Once known as a cash-first economy, India has undergone a dramatic shift in how it transacts.

From corporate giants to local tea stalls, everyone has a QR code now. And with just a few taps, payments happen instantly, cashlessly.

India’s digital payments story isn’t just growing, it’s exploding. In FY24 alone, we saw 159 billion digital transactions. And by FY29, that number is expected to triple.

What’s powering this boom?

– Affordable smartphones

– Seamless payment experiences

– Government-backed initiatives like UPI and the PLI scheme

And at the centre of it all is Paytm — a name that’s become synonymous with digital payments in India.

Scroll through any payment app, and chances are, you’ll see Paytm in the mix.

Today, Paytm share price was in focus after the fintech company posted its Q1 results.

Let’s take a detailed look to understand how the company performed and what lies ahead.

Paytm Reports Positive EBITDA for the First Time

Paytm’s parent company, One97 Communications, reported a positive EBITDA for the first time in Q1FY26.

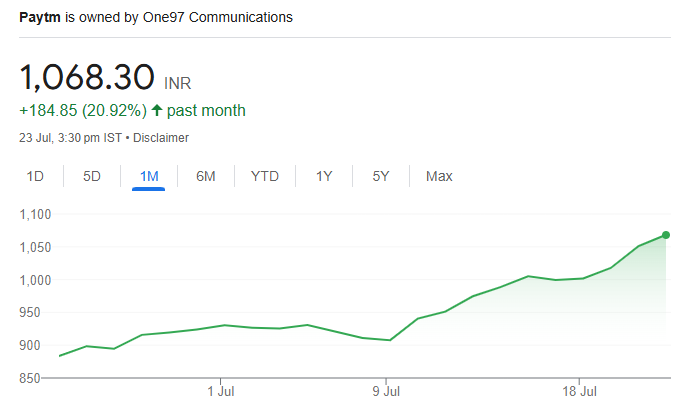

Reacting to this, the stock price surged over 2% today. In fact, the stock has surged over 20% in the past month, reflecting renewed investor confidence.

Paytm Share Price – 1 Month

Founded in 2010, Paytm is one of India’s leading digital payments and financial services companies.

What began as a simple mobile wallet has now evolved into a comprehensive fintech ecosystem.

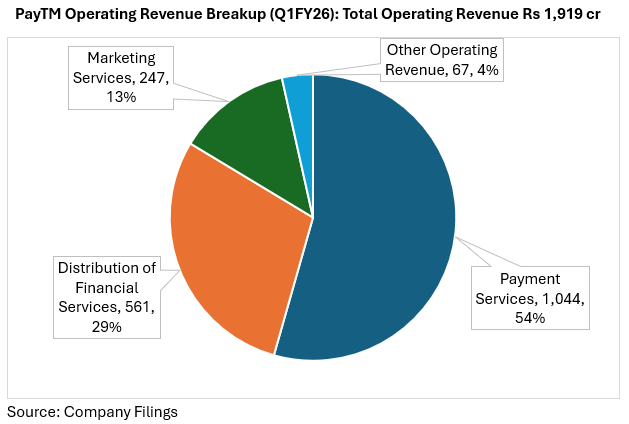

- The company earns the majority of its revenue from payment services, including peer-to-peer and merchant QR payments, UPI transactions, and its signature soundbox devices.

- Its financial services distribution arm covers credit cards, insurance, loan distribution, wealth management, and brokerage.

- Under marketing services, Paytm helps merchants with advertising, deal promotions, ticket bookings, and gift vouchers.

Q1FY26 Performance Highlights

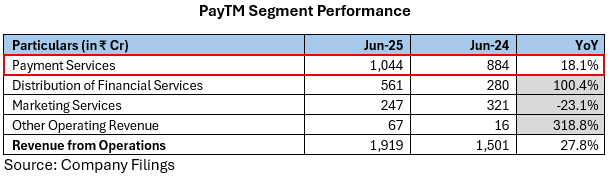

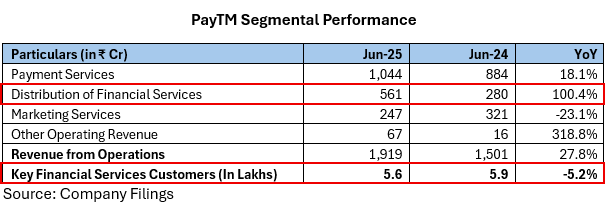

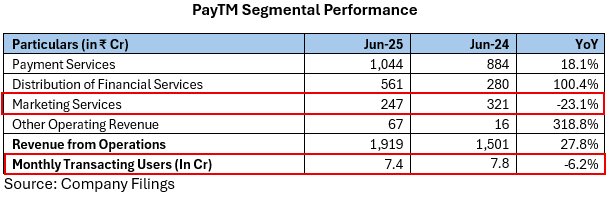

Payment services, the company’s core business, grew by 18% YoY.

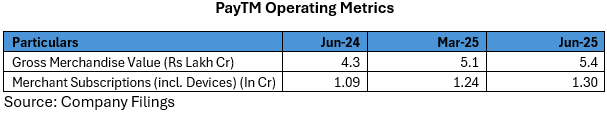

Paytm’s Gross Merchandise Value (GMV) increased 27% YoY, reaching ₹5.4 lakh crore — largely driven by the addition of new devices.

The company’s revenue from financial distribution services doubled during the quarter.

While personal loans saw a slowdown and equity broking faced regulatory adjustments, leading to a dip in customers from 5.9 lakh to 5.6 lakh, revenue still grew. This growth was led by higher disbursement of non-default loss guarantee (non-DLG) loans to merchants, indicating better asset quality. Notably, 50% of loans went to repeat borrowers — a strong signal of trust and retention.

Marketing services revenue declined, attributed to a drop in monthly transacting users.

What Worked Behind the Numbers

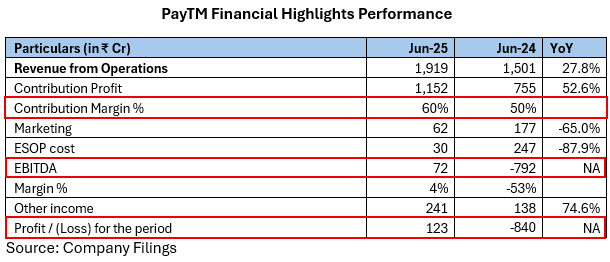

Paytm’s operating costs were tightly managed. A reduced share of DLG loans helped cut costs significantly. As a result, contribution profit jumped 52%, with contribution margin improving to 60%.

The company also controlled employee costs, ESOP expenses, and marketing spends, which helped swing from EBITDA loss to profit.

This EBITDA turnaround, along with an income tax refund (reflected in other income), helped Paytm report a net profit of ₹123 crore for the quarter.

Paytm Outlook after Q1 Results

While the contribution margin stood at 60% in Q1, management has indicated it may soften to the mid-to-high 50s in the upcoming quarters.

ESOP cost was unusually low this quarter due to CEO Vijay Shekhar Sharma voluntarily surrendering his ESOPs. However, the company expects FY26 ESOP cost to be in the ₹250–275 crore range, significantly higher than the ₹30 crore in this quarter.

The rise in non-DLG loans within financial services is a positive trend.

In the merchant segment, Paytm continues to build a strong and sticky portfolio, benefiting from its ecosystem strength and early-mover advantage — both critical for long-term growth.

Based on the current momentum and operational discipline, Paytm appears well-positioned to maintain EBITDA profitability through FY26.

Long Term Growth Prospects

India’s journey towards a cashless economy is accelerating fast and the numbers speak for themselves.

At the centre of this transformation is UPI, which is projected to handle 91% of all retail digital payments by FY29. With its unmatched convenience and speed, UPI is clearly displacing traditional methods like debit cards.

This explosive growth creates a long runway for companies driving the UPI ecosystem — from fintech players to digital platforms and agile private banks.

Their ability to innovate, scale, and stay resilient amidst regulatory and competitive pressures will determine who leads India’s digital financial future.

Conclusion

While Paytm has posted its first-ever profit this quarter, its regulatory challenges are far from over.

The company has taken significant steps to align with compliance norms, but how effectively it executes these changes remains to be seen.

There’s no denying Paytm’s long-term potential — its brand, reach, and tech ecosystem are unmatched.

But that’s also the challenge: realising that potential depends on survival and execution in the short term.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.