There’s no typo in our heading. Its just that the fall and then subsequent recovery has been so pronounced that we couldn’t help but replace the

letter W with a V.

In this newsletter, we focus on:

- V-shape recovery being seen in the second half of 2020 accompanied by significant parts of the economy doing well

- Excessive focus on negative GDP data will do no good

- Examples of how Indian corporates are using times of adversity to

tighten their belts and prepare themselves for next leap of growth and - A select sectoral trends

V SHAPE RECOVERY

“When will your sales bounce back to pre-Covid-19 levels?” OR “How much is current sales run rate vs the pre-Covid-19 levels?” were the most common questions asked by analysts to the companies in the last two months and the replies from a majority of the companies surprised everyone as the recovery was +90%. The fact that operating margin expansion led by raw material price softening and fixed cost rationalization ensured profit growth year-onyear (YOY) was another positive surprise. The sharp recovery and then moving even higher from pre-Covid-19 levels was not only true for online companies (Amazon, Flipkart), electronics, cars, but also the equity market. As we end 2020, the experts (few though) which backed the letter ‘V’ won hands down while all others with guesstimates of L, U, W, Nike swoosh sign, etc. had to bite the dust. The prominent reasons backing the recovery were sharp recovery in earnings, change in sentiments, visibility of global availability of vaccine starting Dec ’20, rerating due to multi-decade low-interest rates and higher digital usage and lastly the heavy liquidity pumped in by all governments.

Besides the V shape recovery, which is there for all to see, what is also becoming clear is the letter ‘O’ which denotes circle.

What we mean is loop seems to be getting closed, or in other words, broadbased recovery is an encouraging sign.

INVESTOR CATEGORIES

So, while it was domestic institutional investors that were active buyers in Mar-Jun 2020 followed by retail and HNI (word ‘Robinhood investing’ coined during that time inspired by an explosion in new accounts by US based broker, Robinhood) from June 2020 onwards, the last two months have seen heavy buying from FIIs. They bought over $8bn of equities in India in Nov (highest ever) of which $4bn was just BFSI. Such was the tsunami of flows that November saw all sectoral indices including mid & small-cap indices returning positive growth, only the third time in 2020, the first two being in Apr 2020 (bounce back after sharp fall in March) and June 2020 (phase I of unlock). Key reasons attributed for heavy buying are global liquidity diverted to emerging economies like India especially in the phase of dollar weakening, MSCI weightage increase for India, China IPO fiascos, growth expectations getting revised upwards and vaccine positivity.

SECTOR ROTATION

Initial month post-pandemic saw sectors of pharma, auto, FMCG outperforming the Nifty followed by IT & Media in July-Aug and the last two months have clearly been in favour of Realty, Metals and BFSI.

MARKETCAP PREFERENCE

Midcaps and small-cap indices have made a smart comeback in the last few months. From the lows of 23rd March 2020, while Nifty is up 77%, the Nifty Midcap is up 87% and Nifty Small Cap up by 102%. Also, the midcap index is now at par with high made in Jan 2018 while the smallcap is still 30% lower than high made in Jan 2018 while the Nifty is up 20% since then.

GDP: RECESSION AND NIFTY EARNINGS UPGRADE AFTER 6 YEARS:

TWO SIDES OF THE SAME COIN

With GDP contracting 8.6% in 2QFY21 and two successive quarters of GDP fall, means

that India technically was seeing a recession for the first time in history. To add to it,

some economists and experts have also used select start and end date to prove how India’s

economic situation is deteriorating over the years.

While this only reveals one side of the coin, what is more, pronounced and starkly

revealing is:

Nominal GDP gives a broad indicator of how corporate India revenues have fared in the

quarter/year. However, besides growth in revenues, the earnings/EPS is also governed by the movement of gross margins, fixed costs rationalization, reduction in interest costs or tax rates. Some of these have played out in the last few quarters while others will play out in subsequent quarters.

For example, in 2QFY21, Nifty sales declined by 7% YoY while EBITDA grew 8% YoY and

PAT by 17% YoY. Thus growth in sales (read nominal GDP) is only one of the factors

leading to overall growth in earnings of a company. The EPS growth for Nifty has

been in single digits since FY12 and consistently below nominal GDP growth.

This is expected to reverse in FY21, despite the pandemic.

2QFY21 has been one of the best earnings seasons across sectors in many years. After 6

years or 24 quarters of continuous downgrades, consensus estimates have been revised upwards for the second time, the first being after 1Q. The stock wise upgrade: Downgrade ratio is now at 4:1 meaning for every one company which has seen EPS estimate being revised down, there are four which have seen earnings being revised upwards.

INDIA INC SHEDDING ITS OLD SKIN WITH AIM TO LEAP FORWARD

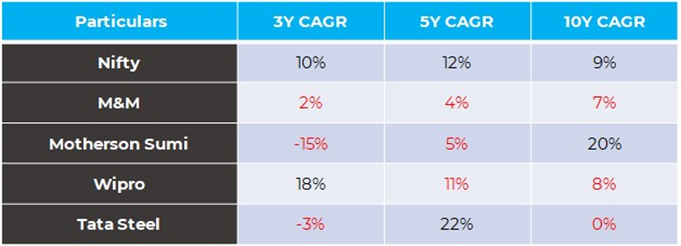

Many companies are using 2020 or the pandemic to reposition or reorient itself in order to cut flab, put more focus on driving growth and optimum return on capital employed. Below is an illustration of some companies who are cognizant of not creating enough shareholder wealth and have taken steps to address it.

From being known as The Western Indian Palm Refined Oil company selling oils and soaps, Wipro transitioned into an IT behemoth over the years so much so that in the mid-90s it was similar to Infosys in terms of size and profitability. As of today, Infosys has twice the size by market cap. Rishad Premji, current Chairman realising the lost years wants to transition Wipro into ‘bolder, risk-taking, agile, obsessed with growth and think big’ by shedding the ‘introvert’ image. Mr Delaporte has been brought from Capgemini who has laid down the new path. Wipro will simplify its operating model by bringing down its 20-25 Profit & Loss units to just 4, with effect from Jan 2021 which is expected to drive significant savings of cost and resources besides a focusing on talent management, and accelerating existing portfolios of large clients by various customer-centric measures.

The leading SUV maker till a couple of years back (Bolero, Scorpio, XUV, KUV, Alturas), M&M has now been overtaken by Korean & Japanese models. It has now stated that it wants to focus on achieving 18% RoE in the near to midterm. This is planned to be achieved through prudent capital allocation, exiting loss-making subsidiaries including SsangYong (which is posting the most significant loss) and another attempt to revive UV volumes with the launch of Thar and W601 and possible positive surprise from LCVs. Robust tractor segment outlook and cost control measures should provide a cushion.

Motherson Sumi plans to more than triple revenues to $36bn by 2025. Of this, it targets 25% to come from non-auto segments, focus on vertical integration and efficiency gains to boost consolidated RoCE to 40%, spend diligently on capex, have dividend pay-out of at least 40% and no country, component or customer have more than 10% of sales. It has achieved success in 4 out of the last five such five year plans, primarily through acquisitions.

Tata Steel has decided to sell the Dutch unit of its company present in the Netherlands. The deal would further strengthen the company’s balance sheet and will help to achieve the target to reduce debt by $1 billion every year. The due diligence would be completed in two months following which the transaction value would be known.

SECTORAL TRENDS

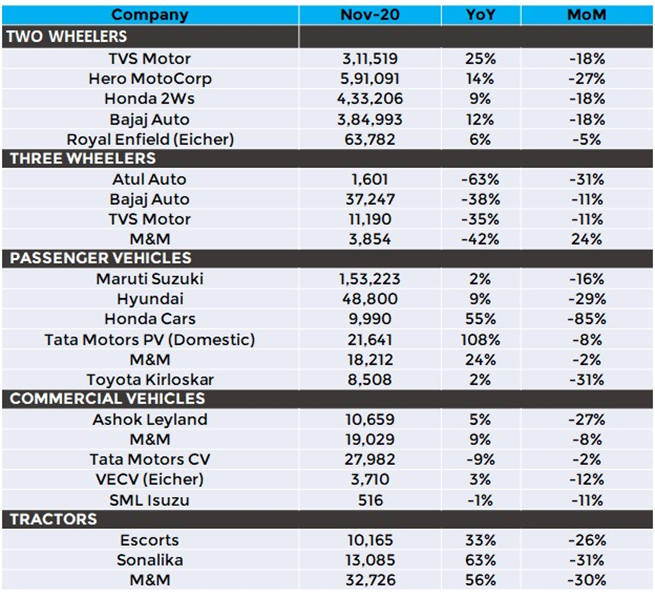

A U T O B O U N C E B A C K , A N D R E S I L I E N C E C O N T I N U E S . . .

A more in-depth look into sales of personal mobility segments—twowheelers (Two Wheelers) and passenger vehicles (PVs) indicates that recovery is encouraging in PVs than in Two Wheelers.

Downtrading trends are visible in PVs as the share of hatchbacks, and compact SUVs is rising. The percentage share of hatchback cars (mini + compact, sub 4metre length PVs) has increased to +80% of the market vs 73% in FY19 and 77.5% in FY20. Within hatchback, the compact SUV segment is now 41% of the market vs 36% in FY19. On the other hand, the share of MPVs has fallen by 4%, give its use for group travel.

Two Wheelers, in contrast, is showing more impact in the entry-level category. The share of lower-end bikes has reduced over 2% due to a significant price hike owing to BSVI and the pandemic impacting customers at the lower end of the economy. Rural India, which is less impacted, is also preferring mid to high-end Two Wheelers.

The buoyancy in monthly continued in November with most segments shining.

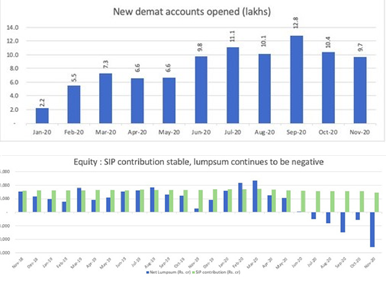

DIRECT INVESTING VS MF ROUTE: NO PRIZE FOR GUESSING WHO IS THE WINNER SO FAR

As equity markets surpassed all-time highs, the equity MFs saw outflows for the fifth month in a row- Rs. 129 bn (Inflow: Rs. 142 bnand redemptions: Rs. 271 bn); Redemptions in Nov ’20 was twice the average of FY20. SIPs also slipped to Rs. 73 bn vs the monthly run-rate of more than Rs. 78 bn.

The probable reasons are :

Less launch and thus contribution from New Fund Offer in November Profit booking by HNIs/retailers Redeployment of proceeds into other avenues including business Rising trend of direct participation by retail/HNIs, which typically happens in a rising market.

Click here to invest in multibagger stocks which will outperform over the next few years.

DIGITAL TECH IS THE WAY TO GO

If there is one sector which has benefited disproportionately in 2020 with more legs to

growth, has companies of repute in India and globally with a scale where investors can take an

exposure, it is IT. It was common for corporates to reduce spend on advertising, travel etc. while increasing the IT budgets.

The demand is so much that the Singapore government has announced new Work Pass

for foreign tech experts – called Tech.Pass to attract talent from e-commerce, Artificial

Intelligence, and cybersecurity. And one key difference for Tech.Pass is that it is tied to the

individual vs the Employment Pass that was in existence earlier, which has the sponsorship of

the employer, thereby giving the individual the flexibility to explore growth opportunities in

Singapore like locals. The government has announced this despite record job losses.

Most techies are working overtime, including on weekends and more so in companies

where onsite traffic or sales post-Covid-19 are 150-200% of pre-Covid-19.

Bain & Co estimates $5-10 trillion to be invested by US companies in IT in “retooling

the new normal” in coming decade.

Experts say that they could see this coming, but Covid-19 has just hastened

it. From water and steam power in the first Revolution, we moved to electric power In the second, the third was based on semiconductors, which facilitated the data processing that automated production and spawned the digital age. We are currently in the 4th Revolution which is taking shape, where the internet will completely take over – IoT, sensors, robots, work from home gadgetry, Zoom, digital transformation, automation etc etc.

More on the new-age tech in our next newsletter.

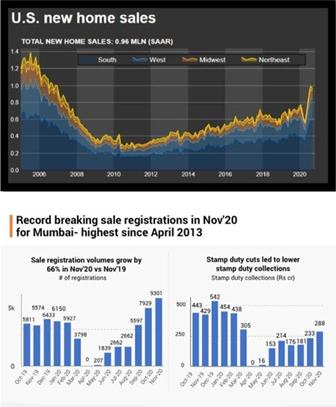

WORK FROM HOME MAY CONTINUE, IN SOME FORM OR OTHER; WHY NOT SPEND IN BUYING A HOME

Real estate has been a surprise winner in the last couple of months given lowest ever housing loan rates in distant memory, builders ability to drop prices further or launch projects at affordable ticket size and some states reducing stamp duties.

Read on to know why.

US home sales are rising every month are now at the highest pace in 14 years. At the current

pace of sales, the existing inventory will just last just 2.5 months, a multi-year low. And this is despite high unemployment (7%) and +2 Lakh Covid cases every day.

Mumbai where the stamp duty was cut to 2% (till Dec ’20) and 3% (till Mar ’21) vs 5% earlier saw 50% higher registrations in Nov ’20 vs the average monthly of 2019. The drop in interest rates by 200bps (8.9% last yr to 6.75% now), a fall/stagnation in property prices and rise in income levels have made homes 35% more affordable in top 10 cities, in the last 5 years.

Since some part of discretionary (apparels, movies, entertainment) and most of the

ultra discretionary spend (holidays, luxury car/watch) is curtailed and people spending more time at home, there is a desire to move into own apartments or larger/better ones.

If you do a random survey in any office in a metro city in India, chances are there would be 10-20% employees who would have booked an apartment or are planning to do it very soon.

Readers may argue this sector has not been amongst long term compounders and doesn’t have too many large reputed players worth betting on. Our answer to that will be there are always ancillary sectors through which this theme or uptrend can be played like Housing Finance companies, building material or the paint/electrical companies.

WISHING YOU A MERRY CHRISTMAS & HAPPY NEW YEAR 2021!

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.