Have you ever rushed through the airport terminal, craving a quick bite or a comfortable lounge to wait out a delayed flight?

Chances are, you’ve already interacted with Travel Food Services (TFS) without even realizing it.

As one of India’s leading players in airport dining and lounge services, TFS is now stepping into the spotlight with its much-anticipated ₹2,000 crore initial public offering (IPO).

But what does this IPO really offer investors? Is it a chance to be part of India’s aviation growth story, or just another high-valuation exit for existing promoters?

In this article, we’ll take you through the detailed analysis of the Travel Food Services IPO and evaluate whether it deserves a place in your portfolio.

Travel Food Services IPO Details

The IPO of Travel Food Services is entirely an Offer for Sale (OFS) of 1.82 crore equity shares, totaling ₹2,000 crore. No fresh shares are being issued, which means the proceeds will go directly to the promoter selling shareholder, not to the company.

| Offer Price | ₹1,045 to ₹1,100 per share |

| Face Value | ₹1 per share |

| Opening Date | 7 July 2025 |

| Closing Date | 9 July 2025 |

| Total Issue Size (in Shares) | 1,81,81,818 |

| Total Issue Size (in ₹) | ₹2,000 Cr. |

| Issue Type | Bookbuilding IPO |

| Lot Size | 13 Shares |

| Listing at | BSE, NSE |

Allocation of Shares

| Investor Category | Lots | Shares | Investment Amount |

| Retail (Min) | 1 | 13 | ₹14,300 |

| Retail (Max) | 13 | 169 | ₹1,85,900 |

| S-HNI (Min) | 14 | 182 | ₹2,00,200 |

| S-HNI (Max) | 69 | 897 | ₹9,86,700 |

| B-HNI (Min) | 70 | 910 | ₹10,01,000 |

The issue includes a reservation of 40,160 shares for eligible employees, offered at a discount of ₹104 per share.

Anchor Investors

Before the IPO went public, TFS raised ₹600 crore from key institutional investors including:

- ICICI Prudential Mutual Fund

- Axis Mutual Fund

- Kotak Mutual Fund

- Baroda BNP Paribas Mutual Fund

- Abu Dhabi Investment Authority

- Fidelity

- Government Pension Fund Global

These investments were made at the upper price band of ₹1,100, indicating strong pre-IPO confidence.

Grey Market Premium (GMP)

As of July 7, 2025, the GMP for Travel Food Services IPO is ₹30. Based on this premium and the upper price band, the estimated listing price is ₹1130, reflecting an expected gain of 2.73% per share.

Objectives of the Offer

Because this IPO is a complete OFS, it will not receive any proceeds. The primary objective is:

- To provide an exit opportunity for the promoter selling shareholder

There is no plan to use the funds for business expansion, capital expenditure, or debt repayment.

Company Overview

Established in 2007 and based in Mumbai, Travel Food Services operates in the travel-focused quick-service restaurant (QSR) and airport lounge space. The company runs operations across airports in India, Malaysia, and Hong Kong, with select outlets on Indian highways as well.

According to CRISIL, the company commands:

- 26% share in India’s airport QSR market

- 45% share in the airport lounge segment

Key Operational Highlights:

- 442 QSR outlets

- 37 lounges

- 37 in-house brands

- 90 brand partnerships, including 32 international brands

- 93.9% contract retention rate since 2009

TFS caters to both high-traffic public areas and exclusive premium services. Lounges are accessible to business and first-class flyers, loyalty program members, and select credit/debit card holders.

The company has also secured future concessions at Greater Noida and Navi Mumbai airports, indicating that it is well-positioned to grow along with India’s expanding aviation infrastructure.

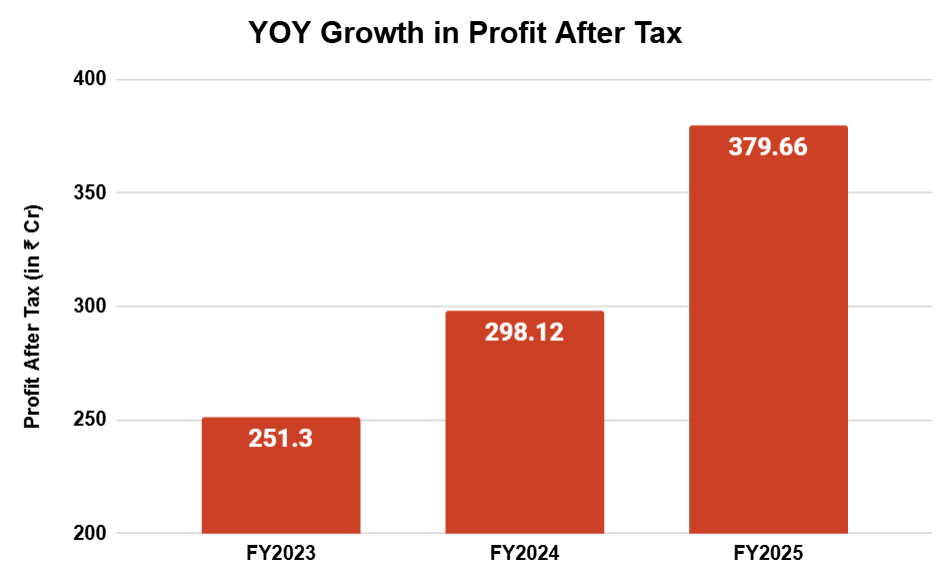

A Close Look at Financials

Let’s take a closer look at the numbers between FY23 and FY25:

- Revenue from operations: Grew at a CAGR of 26% to reach ₹1,687.7 crore

- Net profit: Rose 23% CAGR to ₹379 crore

- EBITDA: Increased by 21.5% CAGR to ₹676.3 crore

- EBITDA margin: Declined from 42.9% in FY23 to 40.1% in FY25

Like-for-Like (LFL) Sales Growth

LFL sales growth dropped from 166.6% in FY23 to just 4.6% in FY25. This decline is primarily due to new airport terminals attracting traffic away from older ones. Analysts note that LFL growth may not be the best metric to judge the company’s performance in this evolving context.

SWOT Analysis

| STRENGTHS | WEAKNESSES |

| Market Leadership: Dominates the airport QSR and lounge space in India. Strong Brand Portfolio: Mix of in-house and global partner brands. High Contract Retention: Nearly 94% retention rate over 15+ years. Presence in Upcoming Airports: Secured wins at Navi Mumbai and Greater Noida. | Dependency on Airport Traffic: Business highly reliant on air passenger volume. No Fund Infusion: IPO is OFS-only, so there’s no direct growth capital being raised. Decline in EBITDA Margins: Profitability margin has slightly slipped. Low LFL Growth: Recent sales growth has slowed. |

| OPPORTUNITIES | THREATS |

| Aviation Growth in India: Rising air travel opens new market potential. International Expansion: Presence in Malaysia and Hong Kong can be expanded. Highway Segment Potential: Currently under-penetrated but holds promise. Premiumization Trends: Growing demand for quality F&B at travel hubs. | Airport Concession Risk: Business relies heavily on contracts with airport authorities. Operational Disruptions: Travel bans, pandemics, or geopolitical tensions can affect traffic. Intense Competition: Especially in the QSR segment from both local and global players. Inflation Impact: Higher input costs could pressure margins further. |

Conclusion

The IPO of Travel Food Services offers investors exposure to a niche but growing segment of India’s consumer and travel ecosystem. While the company enjoys leadership and has strong operational credentials, the lack of fresh capital infusion, dependency on travel volumes, and flattening sales growth could be red flags for cautious investors.

Still, anchor investor interest and GMP momentum show there is optimism around the listing. If you’re planning to invest, evaluate your risk profile, consider the limited upside reflected in GMP, and decide whether this IPO aligns with your portfolio strategy.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora