Fundamental Analysis of Stocks – Blog Category

Fundamental analysis of stocks based on the quarterly and annual reports of the companies.

Introduction Zomato! This word makes one think about food – Chicken Biryani, Shahi Paneer, Chole Bhature, Momos, and whatnot! So […]

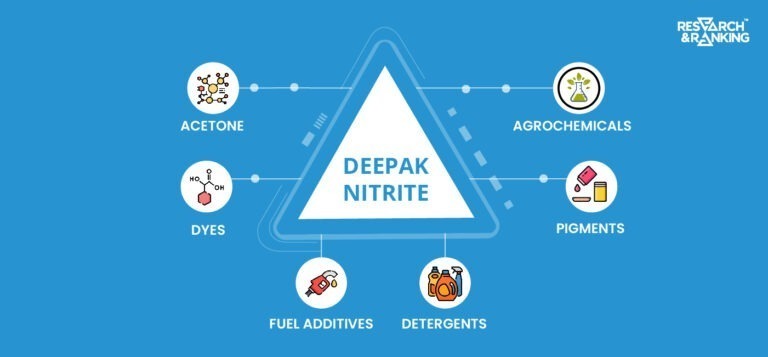

Introduction Deepak Nitrite led the Chemical stocks during the Covid-19 bull run and became almost a 10x multi-bagger between March […]

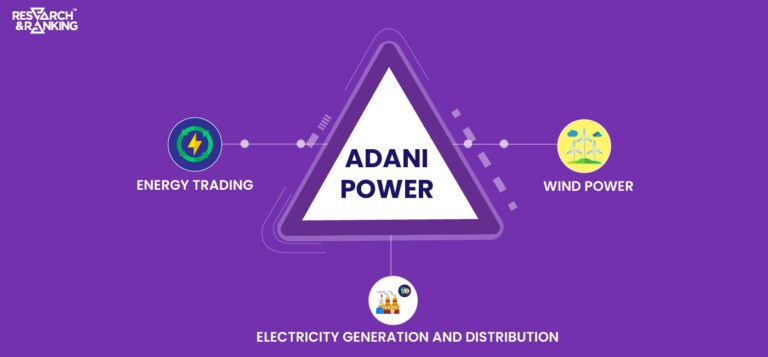

The power sector is the most critical sector of any economy because any country’s long-term economic development requires adequate, reliable, […]

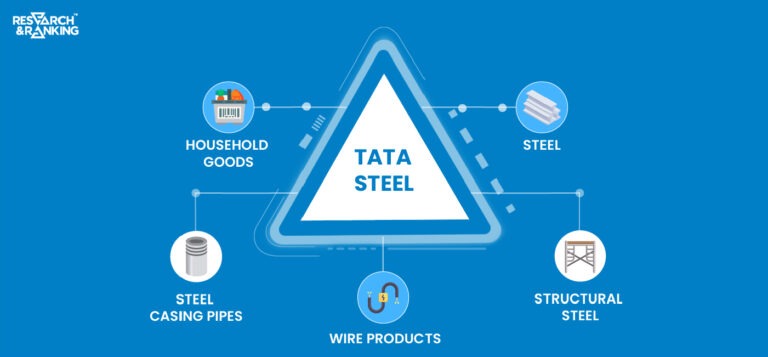

Introduction The Indian economy is expected to become the third largest economy by 2030, and the steel industry will play […]

Reliance Industries Reliance Industries operates on a massive scale. It became India’s first corporate to cross $100 billion in annual […]

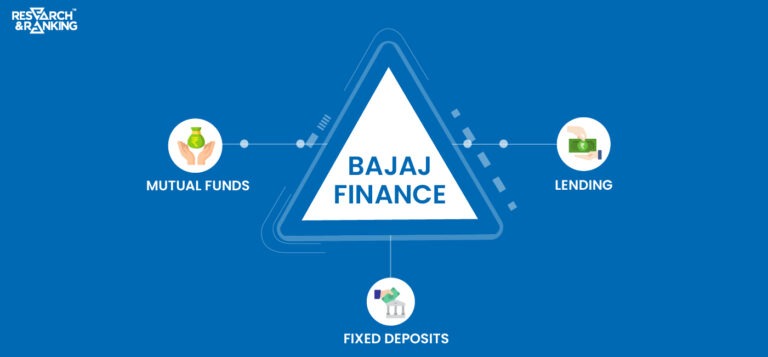

Humara Kal Humara AajBuland Bharat Ki Buland TasvirHumara Bajaj Humara Bajaj The song that captivated the entire country in the […]

When most Indians hear the term “IT sector,” they immediately think of two companies: TCS and Infosys. And why do […]

Introduction From being mired in multiple scams and controversies towards the end of 2018 to being recognized as the “Company […]

Introduction When the crisis at IL&FS (Infrastructure Leasing & Financial Services) exploded in September 2018, many saw it as India’s […]

Private Banks have created much wealth for their shareholders in the last two decades. HDFC Bank, in particular, has been […]

Frequently asked questions

Get answers to the most pertinent questions on your mind now.

What is an Investment Advisory Firm?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Do we have SEBI registration as an Investment Advisory?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

Why choose a SEBI Registered Investment Advisor?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.

What is the Role of an Investment/Stock Market Advisory Firm in India?

An investment advisory firm is a company that helps investors make decisions about buying and selling securities (like stocks) in exchange for a fee. They can advise clients directly or provide advisory reports and other publications about specific securities, such as high growth stock recommendations. Some firms use both methods, like Research & Ranking, India’s leading stock advisory company, specializing in smart investments and long-term stocks since 2015.