Tata group company Titan is acquiring a 67% stake in UAE-based Damas Jewellery for nearly ₹2,438 crore aiming to expand its presence in the Gulf Cooperation Council (GCC) region through a well-established luxury jewellery retailer.

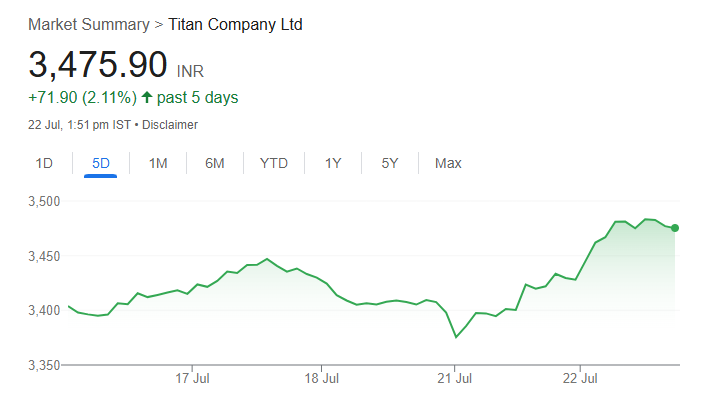

Reacting to the same, Titan share price gained over 1% in early trade.

Titan Share Price

So, what does this move mean for the company and how will it play out for existing shareholders? Let’s decode.

Overview Of Titan Company

Titan Company was established in 1984 as a joint venture between the Tata Group and the Tamil Nadu Industrial Development Corporation (TIDCO). It has grown into one of India’s leading lifestyle companies. The company’s portfolio spans watches, jewellery, eyewear, wearables, fragrances, fashion accessories, and ethnic dress wear. Plus, its flagship brands, Tanishq, Titan, Fastrack, Mia, CaratLane, and Titan Eye+, serve a broad consumer base through a retail network of over 2,000 stores.

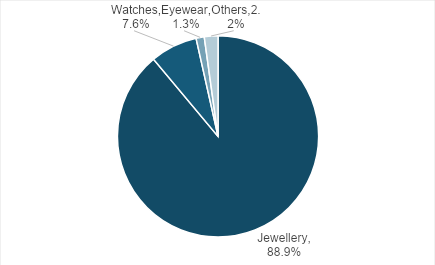

Jewellery remains the company’s largest business, contributing approximately 85% of revenue in FY25, led by brands such as Tanishq, Mia, Zoya, and CaratLane. The watches and wearables division accounted for 8%, with Titan holding a significant share of India’s analog watch market. The eyewear business contributed around 1%, with Titan Eye+ being the largest optical retail chain in the country. Emerging businesses, including fragrances, Indian dress wear (Taneria), and fashion accessories, made up the remaining 2% of revenue.

Titan Revenue Break-up – FY25 Revenue Rs 60,456 Cr.

In addition to its domestic presence, Titan is expanding internationally with jewellery and eyewear stores across the Gulf, North America, and Southeast Asia. Its global ambitions are also supported by strategic moves such as the recent deal with the Damas Jewellery in the UAE, aimed at strengthening its Middle East footprint and scaling international growth.

Details Of Damas Jewellery’s 67% Acquisition

Titan Company, through its wholly owned subsidiary Titan Holdings International FZCO, has announced the acquisition of a 67% stake in Dubai-based Damas Jewellery LLC, marking its largest global acquisition to date.

The all-cash deal is valued at an enterprise value of AED 1,038 million (approximately ₹2,438 crore or $283 million), inclusive of debt. The seller in this transaction is Mannai Corporation QPSC, a Qatar-based firm that has owned Damas since 2012.

The acquisition specifically excludes Damas’s franchise business with Graff, the British luxury jeweller. By acquiring this stake, Titan gains a significant foothold in the Gulf Cooperation Council (GCC) market through a brand with deep regional roots and recognition.

To finance the deal, Titan will use a combination of internal accruals, existing cash reserves, and debt, indicating both strong liquidity and a strategic capital deployment plan. The transaction is expected to close by January 31, 2026, pending regulatory and antitrust approvals across relevant jurisdictions.

Under the agreement, Mannai Corporation will retain the remaining 33% stake for a minimum of four years, after which Titan will hold the option to acquire full ownership as of December 31, 2029.

Strategic Rationale Behind The Deal

- The deal gives Titan direct access to a large, high-value market through a well-established jewellery brand with a strong retail footprint.

- It strengthens Titan’s presence in the GCC region, where luxury jewellery demand is steadily increasing.

- It aligns with Titan’s plan to expand its reach beyond the Indian diaspora and connect with a broader international customer base.

- Damas’s wide store network offers Titan an immediate platform for growth in a new geography, reducing the need for ground-up expansion.

- Titan plans to leverage its experience from previous acquisitions, like CaratLane, to integrate Damas, focusing on digital tools and a blended retail model.

- The company expects to benefit from combined strengths in supply chain, talent, and product development while preserving Damas’s brand identity.

- This acquisition supports Titan’s broader strategy of entering high-growth, premium segments with long-term potential.

Implications Of The Deal

The acquisition of Damas Jewellery by Titan Company Limited brings several important implications for the company’s financials, strategy, and shareholders—both in the short term and over the long haul.

- Short-Term Financial and Operational Impact

- Titan is funding the ₹2,440 crore acquisition through a combination of internal accruals, existing cash reserves, and debt. This involves a significant outflow and will impact Titan’s immediate liquidity position.

- The completion of the deal is subject to regulatory and antitrust approvals across relevant jurisdictions. The agreement also includes the exclusion of Damas’s franchise operations with Graff, which are to be carved out before the transaction is closed.

- Initial integration will involve aligning operations, teams, and systems. These activities are expected to incur costs during the transition phase.

- Long-Term Strategic Impact

- The acquisition adds a new international business segment to Titan’s structure through its subsidiary Titan Holdings International FZCO. Damas’s retail network and brand portfolio will operate alongside Titan’s existing jewellery businesses.

- Damas’s operations will be integrated into Titan’s broader ecosystem, which includes jewellery brands such as Tanishq, Mia, Zoya, and CaratLane. The addition increases the company’s scale in terms of retail presence and product offerings across multiple geographies.

- Implications for Shareholders and Investment Outlook

For investors, the acquisition offers potential long-term value through market expansion, increased revenue, and broader diversification. Titan will gain a direct foothold in a high-growth luxury market, supported by rising disposable incomes, tourism growth, and cultural demand for premium jewellery in the GCC. However, despite the growth prospects, the shareholders should also watch for:

- Delays in approvals or execution

- Economic sensitivity of the GCC region to oil prices and geopolitical issues

- Challenges in blending two brands with different operating models and customer bases

Conclusion

As a shareholder or market participant, you now have clarity on Titan’s latest international acquisition and its planned execution. The transaction introduces a new business segment, expands Titan’s retail footprint in the GCC, and brings operational changes over the coming quarters.

You can refer to regulatory filings and official disclosures to stay informed on how the deal progresses across timelines, approvals, and integration milestones. Staying updated on these developments can help you understand how such strategic moves shape the company’s evolving business structure and financials

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora