Angel One has built a compelling growth story in India’s broking space.

With a strong growth in new demat accounts and a solid rise in its net profit and revenue, the numbers speak for themselves. The company has also maintained return ratios of over 40% for consecutive years – an impressive feat in a highly competitive industry.

Few players in India’s broking landscape can match this blend of scale, profitability, and consistency.

By staying focused on client-centric innovation and technology-first solutions, Angel One has carved out a leading position in India’s fast-evolving financial ecosystem.

Today, shares of Angel One were in focus following the release of its quarterly earnings for June 2025.

Let’s look at the company’s profile, latest results, and examine whether the company will be able to continue its growth trajectory.

About Angel One

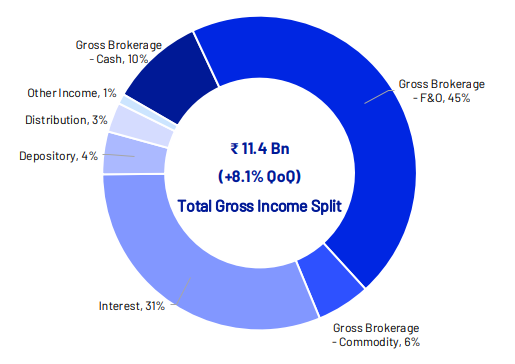

Angel One has a diversified business profile that spans across multiple segments of financial services. Currently, the brokerage business makes up for most of its revenue, followed by interest income.

Angel One Revenue Mix

To diversify its income, the company has ventured into other businesses. The company has nine businesses.

| Business Unit | Function |

| Angel Securities | Broking |

| Angel Crest | Broking |

| Angel Financial Advisors | Distribution of Insurance Products |

| Angel AMC | Asset Management Company |

| Angel One Trustee | Trustee company for AMC business |

| Angel One Wealth Management | Wealth Management Services |

| Angel Fincap | Non-Banking Financial Company (NBFC) |

| Mimansa Software Systems | Software and technology-related services |

| Angel Digitech | Business support services |

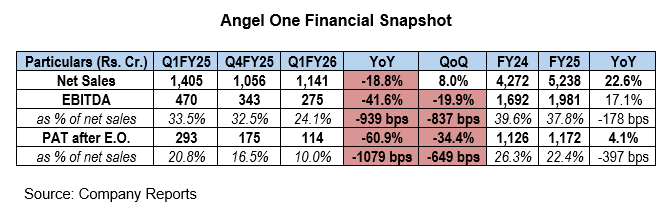

Angel One Q1 Results

In the June 2025 quarter, Angel One’s revenue declined by 19%. This drop was driven by multiple factors—new F&O regulations, weak market sentiment which impacted trading volumes, and new compliance norms that affected the company’s other income streams.

Broking revenue alone saw a sharp 23% fall.

The company’s operating performance was also under pressure. Operating costs rose by 23%, with ₹1.1 billion spent solely on IPL-related expenses.

Overall, it was a tough quarter for Angel One. However, the company’s new initiatives showed strong traction.

Its wealth management business performed well, with the client base crossing 1,000.

Credit disbursements saw a massive 123% jump, and with new lending partners like KreditBee, further growth is expected.

Even the mutual fund distribution business expanded, with AUM rising from ₹111 billion in March 2025 to ₹138 billion now.

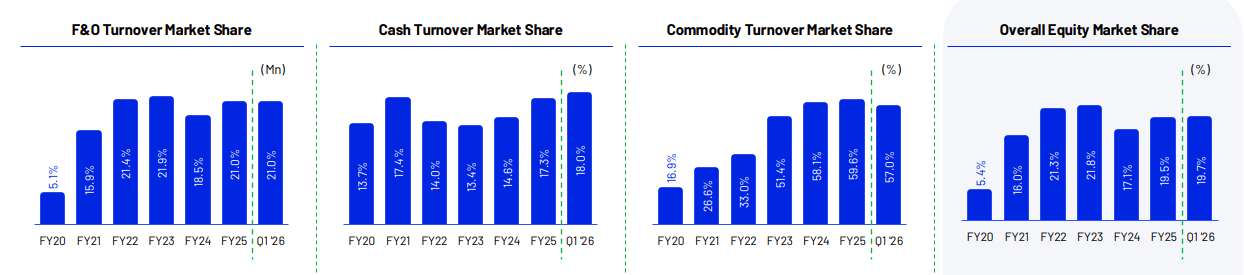

Angel One Market Share

Angel One retained healthy market share across segments with 19.7% in option premium-based equity, 21.0% in F&O, 18.0% in cash, and 57.0% in commodities.

Angel One Market Share Trends

Source: Investor Presentation

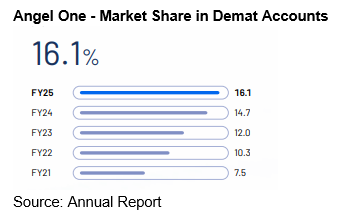

The company also has some very impressive numbers when it comes to share in India’s incremental demat accounts, average daily turnover and active client base.

Overall, as of FY25, Angel One had a 16.1% market share in demat accounts.

What Next?

Angel One’s business has grown dramatically over the last three years on the back of an increase in retail investor participation in the stock market.

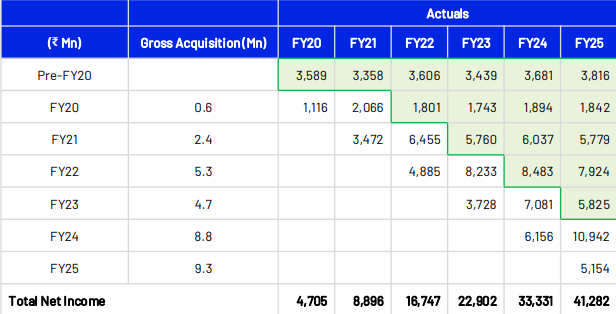

Consistent Net Revenue From Every Cohort

Source: Investor Presentation

Angel One’s blitz marketing campaigns have allowed the company to grow exponentially over the past 5 years.

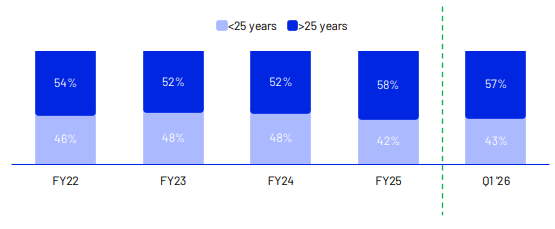

Given that Angel One’s primary target market belongs to the young demographic profile from smaller cities, with a keen interest in investing in the share markets, the company does have a long runway of growth.

Angel One Client Demography

Source: Investor Presentation

However, the strong potential of significant losses in the F&O market in the event of a market crash exposes the business of Angel One to significant risk.

Moreover, Angel One is exposed to regulatory risk as capital markets are highly regulated. The market regulator keeps changing or introducing regulations with the objective of further enhancing the transparency levels and limiting the misuse of funds.

It also faces intense competition in the brokerage industry, especially with the rise of 100% digital and zero brokerage firms, leading to competitive brokerage rates across the sector. It faces competition from Zerodha, Groww, Upstox and ICICI Securities.

Conclusion

Angel One continues to be a dominant force in India’s stockbroking space and a growing foothold in wealth management and mutual fund distribution.

Despite a challenging quarter marked by revenue pressure and rising costs, the company’s underlying growth engines remain intact and are gaining traction.

However, headwinds like rising competition, regulatory uncertainty, and reliance on F&O volumes are key risks to watch.

Going forward, Angel One’s ability to balance growth with compliance, innovation with cost control, and scale with customer trust will determine how strongly it navigates this evolving landscape.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora