In recent years, weight loss medicines have become a major trend. Leading this trend are GLP-1 drugs like semaglutide and tirzepatide.

These drugs were originally developed to treat Type 2 diabetes, but they have gained popularity for their significant weight loss effects, helping people lose 15% to 20% of their body weight in clinical trials.

The strong effect of these drugs on both diabetes and weight loss has led to a huge rise in global demand, causing supply shortages for the original makers.

As production struggles to keep up, the pharma industry is now focusing on the upcoming patent expiry of key GLP-1 drugs like semaglutide, expected to start in early 2026 in countries like India, Brazil, China, and Canada (some reports even suggest 2025).

This opens up a multi-billion-dollar opportunity for Indian drugmakers, especially those that make APIs (Active Pharmaceutical Ingredient) or work as contract manufacturers, as they are well-placed to enter and benefit from this fast-growing market.

Understanding GLP-1 Drugs

Before we go further, let’s understand what GLP-1 is. GLP-1 (glucagon-like peptide-1) receptor agonists are drugs that act like a natural hormone in the body. They help release insulin, reduce appetite, and slow digestion, making them effective for controlling blood sugar and supporting weight loss.

The most popular drugs in this class include:

- Semaglutide: Marketed as Ozempic (for diabetes) and Wegovy (for weight loss) by Novo Nordisk.

- Tirzepatide: Sold under the brand Mounjaro by Eli Lilly.

These drugs are administered via injectables, with some oral variants in development. Their use has now expanded beyond diabetes, as off-label prescriptions for obesity management and even cosmetic weight loss have become increasingly common.

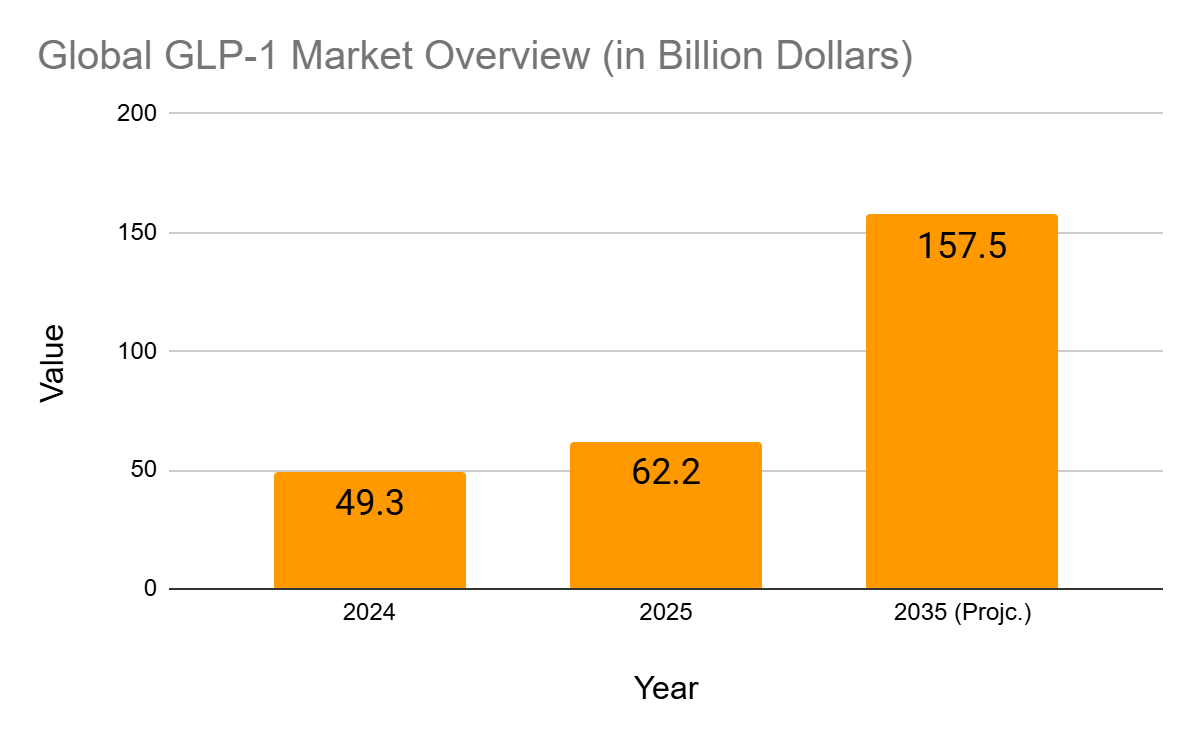

Market Projections

- The global GLP-1 market is estimated to surpass $157.5 billion by 2035.

- Demand has significantly outstripped supply, with Novo Nordisk even limiting new prescriptions in the US due to manufacturing constraints.

- India, with its skilled manufacturing base, is now poised to become a central hub in the production of generic GLP-1 drugs post-patent expiry.

Source: rootanalysis.com

Patent Expiry – A Key Trigger

Patent expiration, often termed the “patent cliff,” presents a crucial turning point in the life cycle of blockbuster drugs. Novo Nordisk’s semaglutide is expected to lose its patent protection in Canada, Brazil, India, and China in 2025–2026.

Why Is This Important?

- Once patents expire, generic drug makers can legally produce and sell biosimilar versions of these drugs, often at significantly lower prices.

- Given the supply constraints faced by original drugmakers and the unmet demand, generic players have a golden opportunity.

- Indian companies, known for their cost-effective and regulatory-compliant manufacturing, can emerge as global suppliers.

According to ICICI Securities, Indian Contract Development and Manufacturing Organizations (CDMOs) like Gland Pharma and OneSource (Concord Biotech) could play a key role in manufacturing biosimilar semaglutide for both local and international markets.

Indian Drugmakers Prepare for Patent Expiry Opportunity

As semaglutide patents begin to lapse across more than 100 countries, Indian pharma companies are gearing up to flood the market with generic alternatives to Novo Nordisk’s blockbuster formulations. Brands like Ozempic (for diabetes) and Wegovy (for weight loss) together contributed an estimated $25.4 billion in global revenues in 2024, highlighting the immense commercial potential.

India, with its established base of cost-efficient, FDA-compliant manufacturers, is poised to become a critical player in this generics transition. The expiry of semaglutide patents in India and Canada (January 2026) and Brazil (March 2026) opens the doors for affordable alternatives to penetrate emerging markets, where obesity and diabetes are growing public health challenges.

Source: Moneycontrol

Emerging Markets Offer Early Growth Potential

While US and Western Europe, the most lucrative for weight-loss medications, are expected to retain patent protections for a few more years, emerging markets will open up first. These markets are already witnessing increasing demand for affordable diabetes and weight-loss treatments, making them ideal launchpads for Indian generic producers.

This shift is likely to trigger a surge in prescription volumes, compensating for lower per-unit margins with higher sales volume.

Top Indian Stocks to Watch in the GLP-1 Opportunity

1. Gland Pharma

Gland Pharma has long been known for its prowess in injectable formulations and complex sterile products. Backed by China’s Fosun Pharma, Gland has been expanding its capabilities to include peptide-based injectables, making it a potential frontrunner in the biosimilar semaglutide race.

- Regulatory Approvals: Gland holds USFDA, EU, WHO, and MHRA approvals, allowing access to global markets.

- Manufacturing Edge: Expertise in sterile injectables is critical for semaglutide, which is currently available only in injectable forms.

- Capacity Expansion: The company has been investing in new production lines tailored for complex biologics and peptides.

2. OneSource Specialty Pharma

- Early entrant: OneSource Specialty Pharma, headquartered in Bengaluru, is emerging as a first mover in India’s generic semaglutide space.

- Significant investment: The company is investing $100 million to scale up its manufacturing capacity, aimed at meeting the expected surge in demand for semaglutide generics.

- Revenue target: OneSource aims to achieve $400 million in annual revenue within the next three years, with semaglutide as a key contributor.

- Strategic intent: This investment highlights OneSource’s plan to establish a strong early foothold in the growing weight-loss generics segment.

3. Dr. Reddy’s Laboratories

- Actively preparing to enter the high-volume, low-cost generics market for GLP-13 drugs.

- Has been working on semaglutide development for over a decade, targeting both injectable and oral formulations.

- Plans a global rollout of generics for Ozempic, Wegovy, and Rybelsus.

- Leveraging a mix of in-house production and contract manufacturing for market scalability.

4. Biocon

- Biocon views GLP-1 as a significant opportunity, citing its robust portfolio of GLP-1s and insulin products.

- Has already launched oral GLP-1 diabetes drug Liraglutide in the UK, demonstrating early market presence.

- Positioned to scale up manufacturing and distribution for global GLP-1 demand.

5. Zydus Lifesciences

- Investing over ₹100 crore ($12 million) in a new manufacturing facility for semaglutide.

- Using proprietary technology aimed at producing cost-effective semaglutide formulations.

- Focused on improving affordability and accessibility in emerging markets.

6. Divi’s Laboratories

- Hyderabad-based API giant and a key supplier of semaglutide components.

- Reported strong growth in its peptide business, driven by surging global demand for GLP-1 drugs.

- Well-positioned to benefit as a backend enabler in the semaglutide supply chain.

Other Key Players: Sun Pharma, Cipla, Lupin, Aurobindo

- These leading firms are also strategically aligning operations to benefit from semaglutide’s patent expiry.

- Likely to contribute through contract development, manufacturing partnerships, and API production.

Source: Moneycontrol

Why Global Pharma Might Outsource to India

Given the surging demand for GLP-1 drugs and limited global manufacturing capacity, Indian pharma is increasingly viewed as a natural outsourcing hub.

Key Advantages India Offers:

- Low-cost production with FDA-compliant facilities.

- Proven track record of biosimilar and complex injectable production.

- Skilled labor in peptide synthesis and sterile injectables.

- Proximity to key emerging markets (Asia, Africa, LATAM).

Multinational players like Novo Nordisk and Eli Lilly may partner with Indian CDMOs to:

- Meet rising demand across geographies.

- Reduce production costs.

- Manage regulatory and logistical complexities.

Risks and Challenges

While the outlook is promising, investors must consider several potential challenges:

1. Regulatory Risks

- USFDA warnings or plant inspections can derail timelines.

2. Pricing Pressure

- Generic versions may face price erosion, especially in price-sensitive markets like India and Brazil.

3. Side Effects and Ethical Concerns

- Long-term side effects (e.g., pancreatitis, thyroid tumors) could result in litigation or reduced prescriptions.

4. Patent Litigation

- Original drugmakers may contest biosimilar entries, delaying rollouts through legal challenges.

5. Global Competition

- Chinese CDMOs and Latin American firms are also eyeing the post-patent market.

Investor Takeaway

For investors seeking exposure to the GLP-1 boom in India, the key is to identify companies with proven capabilities in:

- Peptide synthesis

- Sterile injectable manufacturing

- Global regulatory compliance

- CDMO services with US/EU clients

Recommended Monitoring:

- R&D updates and capacity expansions

- Any tie-ups with global GLP-1 players

- Clinical trial progress for biosimilar versions

- Regulatory approvals (USFDA, EMA)

- Export data to key markets (USA, Canada, China)

Conclusion

The weight loss drug boom is changing global healthcare and creating a huge business opportunity for Indian pharma companies. With patents for semaglutide and other GLP-1 drugs set to expire in key markets, Indian CDMOs, API makers, and biologics experts are well placed to step in. Gland Pharma and OneSource are leading the way, while companies like Dr. Reddy’s Laboratories, Biocon, and Divi’s Laboratories could also benefit. For long-term investors, this may mark the beginning of an exciting new phase in India’s pharma growth story.

FAQs

What are GLP-1 drugs and why are they important?

GLP-1 drugs like semaglutide are used to treat Type 2 diabetes and support weight loss. Their dual benefits have led to high global demand, creating strong growth potential for generic manufacturers after patent expiry.

Which Indian companies are leading this opportunity?

Gland Pharma and OneSource are currently at the forefront, with major investments in manufacturing. Others, such as Biocon, Zyduc, Laurus Labs, and Divi’s Laboratories, are also well-positioned to benefit from the expected surge in demand.

What makes Indian pharma firms competitive in this space?

India’s strength lies in its cost-effective manufacturing, FDA-approved facilities, and proven capabilities in APIs and biologics, making its pharma firms ideal partners for producing generic GLP-1 drugs at scale.

Is this trend a good sign for investors?

Yes, the weight loss drug wave offers long-term growth potential. With Indian firms gearing up for global expansion, investors could benefit from early exposure to this emerging and high-demand pharmaceutical segment.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered aes a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora