The Indian IT sector has seen a mixed performance in recent quarters.

Global economic uncertainty has led many clients to cut back on non-essential tech spending.

At the same time, digital transformation remains a top priority.

Although deal activity has slowed, leading IT firms continue to see steady demand in areas like cloud computing, artificial intelligence (AI), and infrastructure services.

With early signs of a global IT recovery on the horizon, investor interest is shifting back to top-tier tech stocks. And among them, HCL Technologies is drawing attention.

As one of India’s top four IT exporters, HCL Tech has a strong presence in engineering, digital, and enterprise IT services. It also enjoys a stable global client base and continues to sharpen its focus on high-margin business areas.

The company recently posted its Q1 earnings. Let’s take a detailed look at the numbers and understand how the IT major is placed for the coming quarters.

About HCL Technologies

HCL Technologies has undergone a significant transformation over the last few years. The company has shifted its strategy from offering traditional services to focusing on digital solutions by leveraging technologies like cloud analytics, the Internet of Things (IoT) and cybersecurity to support enterprises in transforming themselves digitally.

The company’s key business segments include IT & Business Services (cloud transformation, apps and data modernisation, digital operations), Engineering R&D services (product engineering) and Products and Platforms.

HCL Tech Q1 Results

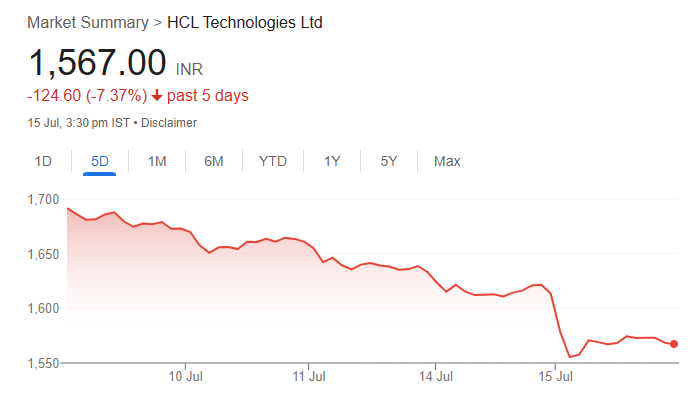

On 14 July 2025 post market hours, HCL Tech posted its Q1 results for the financial year FY26. On the next day, the stock opened over 3% lower as investors reacted to its earnings.

HCL Tech Shares Fall Post Q1 Results

During the quarter, the company posted a marginal growth in its revenue on a sequential basis.

The company’s operating margins declined due to lower utilisation, a higher share of revenue from the services segment, and the impact of a client bankruptcy.

HCL Tech Financial Snapshot

| Particulars (Rs. Cr.) | Q1FY25 | Q4FY25 | Q1FY26 | YoY | QoQ |

| Net Sales | 28,057 | 30,246 | 30,349 | 8.2% | 0.3% |

| EBIT | 4,795 | 5,442 | 4,942 | 3.1% | -9.2% |

| as % of net sales | 17.1% | 18.0% | 16.3% | ||

| PAT after E.O. | 4,259 | 4,309 | 3,844 | -9.7% | -10.8% |

| as % of net sales | 15.2% | 14.2% | 12.7% |

Source: Ace Equity

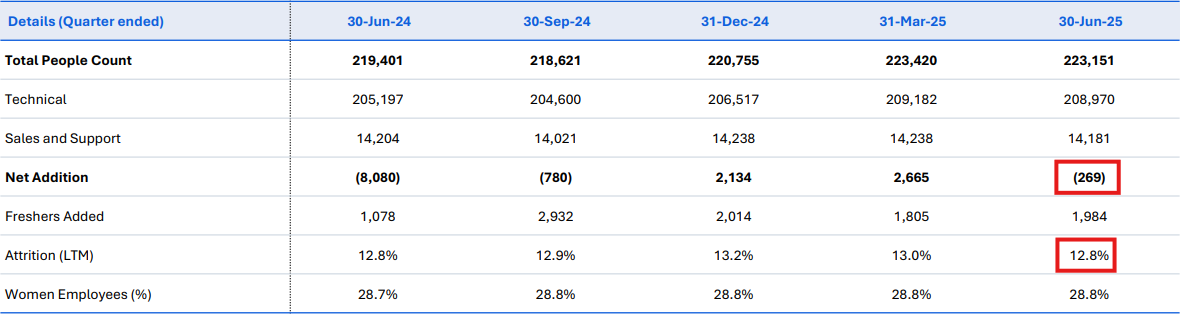

During the quarter, net employee additions declined, and the attrition rate also improved.

HCL Technologies Employee Metrics

Source: Investor Presentation

Along with results, the company’s board also declared an interim dividend of Rs 12 per share. HCL Tech has constantly rewarded investors with dividends and is a dividend aristocrat.

HCL Tech’s Rich Dividend History

| Year Ending | Dividend Per Share (Rs) |

| FY21 | 10 |

| FY22 | 10 |

| FY23 | 42 |

| FY24 | 48 |

| FY25 | 52 |

Source: BSE, Company Reports

What Next?

HCL Tech has raised its revenue growth guidance from 2%–5% to 3%–5%, indicating confidence in strong deal wins over the coming quarters.

However, the company has lowered its operating margin guidance from 18%–19% to 17%–18%. This revision comes amid global macroeconomic uncertainty, where clients are exercising tighter control over budgets, reducing discretionary spending, and focusing more on cost optimisation.

The company also acknowledged that there could be some short-term pressure, but it believes the long-term demand environment remains stable.

Conclusion

HCL Tech has set a steady plan for FY26, backed by strong deal wins and growing demand for AI, cloud, and engineering services.

It’s also eyeing the semiconductor space, expanding into chip design and embedded software.

Partnerships with firms like Western Union and Carrix, along with GenAI-led contracts, are boosting long-term growth visibility.

Operationally, HCL continues to deliver solid cash flows, stable dividends, and better capital returns—helping build investor confidence.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora