India’s financial sector is evolving at a breakneck pace — with legacy players scaling up and nimble new entrants adding to the competition.

In this ever-expanding universe, one name has consistently stood out: Bajaj Finance.

A pioneer in retail lending and consumer finance, Bajaj Finance has built a solid reputation for aggressive growth, innovation, and consistent value creation for shareholders.

Over the last decade, it has transformed from a traditional lender to a digital-first NBFC powerhouse — and, in the process, created immense wealth for long-term investors.

However, even the best-performing stocks aren’t immune to market reactions.

Today, Bajaj Finance shares slipped nearly 5% post Q1 results, driven by concerns around asset quality pressures in select segments and a cautious management outlook.

Bajaj Finance Slips After Q1 Results

So, is it just a short-term reaction — or a signal to reassess expectations?

Let’s decode what the results mean for Bajaj Finance and what could come next.

Bajaj Finance Q1 Result Analysis

For the quarter ended June 2025, Bajaj Finance reported decent results:

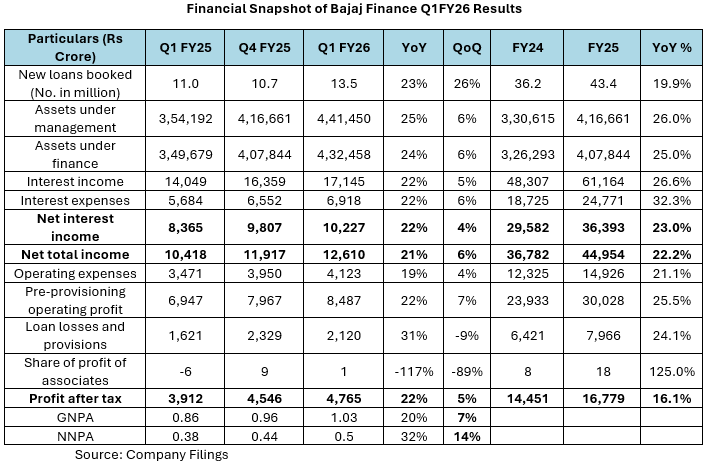

- Net Interest Income (NII) grew by 22% YoY.

- The company disbursed 13.5 million new loans during the quarter — a 23% increase compared to last year, driven by strong demand in the retail, MSME, and mortgage segments.

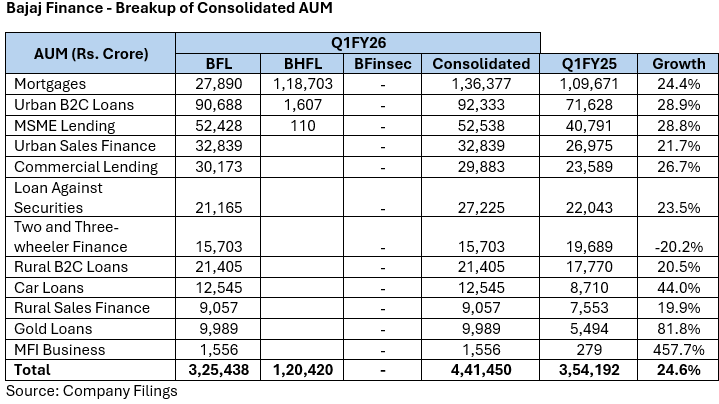

- Assets Under Management (AUM) grew by 25% YoY, supported by strong performance in mortgages, urban B2C loans, and MSME lending. However, two- and three-wheeler loans declined 20% YoY.

- For the first time, the company reported a ₹1,556 crore microfinance loan book this quarter.

While NII growth was strong, it fell short of historical performance benchmarks.

The management also flagged concerns around rising consumer leverage, and said it is actively reducing exposure to customers with multiple loans. This could impact yields in upcoming quarters.

On the asset quality front:

- Gross and Net NPAs rose slightly, mainly due to:

- Stress in unsecured and small-ticket retail loans (an industry-wide trend)

- The impact of stricter RBI regulations

- Stress in unsecured and small-ticket retail loans (an industry-wide trend)

- Loan loss provisions rose 26% YoY, reflecting the company’s cautious risk management stance.

Importantly, the company noted that in FY26, it will intentionally keep AUM growth muted in the two-wheeler, three-wheeler, and MSME segments — as credit costs in these segments remain elevated.

Bajaj Finance Outlook After Q1 Results

Bajaj Finance reported healthy growth in NII, AUM, and profit, largely driven by volume expansion across its core lending businesses.

However, the rise in NPAs and provisions suggests that the company is now operating in a more cautious mode, especially given the evolving asset quality trends in segments like unsecured retail and auto finance.

That said, the overall business outlook remains strong, supported by its digital initiatives and granular lending strategy.

Still, it will be important to closely monitor credit quality trends over the coming quarters

Bajaj Finance Succession Plan

A few days ago, the company’s CEO and MD Anup Kumar Saha resigned. Post Saha’s exit, Rajeev Jain, the former CEO of Bajaj Finance re-entered the company in an active operational role and was assigned the additional responsibility and re-designated as vice chairman and MD of the company till March 31, 2028.

While announcing results, Rajeev Jain on July 24 said the company will submit detailed succession planning process in six months to the board and nomination and remuneration committee (NRC).

In March, Rajeev Jain was appointed by Bajaj Finserv as additional director in a non-executive position and also as the vice chairman of Bajaj Finance effective April 1 2025.

Some Businesses to Grow Slow in FY26

On the surface, Bajaj Finance’s numbers for Q1 look solid. But investors were concerned when Rajeev Jain said that its 2 & 3 wheeler and MSME businesses could grow slow in FY26, as the company is going slow on these businesses amid stress.

The company’s two & three-wheeler finance AUM declined by 20% YoY. However, MSME lending of the company increased by 29% YoY.

On the asset quality, stage 2 assets increased by Rs 324 crore primarily on account of these MSME customers.

Conclusion

As India’s economy expands, rising disposable incomes and a growing middle class are set to fuel demand for credit and financial services.

This structural shift places companies with strong foundations in a favourable position — and Bajaj Finance is right at the center of this opportunity.

Backed by its diversified product portfolio, deep customer reach, and aggressive digital push, Bajaj Finance is not just adapting to change — it’s helping shape the future of financial services in India.

For long-term investors, this makes it a stock worth watching — not just for short-term market reactions, but for the broader growth story it represents.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora