Options trading is one of the most powerful segments of the derivatives market. Whether you are a beginner or an experienced trader, understanding put vs call option is essential for making informed trading decisions. These two instruments help traders hedge risks, predict market movements, and build strategic positions. In this detailed guide, we explain the meaning of call and put options, the difference between them, types of options, and real-life examples that make the concept easy to understand. If you rely on a share market advisory, you will notice that most advanced trading strategies are built on the foundation of call and put options.

What Is a Call Option?

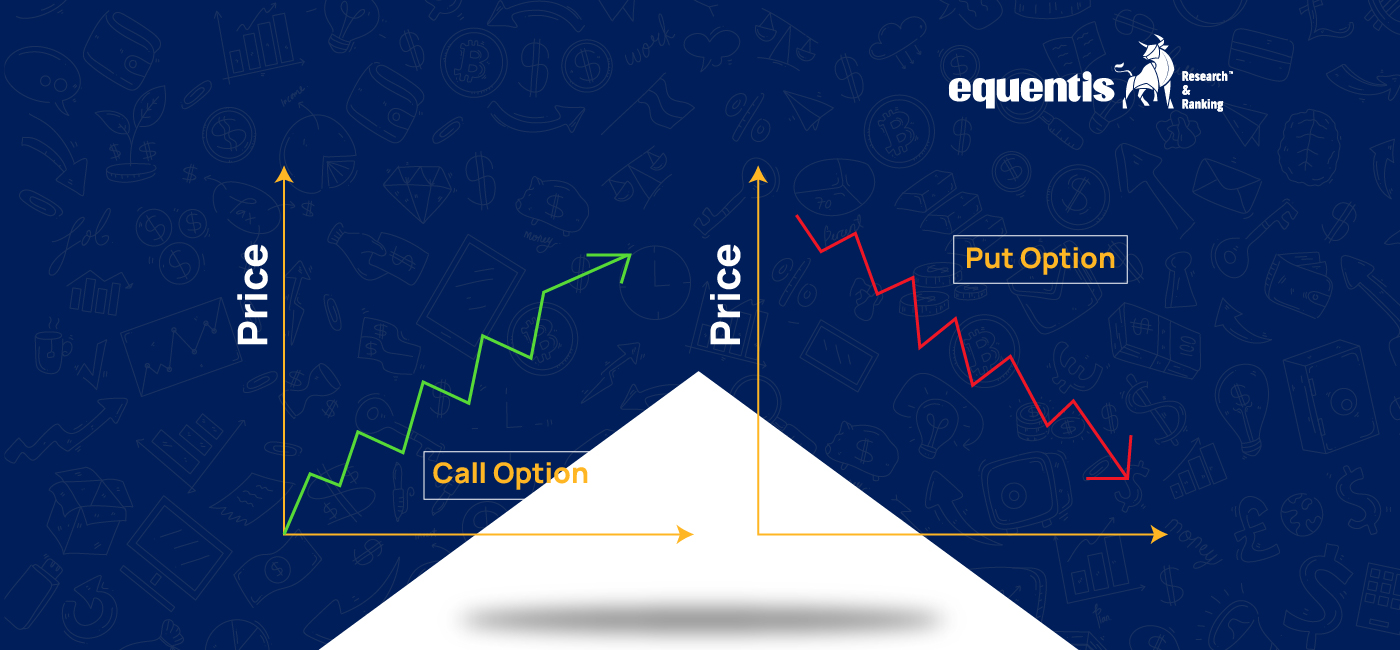

A call option is a contract that gives the buyer the right, but not the obligation, to buy an underlying asset (like a stock or index) at a predetermined price known as the strike price, before or on the expiry date.

Traders buy call options when they expect the price of the underlying asset to rise.

Example of a Call Option

Suppose a stock is trading at ₹100. You buy a call option with a strike price of ₹110. If the stock rises to ₹130 before expiry, you can buy it at ₹110 and profit from the difference. If the price doesn’t rise above ₹110, you only lose the premium paid.

What Is a Put Option?

A put option gives the buyer the right, but not the obligation, to sell an underlying asset at a predetermined price before or on expiry.

Traders buy put options when they expect the price of the underlying asset to fall.

Example of a Put Option

A stock trades at ₹200. You buy a put option with a strike price of ₹190. If the stock falls to ₹160, you can sell it at ₹190 and earn a profit. If the price stays above ₹190, only the premium is lost.

Put vs Call Option: Key Difference

The simplest way to understand put vs call option is:

• Call Option = Right to Buy

• Put Option = Right to Sell

You buy:

• A call when you expect prices to rise

• A put when you expect prices to fall

This opposite functionality is what makes options so powerful in volatile markets. Many investors also use tools like a reverse CAGR calculator to estimate expected returns and compare scenarios before deciding whether to use options in their portfolio.

Types of Options

1. American Options

Can be exercised any time before expiry.

2. European Options

Can be exercised only on expiry day (used in Indian markets).

3. Equity Options

Based on individual stocks.

4. Index Options

Based on market indices like Nifty or Bank Nifty.

5. Cash-Settled Options

Settled in cash without physical delivery.

6. Long and Short Positions

Position depends on whether you buy or write (sell) the option.

How Call and Put Options Work in Trading

Options have two sides:

• Buyer (Holder) – Pays the premium, has the right but not the obligation

• Seller (Writer) – Receives the premium, but must execute the contract if the buyer exercises the right

This buyer-seller dynamic creates strategic opportunities for hedging, speculation, and arbitrage. Professional traders and share market advisory services use combinations of puts and calls to build strategies such as spreads, straddles, and strangles.

Why Traders Use Options

• Hedge against market volatility

• Generate income through writing options

• Leverage positions with smaller capital

• Speculate on market direction

• Protect portfolios during downturns

Investors who want safer choices often explore emergency fund investment options or the best investment options, while traders seeking higher risk-adjusted returns often rely on derivatives.

Practical Example: Put vs Call Option

Example 1: Bullish Situation (Call Option)

A trader buys a call option on Reliance with a strike price of ₹2,800. If the price rises to ₹3,100, the call becomes profitable.

Example 2: Bearish Situation (Put Option)

A trader buys a put option on TCS with a strike price of ₹3,500. If the stock falls to ₹3,200, the put buyer earns from the price decline.

Example 3: Hedging Portfolio Losses

If you expect temporary market weakness, you buy a put option to protect your long-term investments.

Options vs Stocks: What’s Better?

Stocks are better for long-term wealth creation. Tools like a reverse CAGR calculator help estimate long-term returns. Options, on the other hand, are better for short-term strategies, hedging, and leveraged positions.

Investors looking for stability may prefer:

• Liquid funds

• Fixed deposits

• Overnight funds

• Hybrid funds

These are often recommended as emergency fund investment options.

Final Thoughts

Understanding put vs call option is the foundation of options trading. Whether you trade independently or seek help from a share market advisory, mastering the basics of call and put options helps you make better decisions during market volatility. Options offer flexibility, risk management, and profit opportunities—making them a vital part of modern trading strategies.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

20 FAQs on Call and Put Options

1. What is the main difference between a put and call option?

A call gives the right to buy, while a put gives the right to sell the underlying asset.

2. What does put vs call option mean?

It refers to comparing the rights, purposes, and trading uses of call and put options.

3. Which option should I buy in a rising market?

A call option, since it profits from upward price movement.

4. Which option is better when markets are falling?

A put option, which benefits when prices decline.

5. Are options risky for beginners?

Yes, if used without understanding. Taking help from a share market advisory can reduce mistakes.

6. What is the premium in options trading?

The cost paid by the option buyer to the seller for purchasing the contract.

7. Do options guarantee profit?

No. Profit depends on market movement, strike price, and timing.

8. Can I lose more money with options?

Buyers’ losses are limited to the premium, but writers can face unlimited losses.

9. Which is safer: call option or put option?

Both carry risks. Safety depends on market expectation and strategy.

10. What is an example of put vs call option?

Call profits when prices rise; put profits when prices fall.

11. Are put and call options part of derivatives?

Yes, they are derivative contracts based on underlying assets.

12. Can I use a reverse CAGR calculator for options?

Yes, to estimate required return rates before using options-based strategies.

13. What type of investor uses options?

Traders, hedgers, arbitrageurs, and advanced investors.

14. Can options be used for emergency fund planning?

No. Options are speculative. Instead, use emergency fund investment options like liquid funds or FDs.

15. Are options better than stocks for beginners?

No. Stocks are simpler. Options require understanding of pricing, volatility, and time decay.

16. Can call and put options be exercised anytime?

American options can be; European options (like in India) only on expiry day.

17. What is the strike price in options trading?

The predetermined price at which the buyer can buy or sell the asset.

18. Do options expire?

Yes. They become worthless after the expiry date if not profitable.

19. Is options trading good for wealth creation?

Options are better for hedging and short-term trading. Long-term wealth comes from selecting the best investment options like mutual funds, stocks, and SIPs.

20. Should I take advisory help before trading options?

Yes, especially for beginners. A share market advisory helps reduce risk and build proper trading strategies.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Jaspreet Singh Arora is the Chief Investment Officer at Equentis, where he heads a seasoned team of equity analysts and turns two decades of market experience into portfolios that consistently beat the benchmark. A go-to voice on cement, building-materials, real-estate, and construction stocks, Jaspreet previously ran research desks at leading brokerages, honing an eye for the metrics that truly move share prices. His plain-spoken analysis helps investors cut through noise and act with conviction. When he’s not deep-diving into earnings calls, you’ll find him unwinding over sports, weekend cricket or a good history podcast.

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora

- Jaspreet Singh Arora