Tata Technologies’ stock has turned out to be a letdown for long-term investors.

Back when the company launched its IPO in November 2023, the market response was overwhelmingly positive. The IPO was heavily oversubscribed.

And the listing?

Tata Technologies delivered a stellar debut, soaring 168% on Day 1.

However, post that initial euphoria, the stock has steadily lost momentum. In fact, it’s down over 40% since then.

Tata Technologies Share Price Since Listing

Yesterday, the company posted its Q1 results for the current financial year FY26. The Tata group company shared some key updates which may turnaround its performance over the long run. And the markets even gave a thumbs up with a 4% rally in its stock price on 15 July 2025.

Let’s analyze Tata Tech’s Q1 results, its growth prospects and how the company plans to improve its business amid growing uncertainty.

About Tata Technologies

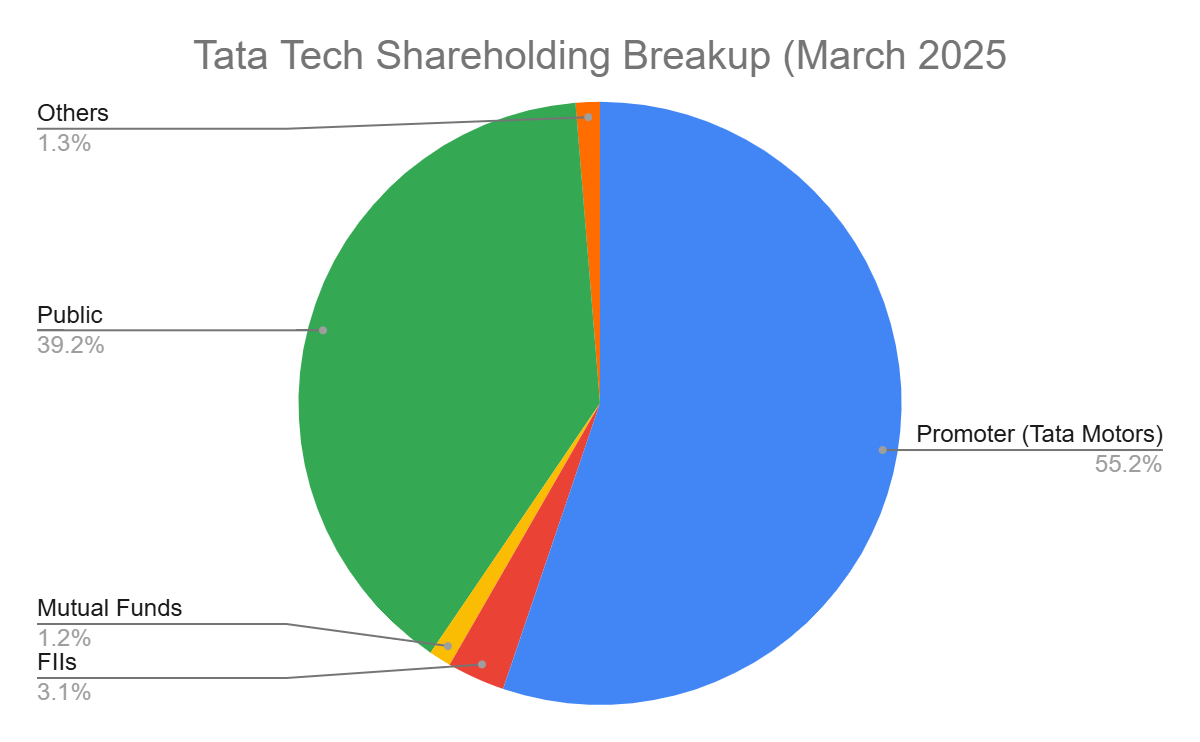

Tata Technologies is a global engineering and product development digital services company. It’s a subsidiary of Tata Motors, which holds close to 55% stake in it as of March 2025.

Source: BSE

Tata Technology provides services in engineering and design, product lifecycle management, manufacturing, product development, and IT service management. Essentially, it helps clients create better products.

The company mostly focuses on automotive, aerospace, and industrial heavy machinery.

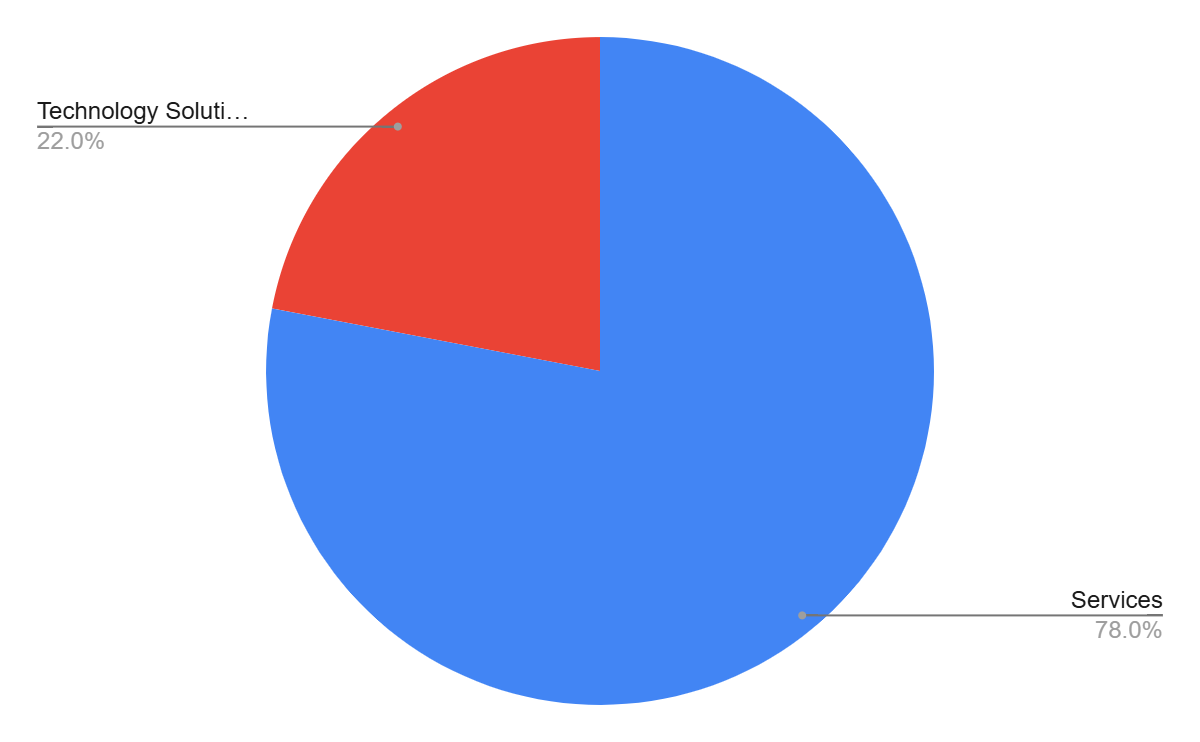

Tata Tech Revenue Breakup – FY25 Revenue Rs 5,168 Cr.

Source: Investor Presentation

Tata Technologies Q1 Results

For the quarter ended June 2025, Tata Technologies reported a revenue decline of 3.2% on a sequential basis and 1.9% on a YoY basis, in-line with street estimates.

Better-than-expected performance in the technology services segment, led by education business, aided to its revenues.

However, its margins declined due to weak demand. The company’s clients in North America have been significantly impacted by tariffs and policy changes that have led to revisiting their product plans.

Tata Tech’s net profit was up 2.1 YoY, aided by significant forex gains driving to higher other income.

Financial Snapshot

| Particulars (Rs. Cr.) | Q1FY25 | Q4FY25 | Q1FY26 | YoY | QoQ |

| Net Sales | 1,269 | 1,286 | 1,244 | -1.9% | -3.2% |

| Gross Profit | 1,044 | 1,082 | 1,026 | -1.7% | -5.2% |

| EBITDA | 231 | 233 | 200 | -13.4% | -14.3% |

| as % of net sales | 18.2% | 18.2% | 16.1% | ||

| PAT after E.O. | 162 | 185 | 165 | 2.1% | -10.7% |

| as % of net sales | 12.8% | 14.4% | 13.3% |

Source: Ace Equity, Company Reports

During the quarter, Tata Technologies announced six large deals – four were above $10 million and two deals in the $5-10 million range.

What Next?

In recent quarters, the business performance of Tata Tech has been impacted, due to the company’s heavy reliance on the automotive sector, which is facing global headwinds.

Regulatory uncertainties in the US and Europe, slowing EV adoption, and cost-cutting by automakers have led to delays in R&D and engineering outsourcing, impacting the company’s growth prospects.

Nevertheless, the management is confident about the coming quarters and they have indicated that demand could grow following clarity emerging on the Tariffs front. Tata Technologies is looking to participate in new product development activities in the upcoming months.

The company’s aerospace segment is showing green shoots, where Tata Tech has a presence and is now diversifying into propulsion systems, deepening its relationship with Airbus.

Conclusion

Overall, auto demand is still a bit weak, especially among US-based carmakers, where delays are happening due to tariffs and changes in EV policies. However, Tata Tech’s key clients — Tata Motors and Jaguar Land Rover — are continuing to invest actively in new product development.

Tata Tech’s joint venture with BMW is also performing well. In this quarter, it earned a profit of ₹48 million — 35% higher than the previous quarter and contributing 5.6% to Tata Tech’s total pre-tax profits.

The management believes growth will start picking up from Q2 onwards, as the company secured six large deals in Q1. The aerospace segment also remains strong, and momentum is now spreading beyond Airbus to its supply chain vendors and propulsion system makers.

Overall, the company expects the second half of the year to be stronger, and as uncertainty reduces, the rate at which deals convert into actual business is likely to improve.

What do you think dear reader? Let us know in the comments section below.

Happy Investing.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora