JSW Steel has become India’s largest steel manufacturer by market capitalization, overtaking Tata Steel. While other steel manufacturers are facing operational challenges, global headwinds, JSW Steel continues to expand its footprint, both in India and overseas, through aggressive brownfield expansions and capacity additions at existing plants.

In this article, we will take a closer look at JSW Steel share price performance, operational strength, and the long-term growth outlook. Let’s dive in.

JSW Steel Business Overview

JSW Steel is one of India’s largest integrated steel manufacturers. Founded in 1994, it has grown into a global player with exports to 100+ countries.

The annual steel production capacity is 38.5 million tonnes with its six operational plants in India and the US.

In India, it has plants in Vijaynagar, Dovi, Salem, Tarapur, Vasind, and Kamleshwar. The Vijaynagar plant is India’s biggest single-location steel plant.

It has a diverse product portfolio, including flat products, long & special steel, and value-added steel products (VASP), which contribute nearly 60% of the sales.

The company is recognized for its innovative products. It has a technological partnership with JFE Steel of Japan for the manufacturing of high-strength automotive wheels. And has also won many accolades for its sustainability efforts.

JSW Steel is recognised as a 2025 Sustainability Champion by the World Steel Association for the 7th consecutive year.

JSW Steel Leadership Team

Mr Sajjan Jindal is the Chairman and Managing Director of JSW Steel and also the principal promoter of the company.

Mr Jayant Acharya is the Joint Managing Director and CEO. He started his career in the year 1986 with SAIL. With over three decades of experience in the metal & mining industry, Mr Acharya played a key role in the growth of JSW Steel. He holds a Bachelor’s degree in Chemical Engineering, a Master’s degree in Physics from BITS Pilani, and an MBA degree.

Mr Gajraj Singh Rathore is the Whole‑Time Director & COO of the company. He has over 35 years of experience in the steel industry and has been with JSW Steel for the past 27 years. He played a key role in the successful expansion and capacity utilization at Vijaynagar and other steel plants.

Mr Arun Sitaram Maheshwari is the Director (Commercial & Marketing) of JSW Steel and has been with the company for over 28 years. During his tenure, he played a key role in the sourcing of raw materials for the steel and power businesses, shaping corporate strategy, and international presence. Mr Arun holds a B.Com and an MBA degree.

Mr Swayam Saurabh is the CFO and has been with the company since July 2023. A chartered accountant by profession, Mr Swayam was earlier associated with companies like Arvind, Ola, Hindustan Zinc, Philips, etc.

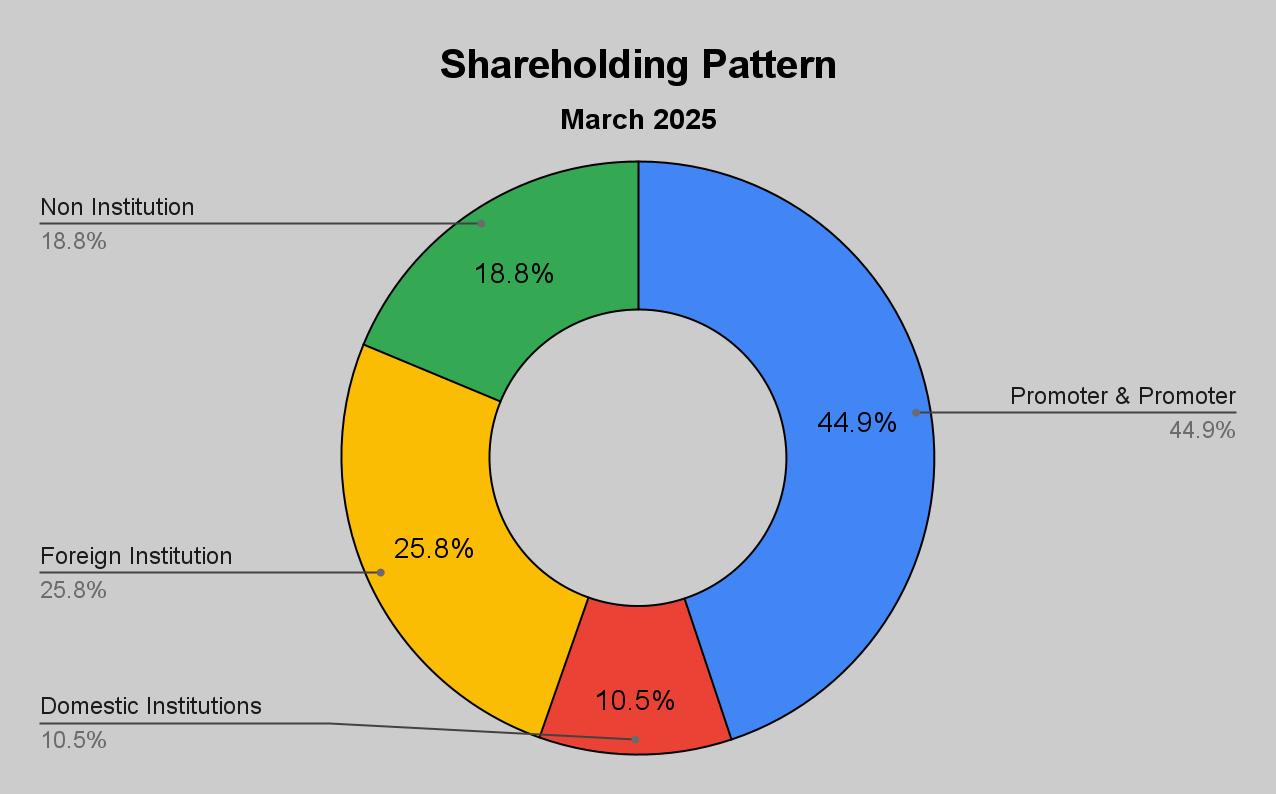

JSW Steel Shareholding Pattern

In the domestic institution segment, mutual funds hold a 3.54% stake in JSW Steel, and LIC holds a 6.45% stake.

And, in the foreign institution segment, JFE Steel International Europe B.V., the technological partner of JSW Steel, holds a 15% stake in the company.

JSW Steel Financials

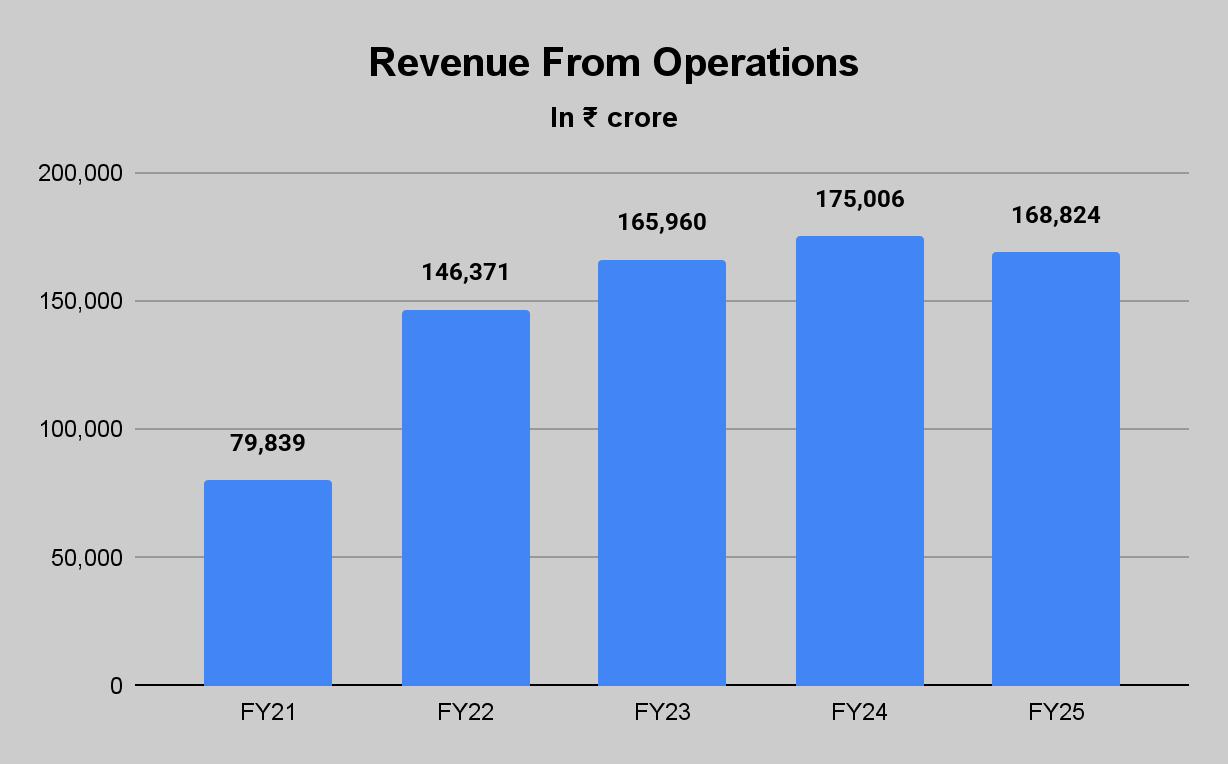

Revenue From Operations

In FY25, the company’s revenue from operations declined by 3.5% year-on-year to ₹1,68,824 crores.

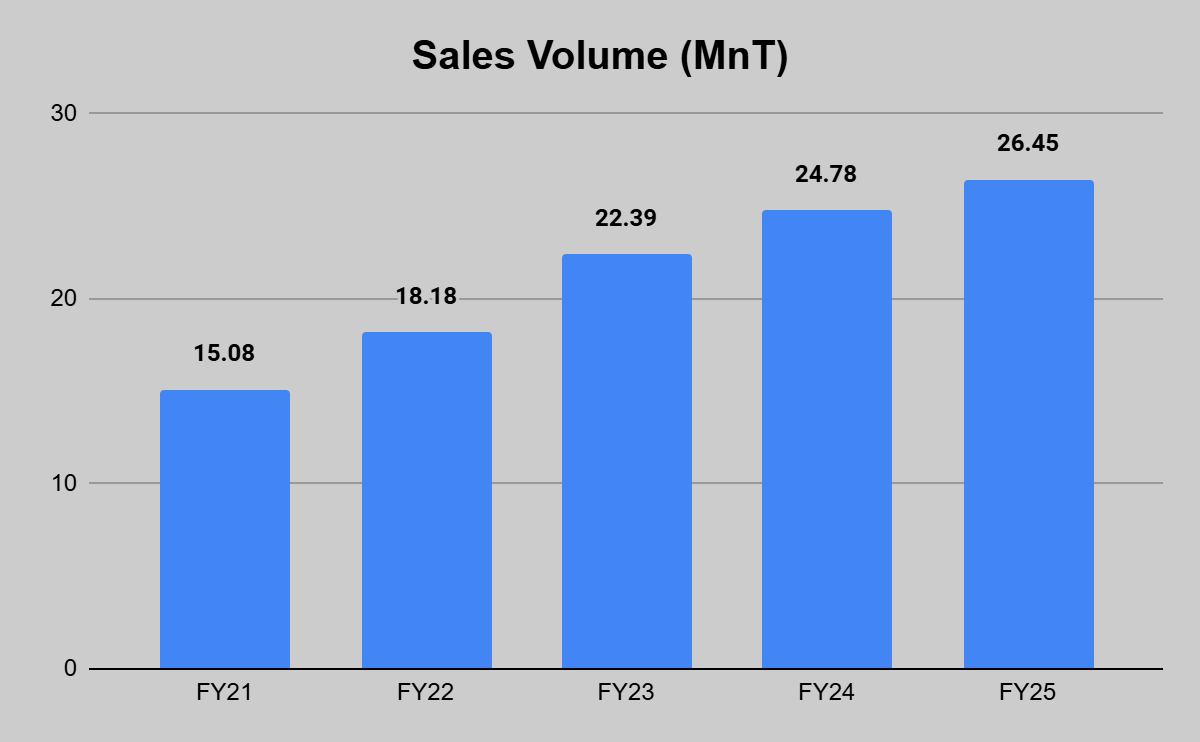

The decline in revenue came despite 6.7% year-on-year growth in sales volume. Globally, steel prices have moderated, which has affected the top-line growth of many steel companies.

In Q1FY26, the company’s revenue from operations increased marginally to ₹43,147 crores from ₹42,943 crores. Total sales volumes during the quarter were at 6.69 MT, up 9% YoY.

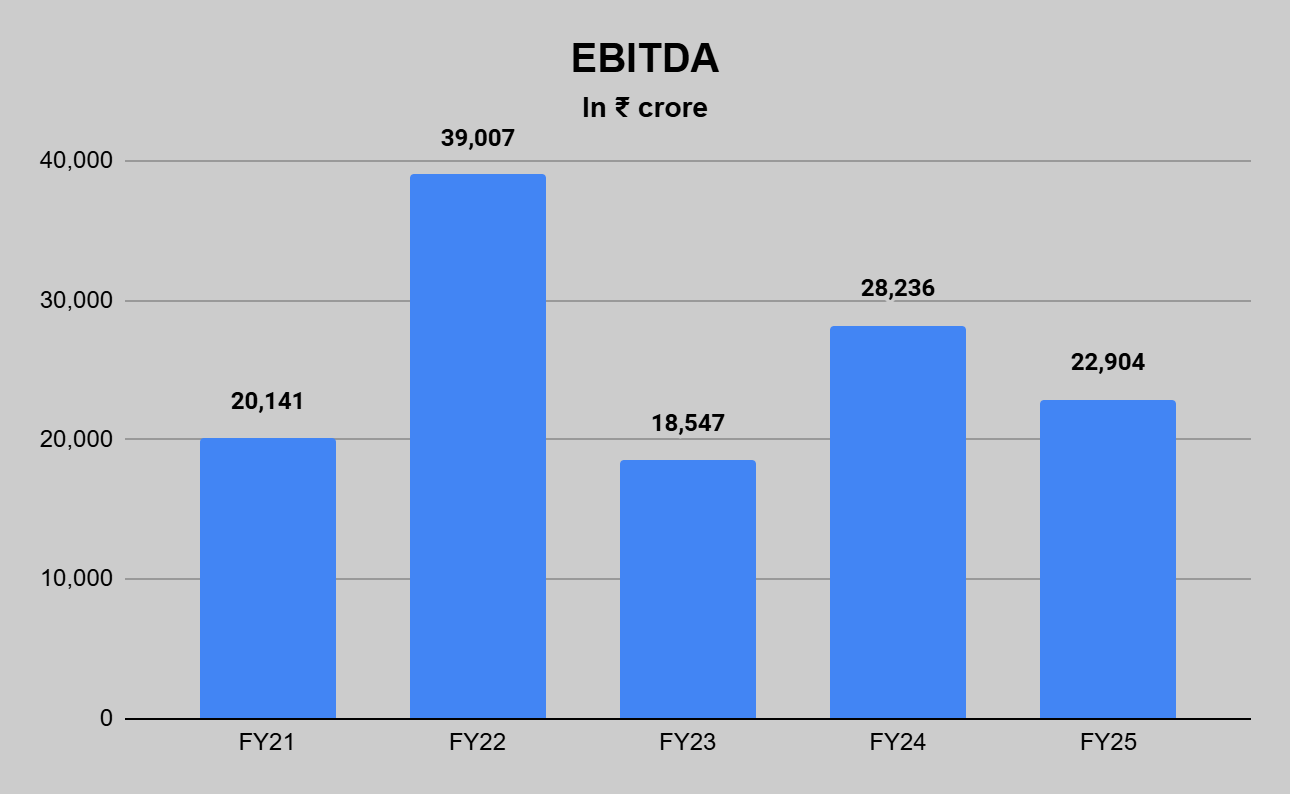

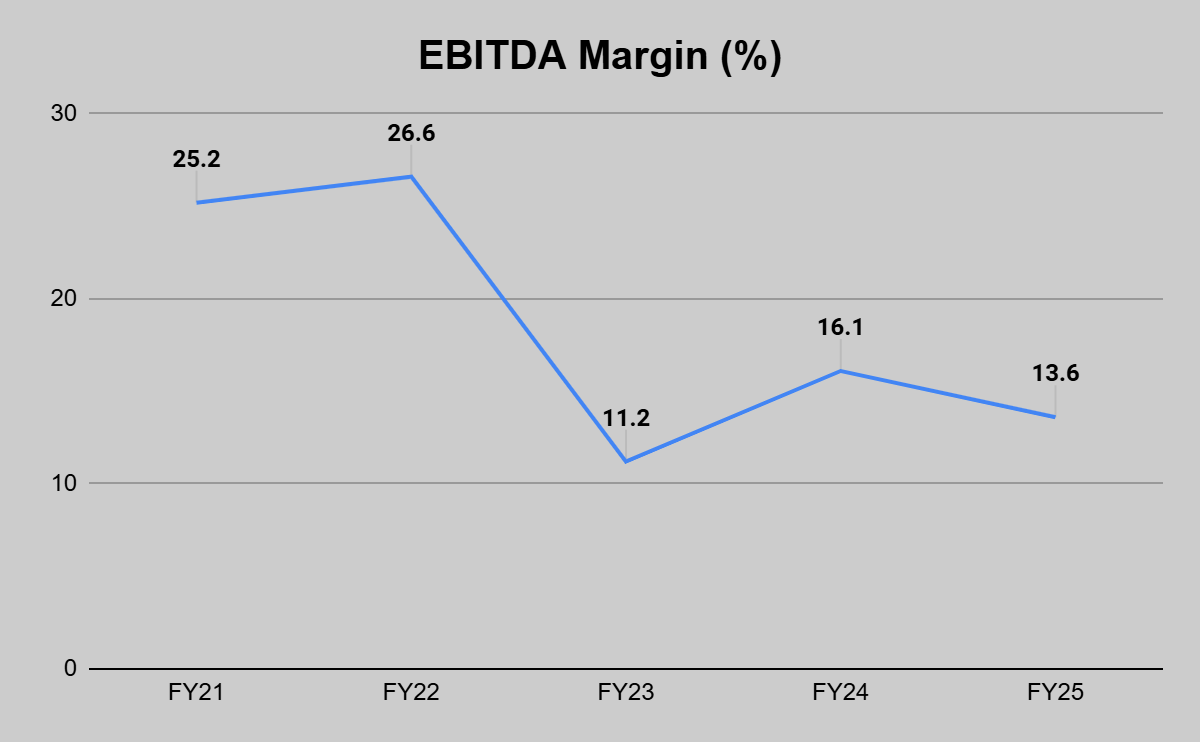

EBITDA

In FY25, EBITDA declined by 19% on a year-on-year basis to ₹22,904 crores from ₹28,236 crores. The decline in EBITDA is due to lower sales realisation on account of moderate steel prices and lower EBITDA from Bhushan Power & Steel.

For the Q1FY26 period, EBITDA improved 37.5% to ₹7,576 crores from ₹5,510 crores in Q1FY25. This is due to lower raw material costs and a higher share of premium products in total sales.

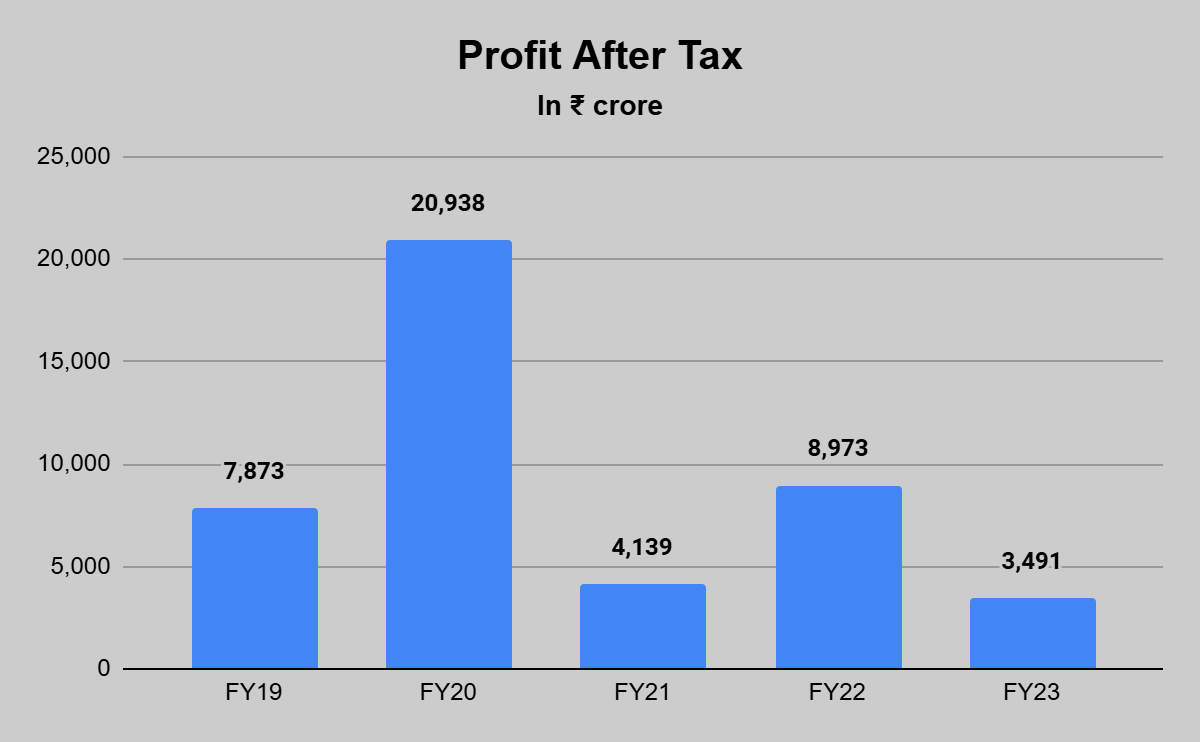

Net Profit

In FY25, the net profit of JSW Steel declined by more than 60% year-on-year to ₹3,491 crores from ₹8,973 crores in FY24.

For Q1FY26, the net profit of the company increased by 154% on a year-on-year basis to ₹2,209 crores from ₹867 crores in Q1FY25.

Key Financial Metrics

Current Ratio: In FY25, the current ratio of JSW Steel improved 22% to 1.06 times from 0.87 times in FY24. The increase is primarily due to an increase in cash and cash equivalents, investments in mutual funds, and lower trade payables.

Debt-to-equity Ratio: Due to higher borrowing, the debt-to-equity ratio of the company increased to 0.82 times in FY25 from 0.78 times in FY24.

Debt Service Coverage Ratio: In FY25, the debt service coverage ratio of the company declined by 20.7% to 2.42 times from 3.05 times in FY24. The decline is primarily due to lower profits during the financial year.

Return on Capital Employed (ROCE): The ROCE of the company declined to 8.59% in FY25 from 12.90% in FY24, primarily due to decreased profit levels.

JSW Steel Share Price Analysis

In the last five years, JSW Steel share price has increased from ₹205 (21st July 2025) to ₹1,031 (23rd July 2025), a rise of almost 405% in 5 years. Its 52-week high level is ₹1,075.

It has a consistent track record of paying dividends to shareholders. In the last three financial years, it has paid ₹3.40 (FY23), ₹7.30 (FY24), and ₹2.80 (FY25) as dividends.

At the current JSW Steel share price of ₹1,031, the dividend yield stands at 0.27%.

JSW Steel Share Price: Future Growth Potential

The steel industry is cyclical, meaning its performance is directly dependent on the state of the economy. When economic growth slows, demand for steel drops, making it tough for businesses.

Because of this, companies like JSW Steel see high variations in revenue and profit growth. Their valuation tends to stay low, with modest P/E, due to the unpredictability in earnings.

Generally, cyclical stocks are best bought when they’re out of favor and sold when businesses boom. As the economy recovers and demand picks up, these stocks usually rally. After 2020, we have seen a strong rally in commodity stocks, including steel.

But mis-timing your entry can hurt your returns. Buying during peak performance leaves little room for upside.

Positives for JSW Steel Share Price

- Favorable cost dynamics. The price of both key raw materials, coking coal and iron ore, is expected to remain soft, helping to improve cost efficiencies.

- Volumes are expected to improve in Q2FY26, as planned plant shutdowns are expected to conclude. And, the addition of new capacities coming on-stream.

- Increasing the share of securing raw materials from captive sources: In FY26, the management expected the company to meet 40% of its iron ore requirement from its sources, up from 37% in FY25. For coking coal, the company doesn’t possess any captive mines as of now. But expects production from the Moitra mine (captive) to commence from June 2026. High captive share is essential for both quality, control over steel prices, and earnings stability.

Negatives for JSW Steel Share Price

- The global economy is experiencing a period of volatility, influenced by tariff escalations and ongoing geopolitical tensions. This uncertainty has led the IMF to lower its 2025 global forecast.

- A sharp revival in Chinese steel demand is a major cause of concern, leading to depressed domestic steel prices. Also, FTAs with Vietnam, Korea, and Japan continue to pose a risk.

- While management expects coking coal prices to remain lower, volatility in iron ore prices can impact margins.

- Legal uncertainty surrounds Bhushan Power & Steel Ltd’s acquisition. The Supreme Court has rejected JSW Steel’s resolution plan for BPSL and has directed refunds of amounts paid to creditors and equity contributions.

Driven by volume growth, a higher share of premium products in revenue, and shoring up its captive sources, JSW Steel offers a compelling growth story. However, the cyclical nature of the industry should be considered before investing in JSW Steel.

FAQ

How has JSW Steel share price performed in the last five years?

JSW Steel has been a multibagger stock in the last five years. JSW Steel share price increased from ₹205 (21st July 2025) to ₹1,031 (23rd July 2025), a rise of almost 405% in 5 years.

Who owns JSW Steel?

JSW Group owns JSW Steel and is headed by Mr. Sajjan Jindal.

Is JSW Steel profitable?

Yes, JSW Steel is a profitable steel manufacturer. In FY25, its net profit was ₹3,491 crores on sales of ₹168,824 crores.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora