The Indian hospitality industry is in full swing — and the next three years could be even bigger.

With weddings, travel, tourism, and mega-events like conferences and exhibitions on the rise, the sector is expected to clock a 10.5% CAGR — adding a whopping ₹82,000 crore in annual demand.

Naturally, hotel chains are racing to expand — adding new properties, more rooms, and sharper service offerings.

Among the front-runners? Chalet Hotels.

The company just posted blockbuster Q1 results… and the stock jumped in response.

Share price of Chalet Hotels surged over 10% to hit a fresh all-time high after it posted a multifold jump in its net profit for the first quarter of FY26.

Chalet Hotels – 5 Year Share Price

But is this just the beginning? Let’s find out.

About Chalet Hotels

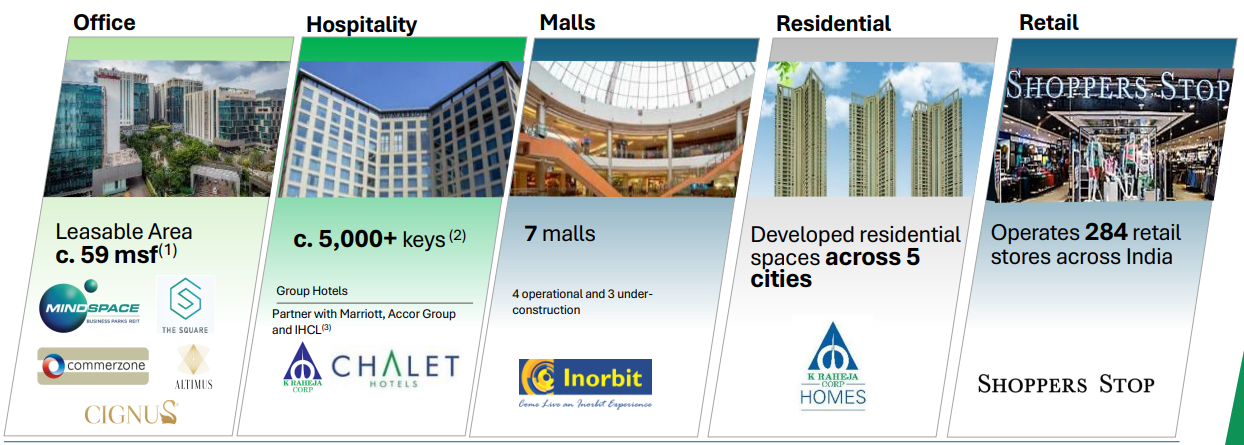

Chalet Hotels is part of the reputed K Raheja Corp Group, which has diversified business interests across real estate development (residential and commercial), hospitality and retail segments.

K Raheja Corp Group Overview

The company’s existing hotel properties include some big names like The Westin Mumbai Powai, Lakeside Chalet, Mumbai-Marriott Executive Apartments, etc.

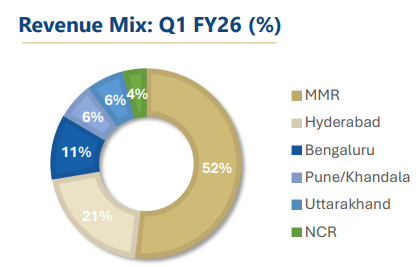

As of June 2025, the company derives 52% of its revenue from Mumbai, followed by 21% from Hyderabad and 11% from Bengaluru.

Chalet Hotels Q1 Results

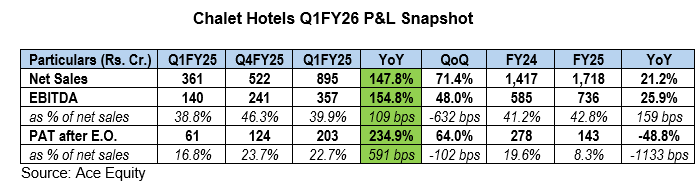

For the quarter ended June 2025, Chalet Hotels’ total income rose 148%.

This was a result of a one-time boost which the company recognised as revenue from its residential project in Bengaluru.

As a result, the company’s operating profit rose 155%, while margins improved to 39.9%.

Subsequently, Chalet Hotels posted a multifold increase in net profit.

Operating Performance

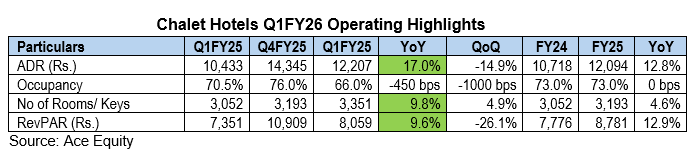

This strong growth was backed by a healthy operating performance as occupancy levels remained strong, the company added more rooms, while revenue per available room also rose.

Management Change

Along with results, Chalet Hotels also shared a management rejig. Shwetank Singh, the current executive director of Chalet Hotels, will take over as the managing director (MD) and chief executive officer (CEO) beginning February 2026.

This is in alignment with a well-crafted succession plan where the current MD and CEO Sanjay Sethi shared his intent not to seek an extension of his current term.

Outlook

The company has started FY26 on a strong note, partly aided by a low base effect for last year. Nevertheless, the management expects the momentum to continue in the rest of the year as well, with the expectation of double-digit RevPAR growth.

With tourism on the rise, Chalet is expanding its presence in cities handling most of India’s air traffic.

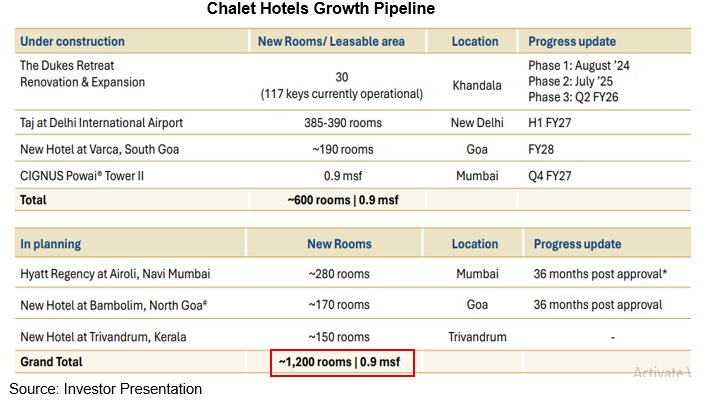

The company has a healthy growth pipeline wherein it’s planning to add new rooms in Mumbai, Goa and Kerala.

Conclusion

India’s hotel industry is gearing up for a boom — driven by rising tourism, a growing middle class, surging business travel, and massive infrastructure push by the government.

Double-digit growth is on the cards… and leading hospitality players like Chalet Hotels are in prime position to ride this wave.

But here’s the catch — this is a cyclical industry. Seasonal swings and demand uncertainty can turn the tide quickly.

So while the opportunity is big, investors need to tread with caution.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora