Indian share markets broke their 4-day losing streak as they opened higher on July 15, 2025 following better than expected inflation data.

Many stocks also followed the positive trend, but amidst a few that stood out was RailTel Corporation. The stock price rose by 4%, propelled by the string of new orders in July 2025.

Let’s take a detailed look at RailTel, its recent order wins and growth trajectory.

Overview of RailTel Corporation

RailTel Corporation of India, a Navratna CPSE under the Ministry of Railways, is among the country’s largest neutral telecom infrastructure providers. The company was established in 2000 with an aim to modernize Indian Railways’ telecom systems and build a pan-India optic fiber network that could generate additional revenue by serving both government and commercial clients.

As of FY25, RailTel owns over 61,000 route kilometers of optic fiber cable (OFC) and has network coverage across 6,100+ railway stations, reaching deep into both urban and rural regions with over 21,000 km of citywide access.

Its broadband arm, RailWire, is the 13th largest broadband provider in India and ranks 4th in rural subscriber count, serving a critical role in digital inclusion.

RailTel’s business spans two major verticals:

- Project Services, which now accounts for nearly 60% of revenue (Q1 FY25), includes railway signaling, smart city, ICT infrastructure, and digital connectivity projects.

- Telecom Services, comprising leased lines, tower colocation, dark fiber, data centers, and VPN services.

The company has delivered national projects like BharatNet and the National Knowledge Network, and continues to partner with entities like the Ministry of Railways, ONGC, SBI, SECL, and even global players like Google and Amazon.

With increasing demand for ICT infrastructure and consistent support from Indian Railways, RailTel’s growing project pipeline and order inflows are central to its expansion strategy.

Orderbook of RailTel Corporation

- July 2025 Orderbook Updates:

| Client | Order Value (₹ Crore) | Project Scope | Execution Timeline | Announcement Date |

| East Central Railway | 264.07 | Kavach (TCAS) implementation on 607 RKm | By July 14, 2027 | July 14, 2025 |

| GAD, Chhattisgarh | 17.47 | Integrated communication infrastructure (WLAN, LAN, EPABX, O&M) | By January 14, 2031 | July 9, 2025 |

| Indian Overseas Bank | 10.27 | Point-to-Point (P-to-P) services | By August 7, 2025 | July 12, 2025 |

| Central Warehousing Corp. | 96.99 (LOI) | Work order (details not specified) | By July 2030 | July 8, 2025 |

| Cuttack Development Authority | 15.84 | Work order (details not specified) | Not specified | July 1, 2025 |

July 2025 stood out for RailTel’s volume, project spread, and long-term revenue potential.

The recent ₹264.07 crore Kavach contract from East Central Railway marked a substantial addition, both in terms of project value and technological relevance, covering over 600 RKm with implementation scheduled through mid-2027.

Alongside this, the ₹96.99 crore (LOI) from the Central Warehousing Corporation and the ₹17.47 crore contract from the Chhattisgarh General Administration Department (with O&M stretching to 2031) reinforced RailTel’s growing presence in infrastructure-heavy, long-tenure projects.

The remaining orders from Indian Overseas Bank and the Cuttack Development Authority, though smaller in ticket size, add to RailTel’s revenue pipeline for FY25 and reinforce its presence in institutional ICT.

What distinguishes July’s wins is not only the size (₹404+ crore cumulatively, including LOI-based values) but also the balance between time-bound execution and multi-year contracts. This mix is likely to strengthen revenue stability and cash flow visibility.

(Source: Company Website)

- FY25 Order Book Activity

Beyond July 2025, RailTel’s order inflow has remained consistent across Q1 FY26:

- Over ₹3,100 crore worth of orders were secured between April and June 2025 from sectors including education, traffic management, and police surveillance.

- Orders such as ₹274.40 crore from Maharashtra MVD (traffic management) and ₹243.11 crore from Bihar’s education department are indicative of growing state-level digital infrastructure demand.

- As of May 2025, 70.28% of RailTel’s ₹6,616 crore order book came from non-railway projects, highlighting diversification.

- Competitive tenders accounted for ~61–62% of the total orders, with the rest from nominations.

This trend of consistent order inflow, particularly from long-tenure and high-complexity projects, supports RailTel’s FY25 growth target of 25–30% and signals continued expansion in its role as a digital solutions partner for government and PSU clients.

(Source: Company Website)

How Did The New Order Win Affect The Share Price?

On July 15, 2025, RailTel’s share price moved up by nearly 4% intraday, reaching ₹425.50 following the announcement of a ₹264.07 crore order from East Central Railway for the Kavach system.

(Source: Money Control)

Other Factors Supporting the Price Rise

The stock movements seen during July 2025, including the 3.85% rise following the East Central Railway order, occurred alongside a set of broader company-specific and sectoral developments:

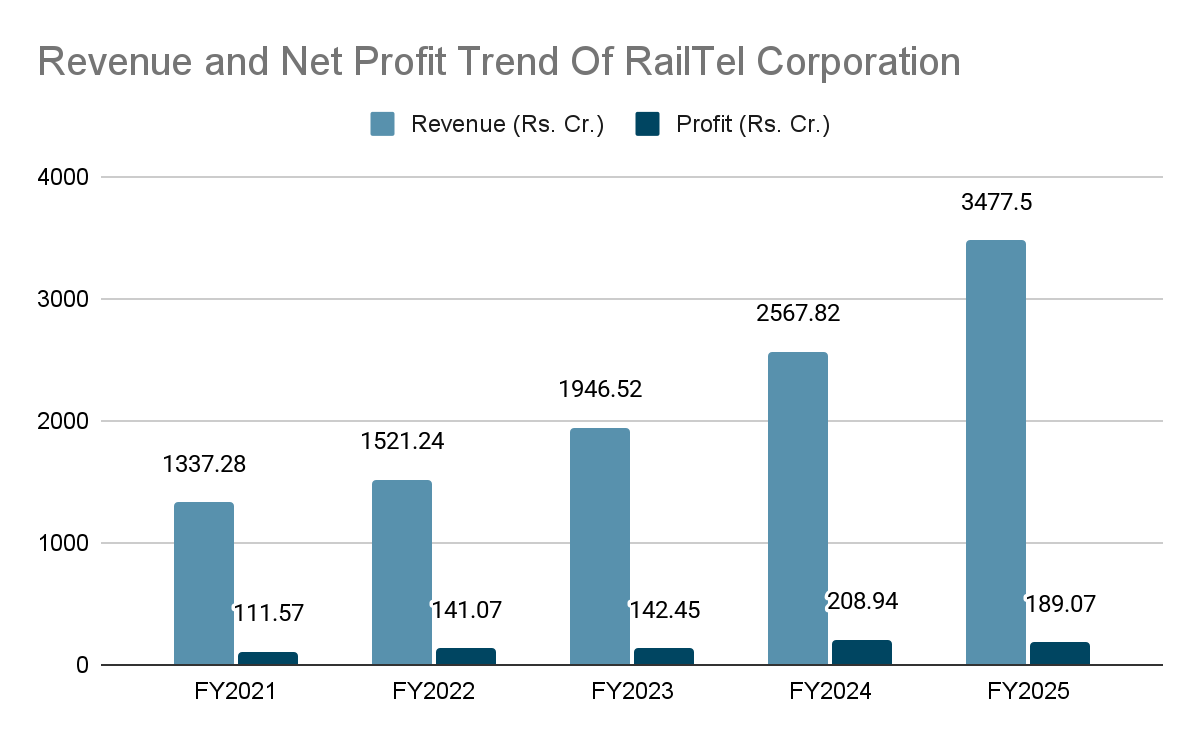

A. Q4 FY25 Financial Results

RailTel’s financial performance for Q4 FY25, announced on May 1, 2025, reported:

- Revenue: ₹1,308.28 crore, up 57% YoY

- Net Profit: ₹113.4 crore, up 46.3% YoY

(Source: Financial Statements)

These figures led to a 7% increase in the share price on May 2, 2025.

(Source: Money Control)

B. Government and Sectoral Context

- Navratna PSU Designation: RailTel received Navratna status in 2024. The classification allows for operational autonomy in select areas and reflects its strategic relevance in telecom and railway modernization.

- Railway Budget 2025: The Union Budget 2025 outlined expanded capital outlay for the railways, including funding for safety enhancements, electrification, and infrastructure upgrades, areas where RailTel has an established presence.

- Rail Infrastructure Projects: Programs such as Vande Bharat, bullet trains, and station redevelopment contribute to an ongoing pipeline for digital and signaling systems.

- Domestic Sourcing Initiatives: Policies under “Make in India” and “Atmanirbhar Bharat” promote reliance on domestic technology providers, increasing contract opportunities for Indian PSUs like RailTel.

C. Telecom Sector Trends (FY25)

- Adjusted Gross Revenue (AGR) for the telecom sector grew 12.02% YoY to ₹3,03,025 crore.

- Gross Revenue (GR) stood at ₹3,72,097 crore, up 10.72% YoY.

- Broadband Subscribers reached 944.12 million, and wireline subscribers rose by 9.62% to 37.04 million.

These developments align with RailTel’s service portfolio in broadband, managed services, and fiber infrastructure.

Conclusion

RailTel’s diversified order book, and ongoing policy momentum in the railway and digital infrastructure sectors provides it good visibility.

While these developments offer a view into the company’s operational and market position, any interpretation of stock movements or forward outlook should be supported by careful research and a deeper analysis of evolving order flows, execution timelines, and financial performance trends.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora