India’s electronics manufacturing industry is in hyper-growth mode.

Valued at US$ 155 billion in 2024, the sector is projected to more than triple to US$ 500 billion by 2030, growing at a staggering pace of 21.5% annually, according to Niti Aayog.

Right at the heart of this transformation is Dixon Technologies — one of the key players riding this wave of growth.

From humble beginnings as a colour TV maker, Dixon has evolved into a diversified electronics powerhouse, producing everything from mobile phones to consumer durables — and now even eyeing the next big frontier: display manufacturing.

What’s driving this momentum?

- Rising demand from India’s growing middle class

- A massive domestic production push under government initiatives

- And the global China+1 shift, opening new doors for Indian manufacturers

With strong tailwinds and ambitious expansion plans, Dixon is positioning itself as a leader in India’s electronics revolution.

Today, Dixon announced yet another acquisition and a joint venture, further strengthening its position in the industry. Investors cheered this move and the stock price gained 4% reacting to the same.

Dixon Technologies – 1 Year Share Price

Let’s understand the key details of the acquisition and the joint venture before we look at the growth prospects.

Why Dixon Technologies Share Price is Rising

Dixon Technologies share price surged as much as 4% to ₹16,537 in intraday trade today after the company announced that it has signed a binding term sheet to acquire a 51% stake in Kunshan Q Tech Microelectronics (India) Private Limited (Q Tech India).

According to the exchange filing, the acquisition will be carried out through a mix of primary and secondary investments.

The deal is intended to strengthen co-operation in the production, marketing, and distribution of camera and fingerprint modules, with applications spanning mobile phones, IoT devices, and the automotive industry.

Q Tech India operates as a subsidiary of Q Technology (Singapore) and Kunshan Q Technology International, both of which belong to the Q Tech Group.

Q-Tech India clocked about ₹2,400 crore in FY24 revenue. According to Nomura, based on an average realisation of about ₹400 per camera module, this suggests volumes of approximately 50 million units-implying a nearly 10% market share. Nomura expects Dixon’s backing could help Q-Tech India scale to 50–60 million phones over the next few years.

With this acquisition, Dixon has entered into the camera and fingerprint module segment, with applications across mobile handsets, IoT devices, and the automotive sector.

JV With Chinese Company

Along with this acquisition, in a parallel development, Dixon also announced a 74% joint venture with Chongqing Yuhai Precision Manufacturing.

The JV will focus on manufacturing precision mechanical and metal components for laptops, mobile phones, IoT products, and automotive applications — marking Dixon’s foray into the precision components segment.

Mutual Fund Buying Adds Further Momentum

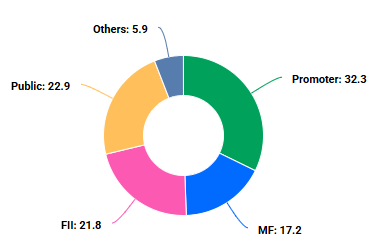

The acquisition and JV have no doubt fuelled a positive sentiment around the stock. But the stock is also rising as mutual funds are lapping up shares.

According to reports, domestic mutual funds added Rs 4,500 crore worth Dixon Tech shares in the month of June 2025.

Dixon Tech Shareholding Breakup – March 2025

Source: BSE, Trendlyne

What Next?

Dixon Technologies has been on a roll since its IPO seven years ago.

Backed by solid execution and smart expansion, the company has consistently delivered strong financial performance year after year.

Its growth story is closely tied to India’s manufacturing revolution — fueled by the ‘Make in India’ push and rising demand for locally made electronics.

And the numbers speak for themselves.

Dixon Financial Snapshot

| Particulars (Rs Cr.) | FY21 | FY22 | FY23 | FY24 | FY25 |

| Revenue | 6,448 | 10,697 | 12,192 | 17,691 | 38,860 |

| Operating Profit | 292 | 384 | 519 | 705 | 1,508 |

| Margins (%) | 5% | 4% | 4% | 4% | 4% |

| Net Profit | 160 | 190 | 255 | 375 | 1,233 |

Source: Screener, Company Reports

That’s the power of entering new product categories at the right time — and executing with focus.

With a strong order book from brands like Voltas, Beko, Lloyd, and BPL, the company is ramping up its refrigerator capacity — and has begun exports to Nepal, with plans to enter Sri Lanka and the UAE soon.

It’s also eyeing export growth in smart TVs, including Amazon Fire TV and LG webOS, with momentum expected to pick up from Q1FY26.

Dixon is doubling down on home appliances and lighting, expanding into categories like robotic vacuum cleaners, water purifiers, chimneys, and automatic washing machines for clients like Panasonic, Godrej, and Reliance.

In IT hardware, Dixon is partnering with top global brands like Asus, HP, and Lenovo and building a new laptop facility (1.5 million units), expected to go live by Q4FY25.

And it’s not stopping there.

The company will soon kick off display manufacturing with HKC, while expanding into precision components, camera modules, and battery packs — all high-margin segments.

With these bold moves, Dixon is eyeing a spot among the world’s top 10 EMS (Electronics Manufacturing Services) companies within 5 years.

So yeah, the future looks exciting for Dixon. It remains to be seen whether the company lives up to the hype and delivers a consistent all-round performance.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora