Editor’s Note: Before you dive in, this Independence Day, set your portfolio free from WhatsApp/Telegram “stock tips.” Build wealth with research, process, and a SEBI-registered stock market advisory — the same discipline that helped century-old franchises like Tata Steel and ITC to keep compounding.

Read on…

ITC’s Journey from Pre-Independence till Date

A steady journey can take you far, but when growth slows in one path, the smartest move is to explore new ones. That’s how you stay relevant as times change.

Over a hundred years ago, a British businessman in colonial India knew this well. Starting with a small cigarette shop in a rented room along the narrow lanes of Kolkata, he laid the foundation for something far bigger.

Over the decades, ITC embraced change, moved beyond tobacco, and became part of everyday Indian life, reaching into FMCG, hotels, technology, agriculture, and more.

Today, ITC stands tall as a proudly Indian enterprise worth more than ₹5 lakh crore, touching millions of lives across the nation.

So, how did a cigarette maker turn into one of India’s biggest conglomerates? Read on…

The Beginning of ITC

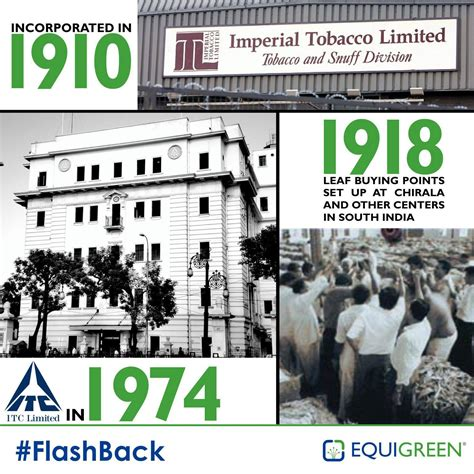

The year was 1910. William M. Jacks founded the Imperial Tobacco Company of India. At the time, cigarettes were the core business, and the market was just beginning to take shape in colonial India. The first office was modest—a small rented space in Kolkata.

In 1926, a decision was made that would mark the beginning of ITC’s identity—a purchase of land at 37, Chowringhee, Kolkata, for Rs. 3,10,000. This site would later become the iconic Virginia House, the headquarters that still stands tall as a symbol of ITC’s heritage.

The company’s name was symbolic of its British roots, but as the decades rolled on, so did its identity. By 1974, “India” replaced “Imperial” in its name, making it the “India Tobacco Company Limited.” Later, as ITC diversified, the word “tobacco” became limiting. In 2001, it became simply “ITC Limited,” a name that reflected its broad ambitions.

ITC’s First Expansion

In 1925, just 15 years after it began, ITC stepped into packaging and printing. Initially, this was to support its cigarette business with high-quality packaging. However, the expertise gained here would later allow ITC to cater to other industries.

This strategic decision laid the groundwork for ITC’s understanding of branding, product presentation, and supply chain integration—skills that would be critical in its later diversification.

ITC’s Big Leap into Hospitality

By the 1970s, ITC realized that cigarettes alone could not be the future. The global push against tobacco was growing, and diversification was essential. In 1975, ITC entered the hospitality sector by acquiring a hotel in Chennai, marking the birth of ITC Hotels.

ITC Grand Chola Chennai

This was not just a business move—it was about representing Indian hospitality on the global stage. Over time, ITC Hotels became known for luxury, sustainability, and blending Indian culture with world-class service. Today, the chain has more than 115 properties across different brands, from the luxury ITC Hotels to the affordable WelcomHeritage line.

Building Sustainability

In 1979, ITC founded ITC Bhadrachalam Paperboards, stepping into the paper and packaging industry. This was not just about diversification—it was a move aligned with sustainability and rural development.

ITC Bhadrachalam Unit

The region of Sarapaka in Andhra Pradesh, where the plant was located, was once economically backward.

ITC’s investment brought jobs, infrastructure, and livelihood opportunities, transforming the area. Later, the company merged the plant with the Tribeni Tissues Division, creating the Paperboards & Specialty Papers Division.

Taking the Brand Beyond Borders

In 1985, ITC made its first international move by establishing Surya Tobacco Co. in Nepal. This was a signal that the company was ready to test itself beyond India. The move was strategic—close to home, yet with the challenges of cross-border operations.

ITC Forays into Nepal with Surya

Through the 1990s, ITC also expanded its agribusiness. Leveraging its sourcing expertise from the tobacco trade, ITC entered into agricultural commodities. This would later become the Agri Business Division, one of India’s largest exporters of agri-products.

Entering the World of Education and Technology

By the turn of the millennium, ITC’s diversification accelerated. In 2000, it created ITC Infotech India, a subsidiary focused on providing IT services globally. While not as large as India’s IT giants, ITC Infotech carved its niche in specialized tech services.

In the early 2000s, ITC also ventured into education and stationery. Brands like Paperkraft and Classmate became household names, especially among students. Classmate, in particular, stood out for its quality notebooks and its socially conscious campaigns promoting education.

ITC’s Big FMCG Leap

If there was one move that truly reshaped ITC’s public image, it was the launch of its FMCG foods business in 2001.

Starting with packaged foods like Aashirvaad atta, Sunfeast biscuits, and Bingo! snacks, ITC became a serious competitor to established players in India’s food industry. The company leveraged its distribution network, brand-building skills, and deep understanding of Indian consumer preferences to grow rapidly.

In 2005, ITC expanded further into personal care products, launching brands in skincare, soaps, and hygiene. Fiama, Vivel, and Savlon became notable players in their categories, proving that ITC could compete outside its traditional comfort zone.

Innovation and Acquisitions

ITC’s rise has never relied solely on organic growth—it has been equally driven by timely acquisitions and bold product launches. In 2010, the company made a classy debut in the premium cigar space with Armenteros. Between 2014 and 2020, it enriched its FMCG portfolio with ready-to-eat meals, dairy offerings, and frozen snacks, catering to changing lifestyles.

By 2021, ITC stepped into the dishwashing gel category, adding more shine to its home care segment. Each of these moves was powered by a blend of innovation, a robust supply chain, and a sharp pulse on what Indian consumers truly want.

Balancing Profit with Purpose

What sets ITC apart is its deep-rooted commitment to sustainability—a promise it has upheld for decades. The company has turned environmental responsibility into a way of doing business. For over 20 years, it has been water positive, conserving and replenishing more water than it consumes. For more than 15 years, it has remained carbon positive, reducing emissions while growing its operations. Its solid waste management efforts ensure that it recycles more than the waste it generates, closing the loop on sustainability.

Beyond the environment, ITC has also touched countless rural lives. Through initiatives like e-Choupal, it has connected farmers to better market access, real-time information, and fairer prices, transforming not just businesses, but entire communities in rural India.

ITC in the Present Day

Today, ITC stands far beyond its tobacco origins—it is a sprawling conglomerate with a commanding presence across multiple industries.

In FMCG, it is home to household names like Aashirvaad, Bingo!, Sunfeast, Yippee!, Fiama, Vivel, and Savlon. Its hospitality arm boasts over 115 luxury and heritage properties that reflect India’s warmth and elegance.

In paperboards and packaging, ITC leads the way in eco-friendly and specialty solutions. Its agribusiness division ranks among the country’s largest exporters of agricultural commodities, while ITC Infotech delivers technology solutions to clients across the globe.

This carefully balanced mix of businesses not only cushions the company against risks but also opens doors to opportunities in diverse markets.

ITC’s stock performance numbers tell a story too…

The company is a big dividend payer and has rewarded investors with hefty payouts.

Apart from that, its stock price has also grown by leaps and bounds in the past two and a half decades.

ITC Share Price Since 2000

Today, the company commands a market cap of more than Rs 5 lakh crore, and is the 11th most valuable company in India in terms of market cap.

A Future Beyond Legacy

As ITC looks ahead, its vision is clear and ambitious. It aims to deepen its FMCG footprint, taking on both homegrown and global giants with equal zeal. Sustainability will remain a cornerstone, as the company continues to lead in environmental stewardship.

The digital wave is another priority—strengthenng ITC Infotech and weaving technology into its supply chain and marketing strategies. And beyond India’s borders, ITC is set on carrying Indian brands to global shelves. Given its century-long record of adaptability, there’s every reason to believe ITC will keep evolving in step with changing consumer tastes, shifting markets, and the planet’s pressing needs.

A Century of Lessons

ITC’s 100-year journey teaches us that no company is bound by its origin story. Starting as a tobacco company could have limited ITC’s possibilities, but strategic diversification, relentless innovation, and a focus on sustainability transformed it into a multisector powerhouse.

Today, ITC is not just a business—it is part of India’s economic fabric, contributing to growth, creating jobs, and promoting sustainability. Its story is proof that with vision and adaptability, even a company rooted in a single product can become a symbol of diversified success.

As 15 August 2025 approaches, take a cue from this century-old champion.

Set your portfolio free—dump the noise of social-media “gurus” and partner with a trusted, SEBI-registered investment advisory. Because true financial freedom isn’t about chasing hot tips; it’s about forging wealth with discipline, research, and time—just like ITC has done for India for over a hundred years.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 15

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora