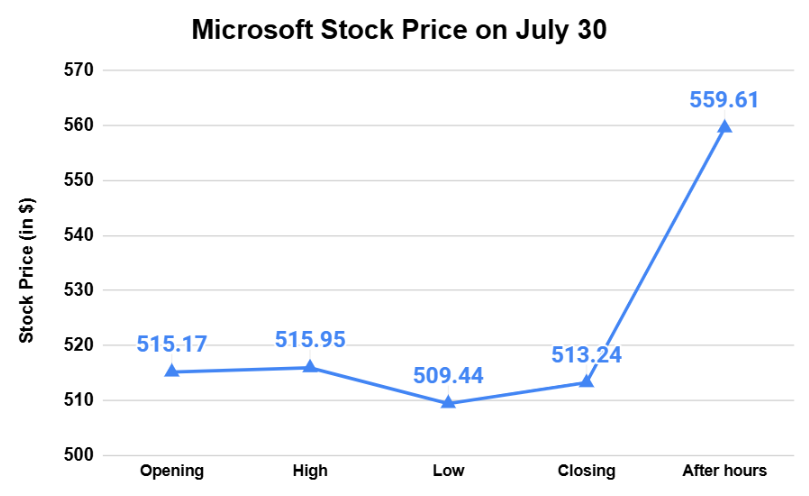

Microsoft just crossed a historic threshold. In after-hours trading on July 30, 2025, its market capitalization surged past $4 trillion, making it only the second company in history to do so, after chipmaker NVIDIA.

This is more than just a big number on a stock ticker. It marks a rare moment when a company that started in the personal computing era of the 1970s has successfully reinvented itself to dominate the age of artificial intelligence (AI) and cloud computing.

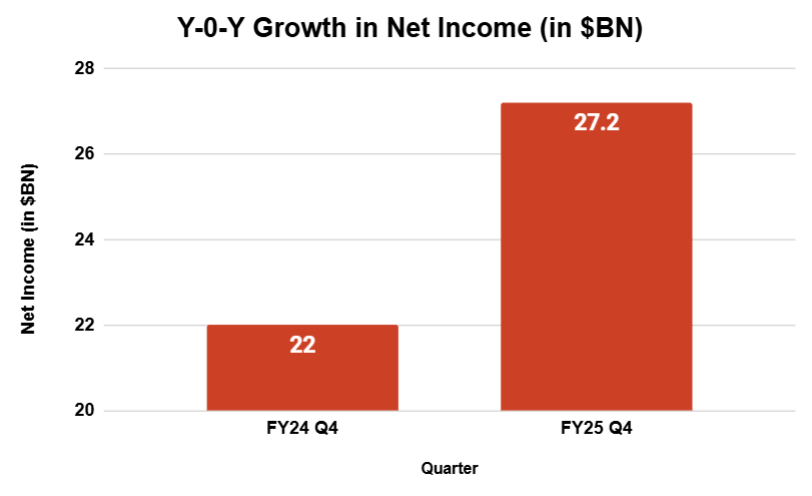

For its fiscal fourth quarter ending June 30, 2025, Microsoft reported results that outpaced Wall Street expectations:

- Revenue: $76.4 billion, up 18% year-on-year.

- Net income: $27.2 billion, a 24% jump from a year earlier.

- Earnings per share: $3.65, beating expectations of $3.37.

Source: Financial Times

Source: Microsoft

What Fueled Microsoft’s Leap to $4 Trillion Market Cap?

Microsoft’s $4 trillion moment rests on two pillars: AI and cloud computing. Its Azure cloud platform is thriving, as it brought in over $75 billion in revenue for the fiscal year, along with other cloud services, growing at an impressive 34% year-over-year. This surge shows just how central cloud and AI have become to Microsoft’s growth engine. The rise reflects high demand for AI-enabled enterprise tools, scalable cloud infrastructure, and secure data services. For many businesses, Azure has become the default choice when moving to the cloud or adopting AI capabilities.

The company’s AI strategy has been deliberate and early. Microsoft’s deep partnership with OpenAI—announced years before most competitors had serious AI ambitions—gave it early access to advanced AI models. This allowed Microsoft to integrate AI into Microsoft 365 Copilot, Azure AI Services, and developer tools far ahead of rivals.

At the same time, Microsoft is spending aggressively to make sure it can handle future AI demand. Capital expenditures hit $24.2 billion this quarter—27% higher than last year—and are projected to rise to $30 billion in the current quarter. Most of this money is going into global data center expansion, critical for handling AI workloads at scale.

Source: Microsoft

Market Reaction and Stock Surge

Investors cheered the results. Microsoft shares surged 8% in after-hours trading, pushing the stock to around $556–$560. Year-to-date, the stock is already up 22%, reflecting strong confidence in Microsoft’s AI-led growth story.

Source: Yahoo! Finance

Microsoft vs NVIDIA: Different Paths to $4 Trillion

Earlier in July 2025, NVIDIA became the first company to reach a $4 trillion market value. While both companies are riding the AI boom, their business models are different.

- NVIDIA dominates AI hardware—specifically GPUs (graphics processing units) that power AI model training and deployment.

- Microsoft focuses on AI software, services, and cloud infrastructure. It uses NVIDIA chips to power Azure AI but sells AI capabilities as part of a broader enterprise technology stack.

How Microsoft Got Here

Microsoft’s transformation over the past decade has been one of the most successful corporate reinventions in history. Three key moves stand out:

- Cloud-first pivot: By prioritizing Azure, Microsoft tapped into one of the fastest-growing sectors in tech.

- AI integration at scale: Partnering with OpenAI positioned Microsoft as the enterprise leader in applied AI.

- Diversification: From gaming (via the Activision Blizzard acquisition) to professional networking (LinkedIn) and AI tools, Microsoft has built multiple growth engines.

Challenges Still Lie Ahead for Microsoft…

Even at $4 trillion, Microsoft faces significant headwinds:

- Layoffs and culture: Around 9,000 jobs were cut this year. While common in the tech industry, such cuts can impact morale and retention at a time when top AI talent is in high demand.

- Overdependence on AI optimism: AI currently accounts for only about 4% of Microsoft’s total revenue. Valuations are based on future expectations, which could shift if AI adoption slows.

- Tough competition: Google’s Alphabet and Amazon Web Services are making aggressive AI moves, while smaller AI startups continue to innovate rapidly.

- Regulatory pressure: Governments are increasingly concerned about the dominance of a few large tech firms in both cloud and AI. Antitrust scrutiny and AI governance rules could reshape the market.

Why $4 Trillion Market Cap Matters

Microsoft’s $4 trillion valuation is more than just a symbolic milestone:

- It signals investor confidence in AI as a long-term driver of enterprise technology.

- It sets a new standard for how legacy tech companies can reinvent themselves for emerging technology cycles.

- It underscores the shift from consumer hardware toward AI-driven cloud services as the foundation of modern tech growth.

What Comes Next for Microsoft?

A few developments could determine whether Microsoft can sustain its momentum:

- AI adoption curve: If enterprises adopt AI tools as quickly as expected, Azure and Microsoft 365 could see even faster growth.

- Infrastructure build-out: The planned $30 billion in upcoming capital expenditure will only pay off if demand keeps pace.

- Competitive positioning: Microsoft will need to maintain its lead over Alphabet and AWS while staying complementary to NVIDIA.

- Global expansion: Emerging markets represent a huge growth opportunity for cloud and AI services, but they come with pricing and localization challenges.

Some analysts believe Microsoft could hit $5 trillion in market cap within the next 12–18 months if AI demand continues at its current pace. Others caution that the pace of growth will inevitably slow as markets mature.

Source: MarketWatch, Indian Express

Conclusion

Microsoft’s rise to $4 trillion is the result of a decade-long pivot, bold investments in AI and cloud, and steady execution. It now sits alongside NVIDIA in a league of its own. The next phase will test whether it can maintain that lead while navigating economic shifts, competitive battles, and evolving AI regulation.

For now, one thing is certain: Microsoft has shown that even in the fast-changing world of technology, reinvention is not just possible—it can be spectacularly rewarding.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora