rally is on the cards.

Top Performing Tata Stocks of 2025

- Rallis India

Coming right on top of the list is Rallis India.

In 2025 so far, shares of the company have rallied more than 25%.

This could be a result of Rallis India’s impressive earnings.

For Q1FY26, its revenue increased 22% YoY, supported by strong demand and successful product launches in crop protection and seeds segments.

Meanwhile, net profit almost doubled and grew 98%.

The company launched nine new products across herbicide, fungicides and insecticides. It plans to introduce some more in the coming quarters.

- Tata Consumer Products

Following Rallis India we have Tata Consumer Products.

Shares of Tata Consumer have gained more than 15% in 2025 so far.

The key reasons behind this could be increasing tea prices, debt reduction and impressive quarterly earnings. Tata Consumer announced to gradually raise tea prices in 2024.

Tata Consumer derives 37% of its revenues from India beverages, 28% from India foods, 10% from US coffee, 15% from international tea and balance 10% from Tata coffee.

The company’s management is confident about the coming quarters as tea cost pressures abate and price increases flow through.

- Tata Steel

On third, we have Tata Steel with 15% gains in 2025 so far.

The rally in Tata Steel comes on the back of falling iron ore prices, China’s increased infra push, and Tata Steel performing well in recent quarters.

Tata Steel has planned a massive capital expenditure of about $ 1.8 billion across India, the UK, and the Netherlands, with a significant portion for capacity and technology upgrades in India.

- Benares Hotels

Coming next is Benares Hotels with close to 15% gains.

The rally comes following decent and in-line earnings by the hotel company.

Benares Hotels is a subsidiary of the Indian Hotels Company. It operates its hotels, viz. Taj Ganges and Nadesar Palace in Varanasi and Ginger Hotel, Gondia in Maharashtra.

Its Taj Ganges is currently adding a 100-room tower with larger rooms and taking the total inventory to 230 rooms.

Now let’s move on to the top losers…

Worst Performing Tata Stocks of 2025

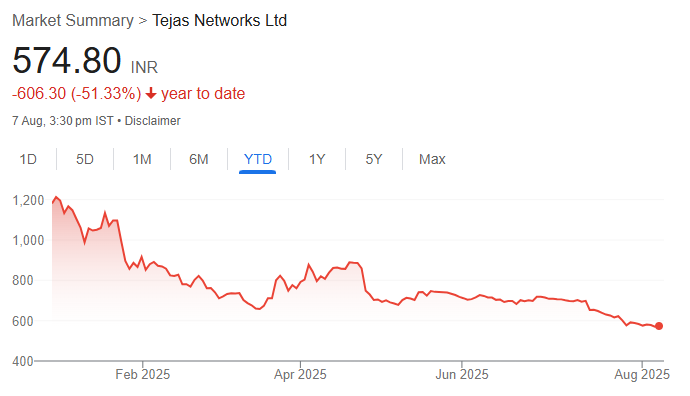

- Tejas Networks

With over 50% fall in 2025 so far, Tejas Networks is the biggest loser from the group so far.

The decline comes after Tejas Networks reported a disappointing June quarter result with a net loss, mainly due to the weaker revenue numbers.

Tejas Networks revenue took a huge hit due to delayed purchase orders and shipment issues with some customers.

Nevertheless, Tejas Networks is gearing up for growth in this fiscal by boosting its product lineup and targeting bigger markets, with a focus on enhanced 5G capabilities and advanced radios.

- Nelco

Next up we have Nelco, with a 33% fall in 2025 so far.

Incorporated in 1940 and now operating as a subsidiary of Tata Power, Nelco provides satellite-based connectivity solutions for enterprise, government, and defence customers across India.

Nelco’s business revolves around providing satellite communication services through VSAT (Very Small Aperture Terminal) systems.

- Voltas

Next up we have Voltas with a 27% fall in 2025 so far.

Voltas has been a household name in India, with a dominant position in the air conditioning and cooling products market.

The company leads the air conditioning segment with a market share in excess of 20%.

Backed by strong brand visibility and goodwill, Voltas looks well-positioned to bounce back and benefit from the growing penetration of RACs in India.

- Tata Consultancy Services (TCS)

Next up is India’s largest IT company Tata Consultancy Services (TCS).

Shares of the IT major have declined up to 25% in 2025 so far.

Asia’s largest firm recently announced that it will reduce about 2% of its global workforce — as much as 12,000 roles — on account of skill gaps and rapid technological changes.

Shares of TCS have fallen this year as its clients in the US and other markets are holding off on big IT spending.

What Next?

The Tata group has seen its combined market capitalisation erode by $120 billion from its peak in September 2024.

From a valuation of $415 billion at the time, the group now stands at $296 billion — a correction that has taken place over the last 11 months.

Market value wise, the group’s crown jewel TCS has been the biggest casualty, losing nearly $70 billion since September last year.

Tata Motors is the second-largest contributor to the group’s market cap erosion, with a decline of around $21 billion.

Most Tata Group companies have delivered negative returns since the beginning of the year.

| Company | Fall in 2025 so far (%) |

| Tejas Networks Ltd. | -52% |

| Nelco Ltd. | -33% |

| Automotive Stampings and Assemblies Ltd. | -28% |

| Voltas Ltd. | -27% |

| Tata Consultancy Services Ltd. | -26% |

| Tata Technologies Ltd. | -25% |

| Trent Ltd. | -25% |

| Tata Teleservices (Maharashtra) Ltd. | -24% |

| TRF Ltd. | -23% |

| Oriental Hotels Ltd. | -20% |

| The Indian Hotels Company Ltd. | -15% |

| Tata Elxsi Ltd. | -14% |

| Tata Motors Ltd. | -12% |

| Tata Chemicals Ltd. | -10% |

| Artson Ltd. | -7% |

| Automobile Corporation of Goa Ltd. | -3% |

| Tata Power Company Ltd. | -2% |

| Tata Communications Ltd. | -1% |

Conclusion

As the rest of 2025 plays out, some Tata Group companies aren’t just surviving—they’re showcasing the power of long-term vision, sharp strategy, and relentless innovation.

Backed by a history of turning headwinds into tailwinds, many of these stocks remain strong contenders for long-term wealth creation.

But remember—past performance is just one part of the story. Smart investing means digging deeper.

Happy Investing.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora