The Bombay Stock Exchange (BSE) is celebrating a major milestone in 2025, marking 150 years since its founding. Established in 1875, the BSE is not only Asia’s oldest stock exchange but also ranks as the tenth oldest in the world.

What began as informal meetings under a banyan tree has grown into a modern, tech-driven financial institution.

This journey reflects India’s own economic and social progress over the decades.

Throughout its history, the BSE has played a pivotal role in developing India’s capital markets, enabling businesses to raise funds and creating wealth for investors nationwide.

Historic Milestone with New Index Launch and Policy Recognition

Earlier this year in April 2025, BSE marked a significant milestone with a grand celebration attended by Finance Minister Nirmala Sitharaman. She lauded BSE’s transformation into a cutting-edge, technology-driven platform that now processes daily orders worth Rs 1,500 crore, an achievement she described as a clear reflection of India’s dynamic economic progress.

The Finance Minister also highlighted BSE’s impressive market capitalization of Rs 400 lakh crore, placing it among the world’s top stock exchanges. She also unveiled the BSE 150 index, a new benchmark designed to track the performance of the top 150 listed companies based on market capitalization and liquidity.

Source: newsonair.gov

From Banyan Tree to Formal Foundation

The roots of the BSE trace back to the 1850s, when informal stock trading began under a banyan tree near Mumbai’s Town Hall. Gujarati and Parsi brokers traded securities, including East India Company shares, relying on trust and reputation, principles that would shape India’s capital markets.

On July 9, 1875, this informal group formalized into “The Native Share & Stock Brokers’ Association,” marking the official birth of BSE.

By 1921, it had established its base on Dalal Street, and by 1930, it was a central platform for corporate financing in British India, supporting industrial giants like Tata, Birla, and Bajaj.

To provide a clear overview of this extensive history, the following table highlights some of the most significant milestones in the BSE’s journey:

| Year | Milestone/Event | Significance |

| 1850s | Informal trading under a banyan tree | Roots of organized market |

| 1875 | Formal establishment as “The Native Share & Stock Brokers’ Association” | Birth of Asia’s oldest exchange |

| 1921 | Shift to Dalal Street premises | Centralization of operations |

| 1956 | Permanent recognition under Securities Contracts (Regulation) Act | Formal legal framework for operations |

| 1986 | Introduction of Sensex (Base 1979=100) | India’s first stock market index and economic barometer |

| 1992 | Establishment of SEBI (empowered) | Regulatory authority strengthened post-scam |

| 1995 | Introduction of BOLT (BSE Online Trading) | Transition to electronic trading |

| 1996 | Introduction of Dematerialization | Enhanced security, efficiency, investor participation |

| 2001 | Launch of BSEWEBX.com | World’s first centralized internet trading system |

| 2005 | Corporatization and Demutualization | Modernized ownership and governance structure |

| 2023 | Unveiling of new BSE logo | Symbolizing renewed vision and growth |

Where BSE Fits in India’s Demat Account Growth Story

As more Indians embrace equity investing, BSE remains at the heart of this transformation — enabling millions of new investors to participate in India’s growth story with trust, transparency, and scale.

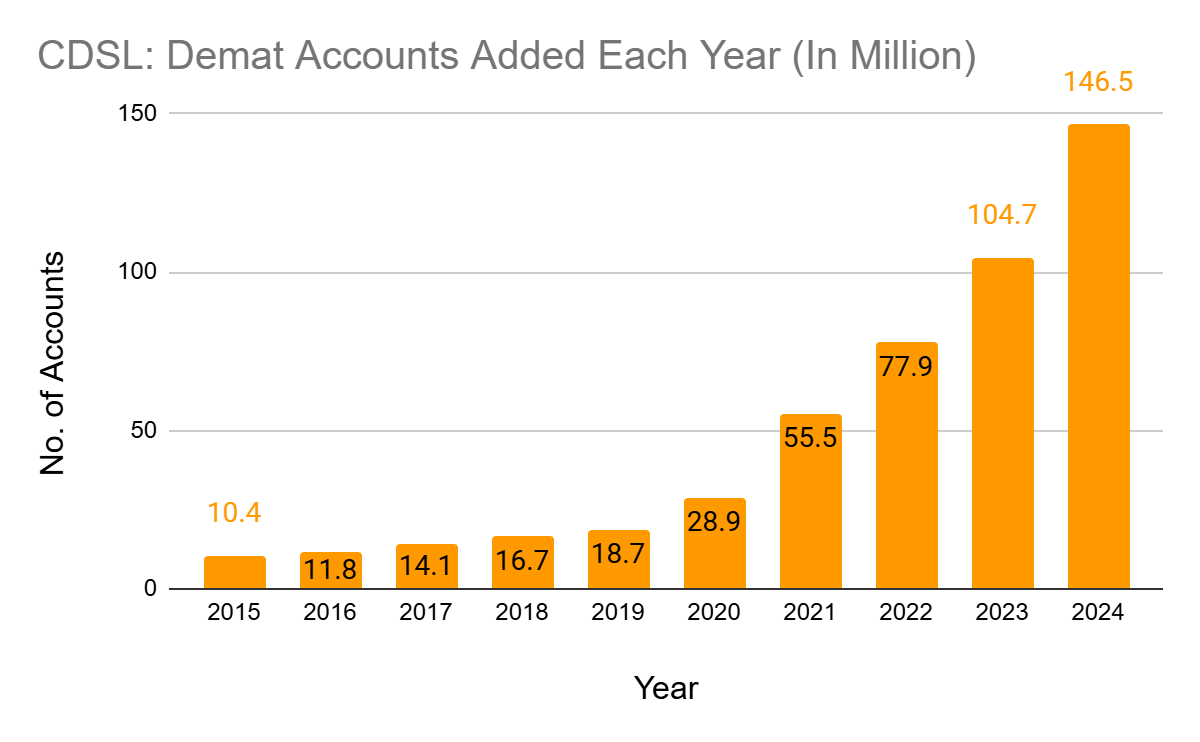

Domestic brokerages added a record-breaking 41.1 million demat accounts in FY25, taking the total number to 192.4 million. This marks the highest-ever annual increase in absolute terms. The monthly average stood at 3.42 million new accounts, setting a new benchmark for any financial year.

| Total Demat Accounts | Change | ||

| Year | Count (in Cr) | Absolute (in Cr) | in % |

| FY21 | 5.5 | 1.4 | 33% |

| FY22 | 9.0 | 3.5 | 63% |

| FY23 | 11.5 | 2.5 | 28% |

| FY24 | 15.1 | 3.7 | 32% |

| FY25 | 19.2 | 4.1 | 27% |

Source: IBEF.org

This surge in demat accounts was driven by easier account opening, rising smartphone usage, and strong market returns.

CDSL: BSE’s Trusted Partner in Secure Electronic Trading

Central Depository Services (CDSL), promoted by the Bombay Stock Exchange (BSE) in 1999, is one of India’s key depositories, enabling electronic holding of shares, bonds, and mutual funds.

Though now a listed company, CDSL remains closely linked to BSE, which is its largest shareholder.

CDSL works with exchanges, brokers, and intermediaries to maintain investor records and streamline trade settlements. Its integration with BSE enables investors to manage and store their securities securely in a paperless environment.

Source: Business Standard

BSE Still Going Strong: Potential for Deeper Market Reach

India’s capital markets have experienced a significant increase in participation over the past few years. However, despite these gains, mutual fund adoption remains surprisingly low, with only 3% of India’s population currently investing in mutual funds.

When it comes to demat penetration, only 8% of the population holds demat accounts, compared to 62% in the US Monthly Systematic Investment Plan (SIP) inflows have also surged, tripling to around ₹25,300 crore, underscoring retail investors’ growing preference for disciplined investment strategies.

Yet, mutual funds’ Assets Under Management (AUM) relative to GDP remain low at 17%, significantly behind the global average of 65%. Stock market turnover velocity also lags international peers at around 70% versus nearly 115% on NASDAQ.

Looking forward, robust demographics and rising incomes could propel further market growth. Over the next decade, an estimated 100 million people are expected to join the workforce, with a similar number of households entering the middle-income segment.

Source: aninews.in

Now let’s explore how BSE has overcome various challenges over time and transformed into one of the world’s leading stock exchanges.

BSE in the Planned Economy Era

In 1956, the BSE became the first stock exchange to gain permanent recognition under the Securities Contracts (Regulation) Act, providing a legal framework for regulated trading.

However, the exchange struggled with poor transparency, malpractices, and slow, manual systems. Trades happened through open outcry, and price updates often reached investors late via newspapers. These issues limited participation and fair pricing, highlighting the need for modernization. These early inefficiencies eventually led to important reforms and the adoption of technology in later years to improve market access and efficiency.

Liberalisation and Market Reforms in the 1990s

The 1990s marked a turning point for India’s economy, triggered by the 1991 reforms aimed at deregulation, foreign investment, and trade liberalisation. These changes greatly boosted the capital markets. BSE’s market capitalisation grew at 27% annually between 1991 and 1999, while trading volumes doubled in a year. The primary market expanded with fresh issues from private firms and mutual funds. Foreign portfolio inflows touched $3.8 billion by 1995, and SEBI gained full regulatory authority in 1992 to enhance market transparency and investor protection.

1992 Scam Sparked Reforms in Indian Stock Market

During India’s economic liberalisation, the 1992 Harshad Mehta scam exposed major flaws in the stock market. By manipulating stock prices using fake funds, Mehta triggered a 12.7% crash in the BSE Sensex on April 18, 1992. While it deeply shook investor confidence, the crisis became a turning point. It led to stronger powers for SEBI, the push for electronic trading, and enhanced transparency, proving that even major setbacks can drive essential reforms for a more robust and efficient market.

Technological Revolution

The launch of the fully automated National Stock Exchange (NSE) in 1994 pressured BSE to modernize. In response, BSE introduced its electronic trading system, BOLT (BSE Online Trading), in 1995, replacing the outdated open outcry system and enhancing speed and efficiency.

In 2001, BSE launched BSEWEBX.com, the world’s first centralized exchange-based internet trading system, allowing global investors remote access to Indian markets, marking BSE’s global push.

A key milestone came in 2005 when BSE corporatized and demutualized under SEBI’s direction. This governance shift enabled strategic partnerships with global exchanges like Deutsche Börse and Singapore Exchange, cementing BSE’s international presence.

Sensex: The Nation’s Economic Barometer

In 1986, the BSE introduced the Sensex, India’s first stock market index, with a base value of 100, which was set in 1979. The Sensex rapidly became a crucial indicator of India’s economic health and a sensitive barometer of market sentiment. Its early movements directly reflected significant economic policies and emerging industrial trends.

Key Sensex Milestones and Their Triggers

- January 15, 1992: Sensex crossed 2,000 points after liberal economic reforms were announced.

- February 29, 1992: Surged past 3,000 points following a market-friendly Union Budget.

- March 30, 1992: Touched 4,000 points, driven by expectations of a liberalised export-import policy, shortly before the Harshad Mehta scam shook the market.

- October 11, 1999: Crossed 5,000 points, coinciding with the victory of a political coalition, boosting investor confidence.

- February 11, 2000: Surpassed 6,000 points, hitting a high of 6,006 due to the booming IT sector during the tech rally.

- 2007: The Sensex surpassed the 20,000-point mark, reflecting robust economic growth and heightened global investor interest.

- 2015 – 30,000 points The Sensex breached 30,000 as the RBI’s rate cuts and policy support boosted investor sentiment and confidence in economic growth.

- 2019 – 40,000 points: Bullish market response to the decisive general election outcome, signaling political stability and continued economic reforms under a strong mandate.

- 2021 – 50,000 points: Post-COVID recovery optimism and liquidity-driven rally propelled Sensex to 50,000, reflecting faith in India’s economic bounce-back.

- 2021 – 60,000 points: Continued economic recovery, global liquidity, and robust corporate earnings lifted investor confidence, pushing Sensex past 60,000 mark.

- 2023 – 70,000 points: Strong domestic demand and resilient macro indicators helped Sensex breach 70,000, a major psychological and historic milestone.

- 2024 – 80,000 points: Sensex touched a record-breaking high driven by strong inflows, policy clarity, and positive economic and earnings outlook.

- 2024 – 85,978: Sensex reached its all-time peak amid surging investor optimism, robust GDP growth, and global interest in Indian equities.

BSE’s Role in Supporting Indian Businesses

The large number of companies listed on the BSE demonstrates the importance of the exchange in helping businesses raise capital. BSE has the highest number of listed companies in the world.

In January 1991, it had 4,510 listed stocks. This number has kept growing, reaching 5,595 in 2025, and 5,647 as of June 27, 2025, according to Wikipedia.

This steady rise highlights how BSE continues to support a wide range of Indian companies by giving them a platform to access funds and grow.

Sensex Performance Analysis

The Sensex, as the benchmark index, provides a compelling narrative of the Indian market’s long-term growth and its ability to navigate periods of volatility. It has demonstrated remarkable long-term growth, achieving a Compound Annual Growth Rate (CAGR) of 15% over the past 20 years and an impressive 16% since its inception.

While the Sensex’s journey has been predominantly upward, it has also experienced several significant single-day or short-period drops, reflecting the inherent volatility of financial markets in response to both domestic and global events.

Today, BSE is a strong global player in the financial world. By June 27, 2025, its market value had grown to ₹461 lakh crore (around US$5.5 trillion), making it the 6th largest stock exchange globally. It also leads the world in the number of listed companies, with over 5,500 firms.

Conclusion

The BSE has completed 150 years, marking a journey of resilience, innovation, and growth. From informal cotton trading under a banyan tree in the 1850s to becoming a formal exchange in 1875, BSE has adapted through every major shift in India’s financial history.

It has seen planned economies, liberal reforms, and global market challenges. Today, BSE is not just a historic platform but a modern, tech-driven exchange that plays a key role in capital formation and economic growth.

As markets evolve, so should your investment decisions. With over 5,000 listed companies and countless choices, investing without the right guidance can be overwhelming—or worse, risky.

That’s why we believe: If you do invest, do it right. With a SEBI-registered advisor who works for you—not for a brokerage.

Because real wealth isn’t built by following noise, it’s built with research, strategy, and accountability.

Watch out for this space as we’ll take you through what the next 150 years could look like for BSE, in our next post.

Happy Investing.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora