India’s largest carmaker Maruti Suzuki is gearing up for a major portfolio transformation with the upcoming launch of its first electric vehicle (EV), the e-Vitara, expected in the first half of FY26.

This marks a pivotal moment for India’s leading carmaker. Can Maruti replicate the dominance it enjoys in the ICE (internal combustion engine) segment in the fast-evolving EV space? That’s the question on every investor’s and analyst’s mind.

In this article, we dive deep into Maruti share price performance, long-term business outlook, and how the EV shift could impact its share price.

Maruti Suzuki Business Overview

Maruti Suzuki is a wholly owned subsidiary of Suzuki Motor Corporation of Japan. Originally, it was established as a joint venture between the Government of India and Suzuki Motor Corporation. It is the largest passenger vehicle manufacturer in India, with a market share of 40% as of FY25.

The company operates two manufacturing plants in Gurgaon and Manesar (Haryana), with a combined annual capacity of 2 million units. Additionally, with its contract manufacturing plant, Suzuki Motor Gujarat (SMG), adds further capacity for exports and domestic demand.

Maruti Suzuki has divided its sales channel into four segments:

- Nexa: It provides a premium sales experience targeted at new customer segments, offering a global buying experience, innovative technology, and enhanced hospitality.

- Arena: A youthful and modern destination that offers sub-premium segment cars to customers.

- Commercial: It’s an automobile retail channel for light commercial vehicles.

- True Value: It’s a destination for the sale and purchase of pre-owned cars at fair and transparent prices.

The company has a distribution network of over 4,440 sales outlets, with over 4,964 service touchpoints.

Maruti Suzuki Management Team

Mr. R. C. Bhargava is the Chairman of Maruti Suzuki and is responsible for stakeholder relationships, corporate social responsibility, and risk management. He has been with the company since its inception. Mr. Bhargava began his career as an IAS officer, and his first appointment was as Joint Secretary in the Government of India’s Ministry of Energy.

Mr. Hisashi Takeuchi is the Managing Director & CEO and has joined the parent company, Suzuki Motor Corporation (SMC) in 1986. He has graduated from the Faculty of Economics, Yokohama National University.

Mr. Kenichi Ayukawa has been the Director of Maruti Suzuki since July 2008 and also served as a member of the Board. A law graduate from Osaka University, Japan, Mr Ayukawa joined Suzuki Motor Corporation in 1980.

Mr. Sunil Kakkar is the Director (Corporate Planning) and is a seasoned professional with over 35 years of experience at the company. He spearheaded many ambitious goals, helping to make the organization more agile and future-ready. Mr. Kakkar is an engineering graduate from IIT Kanpur and did his MBA from the Asian Institute of Technology.

Mr. Arnab Roy is the Chief Financial Officer and has been with the company since October 2023. He is a seasoned professional with over 27 years of experience working with US, French, and British multinational corporations. His earlier assignment was with Schneider as the CFO of the Greater India Region’s Zone.

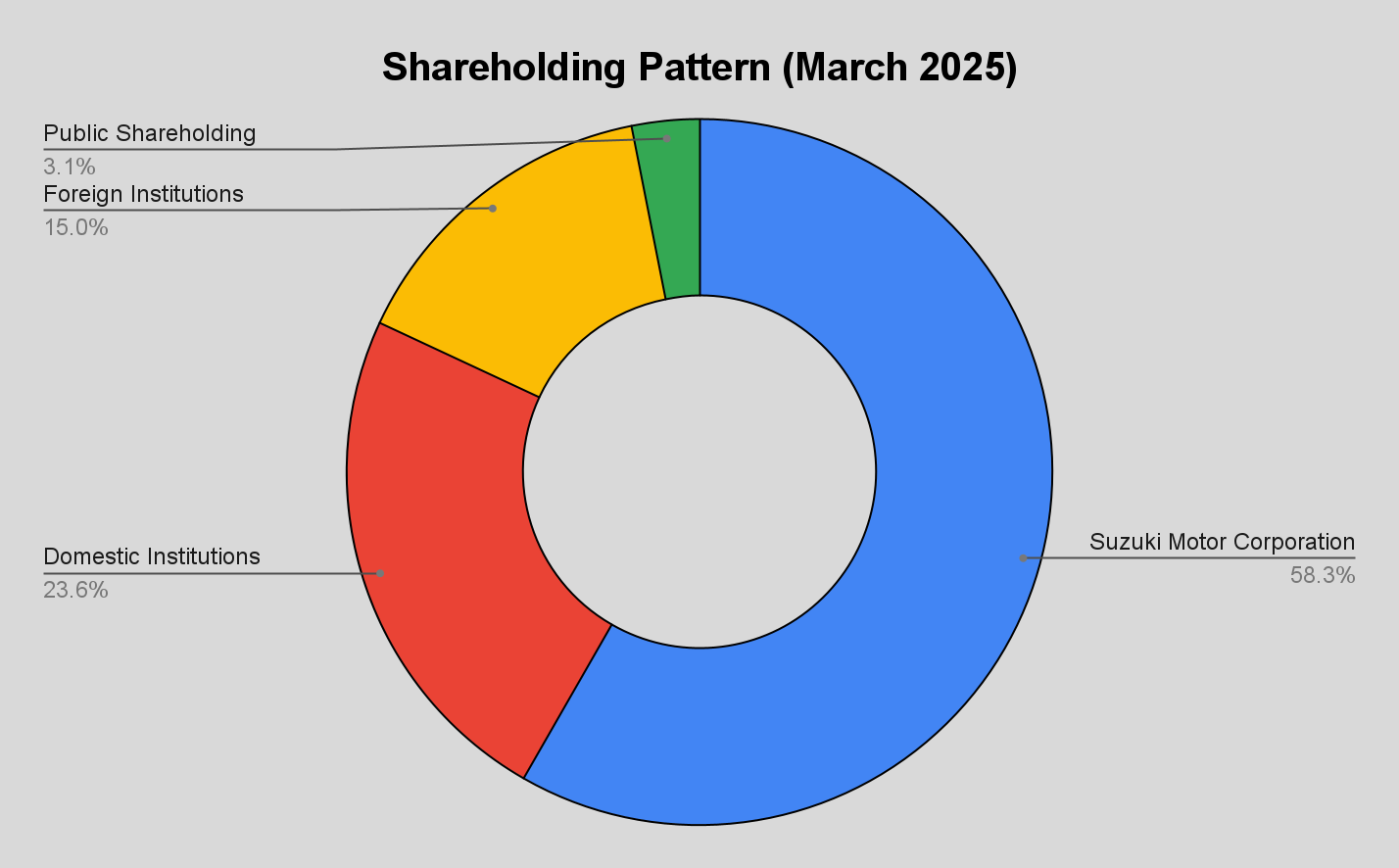

Maruti Suzuki Shareholding Pattern

As of March 2025, mutual funds hold a 15.54% stake in Maruti, and LIC holds a 4.75% stake. While the public shareholding is below 5%.

Maruti Suzuki Financials

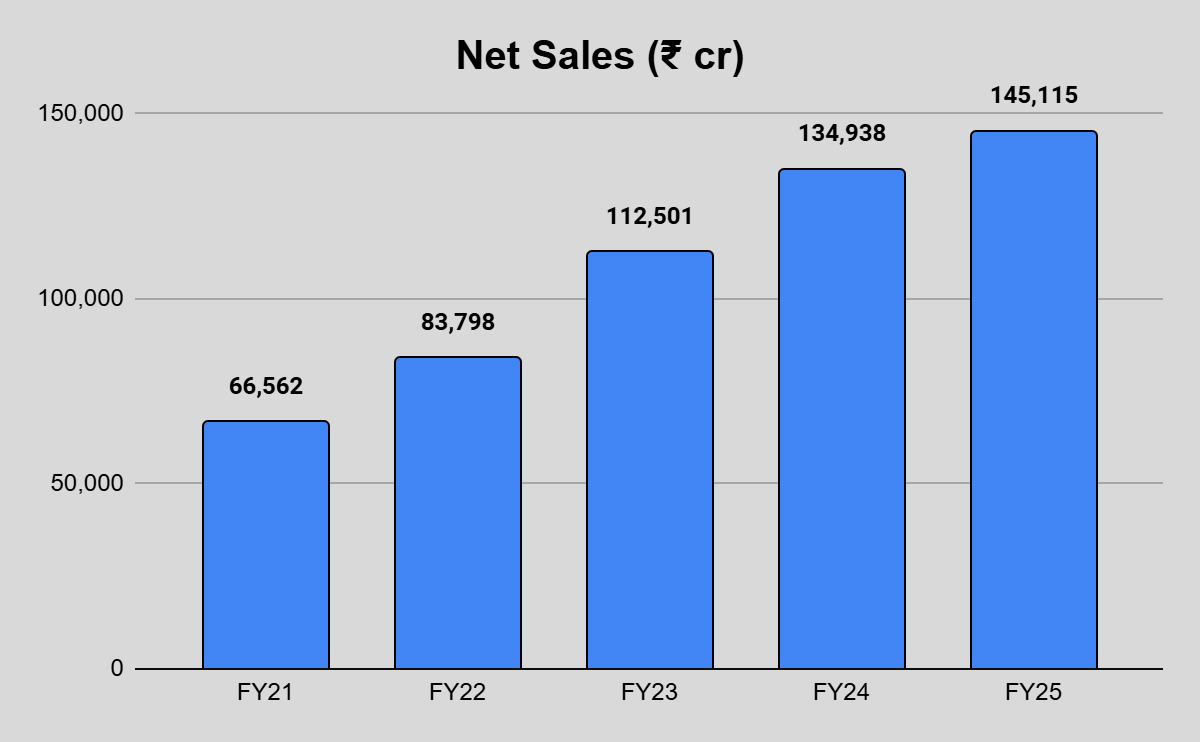

Net Sales

Over the past five years, Maruti Suzuki has shown a robust increase in operating revenue. In FY25, the net sales of the company increased by 7.5% to ₹1.45 lakh crore.

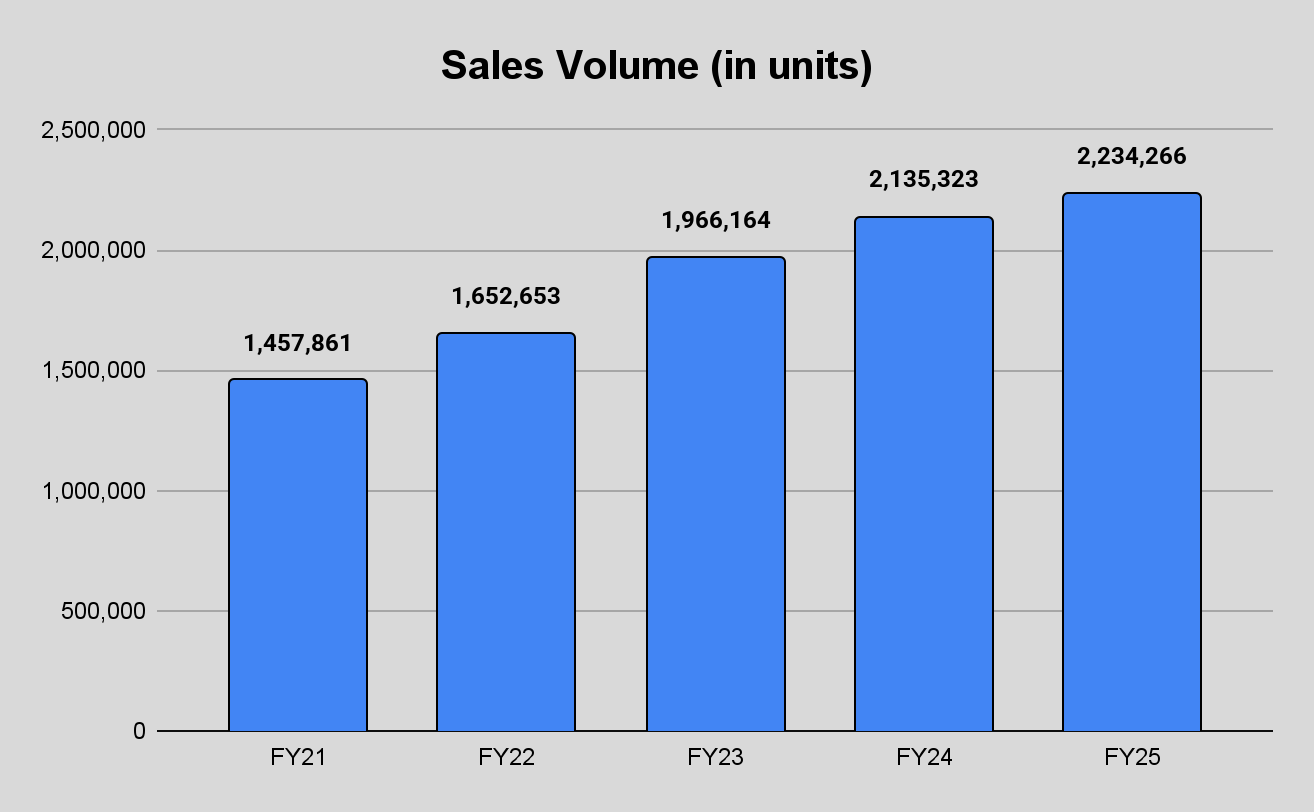

The sales growth has been driven by volume growth. In FY25, it rose by 4.6% on a year-on-year basis to 2.2 million units. Domestic sales accounted for 85% of the total sales volume, with utility vehicles dominating the sales. While 15% of the total sales volume came from exports.

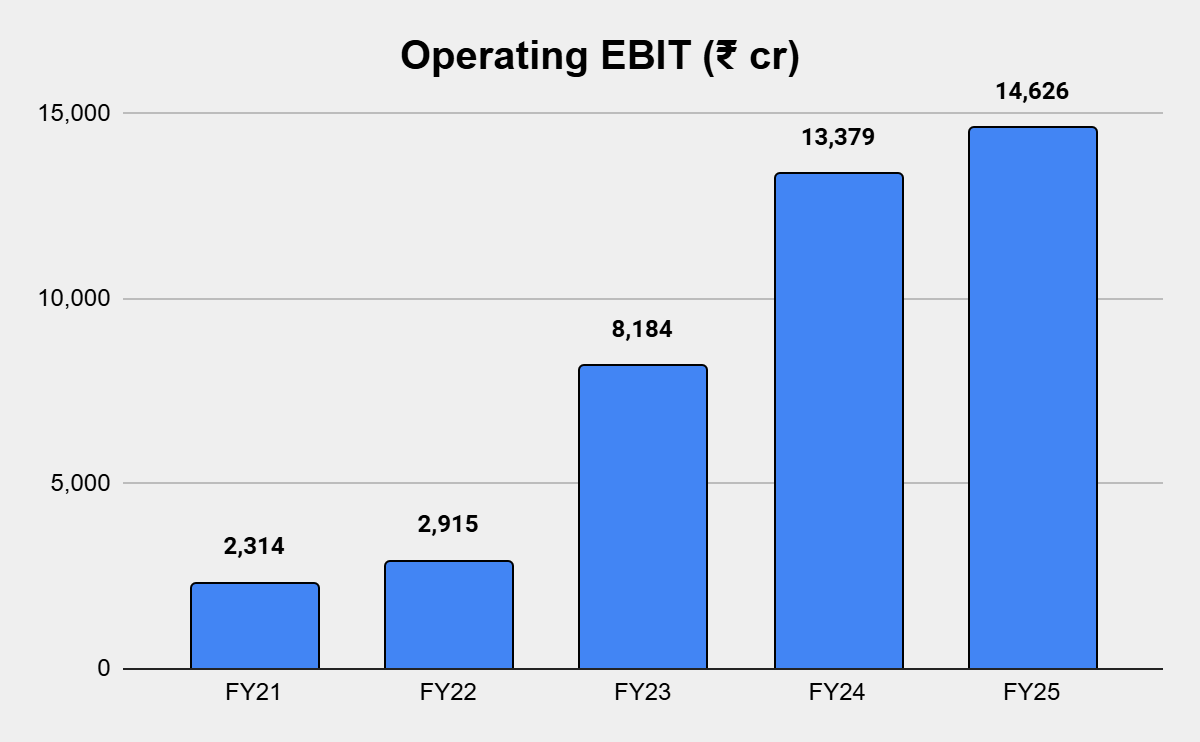

Operating Profit

In FY25, the operating profit (Operating EBIT) of Maruti increased by 9.3% on a year-on-year basis to ₹14,626 crores.

We analysed the company’s operating margin trend to see whether or not it is forgoing earnings in order to boost sales. Maruti Suzuki has continuously increased its operating profit margin over the last five years, demonstrating that the business is not forgoing earnings in favor of expansion.

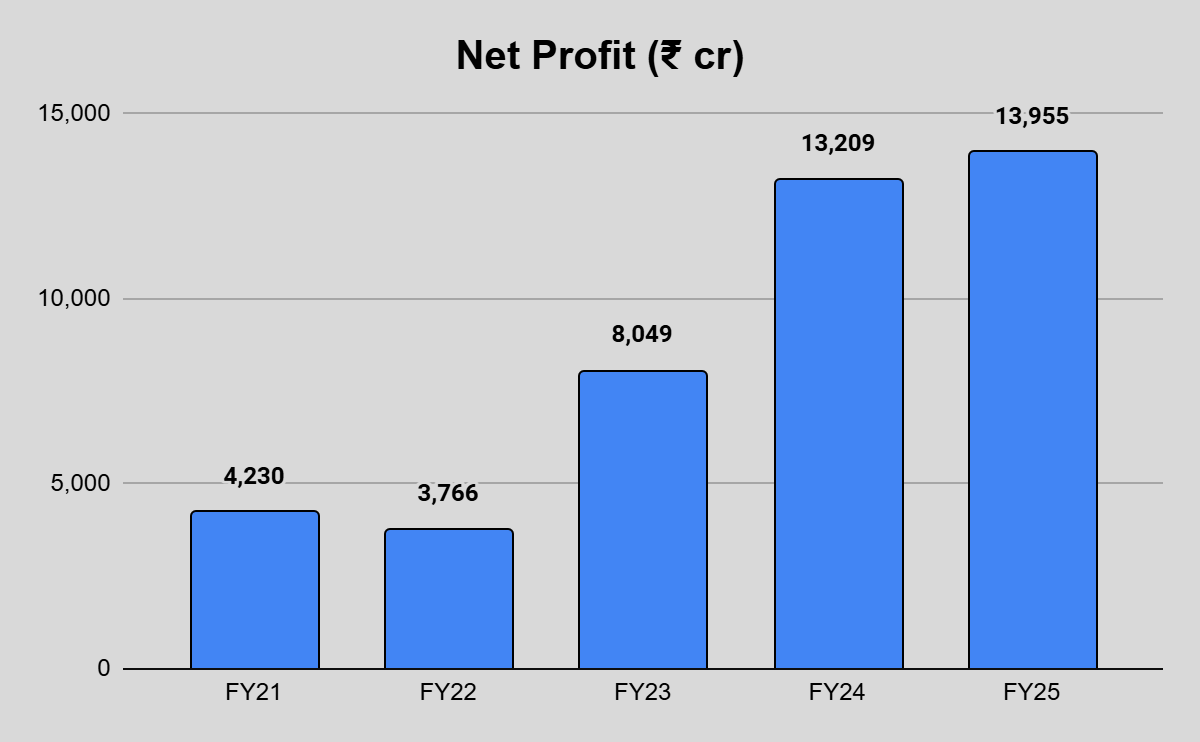

Net Profit

Barring FY22, the net profit of Maruti has been consistently rising over the years. In FY25, Maruti Suzuki’s net profit increased 5.6% to ₹13,955 crores.

Maruti Share Price Analysis

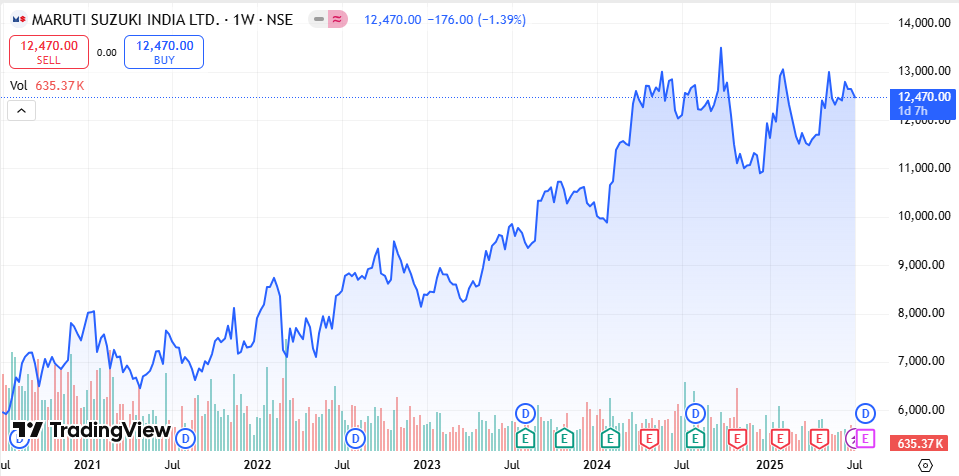

Maruti share price has more than doubled in the last five years, rising from ₹5,919 in July 2020 to currently trading at ₹12,470 (9th July 2025). Its 52-week high level is ₹13,680.

However, Maruti share price has been on a range-bound movement for the last one year, trading between the ₹11,000 and $13,500 levels.

The company has a consistent track record of paying dividends. In the last three financial years, it has paid ₹90 (FY23), ₹125 (FY24), and ₹135 (FY25) per share as dividends to shareholders. At the current market price of Maruti share price of ₹12,470, the dividend yield is 1%.

Maruti Share Price Valuation Metric Analysis

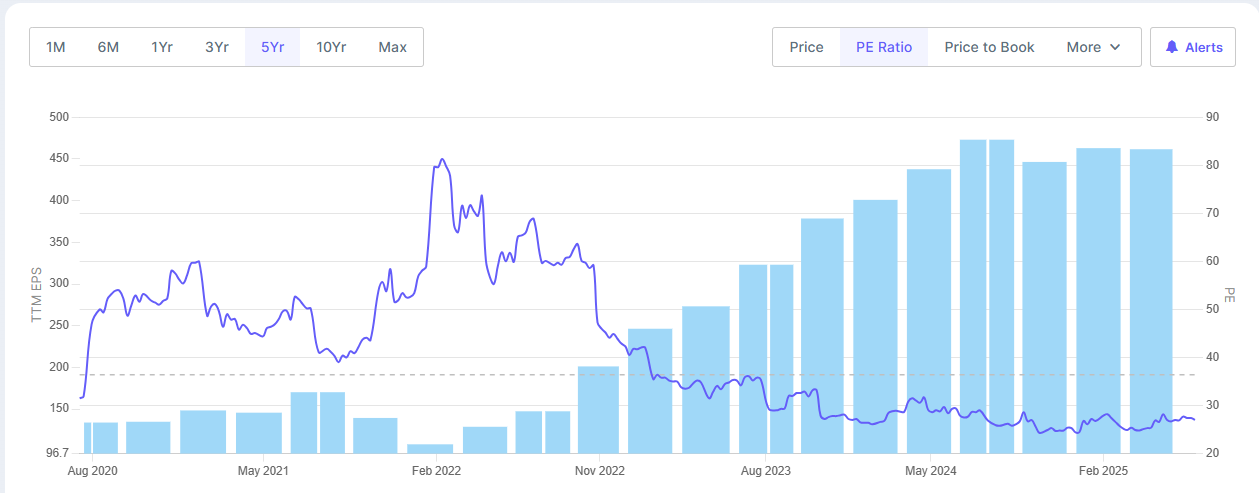

Earnings Per Share (EPS)

Over the last five years, the EPS of the company has more than tripled, rising from ₹140 in FY21 to ₹461 in FY25.

| FY21 | FY22 | FY23 | FY24 | FY25 | |

| EPS (₹) | 140 | 125 | 266 | 431 | 461 |

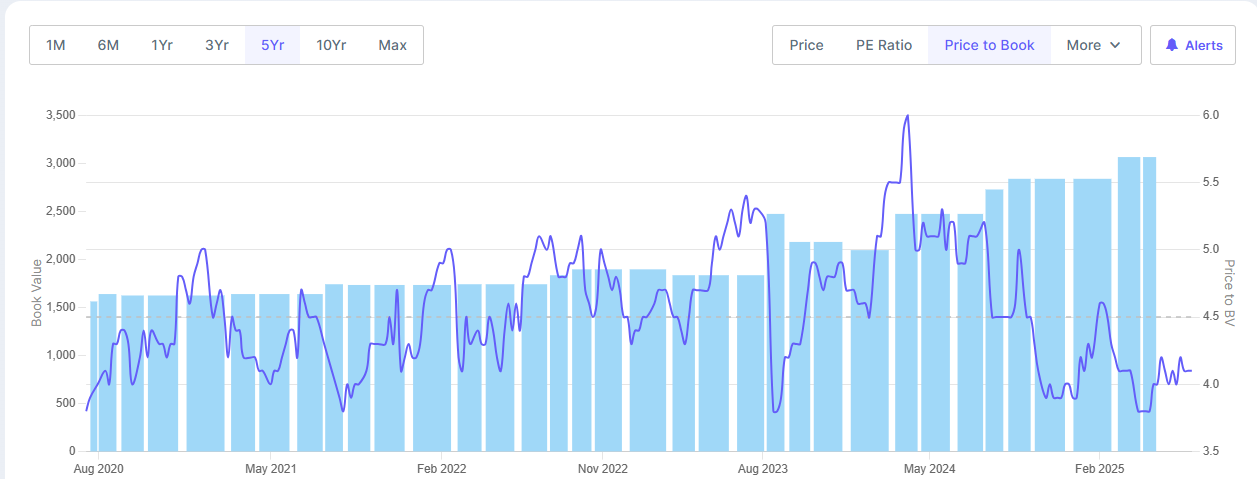

Price-to-Book Value (P/B Ratio)

As of 9th June 2025, Maruti share price is trading at a price-to-book value of 4.1 times. The 5-year median price-to-book value is 4.5 times, largely indicating the stock is trading at a discount compared to its historical valuation.

Source: Screener

Price-to-Equity Ratio (PE Ratio)

The stock is trading at a PE of 27 times, meaning, for every ₹1 of earnings, you are paying ₹27 as a premium. The median 5-Year PE is 36.4 times, which indicates the Maruti share price is trading at a discount compared to its historical valuation.

Source: Screener

Maruti Share Price: Future Growth Potential

Over the years, Maruti Suzuki has shown resilience in its business operations amid the uncertain global macro conditions and sectoral slowdown. The growth in Maruti share price has been driven by both revenue and earnings expansion.

In FY25, Maruti Suzuki became the only passenger vehicle manufacturer in India to record the highest-ever annual sales of 2.23 million vehicles, including the highest-ever export of 3.32 lakh.

Going forward, the management seems confident in continuing the growth momentum. Some of the major highlights of the Q4 conference call:

- The automobile sector is expected to grow at a modest 1 to 2% for FY26. Maruti Suzuki is expected to perform better, supported by new SUV launches

- Aiming to grow exports by at least 20% in FY26

- Plan to launch two new passenger vehicles- the e-VITARA and a new SUV

- e-Vitara is expected to start sales in the first half of FY26, with projected sales of 70,000 units for the year, largely coming from exports

- The company aims to reach 28 models by the end of 2030

- Capex is expected between ₹8000 to ₹9000 crores

- New plant at Kharkhoda (250,000 capacity) expected to bring economies of scale

Few risks highlighted by the management:

- Stagnant domestic demand in the entry segments. The hatchback segment’s share continued to shrink to 23.5% in FY25 from 46% in FY19.

- Commodity price and steel pricing volatility

- Global trade barriers and supply chain stability

- Lower profitability of electric vehicles, which implies potential headwind to overall company profitability as EV penetration increases

Overall, the company is well placed to capture the growth momentum. Closely following the earnings report, monthly sales data, and company updates can provide a clear clue on the long-term performance of the Maruti share price.

FAQ

How has Maruti share price performed in the last five years?

Maruti share price has doubled in the last five years, rising from ₹5,919 in July 2020 to currently trading at ₹12,470.

Who is the owner of Maruti Suzuki?

Suzuki Motor Corporation of Japan holds 58.3% stake and is the promoter of the company.

Does Maruti Suzuki have EV cars?

Maruti Suzuki is expected to launch its first electric vehicle e-Vitara in the first half of FY26.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 1 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora