Income tax is a part of every earning individual or business’s financial responsibility. But sometimes, even after filing your return and paying your taxes, you may receive a demand notice from the Income Tax Department.

Knowing income tax concepts to understand what is income tax demand notice, why it is sent, or how to reply to income tax notice can make the process simple and stress-free.

Here’s a low-down on the concept and how to respond to income tax demand notice.

What is an Income Tax Demand Notice?

An Income Tax Demand Notice is an official communication from the tax department stating that you owe a certain amount of tax. This could be due to mistakes in your return, late payments, or missed tax entries.

Meaning of Notice Under Section 156 of Income Tax Act

When you get a notice under Section 156 of the Income Tax Act, it means the tax department has made a formal demand for payment. This section is invoked after the tax officer completes an assessment or reassessment and finds that additional tax is due. The notice will clearly mention the amount you owe and the due date by which it must be paid.

Reasons for Receiving a Demand Notice

Before getting into how to respond to income tax demand notices, it’s important to understand why the notice was issued in the first place. Here are the most common reasons.

Mismatch in Tax Paid and Tax Liability

This happens when the tax amount mentioned in your return doesn’t match what the department has on record. It could be due to a delay in TDS reporting by your employer or incorrect PAN linking.

Incorrect Reporting of Income or Deductions

If you forget to report some of your income—like interest from savings accounts or capital gains—or if you claim a deduction you’re not eligible for, the department may raise a demand after reviewing your records.

Arithmetical Errors in Return Filing

Sometimes, simple calculation mistakes while filing your Income Tax Return (ITR) can result in wrong tax amounts. These are picked up during processing and can lead to a demand.

Non-Payment or Short Payment of Advance Tax/Self-Assessment Tax

If you’re required to pay advance tax or self-assessment tax but fail to do so in full or on time, a demand notice may be issued for the pending amount along with interest.

How to Respond to Income Tax Demand Notice

You can reply to the demand notice easily through the income tax portal. Here’s how.

Step-by-Step Guide to Responding Online

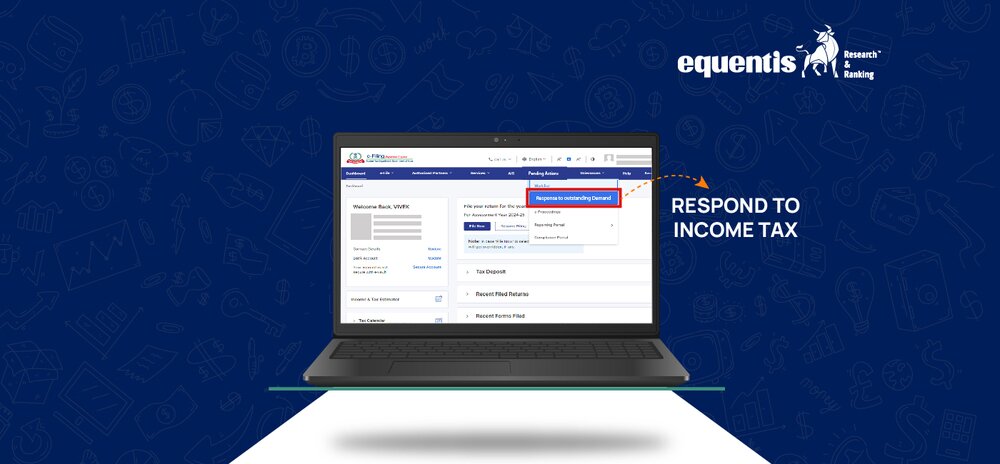

This is the first step in understanding how to respond to income tax demand notice digitally

- Go to www.incometax.gov.in

- Log in using your PAN, password, and Captcha.

- Navigate to Pending Actions > Response to Outstanding Demand.

- You’ll see details of the notice, including the demand amount, assessment year, and date.

- Click on “Submit Response”.

You can choose from three options:

- Demand is correct

- Demand is partially correct

- Disagree with demand

Choose the appropriate one based on your case.

Accepting the Demand and Making Payment

If you agree with the demand, you must make the payment before the due date. Once paid, submit the details online:

- Select “Demand is correct”

- You will be redirected to the payment page

- After payment, update the BSR code, challan number, and payment date on the portal.

Disagreeing with the Demand: How to Submit a Response

If you believe the demand is incorrect:

- Select “Disagree with demand”

- Choose the reason (e.g., demand already paid, appeal filed, or TDS mismatch)

- Upload supporting documents (like challan copies or Form 26AS)

Your response will be reviewed by the tax officer. This is a key step in how to respond to income tax demand notice if you believe the claim is incorrect.

Partial Acceptance and Partial Disagreement Cases

In some cases, you may agree to part of the demand but dispute the rest. For such cases:

- Choose “Partially correct”

- Enter the amount you agree to pay

- Provide reasons and documents for the disputed part

In such cases, knowing how to respond to income tax demand notice with partial disagreement can help you avoid excess payment. It helps avoid penalties on the accepted portion and initiates review of the rest.

How to Pay Outstanding Demand

Paying tax dues has become much easier with online services.

Online Payment Through Challan 280

- Go to the income tax portal

- Under “e-Pay Tax”, select Challan 280

- Choose “Self-Assessment Tax” or “Tax on Regular Assessment” depending on your case

- Enter the assessment year and other details

- Pay through net banking, UPI, or debit card

Save the payment receipt carefully.

Providing Payment Details on Income Tax Portal

After paying, revisit the demand notice section:

- Click on “Submit Response”

- Select “Demand is correct and paid now”

- Fill in the BSR code, challan number, and amount paid

- Submit to complete the process

What if the Demand Notice is Incorrect?

Mistakes can happen at the department’s end, too. You have the right to dispute such notices.

Submitting Disagreement Response

As mentioned earlier, choose the “Disagree” option on the portal and explain your reason clearly. This may include:

- Incorrect tax calculations

- Wrong PAN used

- Duplicate entry of demand

- Demand already paid

Documents Required to Dispute a Demand Notice

You may need to upload:

- Form 26AS

- Tax payment challans

- TDS certificates

- Copy of filed ITR

- Communication with employer or banks (if TDS was not reported)

Make sure the documents are clear and accurate to avoid delays in resolution.

Consequences of Not Responding to Demand Notice

Ignoring a tax notice is never a good idea. Here’s what may happen if you don’t respond.

Interest and Penalty Implications

If you don’t pay the demanded amount on time, interest under Section 220(2) is added monthly. Additional penalties may also be levied for non-compliance.

Initiation of Recovery Proceedings

In serious cases, the department can:

- Adjust your refund against the demand

- Attach your bank account

- Recover money directly from your employer or clients

Hence, timely action is very important.

Best Practices When Dealing with Demand Notices

Receiving a tax notice can be stressful, but it doesn’t have to be. The key is to stay calm, act quickly, and follow a clear plan. Understanding how to respond to income tax demand notice correctly can save you from penalties, unnecessary interest, and even legal complications.

Here are some best practices to follow:

Review Form 26AS, AIS, and TIS Carefully

These documents show all your income and tax deductions. Make sure everything reported is correct and matches your return.

Consulting a Tax Professional for Complex Cases

If you don’t understand the demand or the issue is complex, consult a CA or tax consultant. This is especially helpful for a stock market advisory company or freelancers with multiple income sources.

Maintaining Proper Documentation

Always keep records of your ITR, Form 16, Form 26AS, TDS certificates, and tax payment challans. Good record-keeping avoids future problems.

Conclusion

Importance of Timely and Correct Response to Demand Notices

A demand notice is not the end of the world. It’s simply the department’s way of pointing out a gap. Whether it’s an error or an actual shortfall, responding quickly and accurately is key. Knowing how to respond to income tax demand notice can help you stay stress-free and compliant. Understanding income tax basics and using official resources can ensure your tax journey remains smooth and trouble-free.

FAQs

1. How do I check if there is a pending tax demand against me?

Log in to www.incometax.gov.in, go to Pending Actions > Response to Outstanding Demand to view any pending demands.

2. Can I ignore a small demand amount?

No, even small demand amounts must be addressed. Ignoring them may result in interest, penalties, or refund adjustments.

3. How long do I have to respond to a demand notice?

Generally, you are given 30 days from the date of the notice to respond. Always check the specific due date mentioned in your notice.

4. Can demand notice errors be rectified online?

Yes. You can dispute incorrect demands through the income tax portal by submitting the reason and uploading documents.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora