India is powering up.

With exports to over 100 countries and a domestic pump market racing towards a US$1.2 billion finish line by 2030, the stage seems set for a boom.

Add to that the government’s massive solar push under the PM-KUSUM scheme, and suddenly, solar pump manufacturers are looking at a billion dollar opportunity.

In short — the sector has tailwinds. Big ones.

And yet… Shakti Pumps, one of the biggest names in the business, is down 25% in 2025.

That’s not a small dip. It’s a red splash on an otherwise green story.

Shakti Pumps Share Price in 2025 so far

So what’s really going on here? Is the market punishing short-term pain? Or is it sniffing something deeper?

Is this a golden entry point… or a flashing red flag?

Let’s find out.

About Shakti Pumps

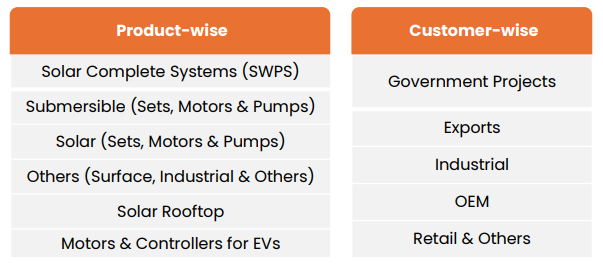

Shakti Pumps isn’t just any pump maker. It manufactures a wide range of pumps, motors, and controllers, offering advanced pumping solutions for everything from farms and factories to high-rises and power plants.

Its reach spans across agriculture, construction, oil & gas, mining, and energy—making it a crucial cog in India’s infrastructure and energy machine.

Shakti Pumps – Diversified Business Model

What sets Shakti apart is its in-house manufacturing capability. It’s one of the few Indian players producing solar and submersible pumps and motors under one roof. With three manufacturing units, it boasts an annual production capacity of:

- 500,000+ pumps

- 100,000+ support structures

- 200,000+ inverters

It’s also a market leader in solar pumps, commanding a solid 25% share under the government’s flagship PM-KUSUM scheme—a key driver of rural electrification through solar.

Why Shakti Pumps Share Price is Falling

In the past 5 trading sessions, Shakti Pumps is down over 7% while in a month, it has fallen around 12%.

The recent underperformance of Shakti Pumps could be attributed to its weak Q1 earnings.

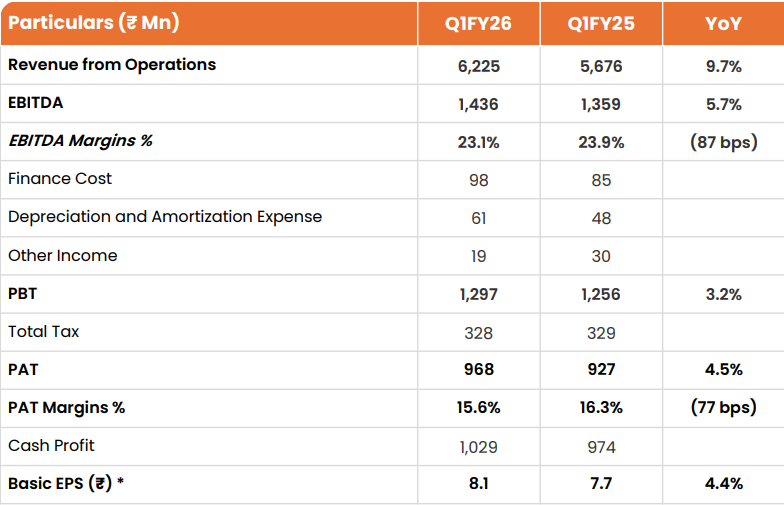

Yes, the topline did grow — revenues came in at ₹6,225 million, up from ₹5,676 million in the same quarter last year. But the pace of growth wasn’t exactly electrifying.

EBITDA rose just 5.7% year-on-year, touching ₹1,436 million, while margins held steady at 23.1% — respectable, but not game-changing.

Net profit? A modest ₹968 million, which is only a 4.75% YoY jump.

Shakti Pumps Q1FY26 Financial Snapshot

For a company riding high on solar tailwinds, rural demand, and EV buzz… these numbers felt more like a quiet drizzle than a thunderstorm. And in a market that rewards momentum, “steady” doesn’t always cut it.

The result? Investors hit pause — and the stock took a hit.

Outlook for Shakti Pumps

Despite the recent weakness in the stock and a lukewarm Q1, Shakti Pumps isn’t slowing down on ambition.

In fact, the company is executing an aggressive ₹17,000 million capex plan to fuel its next leg of growth. This includes:

- Doubling capacity for pumps, motors, VFDs, and solar structures (₹2,500 million)

- Setting up an EV motor and charger facility under its EV arm, Shakti EV Mobility (₹2,500 million)

- And most significantly, building a 2.2 GW solar DCR cell and solar PV module plant in Madhya Pradesh — a massive ₹12,000 million bet on India’s solar future.

Backing this bold expansion is a robust order book of ₹13,500 million.

And it’s not just about solar pumps anymore.

Shakti is now making steady inroads into rooftop solar, aided by government push under PM Surya Ghar: Muft Bijli Yojana. It’s also expanding across domestic, industrial, and EV segments, positioning itself as a diversified clean energy player.

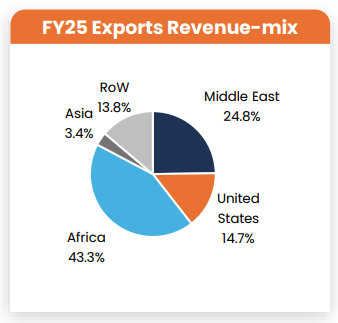

Meanwhile, the export engine is firing on all cylinders. From successful projects in Haiti, Uganda, Nepal, and Bangladesh to growing traction in the USA, Middle East, and Africa, the international story is just getting started.

Conclusion

From a healthy order book and export tailwinds to bold capex bets in solar and EVs — the company is placing its chips across high-growth themes. Execution, of course, will be key.

But here’s the bigger picture.

With India’s capex cycle expanding across key user industries, and the government doubling down on domestic solar pump manufacturing, the entire sector is set for a structural uplift.

And in that story — Shakti Pumps, along with its peers, could emerge as major beneficiaries.

The pump sector may not always make headlines…

But in India’s clean energy and rural transformation story — it could quietly power a big part of the narrative.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora