Income tax compliance is an important part of financial planning. Filing your Income Tax Return (ITR) correctly is a crucial step in this process.

However, even minor mistakes in the return can lead to the Income Tax Department flagging your return as “defective”.

In such cases, a notice is issued under Section 139(9) of the Income Tax Act. Many taxpayers are unsure how to respond to notice under section 139 9 and often panic.

This article is a complete guide to help you understand:

- What is a defective return?

- What does a notice under Section 139(9) mean?

- How to respond properly and avoid future errors.

Let’s dive into the details.

What is a Defective Income Tax Return (ITR)?

A defective return is a return that has been filed with missing information, incorrect data, or incomplete documentation. The Income Tax Department identifies such returns during its internal checks and sends a notification to the taxpayer to rectify the defects within a specified time.

Understanding this is part of knowing income tax basics, which can save you from legal hassles and refund delays.

Meaning of Notice Under Section 139(9) of the Income Tax Act

When the department finds an error in your return, they issue a notice under Section 139(9). This notice informs you about the nature of the defect and gives you a chance to correct it. Failing to act on this notice can result in your return being treated as invalid.

This is one of those income tax concepts that every taxpayer must understand to stay compliant.

Reasons for Receiving an ITR 139(9) Defective Return Notice

There can be multiple reasons behind getting a defective return notice. If you want to know how to respond to notice under section 139(9), here are some of the most common reasons that need to be taken care of:

Missing or Incorrect Information in Filed Return

Simple errors like not filling in all the mandatory fields, leaving income details blank, or selecting the wrong ITR form can trigger a defective return.

Mismatch in Income Details and Form 26AS

Your Form 26AS contains details of all tax credits (TDS, TCS, advance tax). If your return doesn’t match these records, it’s flagged as defective. Always reconcile Form 26AS with your ITR before filing. Many share market advisory services and professionals provide assistance in this process.

Non-Attachment of Mandatory Audit Reports or Documents

If you’re required to undergo a tax audit (under Section 44AB or any other provision) and fail to attach the audit report, the return becomes defective.

Other Common Errors Triggering Defective Return Notice

- Filing ITR without disclosing income.

- Claiming deductions or exemptions not eligible for your income bracket.

- Non-disclosure of capital gains, especially if you invest in stocks or mutual funds.

Time Limit to Respond to Section 139(9) Notice

Deadline for Rectification of Defective Return

As per the Income Tax Act, you are required to respond to the defective return notice within 15 days from the date of issue of the notice. This is a strict timeline.

Extension of Time and Special Cases

In genuine cases, you can request an extension for submitting the rectified return. However, this must be done within the original 15-day period and is subject to approval by the Assessing Officer.

Failing to act within the allowed time will result in your ITR being considered invalid, as if you never filed it.

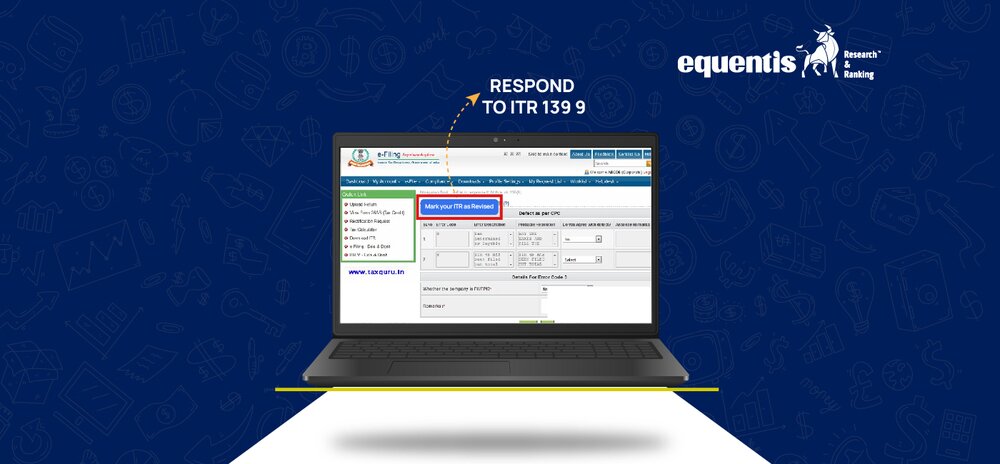

How to Respond to ITR 139(9) Notice

So, if you’re wondering how to respond to notice under section 139 9, here is a step-by-step guide:

Steps to Respond via Income Tax Portal

- Log in to the Income Tax e-filing portal.

- Go to ‘e-Proceedings’ or ‘Pending Actions’ > ‘e-Proceedings’.

- Click on the notice under Section 139(9).

- Read the details of the defect mentioned carefully.

- Select the appropriate response option – either agree and correct the return or disagree and provide a justification.

Correcting the Defective Return Online

Once you accept the defect, you will need to revise the return with the correct details:

- Open your ITR form in the utility tool (Java/JSON/online).

- Correct the error as per the notice.

- In the section “Return Filed Under”, select Section 139(9).

- Validate and generate the XML/JSON file.

Uploading the Revised/Corrected Return

After correction, upload the file:

- Go back to the e-Filing portal.

- Select ‘e-File’ > ‘Income Tax Return’.

- Choose the relevant Assessment Year.

- Select Filing Type: 139(9) – Response to Notice.

- Upload the file and verify using Aadhaar OTP, EVC, or DSC.

Receiving Confirmation of Rectification

Once submitted, you’ll receive a confirmation message on the portal and email/SMS as proof. The department will process this return, and if all is in order, the status will change to ‘Return Processed’.

Documents Required While Responding to 139(9) Notice

You may need to attach or keep handy certain documents while correcting your return.

Revised Computation Statements

A corrected computation of income, reflecting accurate income, deductions, and tax liability, should be prepared.

Audit Reports (if applicable)

If the defect relates to the absence of a tax audit report, ensure you:

- File the Form 3CA/3CB and 3CD properly.

- Attach the report with the revised return.

Other Supporting Documents

These may include:

- Bank statements

- TDS certificates (Form 16/16A)

- Form 26AS

- AIS/TIS records

- Capital gains reports (especially if you’re active in the share market)

Maintaining these records is not only good for income tax basics but also useful in case of scrutiny.

Consequences of Not Responding to Defective Return Notice

Ignoring the notice under Section 139(9) is not a wise idea. Here’s why:

Invalidation of Filed Return

If you don’t rectify the defect, the ITR is treated as invalid. It’s as if you never filed the return, leading to consequences like:

- Penalties for non-filing

- Loss of refund eligibility

- Interest under Section 234A, 234B, and 234C

Impact on Refunds and Tax Assessments

Since your return is treated as invalid:

- You won’t receive any refund due.

- It may invite assessment proceedings under scrutiny.

Additional Penalties or Scrutiny Risks

Repeated negligence may also increase your chances of being selected for a scrutiny assessment.

Responding to the notice timely is a part of maintaining healthy financial habits, especially if you rely on share market advisory services or have multiple sources of income.

Best Practices to Avoid Defective Returns

The best solution is prevention. Avoiding mistakes in the first place helps ensure you won’t receive a notice under Section 139(9).

Filing ITR Carefully and Accurately

Always:

- Use the correct ITR form.

- Fill all mandatory fields.

- Report all income sources: salary, interest, dividends, capital gains, etc.

Cross-Checking Form 26AS, AIS, and TIS

Before filing your return:

- Match income and tax details with Form 26AS.

- Check Annual Information Statement (AIS) and Taxpayer Information Summary (TIS).

- Reconcile any mismatches with actual income.

Consulting Tax Professionals for Complex Cases

If your case involves:

- Capital gains

- Foreign income

- Business income under presumptive taxation

- Loss carry-forwards

It’s best to consult a Chartered Accountant (CA) or use share market advisory services that offer tax assistance.

Using such services can make the process hassle-free and keep you aligned with income tax concepts.

Conclusion

Understanding what is income tax and how it operates helps in staying compliant. A notice under Section 139(9) should not scare you. It simply means there was a mistake, and the department is giving you a chance to correct it.

Whether you are a salaried individual, a freelancer, or an investor using share market advisory services, knowing how to respond to notice under section 139(9) is essential in today’s digital tax environment.

FAQs

What happens if I don’t rectify my defective return?

If you fail to rectify your return within the given timeline, it will be treated as invalid, which means you will be considered as not having filed your return at all. This can attract penalties and interest.

Can I file a fresh return instead of responding to 139(9) notice?

No, a fresh return cannot be filed in place of responding to the 139(9) notice. You must file a corrected return by selecting the option ‘In response to notice under section 139(9)’.

What is the time limit for rectifying defective returns?

You must rectify the return within 15 days from the date of receiving the notice. If you’re unable to do so, you may request an extension, but it’s at the discretion of the Assessing Officer.

Can I respond to a 139(9) notice offline?

No, the process is completely online via the Income Tax e-filing portal. You must log in and submit your response through the appropriate section.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora