India’s solar revolution is gathering serious steam.

From central schemes like PM-KUSUM to production-linked incentives, policy tailwinds are firmly behind the sector. Solar capacity additions are hitting new highs each year — and with energy security and climate change now top national priorities, the push is only accelerating. State governments too are doing their bit, driving solar adoption in both urban and rural pockets.

In this high-growth backdrop, few companies have captured investor attention like Waaree Energies — one of the most prominent players in India’s solar ecosystem.

Yesterday, Waaree posted a blockbuster Q1 — and the markets took notice. The stock jumped 5% in today’s trade.

But is this just the beginning? Can Waaree sustain its momentum and ride India’s solar wave to greater highs?

Let’s decode the Q1 numbers to find out.

About Waaree Energies

Waaree Energies is India’s largest solar module manufacturer. As of FY25, Waaree holds a 15% share in the country’s total solar module manufacturing capacity.

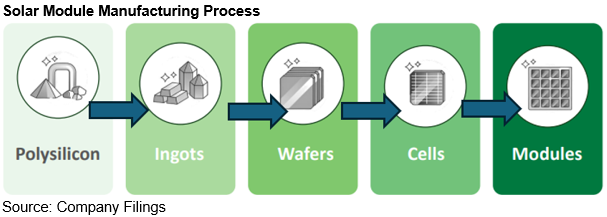

What’s interesting is that over the years, the company has evolved into an integrated solar player — from modules to cells, and now even planning backward integration into raw materials like wafers and ingots.

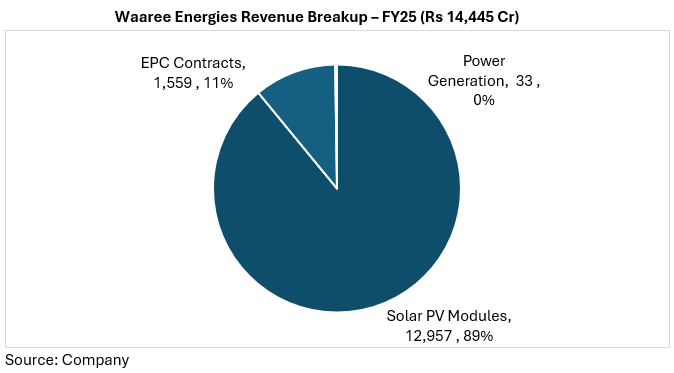

The solar module manufacturing business remains Waaree’s main revenue generator, while EPC contracts contribute about 11% of its total revenue.

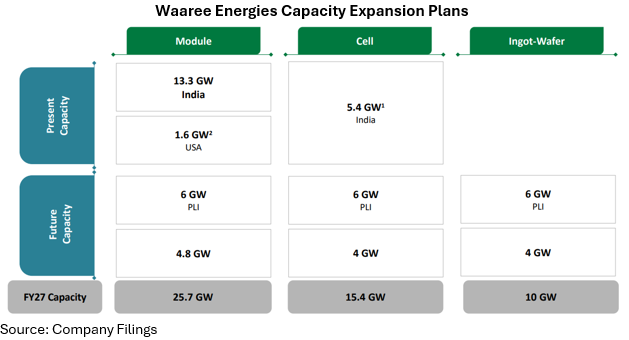

With over 15 years of industry experience, Waaree has ramped up its total PV module capacity to 15 GW — of which 1.6 GW is set up in the US.

Recently, the company also commissioned a 5.4 GW cell manufacturing facility. Its next big step: a fully integrated 6 GW plant where even wafers and ingots will be produced.

Waaree Energies Q1 Result Analysis

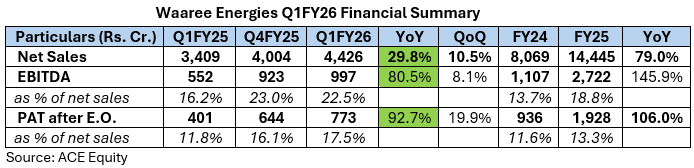

For the quarter ended June 2025, Waaree Energies’ revenue grew by 30%.

The key growth driver was the EPC segment, which grew by 160%, while the solar module business grew by 22%.

Thanks to favorable raw material prices, gross profit surged 80%, which also boosted EBITDA.

Net profit jumped 93%, helped by higher other income and a lower effective tax rate.

Waaree’s order book grew from ₹47,000 crore in March 2025 to ₹49,000 crore as of June 2025

Outlook and Management Commentary Post Q1 Earnings

Waaree posted nearly ₹1,000 crore EBITDA this quarter, and management expects this to improve in the coming quarters. For FY26, they’ve set a target EBITDA range of ₹5,500–6,000 crore.

Looking ahead, the company is planning to set up its 6 GW fully integrated plant either in Gujarat or Maharashtra.

It has already secured board approval for an additional ₹2,754 crore capex — for setting up 4 GW cell capacity in Gujarat and 4 GW ingot-wafer capacity in Maharashtra.

All these new facilities are expected to be operational by FY27.

Waaree’s long-term vision includes expanding into the broader renewable energy ecosystem — with plans to establish a presence in green hydrogen and battery energy storage systems as well.

Conclusion

Waaree Energies finds itself at the right place, at the right time.

With India targeting 40–50 GW of new renewable capacity every year till 2030, and global solar trade dynamics shifting in favour of Indian players, Waaree is well-positioned to benefit from both domestic tailwinds and rising export demand.

Its aggressive capacity expansion, entry into global markets, and readiness to tap into emerging themes like energy storage and firm renewables make it a serious contender in India’s clean energy future.

The company’s robust FY25 performance — marked by record financials, capacity additions, and a healthy order book — has set a strong base for FY26. Management commentary remains upbeat, backed by visibility on project pipelines and manufacturing capabilities across India and the US.

That said, investors must remain mindful of risks. Waaree still depends significantly on imported components, and the solar sector’s fast-paced tech evolution means constant innovation is key. Regulatory shifts, supply chain disruptions, and policy changes are other watchpoints.

The growth story is promising, but like most high-growth themes, it comes with its own set of variables.

For now, Waaree Energies looks ready to shine — but staying invested will require keeping a close eye on execution, competition, and changing policy tides.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora