Trade talks between India and the United States are heating up again, and this time, the global stage is watching closely.

With the US preparing to implement a new wave of tariffs beginning August 1, 2025, the pressure is mounting on countries, including India, to strike a deal or face the consequences.

US President Donald Trump has already sent out tariff notification letters to several trading partners. While the original deadline was July 9, the timeline has now been extended, giving countries a few extra weeks to negotiate before the new tariffs go live. Amid this, Trump confirmed that talks with India are “progressing well”, but the outcome remains uncertain.

As the world’s largest and fifth-largest economies attempt to finalize their trade terms, there are five key areas one should closely monitor.

1. Impact of Fresh US Tariffs on Indian Exports

President Trump has signed an executive order that delays the implementation of new tariff rates until August 1, 2025, extending the 90-day grace period initially scheduled to end on July 9. The US has already outlined punitive tariffs on countries, including Japan, South Korea, Thailand, Indonesia, South Africa, and Bangladesh, among others, with rates ranging from 25% to 40%.

While India’s tariff terms are still under negotiation, the risk of being included in future rounds remains if talks stall. If tariffs are levied, the impact could be significant on sectors where India is a major exporter:

- Pharmaceuticals: India holds a dominant position in the generics market. Its leverage is high, but disruptions could affect pricing and supply chains.

- Textiles & Apparel: A price-sensitive sector that could suffer margin pressure if tariffs are applied.

- Gems & Jewellery: A key export category that may face demand shifts if made costlier by duties.

- Electronics & Auto Components: India’s presence is growing, and tariff-induced price hikes could impact competitiveness.

Countries like Bangladesh (35% tariff), Cambodia (36%), and Indonesia (32%) have already been hit with increased rates, indicating that lower-cost suppliers in Asia are being targeted broadly.

Source: The Mint

2. The Steel, Aluminum, and Auto Components Equation

India’s steel and aluminum sectors are already under scrutiny due to Section 232 tariffs. With US tariffs returning to pre-negotiated levels for many countries, there’s a chance similar measures could be reinstated on Indian metal exports if no trade deal is finalized.

Additionally, the automotive and auto parts sectors are likely to come into sharper focus. The US is a large market for Indian-made components. If tariffs rise, the supply chain may need to be recalibrated. Indian suppliers could lose ground to domestic US producers or face cost escalations that make exports less attractive.

The Trump administration’s decision to impose 25% tariffs on Japan and South Korea, major auto exporters, reflects the direction trade policy is taking and highlights the need for India to secure sector-specific protections if a deal is to be signed.

Source: The Mint

3. Domestic Market Reactions and Stock Market Volatility

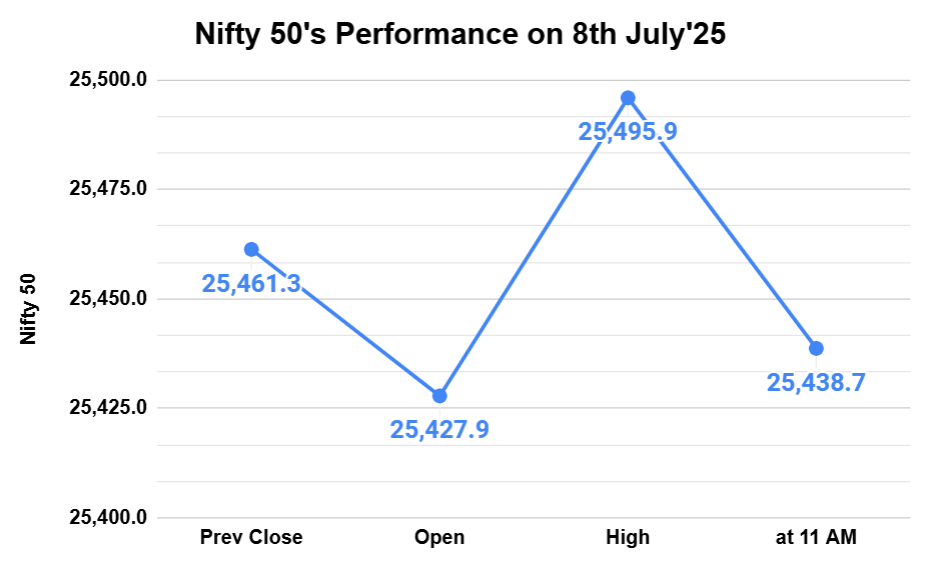

Uncertainty over the trade deal has already impacted Indian financial markets.

Source: NSE

Investors appear to be in “wait and watch” mode. While no tariffs on India have been finalized yet, the fear of potential retaliatory action, rising input costs, and sector-specific disruption is creating cautious sentiment.

Given that trade-related uncertainty can influence foreign investment and currency movements, any negative turn in US-India negotiations could result in short-term market corrections.

4. Strategic Sectors Where India Has Leverage

Despite the risks, India also holds negotiating power. In sectors like active pharmaceutical ingredients (APIs), specialty chemicals, and certain textiles, India has a near-monopoly or dominant global share.

If the US wants to maintain consistent supply in these strategic areas especially in healthcare, India can push for favorable tariff terms or exemptions. This is particularly relevant as Vietnam recently negotiated a reduction in proposed US tariffs from 46% to 20% in exchange for easing US market access.

India could explore similar sectoral negotiations to protect its strongest export categories. This approach could enable India to retain its competitive edge in essential categories even under broader tariff enforcement.

5. The Broader Geopolitical and Trade Context

President Trump has made it clear: countries that fail to negotiate will face higher tariffs, and retaliation will be met with equal escalation. The trade letters warned that if any country raised its own tariffs in response, the US would match that increase proportionally.

So far, deals have been concluded with China, Vietnam, and the UK, and talks with India and the European Union are underway. However, 12 other countries, including Malaysia, Tunisia, Kazakhstan, Serbia, Bosnia, and others, have received tariff letters and have yet to respond substantively.

For India, the strategic calculus is complex. On one hand, it needs to preserve export momentum amid a global slowdown and inflationary pressures. On the other, India must balance its economic priorities and domestic manufacturing goals (such as Make in India) with international trade obligations.

Whether a final deal will be signed before August 1 remains unclear, but the path forward will likely shape India’s trade trajectory for years to come.

Conclusion

As the deadline approaches, the India-US trade discussions are at a critical juncture. The five areas highlighted will determine not just whether a deal gets done, but also how India’s export economy evolves in a more protectionist global environment.

While the final details are yet to be revealed, these moving pieces make it essential to stay informed as we approach the August 1 deadline. With other nations already feeling the impact of announced US tariffs, India’s next steps could shape both bilateral relations and its broader position in global trade.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora