Since 2024, Larsen & Toubro share price is moving sideways with no real wealth creation for investors.

But, if you look at the company’s operational performance, revenue and profitability growth has been healthy during the period.

So, why is Larsen & Toubro share price struggling to move higher despite a strong operational performance?

We will do a deep dive analysis of Larsen & Toubro share price, what is impacting its performance, and the future growth outlook of the company.

Larsen & Toubro Business Overview

Larsen & Toubro (L&T) is one of India’s most respected multinational conglomerates, headquartered in Mumbai. Founded in 1938 by Danish engineers Henning Holck-Larsen and Søren Kristian Toubro, the company is a diversified engineering and infrastructure giant.

It operates in key sectors like construction, engineering, heavy equipment manufacturing, defense, information technology (through subsidiaries like L&T Infotech and L&T Technology Services), financial services, energy, and power.

L&T has now expanded its operations to more than 30 countries, with more than 50% revenue now coming from outside India. The company plays a critical role in India’s development journey and is widely regarded as a benchmark in project execution and engineering excellence.

L&T Leadership Team

Mr. S. N. Subrahmanyan is the Chairman & Managing Director and has been with L&T since 1984, joining as a Project Planning Engineer. Under his leadership, the company has completed many key infrastructure projects, including the Statue of Unity, Atal Setu, K9 Vajra Tank, Ayodhya Ram Mandir, and has geographically expanded the company. Mr. Subrahmanyan did his B.Tech in civil engineering from NIT Kurukshetra, a postgraduate degree in business management from Symbiosis Institute of Business Management, Pune, and also did an Executive Management Program from London Business School.

Mr. Subramanian Sarma is the Deputy Managing Director & President of L&T Group. He oversees the energy portfolio of the company, which comprises hydrocarbons, green & clean energy, asset management & offshore wind business. Mr. Sarma is a chemical engineering graduate and did his master’s from IIT Mumbai.

Mr. R. Shankar Raman is the President and Chief Financial Officer of L&T. He joined the L&T group in 1994 and played a key role in setting up L&T Finance. A qualified Chartered Accountant and a Cost Accountant, Mr Raman is responsible for the entire finance function at the group level.

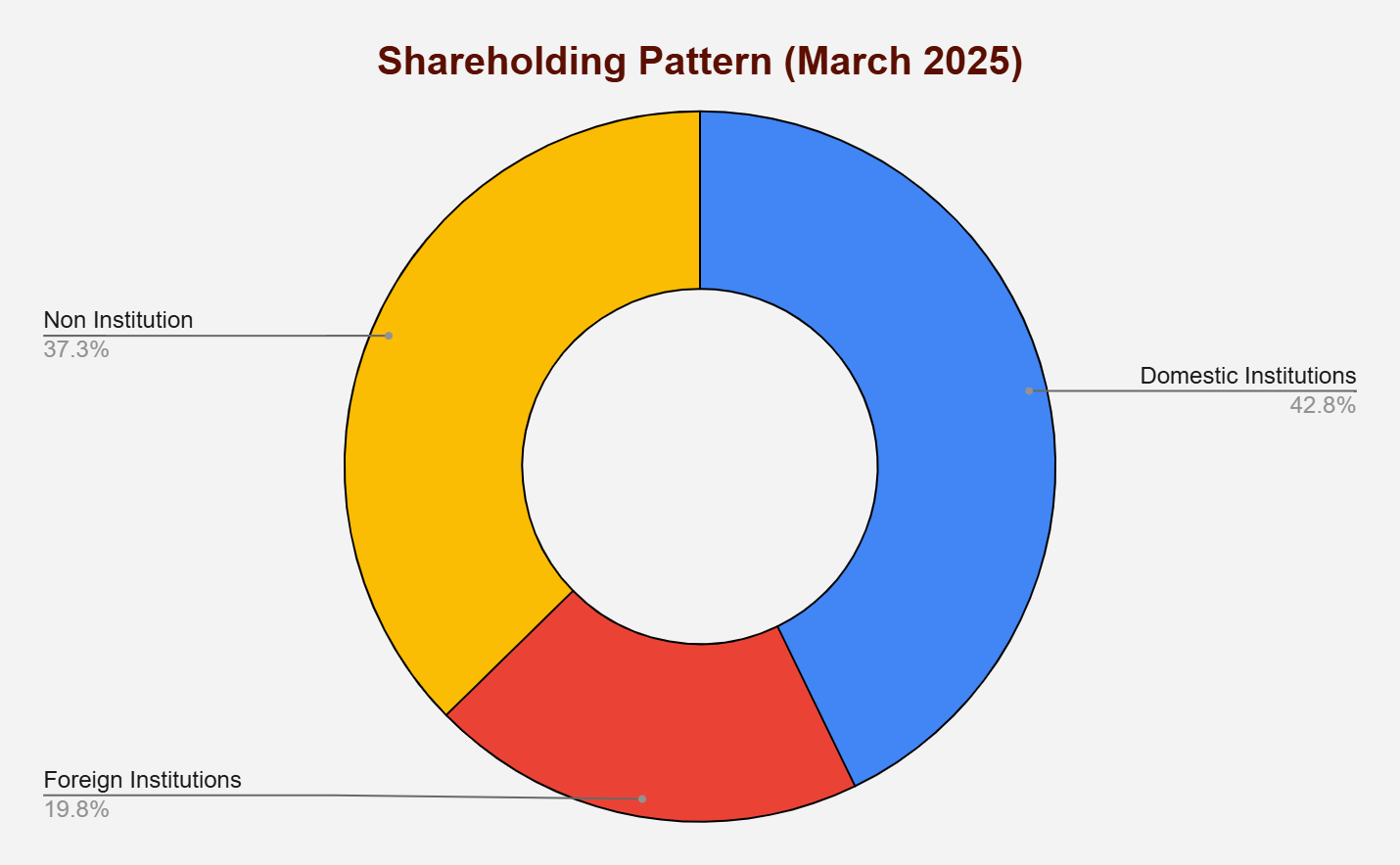

L&T Shareholding Pattern

L&T is a professionally managed company with 100% shareholding held by the public. Nearly 20% of the stake is held by mutual fund houses in India, and LIC holds a 13.25% stake in the company.

Larsen & Toubro Financials

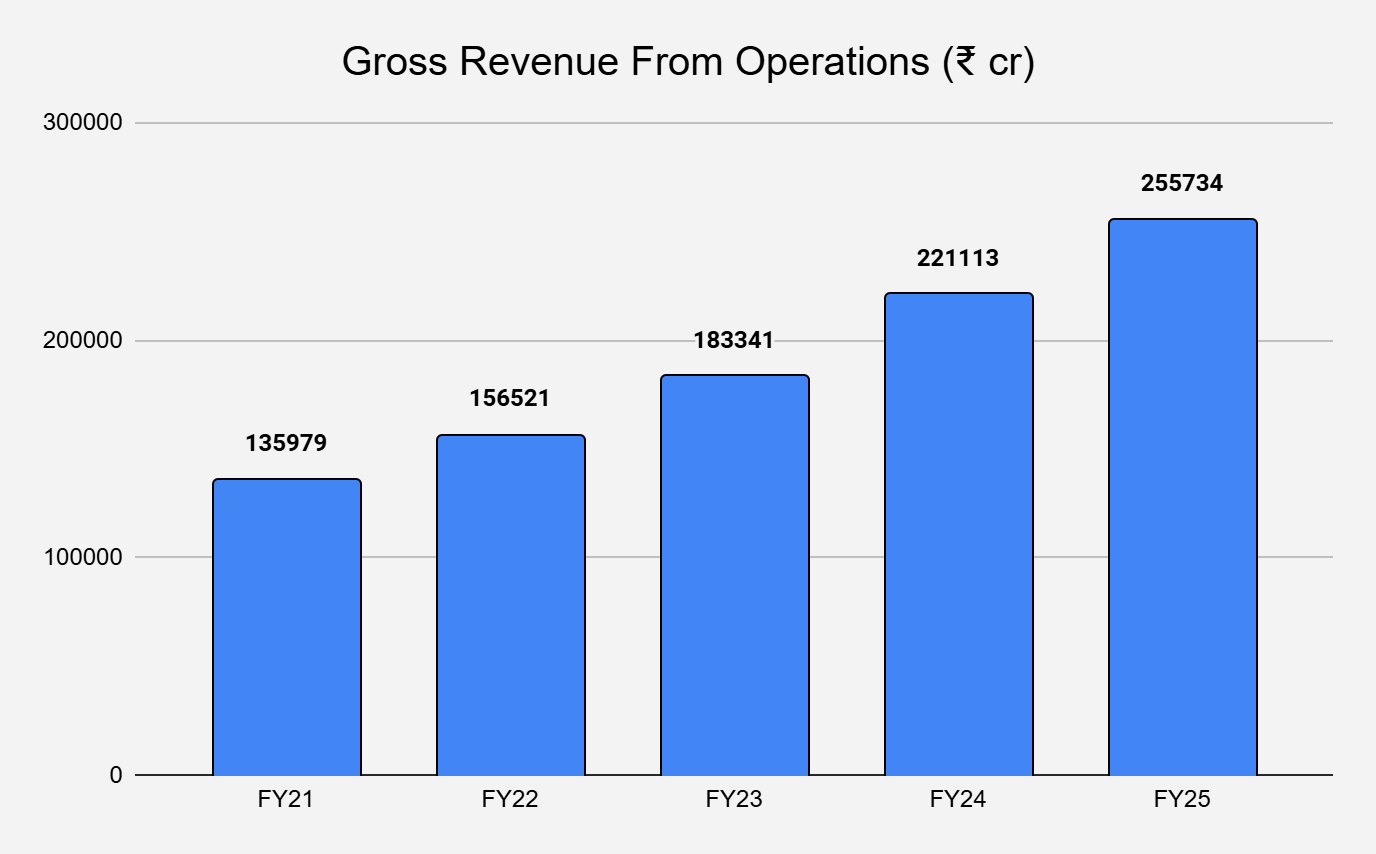

Revenue From Operations

In FY25, L&T’s revenue from operations increased by 16% to ₹2.55 lakh crore from ₹2.21 lakh crore in FY24.

Over the last five years, revenue from operations has increased by 13.47% annually.

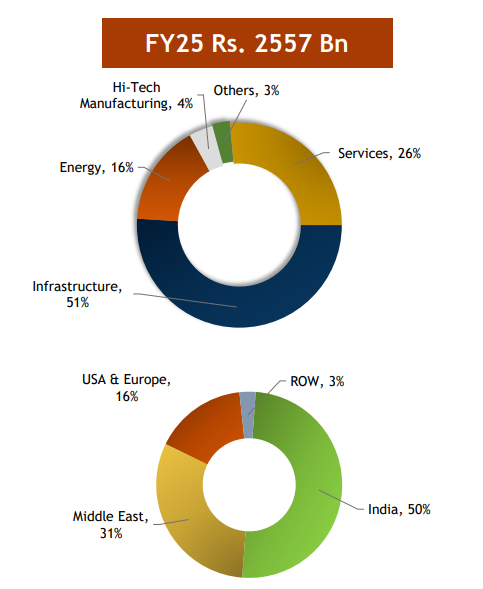

Speaking about the revenue composition, the company earns a lion’s share, i.e., 51% of its revenue from the infrastructure segment, followed by 26% from the services segment and 16% from the energy segment.

Source: Company Presentation

Looking at the geographical distribution of revenue, nearly 50% of the revenue is earned in India, 31% came from the Middle East, 16% from USA & Europe, and 3% from the rest of the World.

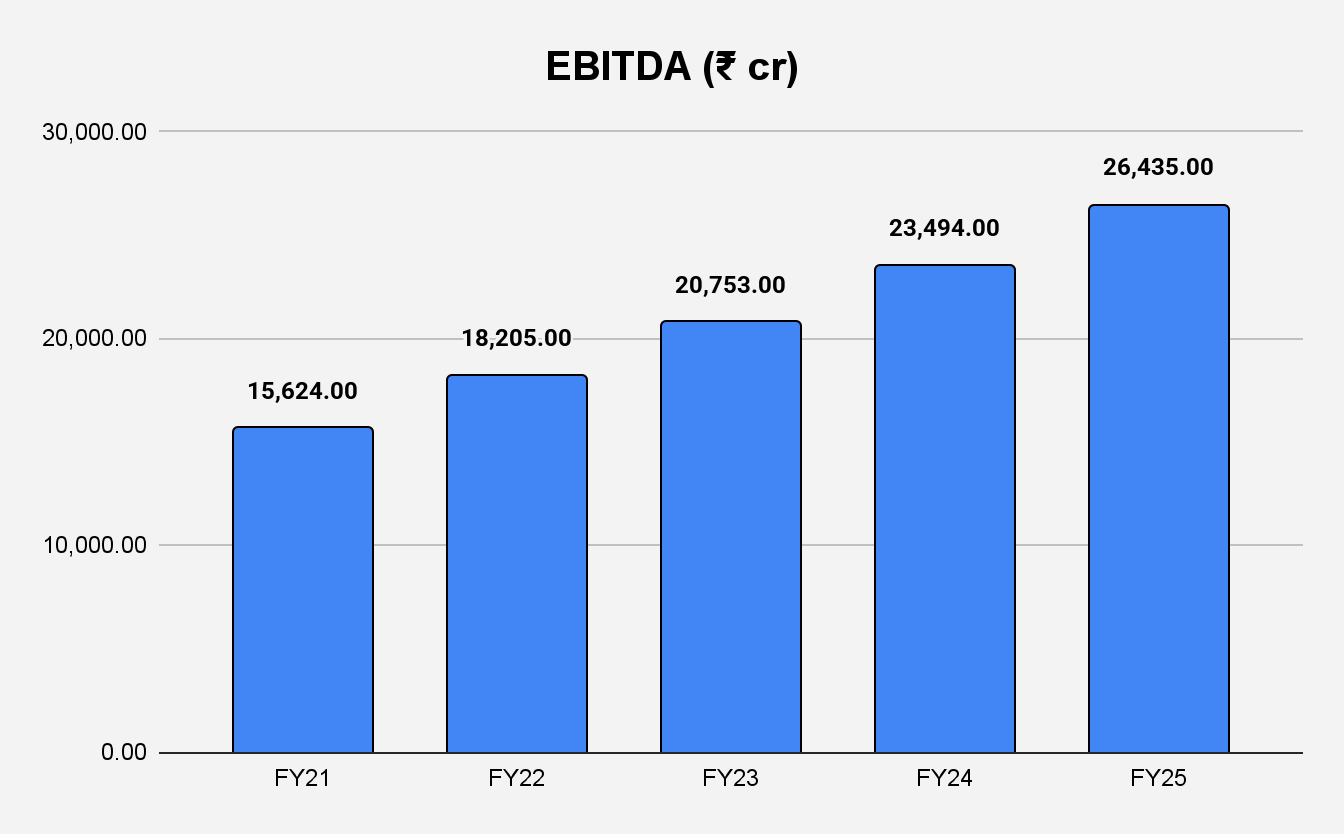

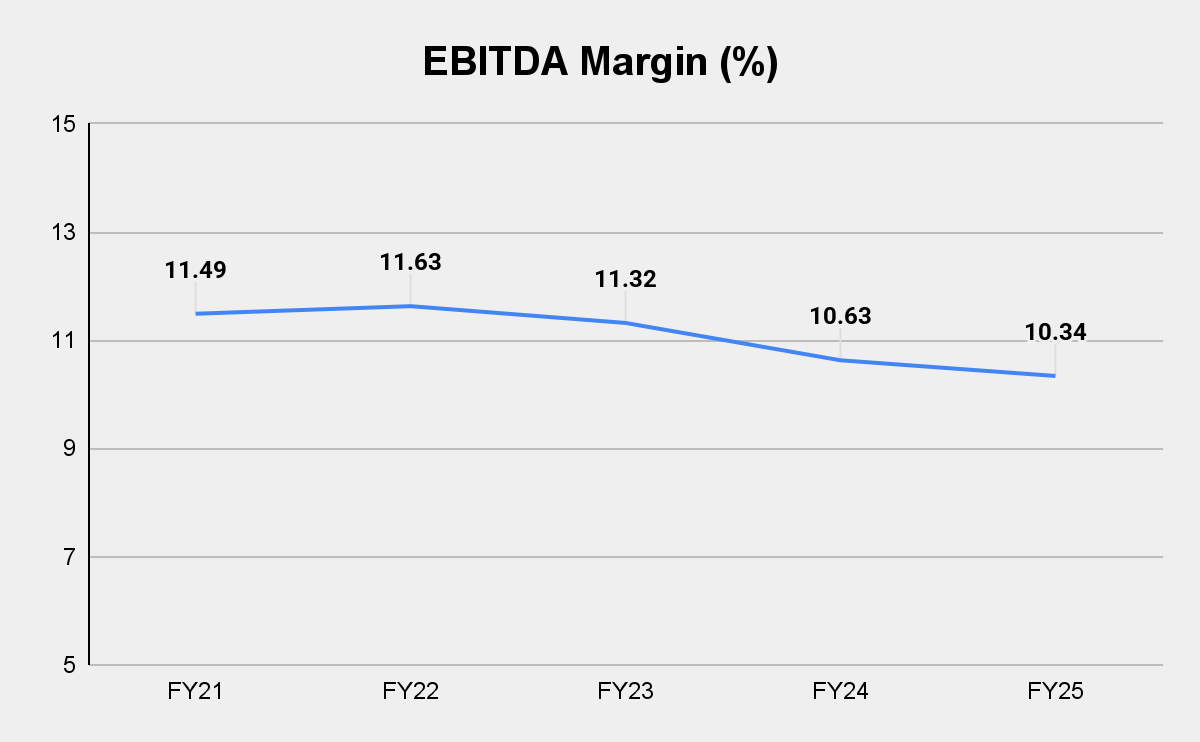

EBITDA

L&T’s EBITDA increased by 13% year-on-year to ₹26,435 crores in FY25, from ₹23,494 crores in FY24.

Looking at the trend of EBITDA margin, it is on a slight declining trend. The margin has declined from 11.49% in FY21 to 10.34% in FY25, a fall of 105 basis points.

Falling EBITDA margin also indicates increased competition in verticals it operates, and the company is sacrificing its profitability to win orders.

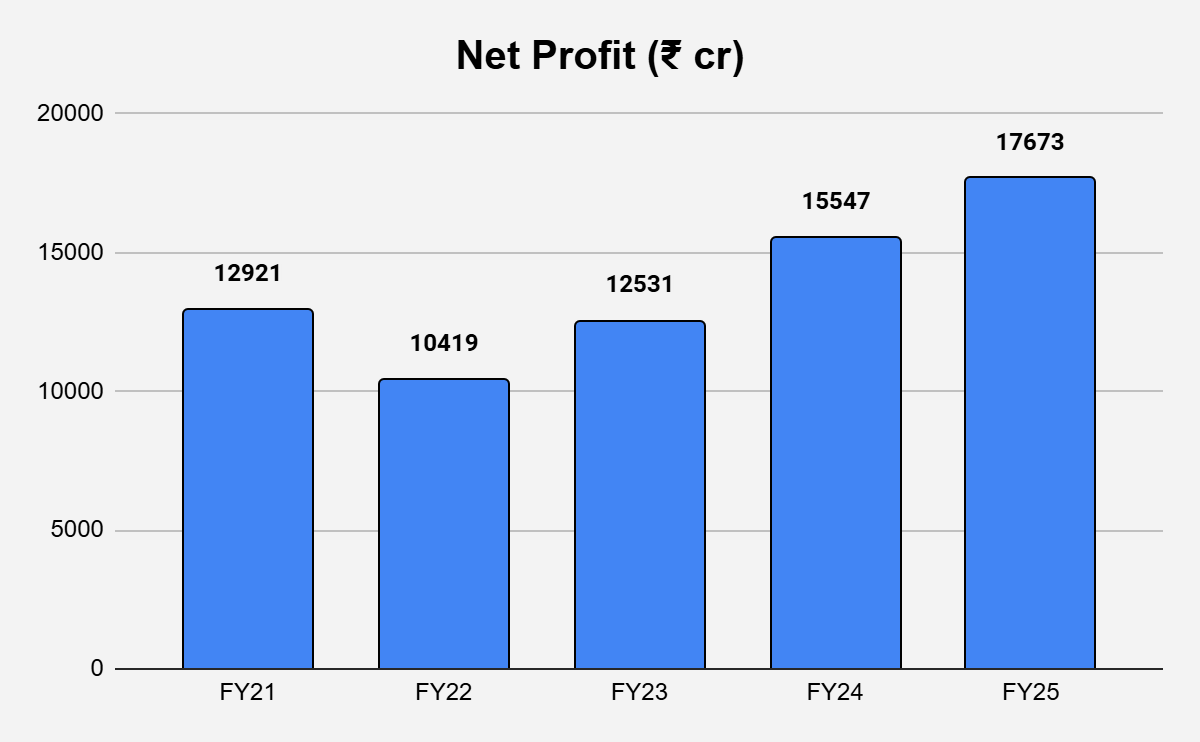

Net Profit

Barring FY22, the net profit of L&T has been consistently rising over the five-year period. In FY25, the net profit increased 13.7% to ₹17,673 crores from ₹15,547 crores in FY24.

Key Financial Metrics

Debt-equity Ratio: At the end of FY25, the company’s debt-to-equity improved by 12.7% to 0.31 times from 0.35 times in FY24.

Debt Service Coverage Ratio: The company’s ability to service debt has improved significantly in FY25, improving to 2.14 times from 1.84 times in FY24.

Return on Equity: The ROE measures the returns on shareholders capital. It has recovered much of fall since 2022. In FY25, ROE improved to 15.94%, from 13.71% in FY24, due to increased profits.

| FY21 | FY22 | FY23 | FY24 | FY25 | |

| ROE (%) | 20.5 | 12.2 | 11.3 | 13.71 | 15.94 |

Return on Capital Employed: The ROCE, which measures the returns on total capital employed (shareholders’ capital + debt), also improved to 13.45% in FY25 from 12.25% in FY24.

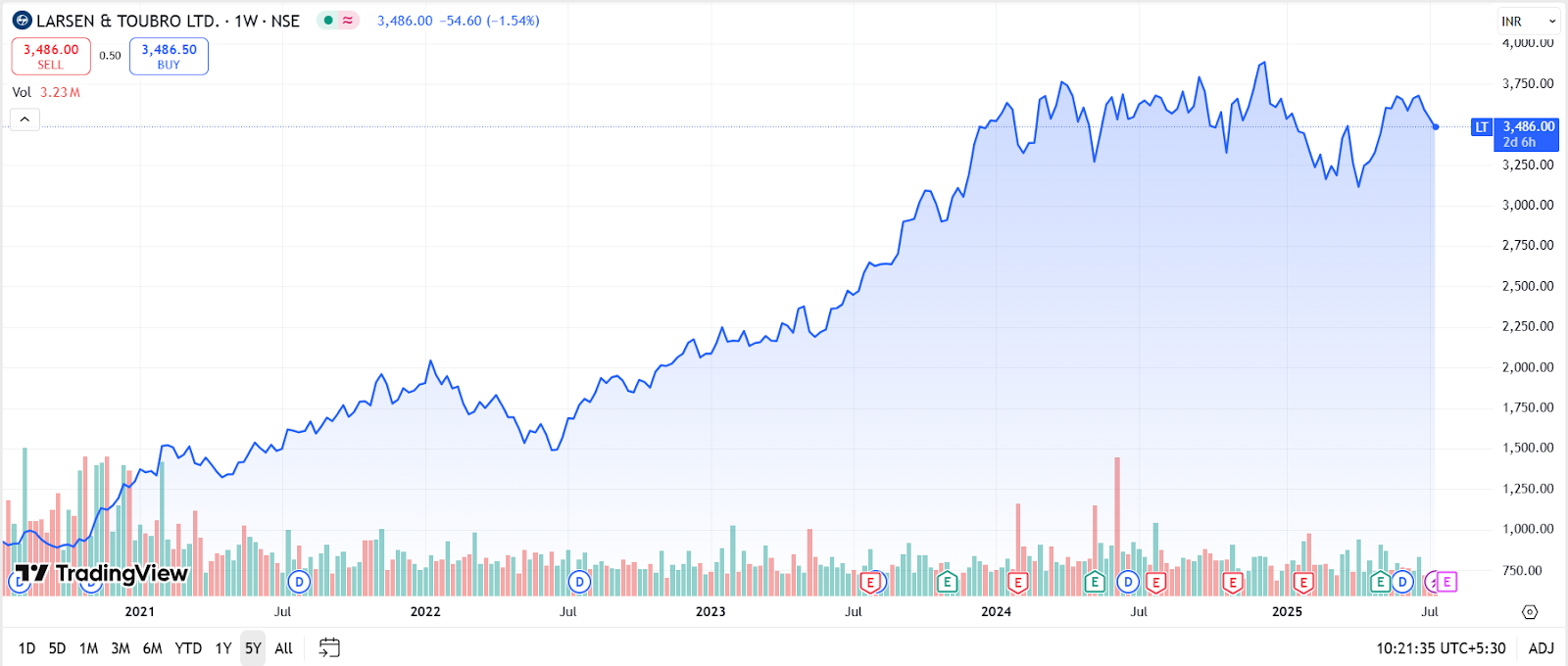

Larsen & Toubro Share Price Analysis

Over the last five years, Larsen & Toubro share price has become a multi-bagger, rising from around the ₹900 level in July 2020 to currently trading at the ₹3,480 level (15th July 2025).

However, if you look, the Larsen & Toubro share price has been trading sideways since 2024.

Larsen & Toubro has a consistent track record of paying dividends. In the last three financial years, the company paid ₹24 (FY23), ₹34 (FY24), and ₹34 (FY25) as dividends to shareholders.

At the current price of ₹3,497, the dividend yield comes to 0.97%.

Larsen & Toubro Share Price Valuation Metrics

Earning Per Share (EPS)

Over the last five years, the EPS of the company has improved, but not significantly. After a decline in FY22, it has been rising. The company has added only ₹27 to its EPS over the five-year period, explaining the sideways performance in the Larsen & Toubro share price.

| FY21 | FY22 | FY23 | FY24 | FY25 | |

| EPS (₹) | 82.49 | 61.71 | 74.51 | 93.96 | 109.36 |

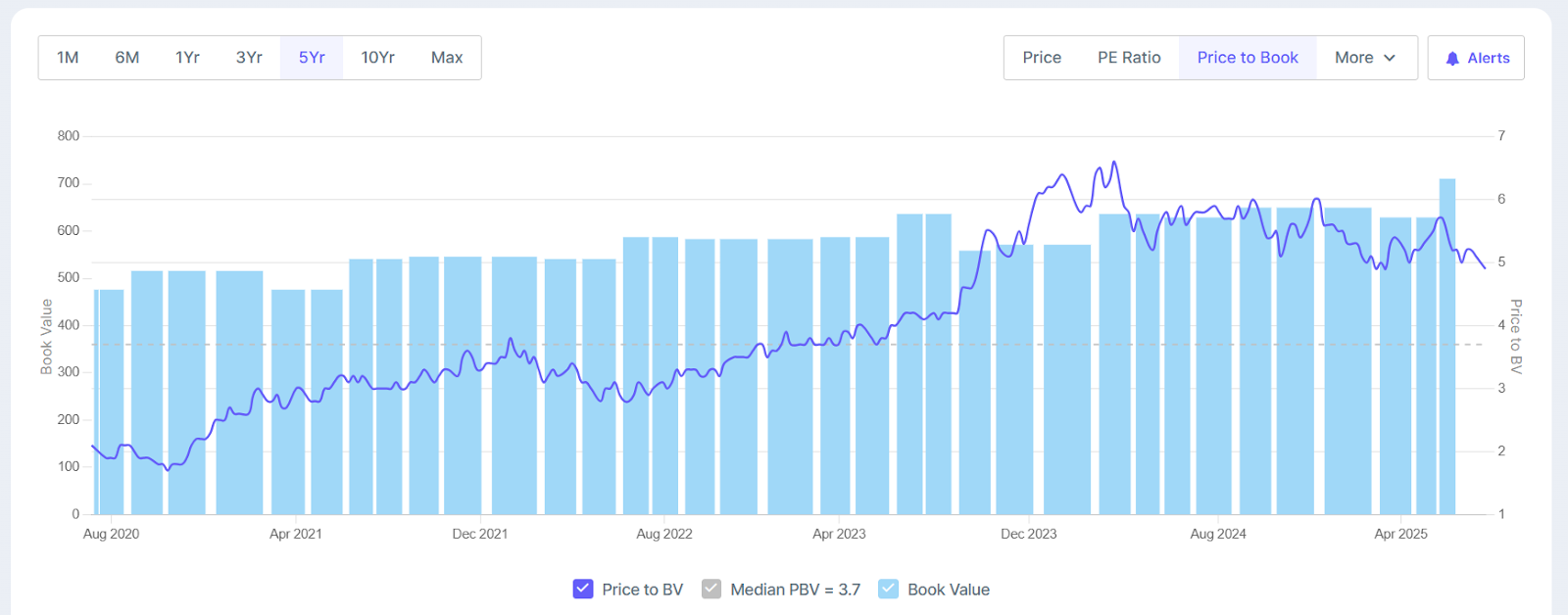

Price-to-Book Value (P/B Ratio)

As of 15th July 2025, the book value of Larsen & Toubro is ₹710 and is trading at a Price-to-Book value of 4.9 times.

The 5-year median price-to-book value is 3.7 times, largely indicating the stock is trading at a sight premium compared to its historical valuation.

Source: Screener

Price-to-Equity Ratio (PE Ratio)

L&T stock is trading at a PE of 31.5 times, meaning, for every ₹1 of earnings, you are paying ₹31.5 as a premium.

The median 5-Year PE is 30.8 times, indicating the Larsen & Toubro share price is trading at a fair valuation compared to its historical valuation.

Source: Screener

Larsen & Toubro Share Price: Future Growth Potential

Order Inflows

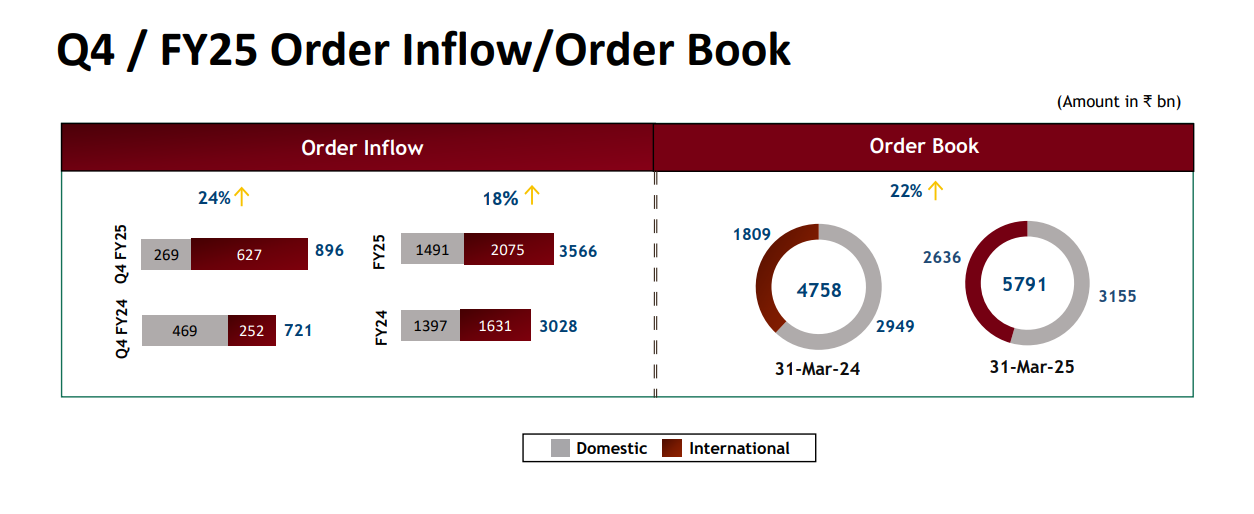

During the year, the company posted a record order inflow of ₹3.57 lakh crore, up by 18% on a year-on-year basis.

This resulted in a total order book of ₹5.8 lakh crore in FY25, up from ₹4.76 lakh crore in FY24. With a strong order book, it gives a multi-year revenue visibility.

Strategic Growth Initiatives

The company has expanded its presence in the Hydrocarbons, CarbonLite, Green, and Clean Energy sectors. Out of the total order book of ₹5.8 lakh crore, ₹1.4 lakh crore is in the Hydrocarbon segment, which the company is focusing on as its next growth drivers.

Regarding the order book distribution, approximately 46% is International, with a significant portion from the Middle East.

It is also focusing on new growth drivers in Renewables, Green Hydrogen, and Offshore Wind. L&T is also stepping up its capital allocation into green energy, data centres, and semiconductor design.

FY26 Guidance

Larsen & Toubro’s management has provided the following guidance for FY26:

- Group order inflows are expected to grow by 10% for FY26.

- Group revenues are expected to grow by 15% for FY26.

- The target margin for the Projects and Manufacturing portfolio is 8.5% for FY26.

- The Net Working Capital to Revenue guidance for March 2026 is 12%.

- The company expects that the revenue and margin targets set for FY26 will become more visible in the second half of FY26.

Risks and Challenges

Global Macro Uncertainty: Marked by continuing trade and military conflicts, corrosion of globalization, disruption in the supply chain, and higher financial market volatility.

Subdued Growth in Services Segment: The IT and Technology Services business is reporting subdued growth, reflecting the global macroeconomic environment impacting spending across the developed world.

Competition in Domestic Market: L&T is facing high competition in the domestic market, resulting in L&T being selective in its domestic order acquisition, especially in sectors like Water and Thermal Power.

Oil Price Volatility Impact on Hydrocarbon Projects: While most international infrastructure projects are not sensitive to oil prices, the Hydrocarbon business (about 60% of international order prospects) could see delays if oil prices fall drastically.

Localization Requirements in the Middle East: As L&T grows in the Middle East, there is an aspiration for local participation, which necessitates investments in ramping up capacity and engaging local contractors. This could impact margins as L&T needs to factor in these costs.

FAQ

How has Larsen & Toubro share price performed over the last five years?

Larsen & Toubro share price has become a multibagger over the last five years, rising from around ₹900 level in July 2021 to currently trading at ₹3,480 level (15th July 2025).

What does Larsen & Toubro do?

Larsen & Toubro is an infrastructure development company offering engineering, construction, technology, and manufacturing for its customers.

Who are the promoters of Larsen & Toubro?

Larsen & Toubro is a professionally managed company with 100% shares held by the public.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.2 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora