From managing everyday SIPs and powering long-term wealth creation for millions of Indians, ICICI Prudential AMC has been a steady force in the mutual fund space.

Now, the fund house is gearing up for something even bigger. With a ₹10,000 crore initial public offering (IPO) in the pipeline, the company is set to launch what could be the biggest IPO ever in India’s asset management space.

Backed by ICICI Bank and Prudential Plc, this mega listing will not only be a significant milestone for the AMC industry but will also offer retail and institutional investors a chance to participate in one of the most profitable segments of the financial services market.

Let’s dive into the key details of this IPO, the company’s fundamentals, and what investors need to know.

ICICI Prudential AMC IPO Details

ICICI Prudential AMC is preparing to raise ₹10,000 crore through its IPO, expected to launch in FY26. The IPO will be an offer for sale (OFS) by existing shareholders — primarily ICICI Bank and Prudential Corporation Holdings. The company filed the DHRP with SEBI on 8 July 2025.

Analysts expect the IPO to be priced in the range of ₹450–₹500 per share, though final pricing will be confirmed post DRHP approval.

ICICI Prudential AMC has appointed a record 18 merchant bankers to manage the IPO, marking the highest number of lead managers appointed for any AMC listing in India.

Source: Moneycontrol

IPO Structure & Objective

The IPO of ICICI Prudential AMC will be an offering of 1.76 crore equity shares by Prudential Corporation Holdings. No fresh equity will be issued by the company. Simply put, all the proceeds from the IPO will go to the selling shareholder, while ICICI Prudential AMC will not receive any of the funds raised.

The primary aim of the IPO is to unlock value and list one of India’s most well-known fund houses on stock exchanges. This will help improve brand visibility, offer liquidity to existing stakeholders, and pave the way for future growth.

Source: Financial Express

ICICI Prudential AMC Company Overview

Established in 1993, ICICI Prudential AMC is a joint venture between ICICI Bank (51% stake) and UK-based Prudential Plc (49%). It is one of the oldest and most trusted mutual fund houses in India.

The AMC manages a diverse portfolio of mutual fund schemes, including equity, debt, hybrid, ETF, and fixed maturity plans, catering to retail, HNI, and institutional investors. It is also a key player in portfolio management services (PMS) and alternative investment funds (AIF).

With a strong distribution network and focus on investor education, ICICI Pru AMC has positioned itself as a retail-friendly, transparent fund house over the years.

Assets Under Management (AUM) & Market Share

As of June 2025, ICICI Prudential AMC’s total Assets Under Management (AUM) stood at over ₹5.4 lakh crore, making it the second-largest fund house in India, just behind SBI Mutual Fund.

The company’s average AUM grew steadily from ₹4.2 lakh crore in FY22 to ₹5.4 lakh crore in FY25. It commands around 13% market share in the Indian mutual fund industry and has a wide presence across Tier 1, Tier 2, and semi-urban regions.

Source: Financial Express

Profitability and Financials

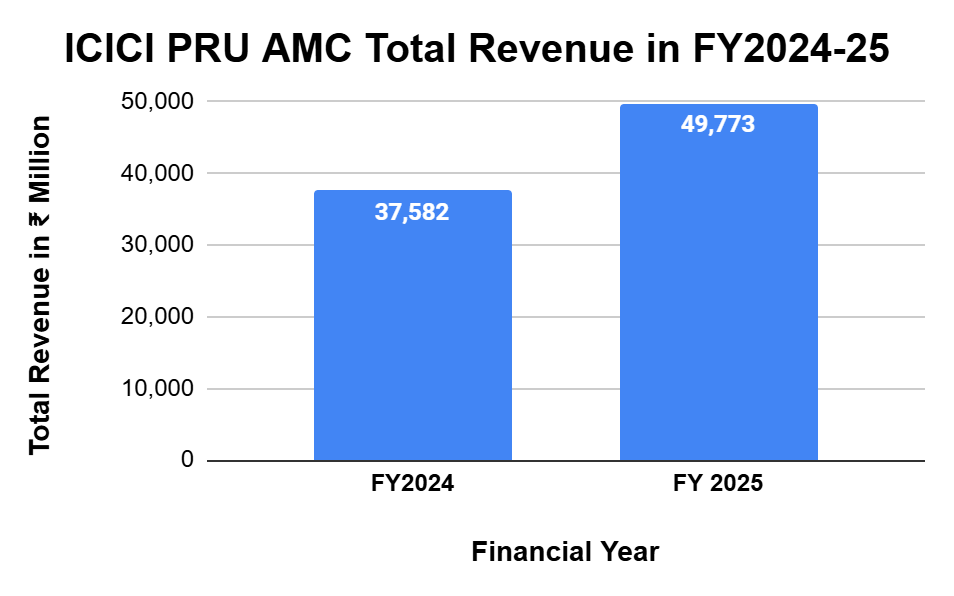

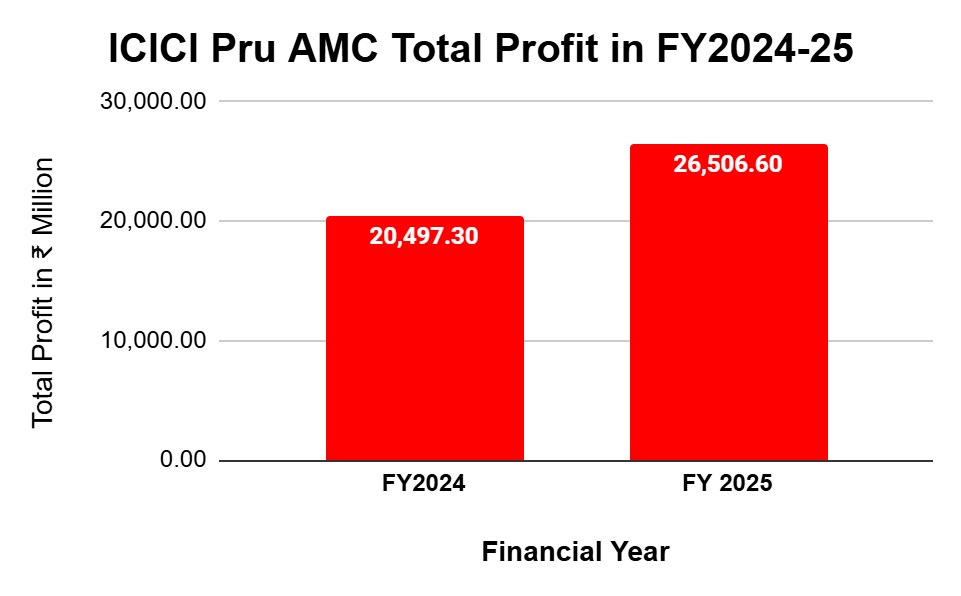

ICICI Pru AMC is among the most profitable AMCs in India, driven by consistent fee income, operational efficiency, and strong retail SIP inflows.

Here’s a snapshot of its key financials (as per available FY24–25 estimates):

- Revenue: ₹3,758 crore

- Profit for the Year: ₹2,650 crore

- EBITDA Margin: 39.3%

- Return on Equity (RoE): 30%+

- Net Worth: Approx. ₹4,200 crore

Source: ICICI Pru AMC 32nd Annual Report, Financial Express

Source: ICICI Pru AMC 32nd Annual Report

Source: ICICI Pru AMC 32nd Annual Report

IPO Size Comparison: How Big Is ₹10,000 Crore?

To understand the scale, here’s how ICICI Pru AMC’s IPO compares to previous listings:

- Nippon Life India AMC IPO (2019): ₹1,542 crore

- UTI AMC IPO (2020): ₹2,160 crore

- HDFC AMC IPO (2018): ₹2,800 crore

At ₹10,000 crore, ICICI Pru AMC’s IPO is nearly 3.5x larger than the biggest previous AMC listing. It reflects both market confidence and the company’s intent to position itself as a dominant, publicly-traded asset manager.

Key Strengths of ICICI Prudential AMC

- Trusted Brand: Strong parentage from ICICI Bank and global partner Prudential

- Wide Reach: 250+ branches and partnerships with 80,000+ distributors

- Digital First: Online onboarding, SIPs, robo-advisory services

- SIP Leadership: Among top 3 AMCs in monthly SIP book (~₹1,500 crore/month)

- Product Innovation: Among the first to launch passive funds, factor-based ETFs, and ESG offerings.

These strengths provide stability to the AMC’s operations while allowing it to innovate and stay ahead in a competitive market.

Risks to Watch Before Investing

While the IPO seems promising, investors should also consider these potential risks:

- Market-Linked Business: Revenue and AUM growth are directly tied to stock market performance.

- Fee Compression: Industry regulator SEBI is constantly pushing for lower expense ratios, which may impact margins.

- Intense Competition: More than 45 AMCs are operating in India, with SBI, HDFC, and Nippon also vying for retail market share.

- Regulatory Risks: Changes in taxation, compliance rules, or investment limits could impact operations.

What Should Investors Do?

ICICI Pru AMC is a top-tier, dividend-paying asset management company with strong margins, high return ratios, and deep brand trust. Long-term investors looking to diversify their portfolio with financial services exposure, especially in non-banking assets, must wait for the final DRHP, review valuation multiples, and consider broader market conditions before committing.

Conclusion

ICICI Prudential AMC’s ₹10,000 crore IPO is not just another listing—it’s a benchmark moment for India’s mutual fund industry. With 18 merchant bankers onboard, a solid growth story, and a robust financial profile, the company aims to make a strong debut on Dalal Street.

While the fundamentals are impressive, informed investment decisions should be based on a thorough analysis of the DRHP and market valuation once details are released. As India’s appetite for mutual funds grows, ICICI Pru AMC’s IPO could be a key milestone in retail investor participation in the financial markets.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora