India’s FMCG engine is running strong — powered by rising incomes, growing urbanization, and the unstoppable rise of both daily essentials and premium indulgences.

From bustling metros to the heart of rural India, consumer demand is shifting gears — and leading players are riding this wave by launching new products and expanding their reach like never before.

Right at the forefront is Hindustan Unilever (HUL) — a brand that needs no introduction. Whether it’s a bar of Lux, a scoop of Surf Excel, a sip of Lipton, or the self-care ritual of Dove — HUL is woven into the fabric of Indian homes.

With a rock-solid distribution network and a diverse portfolio spanning personal care, home care, and food, HUL isn’t just a household name — it’s a market leader.

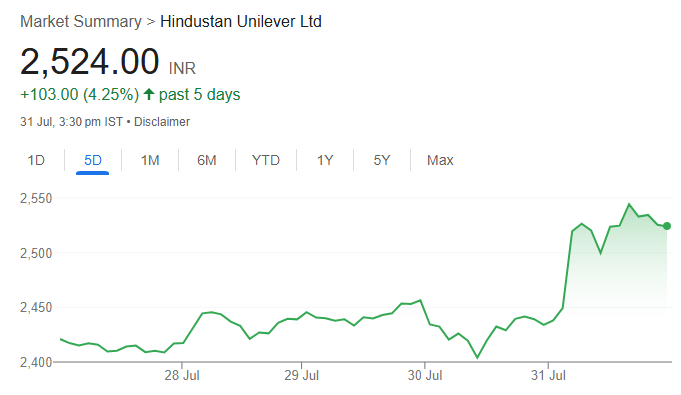

And today, the company dropped its Q1 numbers — prompting a sharp rally in its stock.

HUL Shares Rally After Q1 Results

But what do these results mean for the broader market? Is the stock gearing up for a bigger move?

Let’s break it down.

About Hindustan Unilever (HUL)

Hindustan Unilever (HUL) is India’s largest FMCG company, with a legacy dating back to 1888.

It operates across segments like personal care, home care, foods, and wellness.

Its popular brands include Dove, Lux, Surf Excel, Vim, Lipton, Bru, and Horlicks.

The company has a strong presence in both urban and rural markets. Headquartered in Mumbai, HUL is a listed market leader in the FMCG sector.

HUL Q1FY26 Financial Performance

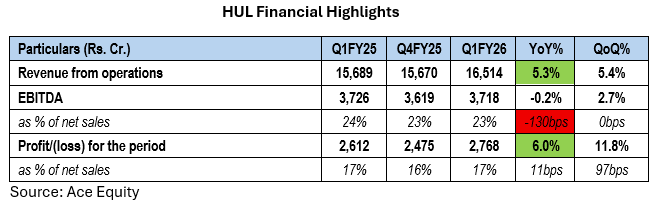

HUL delivered a resilient performance in Q1FY26.

- Revenue grew 5% YoY.

- Operating profit remained flat, but margins declined by 130 basis points (1.3%).

- Net profit rose 6% YoY.

The key driver of revenue growth was 4% volume growth, indicating a gradual recovery in consumer demand. This was HUL’s fifth consecutive quarter of mid-single-digit volume growth.

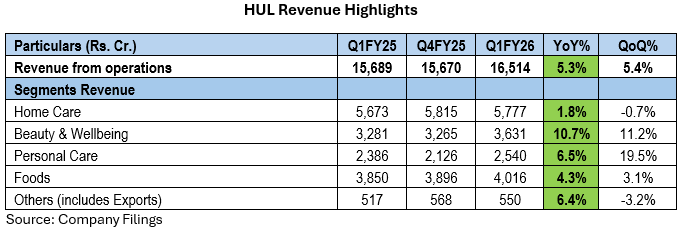

Segment-wise Performance

- Home Care: Strong performance, especially in liquids (like detergents and cleaners), which posted high single-digit volume growth

- Beauty & Wellbeing: Sales up 11%. The Health & Wellbeing portfolio (including brands like OZiva) saw its revenue triple YoY

- Foods & Beverages: Sales rose 4%, with the Beverages segment (tea & coffee) delivering double-digit growth

Margins

The dip in EBITDA margins was temporary, mainly because:

- Raw material costs rose sharply during the quarter

- Price hikes were implemented with a lag

The company also increased its investments in brand building — with higher ad and promotion spending — to drive volume growth and maintain competitive pricing.

Management expects gross margins to improve going forward.

Outlook After Q1 Results

Instead of chasing short-term margin expansion, HUL has focused on driving volume growth — a strong signal of long-term market leadership intent.

Management believes that growth in H1FY26 will be stronger than H2FY25, supported by ongoing portfolio transformation and gradually improving macroeconomic conditions.

If commodity prices remain stable, future price hikes are expected to be limited to low single digits — implying that growth will be largely volume-driven.

With competitive pricing, volume-led growth, and improving margins, the overall outlook for the year remains positive.

Conclusion

After a modest 2% volume growth in FY25, HUL is gearing up for a stronger FY26 — backed by new launches, premiumisation, and deeper reach in core categories like home and personal care.

Recent price hikes and low-unit packs are expected to boost revenues and rural demand, while the spin-off of Kwality Walls could unlock more value.

Add to that: higher consumer spending (thanks to tax cuts) and HUL’s bold bet on D2C with its Minimalist acquisition — and you have a company that’s not just playing defense, but going full throttle for growth.

Yes, macro risks remain. But HUL’s brand power and product pipeline make it a strong contender in what’s shaping up to be a high-potential year for the FMCG space.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora