Once touted as the next big disruptor in India’s financial services space, Jio Financial Services hasn’t exactly lived up to the hype, at least not on the stock market.

In the last one year alone, the stock is down 7%.

This, despite all the buzz around:

- Its Reliance pedigree

- The massive financial opportunity in India

- And a series of headline-grabbing announcements last year

But now, the company has just dropped its Q1 results.

So… is this the turning point?

Is a comeback rally around the corner?

Or is the stock still running more on speculation than substance?

Let’s dig in and find out.

Jio Financial Declares Q1 Results

Jio Financial Services post market hours on Thursday reported a 3.8% growth in its Q1FY26 consolidated net profit at Rs 325 crore.

The company’s revenue from operations surged 47% at Rs 612 crore.

The Mukesh Ambani company drew revenue of Rs 363 crore as interest income.

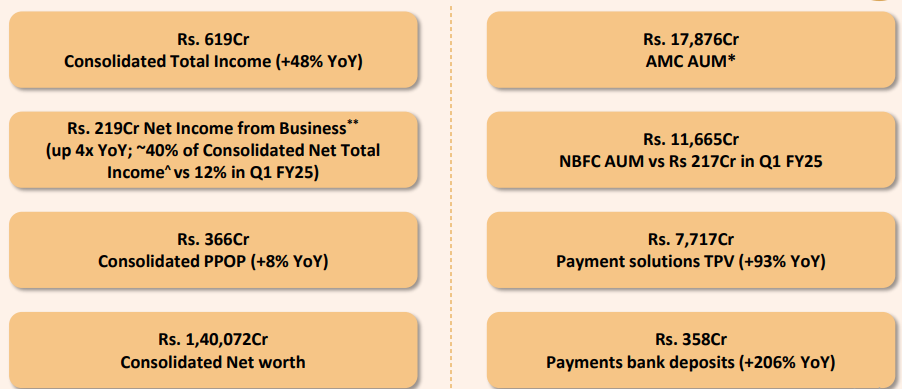

Jio Financial Services Q1 Highlights

Source: Company Reports

Recent Developments

In the last few weeks, Jio Financial Services has fired on all cylinders, unleashing a series of bold moves that have the Street buzzing.

Jio BlackRock is now officially a broker!

SEBI has recently granted Jio BlackRock Broking the green light to kick off stock broking and clearing operations in India.

A JV between Jio Financial and global investing giant BlackRock, this move alone sent the stock flying.

100% control of Jio Payments Bank

Jio Financial has also acquired SBI’s stake in Jio Payments Bank for ₹1.04 billion, making it a wholly owned subsidiary.

Backed by RBI’s approval, this step signals deeper integration and greater control over its digital banking ambitions.

But wait, there’s more…

Investors Expectations

Jio isn’t just making headlines, it’s building an empire.

It pumped ₹13.5 billion into group companies in FY25 to scale operations.

Further, it plans to unleash AI-driven analytics to deliver hyper-personalized financial products in FY26.

The company even infused ₹1.9 billion into Jio Payments Bank for aggressive expansion.

During the quarter, it even received a nod for its Asset Management Company business via Jio BlackRock AMC.

All of this in a financial services sector that’s heating up thanks to digitisation, inclusion, and government tailwinds.

On the valuations front, however, the stock is still trading at a premium valuation.

So the real question is: Are we witnessing the birth of a true fintech powerhouse? Or is this just a hype cycle waiting to fade?

Taking Advantage of a Structural Opportunity

India’s financial sector is in the middle of a major transformation.

With rising financial inclusion, rapid digitisation, and policy support from the government, the foundation is being laid for an ambitious leap—a financial ecosystem capable of supporting a US$30 trillion economy by 2047. That’s nearly 20x growth from current levels.

This wave of structural change isn’t just exciting—it’s inevitable.

And for a company like Jio Financial Services, which is aggressively building out its presence across broking, payments, and asset management…

…it’s a rare moment of alignment between timing, technology, and ambition.

The stage is set.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora