The drone industry in India once soared on optimism. Touted as a promising sector with applications in defense, agriculture, logistics, and infrastructure, the momentum behind unmanned aerial vehicles (UAVs) was hard to ignore.

As regulatory reforms kicked in and indigenous tech gained traction, startups like ideaForge Technology quickly rose to prominence as symbols of India’s deep-tech ambitions.

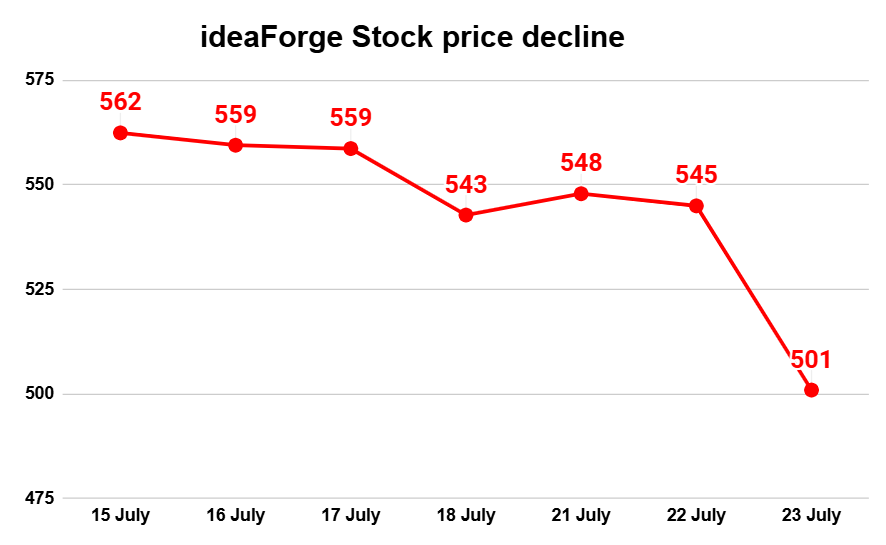

However, the shine seems to have dulled in July 2025. On July 23, ideaForge Technology’s stock price fell sharply, slipping 8.25% to an intraday low of ₹500 on the NSE compared to its previous closing of ₹544.95.

This drop followed a disappointing Q1 FY26 earnings report, with the company reporting an 85% decline in year-on-year revenue and a net loss of ₹25.9 crore.

The sudden reversal in fortunes has triggered a reality check for ideaForge and India’s drone sector as a whole.

Source: NSE

Revenue and Profit Take a Hit in Q1

ideaForge’s Q1 FY26 numbers paint a grim picture. Revenue dropped to ₹12.7 crore, compared to ₹86.1 crore in Q1 FY25, a staggering 85.2% year-on-year decline. The company also slipped into the red, posting a net loss of ₹25.9 crore, versus a ₹1.1 crore profit a year ago. On the operating front, the company reported an EBITDA loss of ₹15.14 crore.

The company saw a 9.3% quarter-on-quarter decline in net profit and faced significant margin pressure. Operating margins fell to 19%, down from 27% the previous year. A key factor behind this was the sharp rise in expenses, notably employee benefit costs, which doubled year-on-year.

While some might see these numbers as part of a post-IPO course correction, the extent of the revenue collapse and cost escalation has raised eyebrows.

Source: Business Today

What Went Wrong?

The lacklustre Q1 performance seems to be the result of a combination of internal and external factors.

- Order Book Lull: Drone procurement, especially from government clients, often follows irregular cycles. Despite long-term demand prospects, quarterly revenue can fluctuate significantly depending on contract timing. This appears to be the case for ideaForge in Q1 FY26.

- High Fixed Costs: ideaForge’s employee benefit expenses doubling year-on-year signals a growing cost base, possibly driven by scale-up efforts post-listing. However, when revenues don’t match the rise in costs, profitability takes a hit.

- Operational Challenges: The shift from small-scale R&D to large-scale production and delivery often comes with teething issues. Delays in deployment, logistics, or regulatory approvals could have compounded execution risk in the quarter.

Long-Term Vision Over Short-Term Pain

Despite the weak numbers, ideaForge remains optimistic. The company maintains that Q1FY2026 marked a positive start and reinforced its resilience in technology and business. ideaForge emphasizes the ₹137 crore order secured under the Government’s 5th cycle of Emergency Procurement after rigorous technical evaluations and country-of-origin checks.

The company also points out its involvement in Operation Sindoor, where ideaForge drones were deployed in active battlefield scenarios, demonstrating the utility of indigenous UAVs in high-risk operations. It underscores this as a validation of ideaForge’s product strength and strategic value to the Indian armed forces.

Looking ahead, multiple tailwinds were highlighted:

- ₹40,000 crore allocation for the 6th cycle of Emergency Procurement.

- A ₹1 lakh crore Research, Development and Innovation (RDI) Fund, aimed at boosting innovation.

- The next phase of the Production-Linked Incentive (PLI) scheme for drone manufacturers.

These policy-level developments suggest that ideaForge could see a rebound in revenue in the coming quarters, especially if defense-related orders materialize at scale.

Source: Business Standard

Industry Outlook: Tailwinds Remain, But the Skies Are Cloudy

ideaForge’s story is closely tied to the larger trajectory of India’s drone industry. Initially bolstered by reforms like the liberalised Drone Rules (2021) and the Drone Shakti initiative, the sector witnessed a spurt in startups, investments, and media buzz. Government tenders and pilot projects made headlines, especially in defence and agriculture.

But in reality, the sector still faces multiple headwinds:

- Slow commercial adoption: Despite hype, mainstream industries like mining, construction, and delivery have been slow in deploying UAVs at scale.

- Procurement delays: Large government orders are critical but often subject to delays and compliance hurdles.

- Dependence on subsidies: Many firms, including ideaForge, remain vulnerable to shifts in government policy support or PLI disbursements.

- Cost management: Scaling deep-tech manufacturing in India while maintaining profitability is a fine balancing act.

The weak Q1 numbers serve as a reminder that the sector’s growth will not be linear. Strategic wins must be matched with consistent execution, cost control, and diversified demand.

ideaForge at a Glance

Despite current headwinds, ideaForge remains a formidable player in the Indian UAV ecosystem. The company is:

- India’s leading indigenous drone manufacturer, with the largest deployment of unmanned aerial systems across the country.

- Backed by marquee investors including Qualcomm Ventures, Infosys, and Florintree Advisors.

- Ranked 3rd globally among dual-use drone makers by Drone Industry Insights in 2024.

- Operates across both civil and defence sectors, with drones taking off once every three minutes in India.

- Completed over 700,000 successful flights across customer applications.

Source: Business Standard

Investor Sentiment: Short-Term Pain, But Is the Long Game Intact?

The market reaction to ideaForge’s Q1 numbers has been swift and sharp. But it also raises a question: how should investors approach new-age defence-tech firms in India?

Unlike software or consumer tech, deep-tech hardware businesses, especially those working in regulated or government-linked sectors, move slowly. Cash flows and results can fluctuate. But the long-term payoff, especially in an import-substitution-driven ecosystem, can be significant.

For now, ideaForge’s stock price correction reflects investor concerns over revenue visibility and margin stability. But its strong order pipeline, government alignment, and operational track record offer some confidence for those with a long-term view.

Conclusion

ideaForge’s Q1 results may have let the market down, but they show the early struggles of an industry still growing. As India seeks to build a self-reliant drone ecosystem, the burden of execution will lie heavily on companies like ideaForge. While it navigates this period of correction, the broader drone sector must also evolve beyond subsidy dependence, towards scalable, diversified, and commercially viable use cases.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

Yash Vora is a financial writer with the Informed InvestoRR team at Equentis. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

- Yash Vora