Have you ever picked up a prescription or relied on a probiotic supplement without giving much thought to the science behind it? Chances are, Anthem Biosciences has played a key role in bringing those products to life.

Established in 2006, Anthem Biosciences is positioned as a technology-driven CRDMO with fully integrated operations spanning drug discovery, development, and manufacturing.

As a key player in the global pharmaceutical outsourcing space, Anthem Biosciences is now making headlines with its ₹3,395 crore initial public offering (IPO).

But what does this IPO really signal for investors? Is it a gateway to tap into the booming Contract Research, Development, and Manufacturing (CRDMO) market, or simply an exit strategy for existing stakeholders?

Let’s find out.

Anthem Biosciences IPO Details

Anthem Biosciences, a leading player in the CRDMO space, has launched its ₹3,395 crore initial public offering (IPO) today, July 14, 2025. This IPO is entirely an offer for sale (OFS) involving 5.96 crore equity shares, meaning the company itself will not receive any direct proceeds from this issue.

| Offer Price | ₹540 to ₹570 per share |

| Face Value | ₹2 per share |

| Opening Date | 14 July 2025 |

| Closing Date | 16 July 2025 |

| Total Issue Size (in Shares) | 5,95,61,404 |

| Total Issue Size (in ₹) | ₹3,395 Cr. |

| Issue Type | Bookbuilding IPO |

| Lot Size | 26 Shares |

| Listing at | BSE, NSE |

The subscription window is open from July 14 to July 16, 2025. The company has fixed the price band between ₹540 and ₹570 per share. For retail investors, the minimum application size is 26 shares, requiring a minimum investment of ₹14,040. High-net-worth investors fall under two categories.

Allocation of Shares

The IPO offers allocations across different investor categories. Retail investors can participate with a minimum lot size of 26 shares. Small non-institutional investors are required to apply for at least 14 lots, totalling 364 shares. Meanwhile, big non-institutional investors must apply for a minimum of 68 lots, amounting to 1,768 shares.

Investors can bid for a minimum of 26 shares and in multiples thereof. The following table depicts the minimum and maximum investment by individual investors and HNIs in terms of shares and amount.

| Investor Category | Lots | Shares | Investment Amount |

| Retail (Min) | 1 | 26 | ₹14,820 |

| Retail (Max) | 13 | 338 | ₹1,92,660 |

| S-HNI (Min) | 14 | 364 | ₹2,07,480 |

| S-HNI (Max) | 67 | 1,742 | ₹9,92,940 |

| B-HNI (Min) | 68 | 1,768 | ₹10,07,760 |

Objectives of the IPO

Since this IPO is purely an OFS, the company will not receive any proceeds from the issue. The objectives can be summarized as:

- No fresh capital will be infused into the company.

- Entire proceeds will go to the selling shareholders after deducting offer-related expenses and taxes.

IPO GMP (Grey Market Premium)

The GMP for Anthem Biosciences IPO indicates strong demand in the unofficial market. As of July 14, 2025, the last reported GMP stands at ₹101 per share. Considering the upper price band of ₹570, the estimated listing price is projected at ₹671 per share. This reflects an expected gain of 17.7% per share based on the current GMP trend.

Source: Chittorgarh

Company Overview

Established in 2006, Anthem Biosciences is positioned as a technology-driven CRDMO with fully integrated operations spanning drug discovery, development, and manufacturing.

The company caters to a diverse customer base, including innovative biotech firms as well as large multinational pharmaceutical companies across the globe.

Core Operations Include:

- Specialized fermentation-based APIs such as probiotics, enzymes, peptides, nutritional actives, vitamin analogues, and biosimilars.

- Support across the pharmaceutical lifecycle from discovery to commercial manufacturing.

Global Presence:

- Serves over 425 customers as of September 30, 2024, expanding to over 550 customers by March 31, 2025.

- Clients span across 44 countries including the U.S., Europe, and Japan.

Project Portfolio:

- 170 discovery projects involving 284 synthesized molecules.

- 132 early-phase projects.

- 16 late-phase projects involving 10 molecules.

- 13 commercial manufacturing projects supporting 10 commercialized molecules.

The company’s integrated model, catering to both emerging biotech firms and established pharmaceutical giants, positions it as a significant player in the global CRDMO space.

Financial Performance

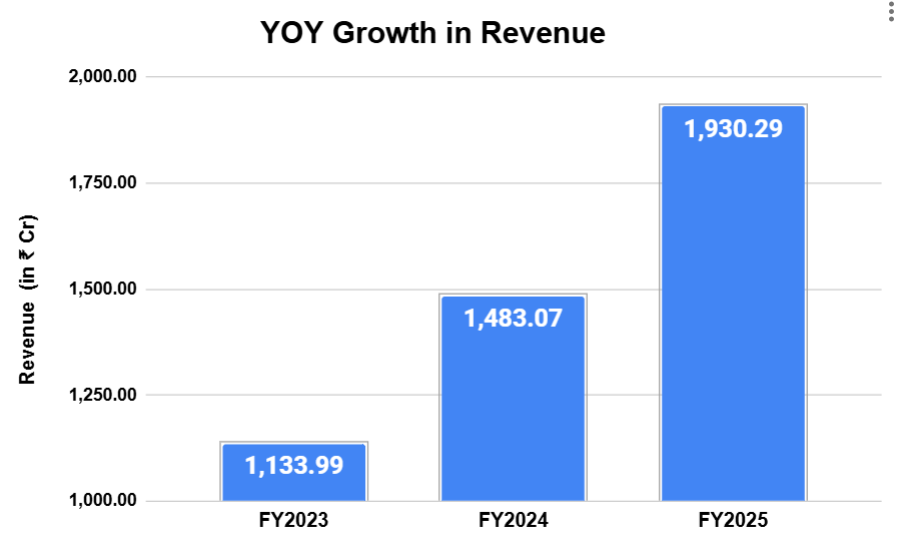

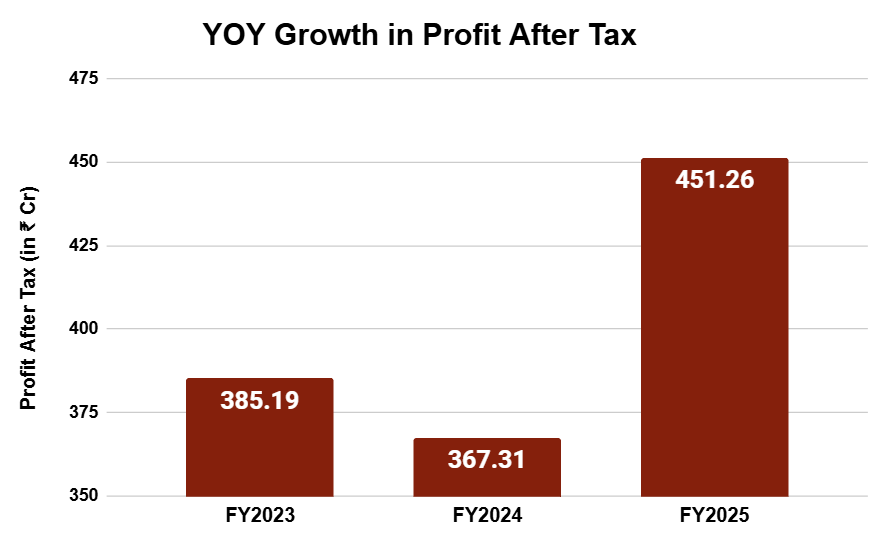

Anthem Biosciences has shown consistent growth in its financial performance:

- Revenue Growth: 30% increase from FY24 to FY25.

- Profit After Tax (PAT): 23% growth over the same period.

- EBITDA Margin (FY25): 36.8%

- Return on Net Worth (RoNW): 20.8%

- Net Worth (as of March 31, 2025): ₹2,410 crore

This robust financial profile reflects efficient operations, strong customer retention, and scalability in its service offerings.

SWOT Analysis

| STRENGTHS | WEAKNESSES |

| Integrated CRDMO business model with end-to-end services. Strong global client base spread across 44 countries. High-margin operations with 36.8% EBITDA margin in FY25. Diversified revenue streams from APIs, intermediates, and biosimilars. Sustained growth in both revenue and profitability. | The entire IPO being an offer for sale indicates no fresh capital inflow for expansion. High dependency on a few large markets like the U.S., Europe, and Japan. Capital-intensive nature of operations may restrict short-term flexibility. |

| OPPORTUNITIES | THREATS |

| Rising global demand for outsourcing drug development and manufacturing. Potential to expand customer base in emerging markets. Continuous innovation in fermentation-based APIs and biosimilars offers growth avenues. | Regulatory risks associated with global pharma markets. Intense competition from global and domestic CRDMO players. Fluctuations in raw material costs impacting margins. |

Conclusion

Anthem Biosciences IPO, with a ₹3,395 crore issue size, reflects investor interest driven by its global presence, diversified offerings, and strong financials. While the grey market premium indicates positive sentiment, investors should consider both strengths and inherent risks of the CRDMO sector before making decisions.

As the subscription window remains open until July 16, 2025, potential investors have time to analyze the opportunity further.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora