Even as we give finishing touches to this newsletter on a Saturday evening while relishing a cappuccino at Starbucks, it is the feeling of life going back to normal post-Unlock 5.0, which excites us the most. Hoping this improvement continues and very soon all of us can go back into watching movies, visit a religious place, work out in gym or take a dip in the pool. Just as we pay our bill, we get the news that Maharashtra government is planning to lift entire lockdown by end November.

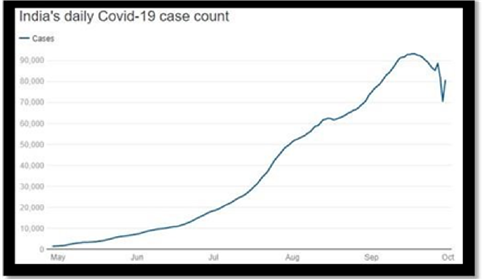

India finally sees some good news, 7 months into the pandemic and over 70 lakh Covid cases. The reproduction rate or the R value of Covid looks to be under control. For the last two weeks, R value has stayed below 1, which means that a single virus carrier is infecting less than one person on an average. This simply means that 100 infected people further infected 90-95 people, thus putting a speed breaker to the virus’ exponential growth.

While most states have situation in control now, it’s the southern states which seem to not show material deceleration and Kerala latest resurgence has taken away some sheen off the good work it did in controlling the spread in April & May.

With most parts of Europe including UK discussing putting vertical lockdown selectively given the incidence of second wave, what is also clear is that people globally have come to terms with the fact that economy cannot come to a standstill and we need to continue living our daily lives with utmost precaution till the end of 2020 at least.

SEPTEMBER: MORE POSITIVES THAN NEGATIVES

INDUSTRY SPECIFIC EXAMPLES

LIFE INSURANCE- POSITIVE

Industry premium for the current month grew by 26% YoY led by both individual (30% YoY) and group (24% YoY) segments.

PHARMA: IPM REPORTS 4.5% GROWTH IN SEP-20- NEUTRAL

Sep-20: Growth returned to positive territory and volume decline slowed down. While volume still showed a negative 4%, price remained steady showing 4.6% YoY growth and new product launches rebounded showing 3.8% YoY growth. We also note that the growth is from a ‘high base’ as Sept’19 had reported 11.9% YoY growth. Sep qtr: IPM growth of 1% YoY with volumes -6.5%, price +4.6% and NI: +2.9%

MULTIPLEXES

Government in end September permitted theatres/multiplexes to open with 50% of capacity, along with SOP from Ministry of Information & Broadcasting. This is the final piece of retail to open. This is positive for other retailers also as Box Office is a key driver for footfalls in malls. Key Hindi movies in November, December to watch out will be Sooryavanshi and 83. The state of Maharashtra (+20% of box office collections) which is very important for Box Office collection, will most likely open in November.

Currently malls are seeing footfalls between 30 to 60 percent of Pre Covid, lower in big cities and higher in smaller cities. Box office performance in Country like USA has been weak (US has very high daily Covid cases) , while Box Office has seen better performance on relative basis in South Korea and Sri Lanka where Covid cases are very limited.

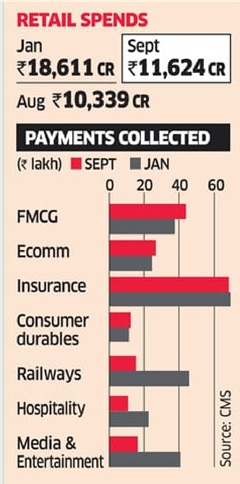

RETAIL SPEND SUP 12% IN SEPT MOM

India’s September retail spending rose 12% vs August levels with revival strongest in rural areas, as per data collated by CMS Info Systems, which handles cash movement and ATMs across the country. India’s September retail spending rose 12% vs August levels with revival strongest in rural areas, as per data collated by CMS Info Systems, which handles cash movement and ATMs across the country. The biggest increase was seen in spending related to ecommerce, fast-moving consumer goods (FMCG), consumer durables, insurance, utility payments, healthcare, logistics and transportation, which surpassed January levels.

COMPANY SPECIFIC EXAMPLES – INDICATOR OF INDUSTRY TRENDS

REAL ESTATE – SOBHA (STRONG)

Sales of 0.89 msf in Q2FY21 valued at Rs. 6.9 bn, its share of sales stood at Rs. 5.3 bn, down ~5% YoY but up 35% QoQ. Volume was down 14% YoY but was up 37% QoQ. Considering the lockdown in Bengaluru during July and no new launches during the quarter, this is a reasonable performance.

PRIVATE BANKS: HDFC BANK (STRONG)

Deposit growth of 20% yoy in 2QFY21 and 24% in 1QFY21, and advances growth of 16% in 2QFY21 and 21% in 1QFY21

NBFC- HOUSING FINANCE: HDFC LTD (STRONG)

Individual loan disbursements in 2QFY21 were at 95% of the 2QFY20 levels – indicating that company have been able to reach near pre COVID levels in disbursements; Sept 2020 vs Sept 2019 have seen one of the strongest recovery in value in terms of Receipts / Approvals / disbursements up by 21% / 31%/ 11% YoY

2QFY21- Recovery rate of ~98% (excluding sale of raw gold), compared to the revenue of the corresponding quarter in the last year; Jewelry sales in September month have been decent, despite the inauspicious period of ‘Shradh’; Even their watch and wearables were back at 55-57%. The walk-ins have picked up.

The pandemic has triggered a faster-than-expected adoption of digital and cloud.

Higher growth is not from one-off deals, but structural ones. The start of the first phase of a multi-year technology transformation cycle is underway.

Enterprises are building a cloud-based foundation, which would serve as a resilient, secure and a scalable digital core.

RETAIL: TITAN (STRONG)

2QFY21- Recovery rate of ~98% (excluding sale of raw gold), compared to the revenue of the corresponding quarter in the last year; Jewelry sales in September month have been decent,

despite the inauspicious period of ‘Shradh’; Even their watch and wearables were back at 55-57%. The walk-ins have picked up.

IT: TCS (STRONG)

The pandemic has triggered a faster-than-expected adoption of digital and cloud. Higher growth is not from one-off deals, but structural ones. The start of the first phase of a multi-year technology transformation cycle is underway. Enterprises are building a cloud-based foundation, which would serve as a resilient, secure and a scalable digital core.

M A C R O E C O N O M I C V A R I A B L E S – S E P T E M B E R

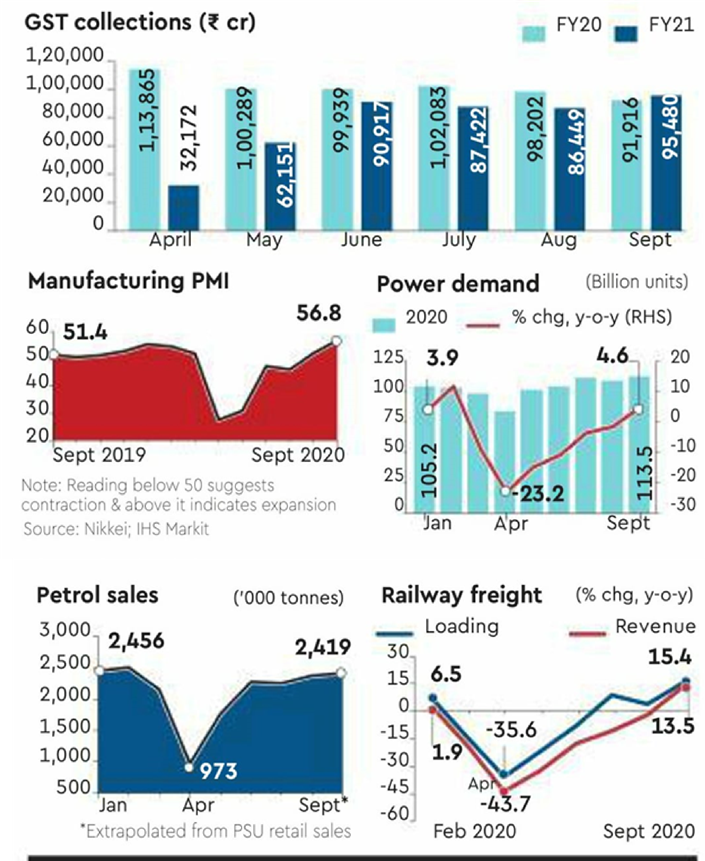

- Eway bills rose 10% to 57.4mn, highest monthly in last 2 years.

- 1941 cr national e-toll collection, up 5% vs Feb 2020 levels.

- Railway freight volumes up 15% yoy.

- Manufacturing PMI at 56.8, 8-year high & up 11% yoy; Services PMI at 49.8 vs 41.8 in Aug; Reading above 50 indicates expansion, while sub-50 print signals contraction.

- Exports up 5% yoy to $27.4 bn.

- GST collections up 4% yoy and 10% mom to Rs.95480 cr.

- Core data degrowth continues in Augustat 8.5% mainly on account of a decline in production of steel, refinery products and cement and IIP degrowth at 8%.

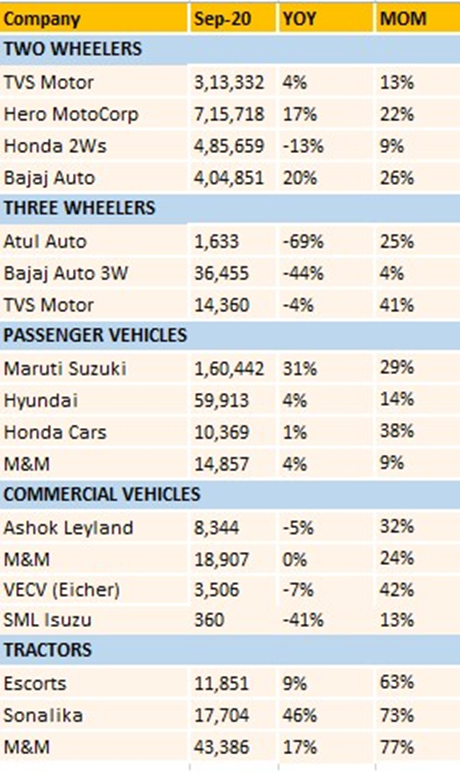

- Passenger cars volume up 31%, highest in 26 months.

For a detailed assessment on auto industry data, click here.

SEBI directive to Multicaps funds, brings mid/small caps into limelight.

As per the proposed rules, any multi-cap scheme will mandatorily need to hold:

- Atleast 75% of the scheme’s investments (AUM) in equity & equity related investments

- Atleast 25% in AMFI-classified Large-caps

- Atleast 25% in AMFI-classified Mid-caps

- Atleast 25% in AMFI-classified Small-caps

Timeline: SEBI has stated that the schemes need to comply within one month of the publishing of the next list of stocks by AMFI in January 2021.

This led to some buying in mid & small caps stocks and also MF industry making a representation to SEBI how this is difficult to implement and how they propose to address it.

FORGET COVID FEVER, INDIA ALSO HAS IPO FEVER

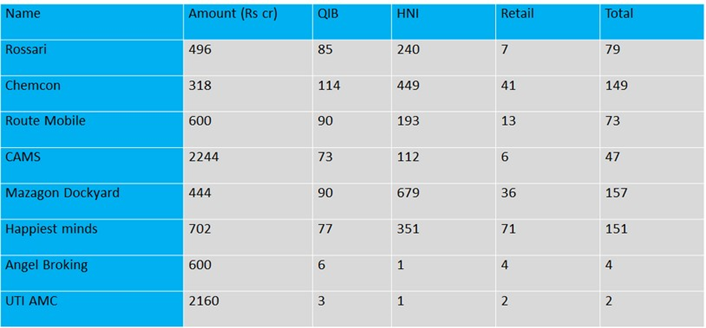

Even as the Robinhood investors continued their activity despite some market correction, the IPO market has seen a big bounce back. Smallcap companies going public getting subscription of 50-100x or more is become a norm now. CAMS in the MF registrar biz, Chemcon and Rossari, in the chemical segment, Happiest Minds in IT, Route in telecom were the stars. Angel and UTI AMC have been the only disappointments so far.

EARLY TRENDS IN OCTOBER

RBI MEASURES

Growth:

Some of the recent high frequency indicators suggest easing contraction and some growth impulses are visible. Focus must now shift towards revival. Rural economy remains resilient. Expect growth to turn positive from Q4FY21. It expects real GDP to contract by 9.6% in FY21 with risks tilted to downside.

Liquidity measures:

On tap TLTRO upto 3 years for investing in corporate bonds, Eased HTM limits for banks, Decided to conduct OMOs in State bonds, Revised regulatory limits for banks to 7.5 crore (from 5 crore), Rationalize risk weights for housing loan and link them to LTV only.

Growing Fatigue With Work From Home

As per a recent survey done by Knight Frank (India) across 1,600 technology professionals in India, 30% reported deterioration in productivity and work performance while working from home.

The recent Mint-Bain India CEO survey, in which 105 CEOs were polled on the economy and business scenarios, underlined the temporary nature of remote working. Less than one-third of the CEOs saw over 25% their workforce continue to work from home, post covid-19. In short, remote work is the present, not the future. The long-term outlook is work from office or a blended model where a minority works out of home.

Even Infosys Ltd which has over 95% of its workers working remotely currently, alludes to the view that social capital is compromised when working from home over a long period and that employees are keen to rejoin offices.

Pratik Kumar, CEO of Wipro Infra said that he always viewed WFH as an alternative. “People were a little hasty in saying WFH is the new defined way of working.”

One such is a study released in July by JLL, a professional services firm, which stated that 82% of office employees in India have missed working from office and cited a lack of personal interaction as the primary factor.

There is also increasing recognition that prolonged work from home is leading to stress. Senior professionals, the more experienced, have greater anxiety issues and would much rather be in office than their younger colleagues.

In fact, where ever covid has come under control, like in China or South Korea, 90-95% of employees have come back to office.

It appears that WFH is a necessity during Covid and is not going to be a permanent feature in India basis results from global and local surveys. But who can say, that 2021 will be less unpredictable given our experiences in 2020.

BEST PRACTICES FOR WEALTH CREATION

Staggered buying approach: Use every dip as opportunity to buy

Stock specific approach: Identify a few solid businesses that you would like to own; start accumulating them

Long-term approach: Keep a horizon of 3-5 years while investing in these businesses

Stay focused: Avoid getting distracted from information overload/distraction/rumors via forwards on WhatsApp/Twitter/news channel.

Trust time in the market: Don’t try to time by selling portfolio now and reentering at lower levels later.

HAPPY VIJAYADASHAMI TO ALL OUR READERS

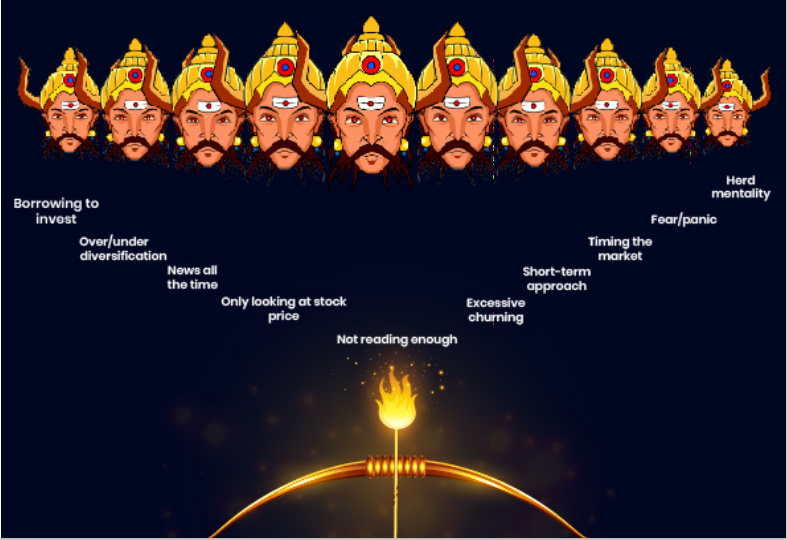

AVOID THESE 10 DEMONS OF INVESTING THIS DUSSHERA

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.