In a world increasingly powered by tech, sometimes the smartest bet isn’t on the final product — but on the builders behind it.

India’s electronics manufacturing space is riding a powerful wave:

- Global outsourcing is on the rise

- The government is offering strong incentives through the PLI scheme

- And homegrown players are rapidly scaling up their capabilities

Right at the heart of this transformation is Dixon Technologies.

A true wealth creator for early investors, Dixon’s share price surged again today, following its latest earnings announcement — reaffirming market confidence.

Dixon Share Price Since Listing

So what’s driving this recent rally?

Let’s break down what worked for Dixon in Q1, what didn’t, and what lies ahead for this electronics giant.

Dixon Technologies Q1 Result Analysis

Following the announcement of its Q1FY26 results, Dixon Technologies’ stock rose nearly 3% this morning.

The rally was largely driven by exceptional growth in the company’s mobile manufacturing business, even as some other segments showed signs of weakness.

Dixon Technologies is India’s largest electronics manufacturer, producing products for several global brands.

The company designs and manufactures:

- Consumer electronics

- Lighting products

- Home appliances

- Mobile phones

- Security cameras

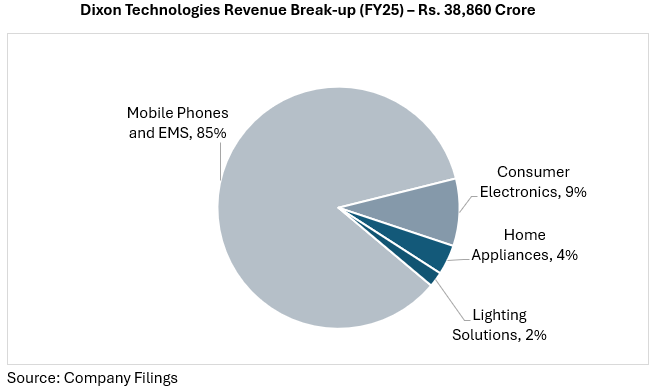

It operates across multiple manufacturing verticals, with mobile phones now emerging as the company’s largest revenue driver.

Q1FY26 Performance Overview

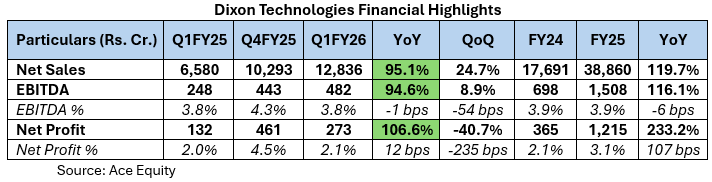

Dixon delivered a strong performance in Q1:

- Revenue: Up 95% YoY

- Operating Profit: Up 95% YoY

- Net Profit: Up 107% YoY

The company’s Mobile & EMS division led the performance, with revenue growing 125% YoY. This segment now contributes 91% to total revenue, up from 79% in Q1 last year — clearly establishing itself as Dixon’s primary growth engine.

However, revenue from the Consumer Electronics and Lighting Products segments declined, indicating some pressure in those areas.

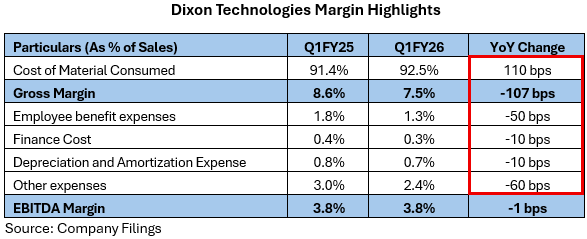

Positively, despite an increase in raw material costs (as a % of sales), the company maintained stable operating margins — driven by strict control over employee and operational costs.

Dixon Tech Outlook After Q1 Results

Dixon’s Q1 performance signals that its Electronics Manufacturing Services (EMS) business is now entering a scalable and predictable growth phase.

The company plans to manufacture 40–42 million phones in FY26, with a target of 60–65 million by FY27. This growth will be supported by strong export orders from key clients like Motorola, which is expected to offset delays in the Vivo JV (now pushed to FY27).

While the end of the mobile PLI scheme in FY26 may pressure margins, Dixon’s backward integration strategy — manufacturing more components in-house — is expected to improve profitability.

Additionally, the Q-tech acquisition and joint venture with Inventec will strengthen integration efforts, expand the product portfolio, and boost margins.

Dixon has firmly positioned itself as a key player in the ‘Make in India’ theme. If the company executes its deeper manufacturing strategy successfully, the long-term growth story remains intact.

Strong Long Term Prospects

The electronics industry is one of the fastest-growing sectors in India, drawing strong investor interest. Over the past two decades, it has attracted over US$ 4.4 billion in foreign direct investment (FDI) — a clear reflection of its rising global relevance.

Looking ahead, India’s ambition of becoming a US$ 5 trillion economy by FY27 will rely heavily on the growth of electronics manufacturing. The government has set a bold goal — to export 40% of total electronics production to global markets.

Dixon is well placed to ride the tailwinds as it has undertaken significant capex in recent years to expand capacities across various verticals and enter new product categories.

Conclusion

Dixon has set its sights high — aiming to break into the list of the world’s top 10 EMS (Electronics Manufacturing Services) companies over the next five years.

Over time, it has steadily expanded its presence across all key segments of electronics manufacturing, earning the trust of several top-tier global clients.

Now, the company is moving up the value chain — entering high-margin verticals like precision components, mechanical parts, camera modules, and battery packs. These segments not only offer better profitability with double-digit margins, but also lay the foundation for Dixon’s next phase of growth.

That said, expectations are already sky-high — and so is the valuation. At current levels, the stock commands a premium multiple, reflecting the market’s confidence in its future.

But in the world of growth stocks, expectations are everything. If Dixon stumbles or fails to deliver on projected growth, the stock could face sharp corrections — the market rarely spares high-flyers that miss the mark.

Still, if the company executes well — especially on backward integration, export growth, and deeper manufacturing — Dixon could continue to be one of India’s most compelling Make-in-India success stories.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora