Introduction

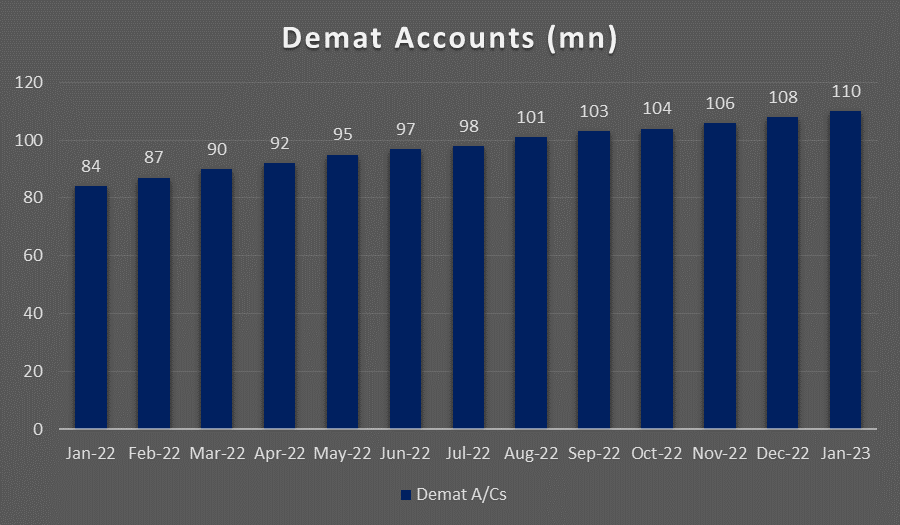

The number of Demat accounts in India surged to 11 crores in January 2023 compared to 8.4 crore accounts in January 2022, which means a growth of 31%. A look at the graph below shows how the number has gone up every month.

Only 3% of people in India actively invest in the share market, which means there will be more people who could invest, and the first thing they would need is a Demat Account. If you plan to invest in the Indian stock market, a Demat account is a must-have. This type of account keeps your securities safe and secure in digital format. We’ve created a helpful blog explaining how to open a Demat account in 10 minutes.

Thanks to modern technology, the process is now quick and easy. Leading brokerage firms in India offer online Demat opening services, allowing you to complete the process from the comfort of your home. With technology, you can open your account in just a few minutes.

Steps to open a Demat account in 10 minutes:

Step 1: Choose a Brokerage Firm

The first step is selecting the right brokerage firm to open your online account. You have several options, including Zerodha, Upstox, and Angel Broking. It’s essential to compare their features, brokerage fees, and other services to determine the best fit for your investment needs.

Step 2: Visit the Brokerage Firm’s Website

After selecting a brokerage firm, go to their website and click on the ‘Open Account’ or ‘Register’ button. This will take you to the page where you can begin the account opening process.

Step 3: Fill in Your Details

When you arrive at the account opening page, you must provide your personal information, such as your name, date of birth, PAN number, email address, and mobile number. Therefore, it’s crucial to carefully double-check all the details you’ve entered before submitting the form.

Step 4: Upload Your Documents

Once you have filled in your personal information, you will be prompted to upload essential documents such as your PAN card, Aadhar card, and a canceled cheque. You must upload high-quality and easily readable copies of these documents to prevent any potential rejection.

Step 5: e-Sign and Pay

After successfully uploading your documents, the next step is confidently signing the application form using your Aadhar card. This is a mandatory requirement set by the Securities and Exchange Board of India (SEBI) to ensure adherence to guidelines. On completing the eSigning process, you will be directed to pay the account opening fees.

Step 6: Verify Your Details

After payment submission, the brokerage firm will promptly verify your details and documents within 24-48 hours. Rest assured that you’ll receive an email and SMS confirmation once your account is verified.

Step 7: Log in to Your Demat Account

After receiving confirmation, log in to your account and start trading confidently. First, however, change your password immediately to guarantee your account’s highest level of security.

How much time does it take to create a Demat account?

In the past, opening a Demat account was a long and cumbersome procedure that required investors to visit the broker’s office and submit physical documents personally. Fortunately, the introduction of online account opening has made the process much faster and more convenient. Now, opening a Demat account online can take 10-15 minutes.

What documents do I need for creating a Demat Account?

To open a Demat account, you need to provide the following documents:

- PAN Card: A PAN card to open a Demat account is mandatory.

- Aadhar Card: Aadhar card is compulsory for eSign, which is required to open an online Demat account.

- Bank Account Details: For a smooth fund transfer, you must provide bank details, like account number and IFSC code.

- Address Proof: You must provide valid address proof like a passport, voter ID, driving license, or utility bills.

Thanks to digital technology, opening a Demat account has been simplified and made straightforward. Following the steps outlined above, you can have your Demat account ready within 10 minutes. Choosing a reliable brokerage firm that offers quality service and reasonable fees is crucial. Before choosing, compare the brokerage fees, services offered, and other vital features.

It is equally important to ensure that the information you provide in the application form and accompanying documentation is accurate and current. Falsifying information can result in the rejection of your application or even legal consequences.

Having a Demat account is a necessary step for investing in the Indian stock market, and it has become much more convenient and faster than before. With the online account opening option, investors can quickly invest in stocks and other securities.

FAQs

What is the use of the Demat account?

Your Demat Account dematerialises your stocks. Dematerialising shares or securities allows you to own them electronically and conduct digital trading, eliminating the need for extensive paperwork and saving time and effort.

What is the least amount you need to open a Demat account?

Opening an account with a zero balance is possible. However, it is crucial to be aware of the account opening charges. Some service providers offer the option to open an account with no charges. Still, others may levy fees such as Rs. 200 or Rs. 400. Make sure to carefully consider all associated costs before deciding.

Can we close the Demat account?

Yes. If you’re not using your Demat account, it’s best to close it to avoid unnecessary maintenance charges. To do so, download the appropriate application from the relevant website, complete it, and submit it in person to the nearest branch of your Depository Participant, along with the necessary KYC documents. Be sure to state your reason for account closure clearly.

Can I buy shares without a Demat account?

No, you cannot buy shares without a Demat account. All investors must have a Demat account to participate in stock or share trading. The regulation was established by the Securities and Exchange Board of India (SEBI) in 1996 due to the extensive documentation required for buying and selling shares and the prevalence of fraudulent activities in the past. Therefore, it is only possible to purchase shares with a Demat account.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 1.1 / 5. Vote count: 293

No votes so far! Be the first to rate this post.